Diego Bonifacio / Profil

- Information

|

10+ Jahre

Erfahrung

|

4

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

Diego Bonifacio

The markets in Asia and the Pacific show a greater appetite for risk after the call to Janet Yellen caution. The Nikkei index, the ASX 200, Shanghai Composite and Shenzhen Composite then close all positive. The weak US dollar has given a new push, more than welcome in the Australian dollar and New Zealand dollar.

Investors in the US dollar remains pending US Non-Farm Payroll out tomorrow. It is likely that the creation of new jobs has slowed in February, which would further justify the prudence of Janet Yellen, but US investors also hope to see positive data.

FTSE and European indices opened in the red this morning, as per expectations. volatility risk for the euro, because of employment data in Germany and the prices at the Eurozone consumption.

Investors in the US dollar remains pending US Non-Farm Payroll out tomorrow. It is likely that the creation of new jobs has slowed in February, which would further justify the prudence of Janet Yellen, but US investors also hope to see positive data.

FTSE and European indices opened in the red this morning, as per expectations. volatility risk for the euro, because of employment data in Germany and the prices at the Eurozone consumption.

Diego Bonifacio

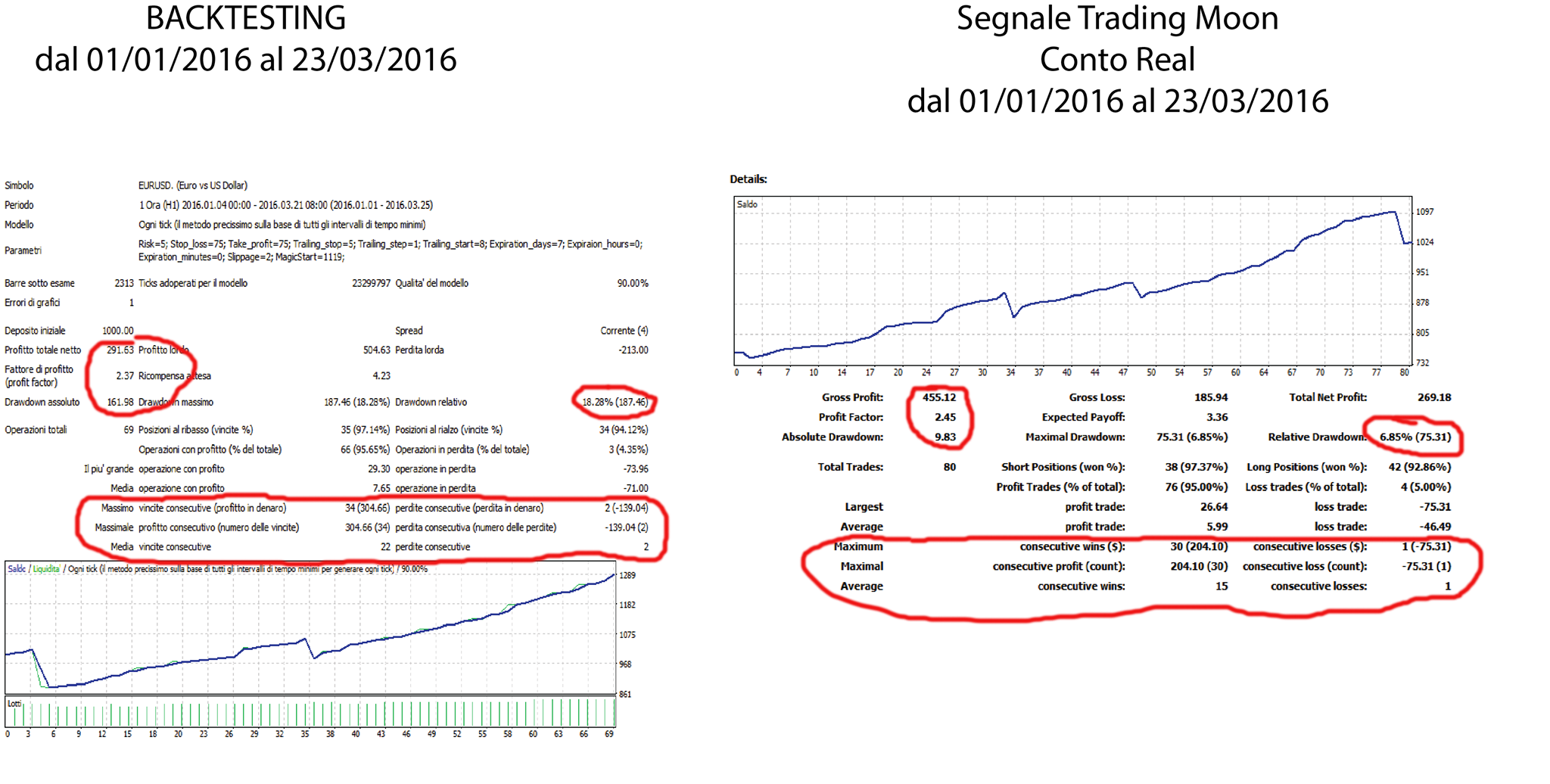

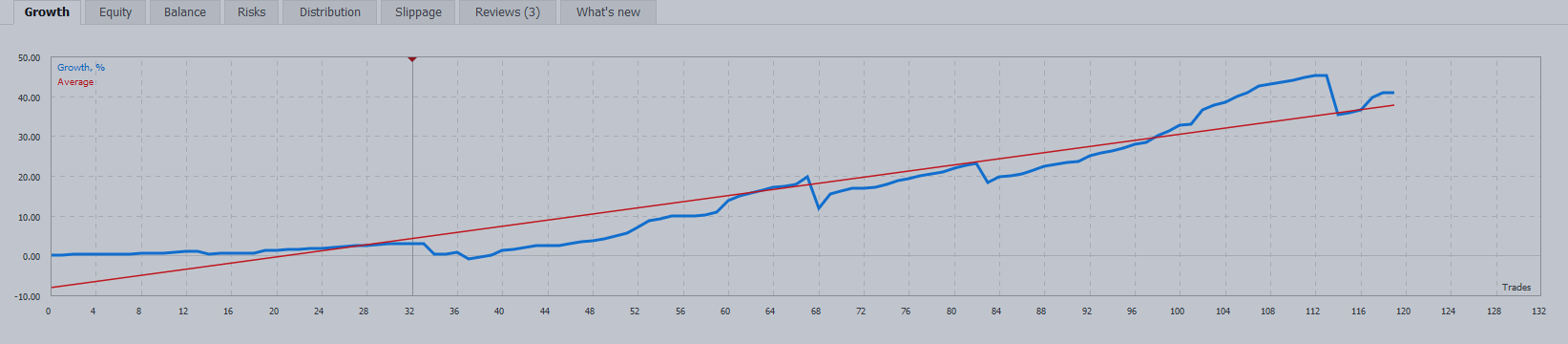

Our automated trading system called "Moon", which also gives its name to our trading signal, arises from the need to find a valid operational tool that generates a steady return over time without jeopardizing the initial capital...

In sozialen Netzwerken teilen · 1

133

Diego Bonifacio

Top 5 Things to Know In the Market on Tuesday Here are the top five things you need to know in financial markets on Tuesday, March 29: 1...

Diego Bonifacio

The European indices open again this morning rising, as expected, after the long Easter weekend. Week remains uncertain, as investors are still in doubt about which direction the market will take in the coming days. This situation can produce surprises and unexpected trading opportunities. The economic calendar does not foresee major events for today, but it is not excluded volatility of the US dollar in the afternoon. Eyes still trained on the dollar ahead of the NFP data, which will be published Friday, and other key economic indicators.

