MR Range Breakouts 4

150 USD

Demo heruntergeladen:

79

Veröffentlicht:

12 März 2021

Aktuelle Version:

4.0

Keinen passenden Roboter gefunden?

Geben Sie Ihren Eigenen in Auftrag

auf Freelance!

Gehen Sie zu Freelance

Geben Sie Ihren Eigenen in Auftrag

auf Freelance!

Wie man einen Roboter oder Indikator kaufen kann

Starte Deinen EA im

Virtual Hosting

Virtual Hosting

Teste einen Indikator/Roboter vor dem Kauf

Möchtest Du Geld im Market verdienen?

Wie man Produkte richtig präsentiert

Sie verpassen Handelsmöglichkeiten:

- Freie Handelsapplikationen

- Über 8.000 Signale zum Kopieren

- Wirtschaftsnachrichten für die Lage an den Finanzmärkte

Registrierung

Einloggen

Sie stimmen der Website-Richtlinie und den Nutzungsbedingungen zu.

Wenn Sie kein Benutzerkonto haben, registrieren Sie sich

I have attached to my H4 chart using default settings but shows...does this need live data to accumulate from the time it is attached to chart to begin calculations?

Looks like it is working now...took a few minutes to load but so far so good.

Looks like it is working now...took a few minutes to load but so far so good.

Hello David T,

Yes, the indicator is built to collect the minimum amount of price data to function normally.

I apologize for answering you now - I had an urgent engagement yesterday...

Best Regards

Hello David T,

No, there is no error in the program code. I will try to show you visually how the processes occur in the formation of the boundaries of the ranges...

The example is quite elementary:

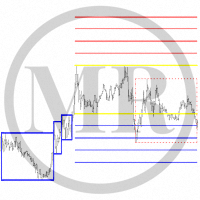

1. When we have two extremes and the price has tested at least 75% of the distance between them in the form of a corrective movement, we say that a “Balance” has been established between buyers and sellers. In the market has established a high and low price for the given financial instrument, according to the concept of "Auction Market Theory". Usually, the intentions to achieve a "Balance" of prices are known only by the "Big" players in the markets. See screenshots 1 and 2.

2. If portion of the "Big" players decide they don't like it to close the "Range" of the prices by exiting it, return the price to the "Range" and test a minimum of 75% of the distance between the two extremes that define the boundaries of the "Range", then we say we have an "Extending" of the boundaries of the "Open Range". See screenshot 3.

3. In screenshot 4, we have two new extremes and we expect the price to test at least 75% of the distance between them in the form of a corrective move...

In the indicator settings you can turn on the internal proportions in the "Open Range" to help you understand what is happening in the ranges. See screenshots 5 and 6.

I guess you'll have more questions, so don't be afraid to ask anything you don't understand!!!

Best Regards

Hi,

Do these rectangles repaint or lag during live market data?

Hi,

In the attached chart of BTC M5 the most recent rectangle forming is red so a Sellers but the price has broken above the upper boundary so will the color of this rectangle change to Blue so indicate Buyers?

Hi,

In the attached chart of BTC M5 the most recent rectangle forming is red so a Sellers but the price has broken above the upper boundary so will the color of this rectangle change to Blue so indicate Buyers?

Hello David T,

Your question is related to the processes taking place in the "Open Range"...

I will start with a very simple explanation for understanding the concept of "Auction Market Theory" developed by J. Peter Steidlmayer. In the market at any given time, there is always a high and a low price that satisfies the market participants. The transactions that are made between these two extremes (prices) form a "Auction of prices". When someone tries to change this "Auction of prices" - wants to get a given financial instrument at a price different from that in "Auction of prices", then new boundaries of high and low price of "Auction of prices" are formed. This is the logic behind price movement in markets and the formation of the "Auction of prices" (the Ranges).

What you show in your screenshot is a place where some of the "Big Players" are trying to get the given financial instrument at a different price than the one in "Auction of prices". This place (this moment) we call "Expansion" of sellers or an "Expansion" of buyers. This usually happens at the upper or lower boundaries of the "Open Range" and between the "Limit Orders Barriers". See screenshot 1.

Not always the appearance of "Expansion" of sellers or an "Expansion" of buyers means an exit from the range. They are simply elements in the formation of the "Open (not completed) Range". In screenshot 2 you can see that the previous attempt to go out of range has failed and a new attempt to go out of range in the opposite direction appears.

We use additional tools to understand the current situation. In screenshot 3 I have shown you the situation with the added indicator "MR-Volume Profile Rectangles". As you can see, the price moves between two POC volumes from previous ranges. In screenshot 4, I have shown you how to correctly set the indicator "MR-Volume Profile Rectangles" for the financial instrument BTCUSD.Another indicator with which you can check what is happening in the "Open Range" is "MR-Sentiments by volumes". This is our latest indicator that attempts to determine the sentiment in the range with a high degree of probability. In screenshot 5 you can see that the indicator shows the accumulated volumes in the range and in the place of exit from it ("Expansion" of buyers). The indicator shows an imbalance between the accumulated volumes in the "Open Range" and in "Expansion" of buyers, that's why we say that the priority is "Expansion" of buyers, and the Range is dominated by sellers who will remain "Locked-in" the range. In screenshot 6 I have shown how to set up the indicator for the H1 time frame ranges. In screenshot 7 you will see how the situation has developed after leaving the range - we have two new ranges of buyers and one new "Open Range".

Why exactly the situation developed like this, you can understand from screenshot 8, where on time frame H1 we have added the indicator "MR-Trend Corrections" and we have set the indicator "MR-Range Breakouts" to time frame H4. From the higher time frame it is seen, that the financial instrument BTCUSD is in a correction after a selling impulse. Corrections between -25% and -50% are systemic in the markets, so one should wait to see the situation develop or trade the pips between the correction levels on a lower time frame.

I hope I have brought some clarity to the usage of the indicator. If you have questions, don't hesitate to ask!!!Best Regards