Diego Bonifacio

Our Automated Trading System named "Moon", which also gives its name to our Signal Trading, is the need to find a valid operational tool that generates a steady return over time without jeopardizing the initial capital...

In sozialen Netzwerken teilen · 2

100

Diego Bonifacio

Even if the markets do not consider it likely a rise in interest rates this month, the FOMC is still divided. The committee's vice-chairman, Stanley Fischer, would be in favor of a rise of 0.25%, while the Federal Reserve Governor Lael Brainard appeals to prudence...

Diego Bonifacio

What is the outlook for the markets and the euro exchange rate Dollar after the measures put in place by the ECB, and Mario Draghi press conference on 10 March 2016? And what are the prospects for gold and oil for the rest of the year...

Diego Bonifacio

Beitrag Petrolio Visione Generale veröffentlicht

Ieri i "rumors" sul petrolio hanno deciso la tendenza del prezzo...

Diego Bonifacio

Mario Draghi e il QE!!!

cresce tra gli operatori l'attesa per l'annuncio del Tasso di Interesse atteso questo giovedi alle ore 13:45.

Mario Draghi già da tempo ha fatto intendere ad una possibile revisione del Quantitative Easing con un possible taglio in negativo del Rating...

se però, anche questa volta dovremmo assistere ad un nulla di fatto da parte della BCE l'euro potrebbe guadagnare parecchio terreno nei confronti del dollaro. nel frattempo stiamo assistendo ad un riposizionamento su EUR/USD....

https://www.facebook.com/Trading-Room-31-338866186298943/

cresce tra gli operatori l'attesa per l'annuncio del Tasso di Interesse atteso questo giovedi alle ore 13:45.

Mario Draghi già da tempo ha fatto intendere ad una possibile revisione del Quantitative Easing con un possible taglio in negativo del Rating...

se però, anche questa volta dovremmo assistere ad un nulla di fatto da parte della BCE l'euro potrebbe guadagnare parecchio terreno nei confronti del dollaro. nel frattempo stiamo assistendo ad un riposizionamento su EUR/USD....

https://www.facebook.com/Trading-Room-31-338866186298943/

: