Young Ho Seo / 프로필

- 정보

|

10+ 년도

경험

|

62

제품

|

1182

데몬 버전

|

|

4

작업

|

0

거래 신호

|

0

구독자

|

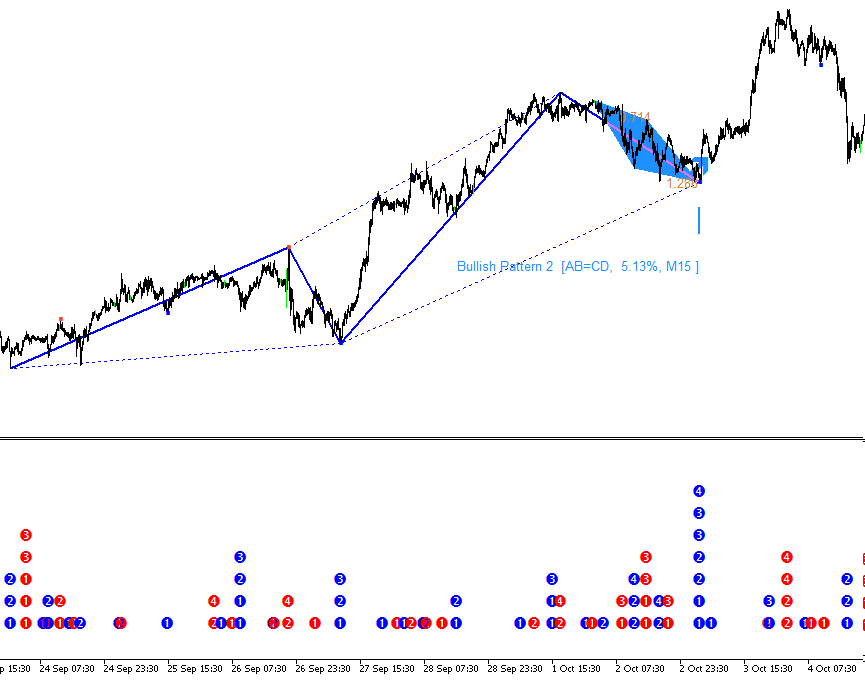

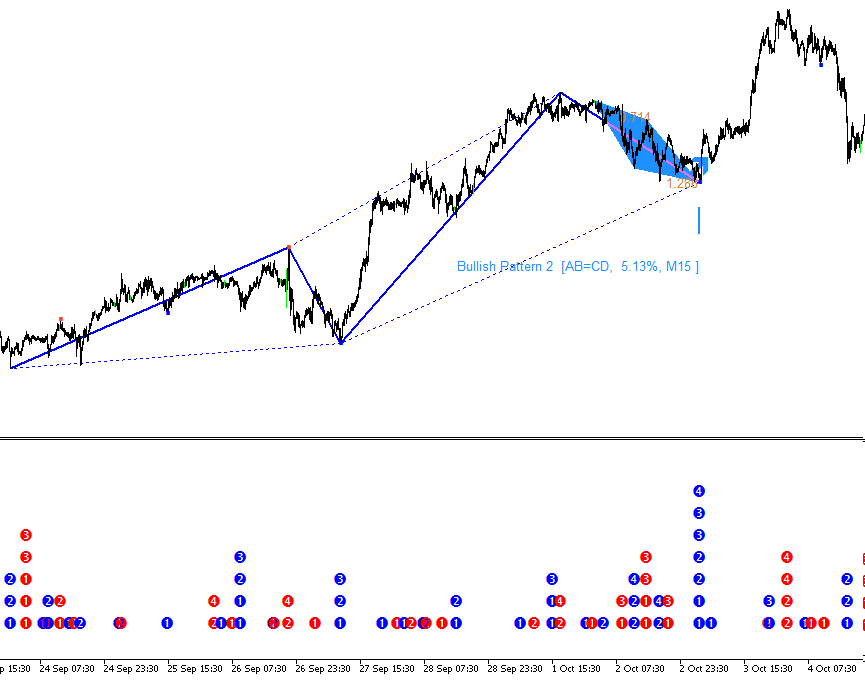

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

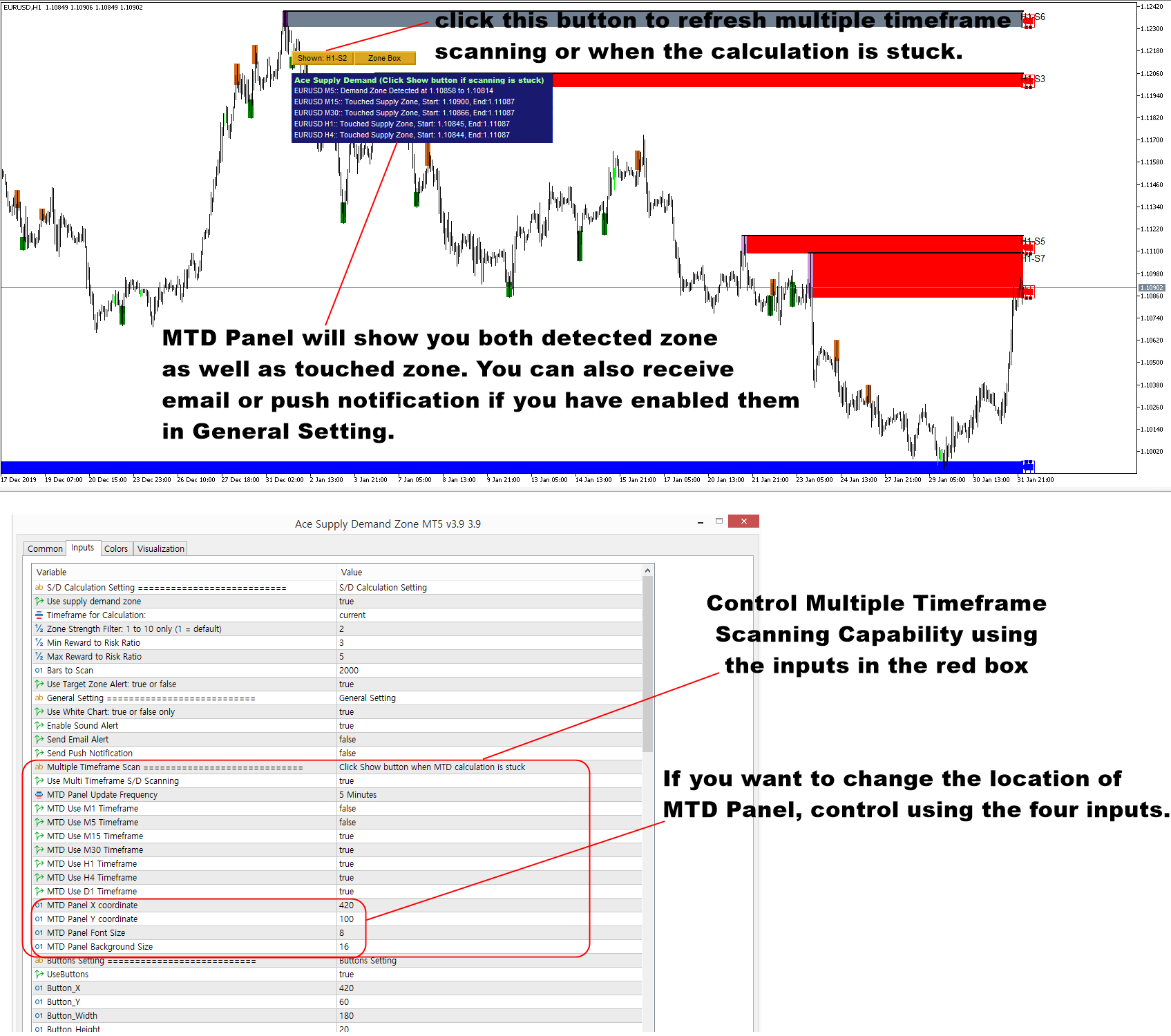

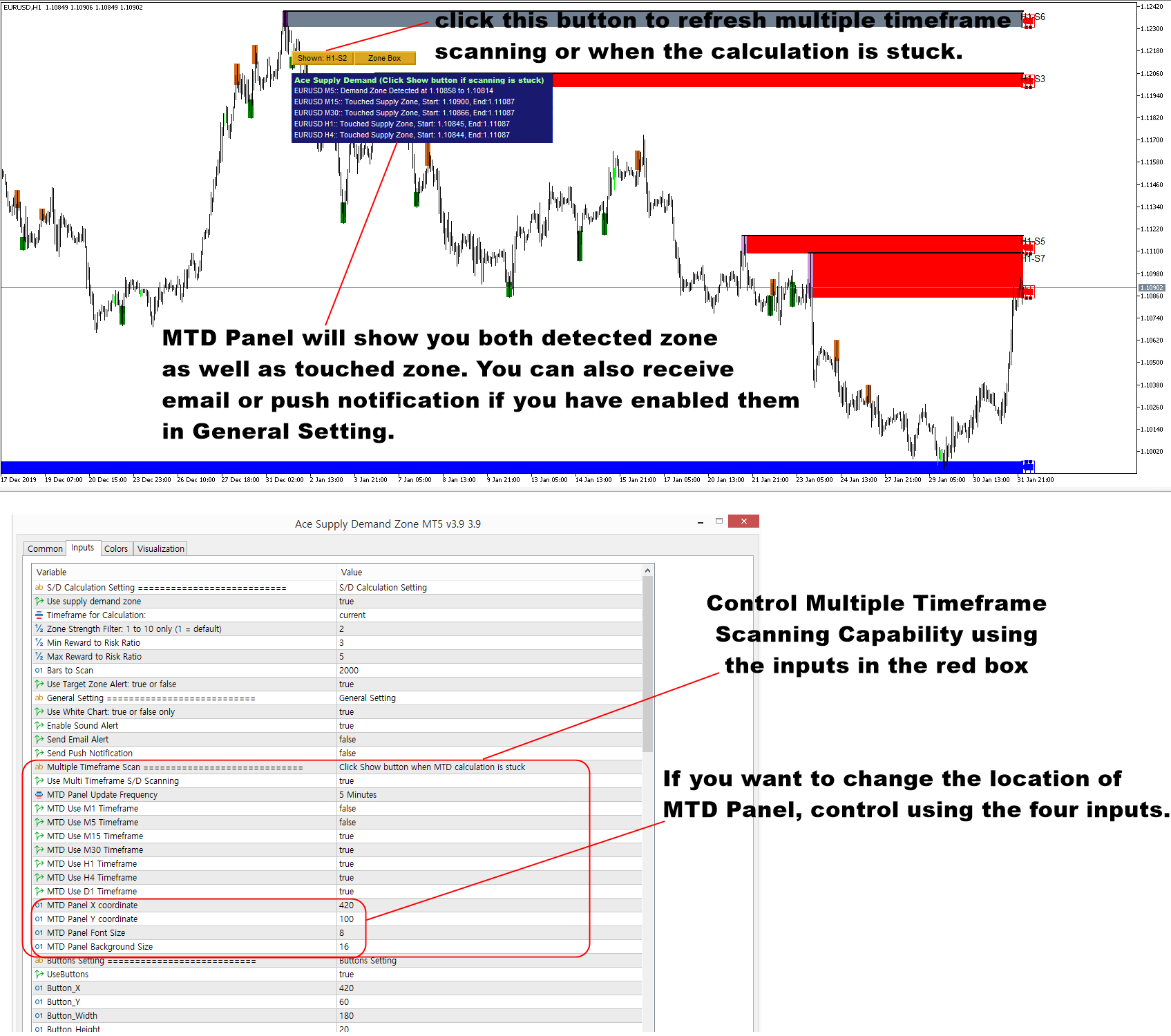

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

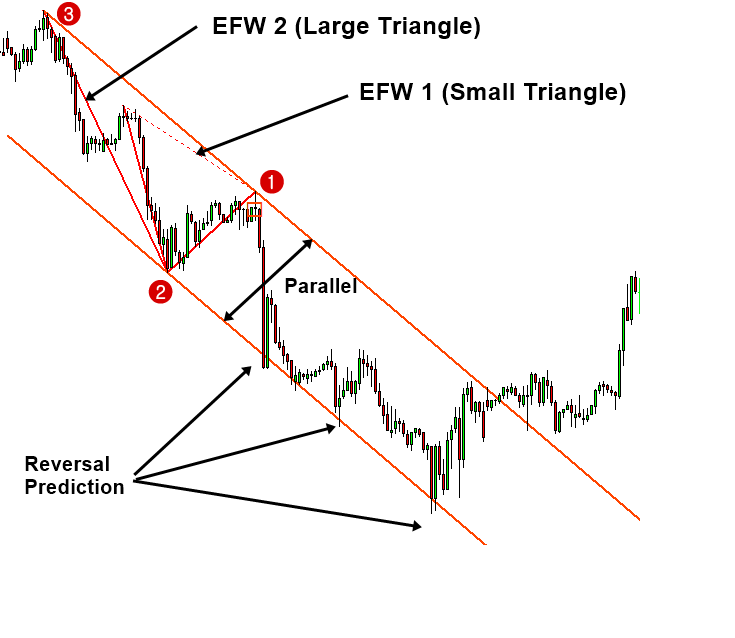

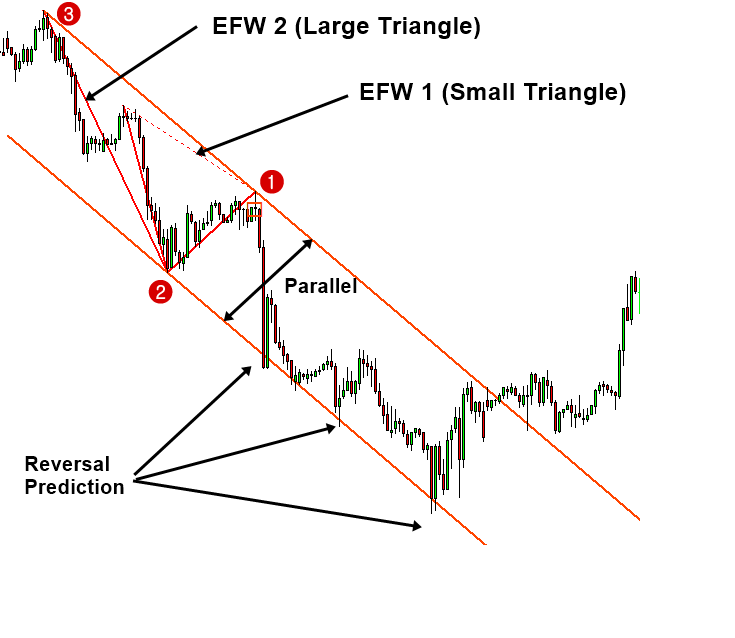

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

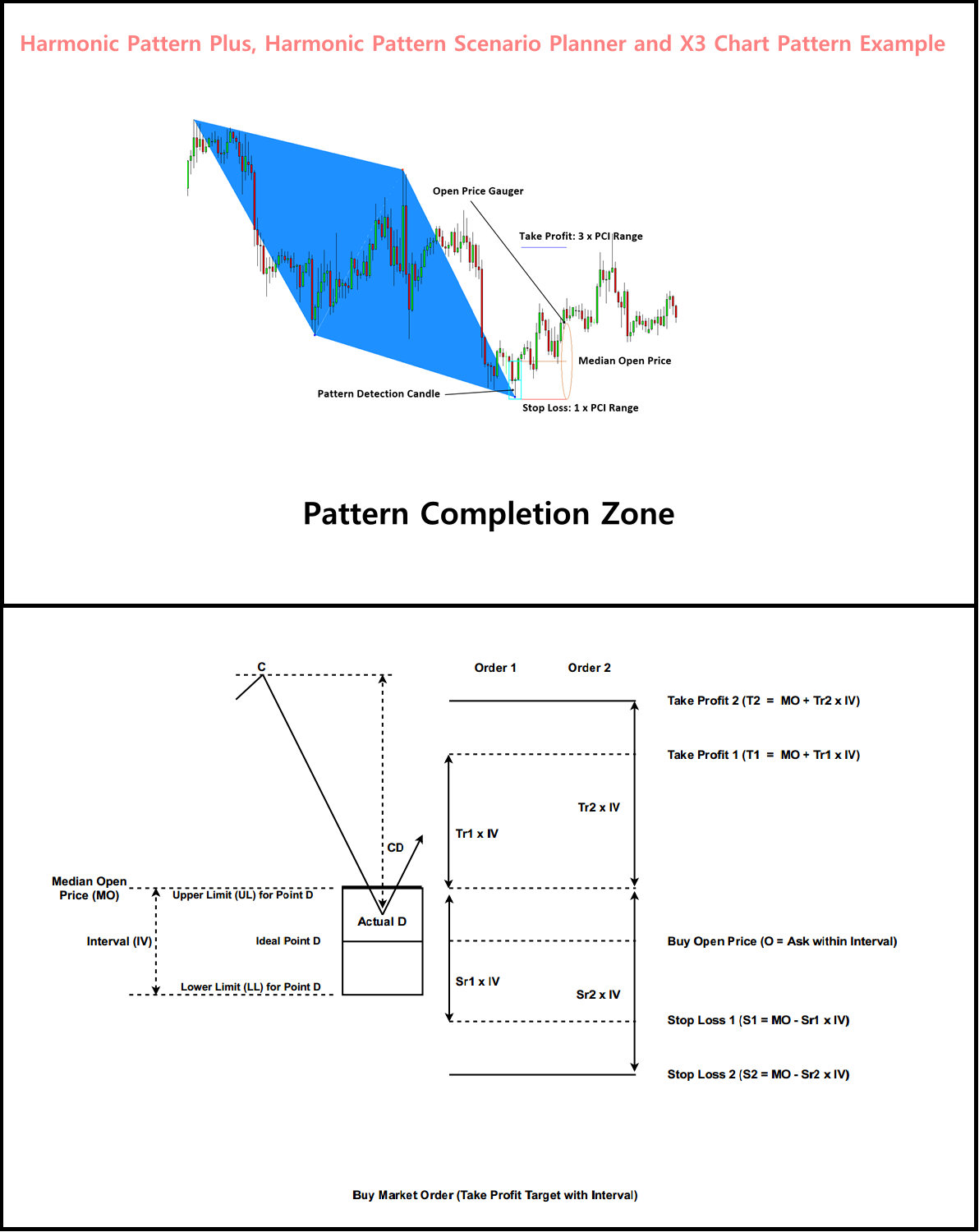

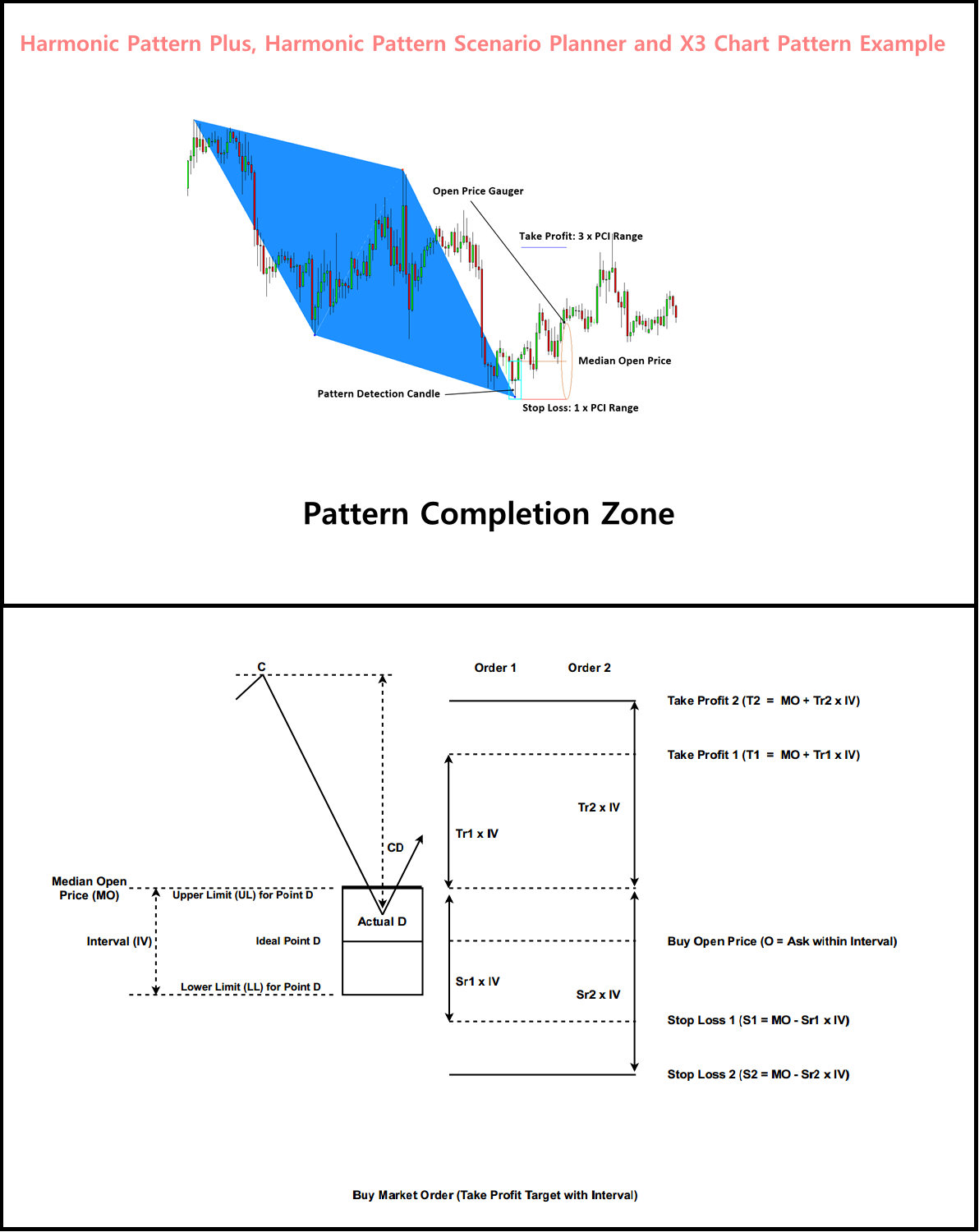

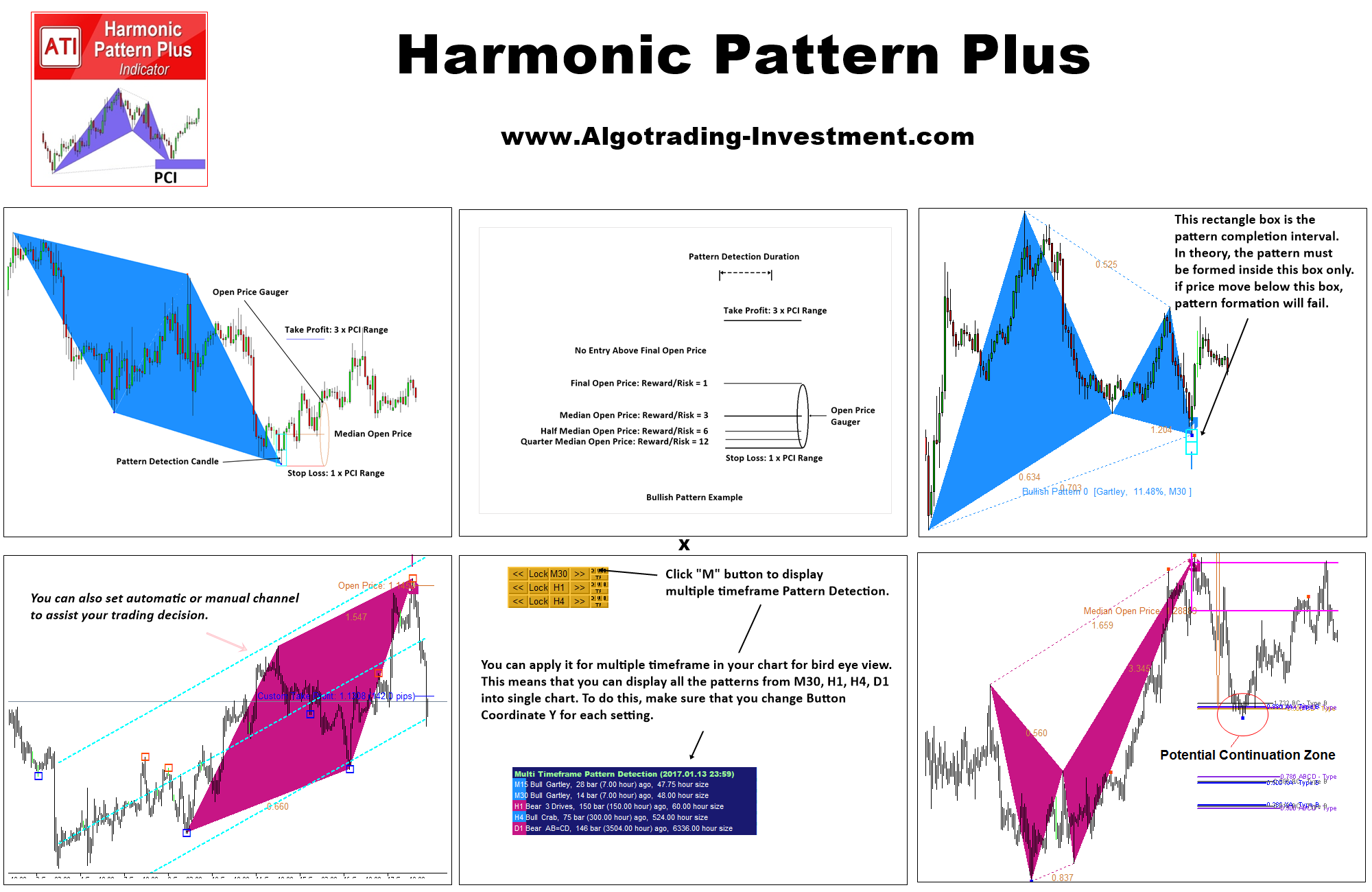

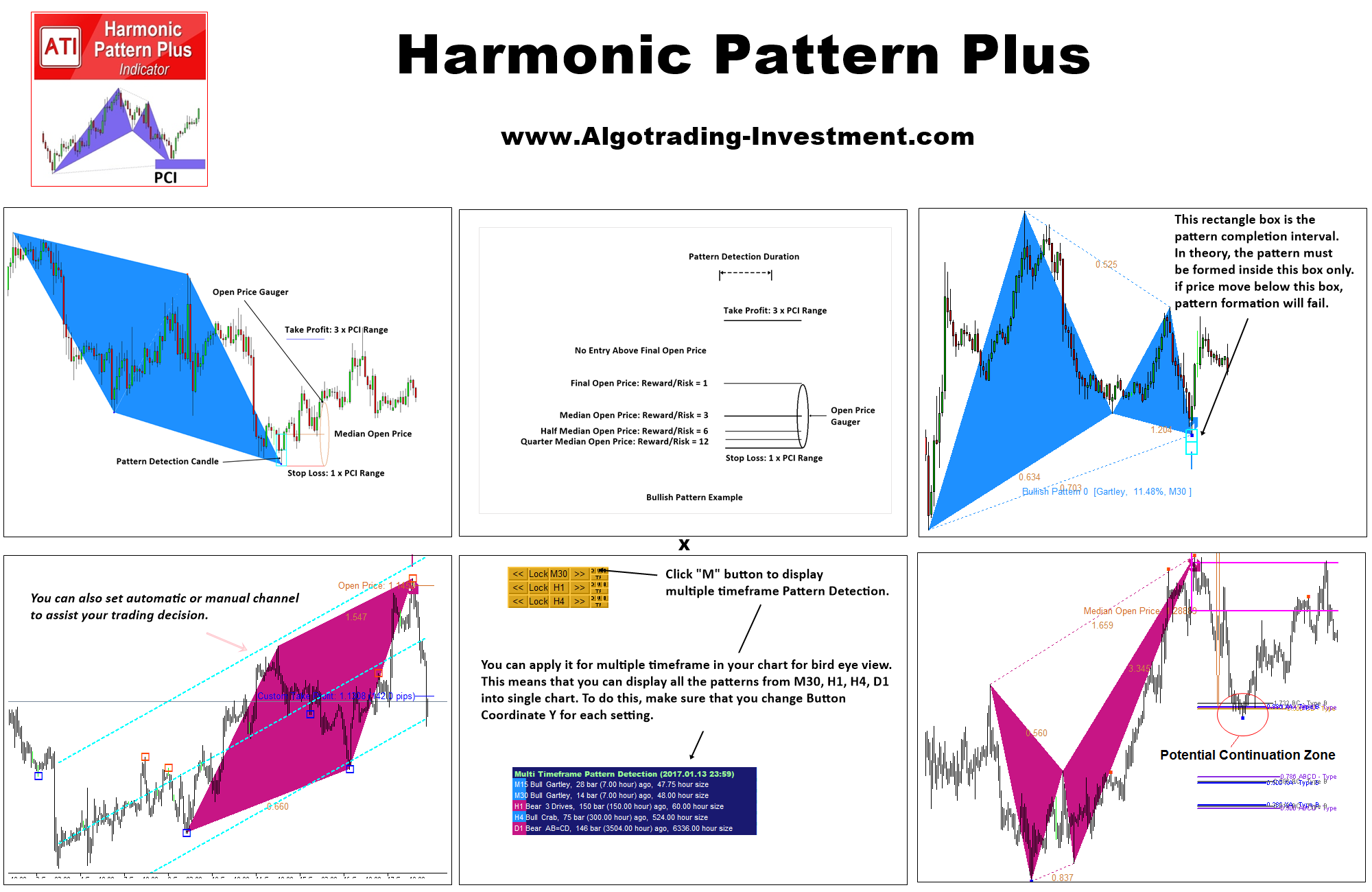

Order Management for Harmonic Pattern

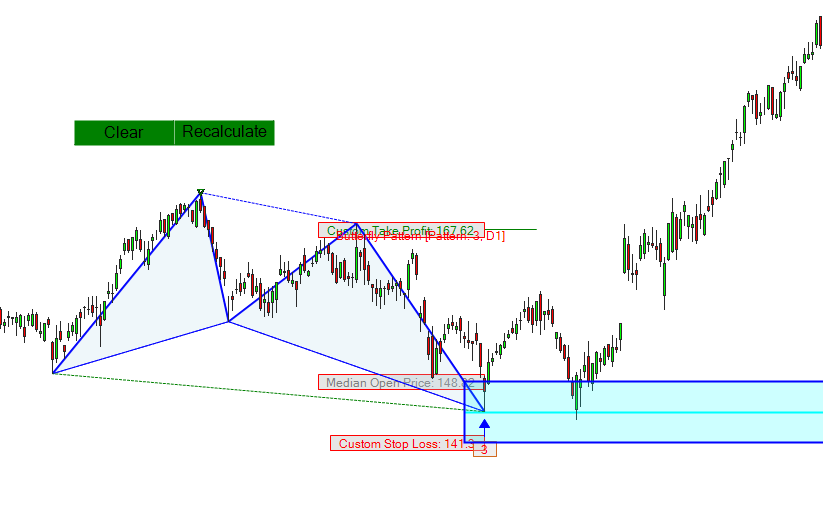

This article will provide some ideas of managing buy and sell orders in Forex trading with the Pattern Compltion Interval in Harmonic Pattern. Many harmonic pattern trader use some arbitrary order management. Some uses Fibonacci levels but they are not able to measure or think how each winning and losing trades can affect their trading balance. You do need to know this to grow your capital safely. Risk and Order management is not the concept you can skip regardless of your trading strategy. So how can we manage buy and sell orders if we are trading with harmonic patterns like Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on. We can use the Pattern Completion Interval (=Pattern Completion Zone).

Pattern Completion Interval (=Pattern Completion Zone) was introduced in the Book: Guide to Precision Harmonic Pattern Trading to help you to trade with harmonic pattern with more scientific risk management. Of course, you can find more details about the Pattern Completion Interval from the book.

Link to Book: https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

In short, the Pattern Completion Interval helps you to achieve the desired Reward/Risk ratio while you are trading in real time tick by tick data. Here is one of many approaches how you may use the Pattern Completion Interval concept for your trading. Of course, this approach is compatible with your Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. We produce this diagram so you can understand this approach intuitively without any calculator in your hands. Tr = Take Profit Ratio and Sr = Stop Loss Ratio. The diagram shows the case of two orders but you can even generate more orders taking this example further. Hopefully this new diagram is easier to understand than previous one.

Of course, this precision trading frame work is inclusive to our Harmonic Pattern Indicators including Harmonic Pattern Plus and Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner. These indicators are available for both MetaTrader 4 and MetaTrader 5 platforms.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

This article will provide some ideas of managing buy and sell orders in Forex trading with the Pattern Compltion Interval in Harmonic Pattern. Many harmonic pattern trader use some arbitrary order management. Some uses Fibonacci levels but they are not able to measure or think how each winning and losing trades can affect their trading balance. You do need to know this to grow your capital safely. Risk and Order management is not the concept you can skip regardless of your trading strategy. So how can we manage buy and sell orders if we are trading with harmonic patterns like Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on. We can use the Pattern Completion Interval (=Pattern Completion Zone).

Pattern Completion Interval (=Pattern Completion Zone) was introduced in the Book: Guide to Precision Harmonic Pattern Trading to help you to trade with harmonic pattern with more scientific risk management. Of course, you can find more details about the Pattern Completion Interval from the book.

Link to Book: https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

In short, the Pattern Completion Interval helps you to achieve the desired Reward/Risk ratio while you are trading in real time tick by tick data. Here is one of many approaches how you may use the Pattern Completion Interval concept for your trading. Of course, this approach is compatible with your Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. We produce this diagram so you can understand this approach intuitively without any calculator in your hands. Tr = Take Profit Ratio and Sr = Stop Loss Ratio. The diagram shows the case of two orders but you can even generate more orders taking this example further. Hopefully this new diagram is easier to understand than previous one.

Of course, this precision trading frame work is inclusive to our Harmonic Pattern Indicators including Harmonic Pattern Plus and Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner. These indicators are available for both MetaTrader 4 and MetaTrader 5 platforms.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

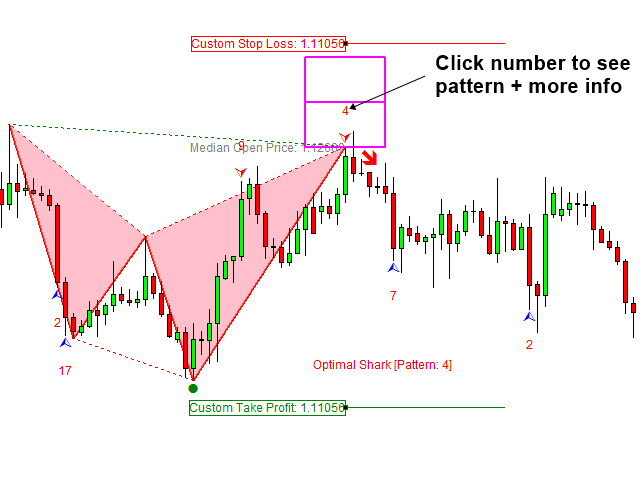

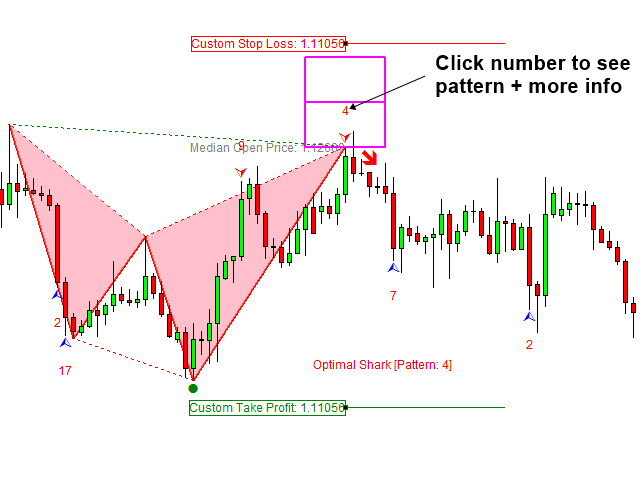

Stop Loss and Take Profit with Harmonic Pattern

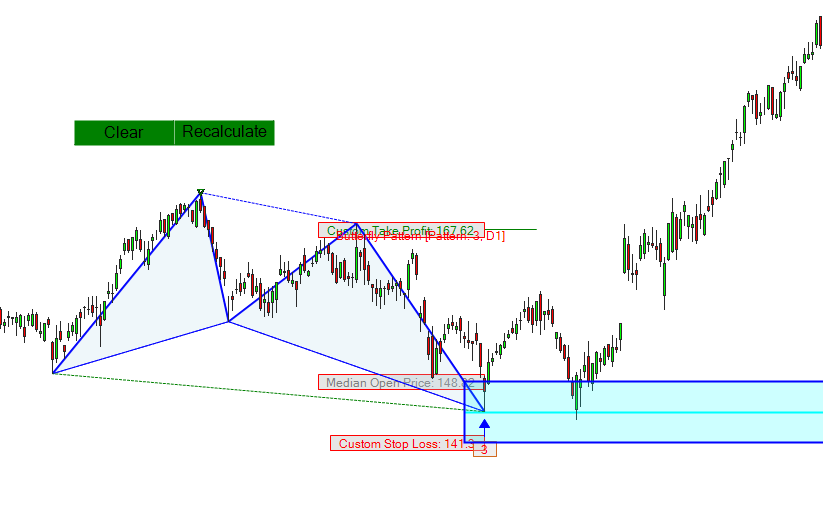

In this article, we will explain how to set stop loss and take profit with Harmonic Pattern. For any professional trading strategy, there are ways to manage the trading risk. Fortunatley, Harmonic Pattern can have the easy and complete trading risk management with Pattern Completion Zone. Pattern Completion zone is not the rocket science. It is a rectangle box drawn at the point D of any Harmonic Pattern. It can be drawn for any Harmonic Patterns including Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on.

You can consider the pattern completion zone as the trading zone simply speaking. If you are not sure what is the trading zone, then think it as just two price range, often used in the support resistance trading or supply demand trading or volume spread analysis or any other technical anlaysis. You can read more about the pattern completion zone and trading zone in Guide to Precision Harmonic Pattern Trading. However, if you have not read this book yet, then let us just assume it as two price around the point D in the Harmonic Pattern. Typically, the pattern completion zone will be provided with Harmonic Pattern Indicator or Scanner you are using for the purpose of the trading risk management. Pattern completion zone is very useful to visualize the price trajectory around the point D of the Harmonic Pattern. For example, price can have several trajectory inside or outside the pattern completion zone.

With the Pattern Completion Zone, you can observe that sometime price can reach outside the pattern completion zone. Sometimes, price might just make a good turning point within the Pattern Completion Zone. The implication of this is that we need to set the sensible stop loss when we trade with the turning point. What is important here is that the stop loss size and take profit size. We can this as the Reward/Risk ratio. This is really important quantity to understand if you want to become a profitable trader.

Stop loss size around the pattern completion zone can be changed. As long as you understand the pros and cons of using large stop loss, it is still fine to control your own stop loss size. It is best to express the stop loss size in terms of pattern completion zone. Likewise, it is best to express the take profit size in terms of the pattern completion zone too. It is because your Reward/Risk ratio is easily visualized in your chart without any additional calculation steps. For example, if the original stop loss size was equal to 1 x pattern completion zone, you can certainly use 1.5 x pattern completion interval or 2 x pattern completion interval. This will impact of your Reward/Risk ratio. Hence, you need to adjust your take profit target too. So there are some interactive element for trading. It is the safe and profitable way to trade as it helps to manage your trading risk in highly visual form and in quantified manner.

Another consideration is, if you can enter the market at the competitive price, then you can feel less guilty when you increase your stop loss size because you are still having the good Rewards/Risk ratio. On the other hands, if you have entered market at not so competitive price, then you might be cautious when you increase your stop loss size. Pattern Completionzon helps you to measure all these important price levels with just a simple box, also know as the trading zone.

All our Harmonic Pattern indicator comes with this pattern completion zone. Hence, Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner come with the Pattern Completion Zone. This means that with these products, you can manage your trading risk like the professional trader does.

In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below, we provide the landing page for Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner for your information.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Indeed, the X3 Chart Pattern Scanner is the most advanced Harmonic Pattern and Elliott Wave pattern scanner. Beside, X3 Chart Pattern Scanner provides many other powerful features like the customizable option and advanced channel and so on

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

In this article, we will explain how to set stop loss and take profit with Harmonic Pattern. For any professional trading strategy, there are ways to manage the trading risk. Fortunatley, Harmonic Pattern can have the easy and complete trading risk management with Pattern Completion Zone. Pattern Completion zone is not the rocket science. It is a rectangle box drawn at the point D of any Harmonic Pattern. It can be drawn for any Harmonic Patterns including Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on.

You can consider the pattern completion zone as the trading zone simply speaking. If you are not sure what is the trading zone, then think it as just two price range, often used in the support resistance trading or supply demand trading or volume spread analysis or any other technical anlaysis. You can read more about the pattern completion zone and trading zone in Guide to Precision Harmonic Pattern Trading. However, if you have not read this book yet, then let us just assume it as two price around the point D in the Harmonic Pattern. Typically, the pattern completion zone will be provided with Harmonic Pattern Indicator or Scanner you are using for the purpose of the trading risk management. Pattern completion zone is very useful to visualize the price trajectory around the point D of the Harmonic Pattern. For example, price can have several trajectory inside or outside the pattern completion zone.

With the Pattern Completion Zone, you can observe that sometime price can reach outside the pattern completion zone. Sometimes, price might just make a good turning point within the Pattern Completion Zone. The implication of this is that we need to set the sensible stop loss when we trade with the turning point. What is important here is that the stop loss size and take profit size. We can this as the Reward/Risk ratio. This is really important quantity to understand if you want to become a profitable trader.

Stop loss size around the pattern completion zone can be changed. As long as you understand the pros and cons of using large stop loss, it is still fine to control your own stop loss size. It is best to express the stop loss size in terms of pattern completion zone. Likewise, it is best to express the take profit size in terms of the pattern completion zone too. It is because your Reward/Risk ratio is easily visualized in your chart without any additional calculation steps. For example, if the original stop loss size was equal to 1 x pattern completion zone, you can certainly use 1.5 x pattern completion interval or 2 x pattern completion interval. This will impact of your Reward/Risk ratio. Hence, you need to adjust your take profit target too. So there are some interactive element for trading. It is the safe and profitable way to trade as it helps to manage your trading risk in highly visual form and in quantified manner.

Another consideration is, if you can enter the market at the competitive price, then you can feel less guilty when you increase your stop loss size because you are still having the good Rewards/Risk ratio. On the other hands, if you have entered market at not so competitive price, then you might be cautious when you increase your stop loss size. Pattern Completionzon helps you to measure all these important price levels with just a simple box, also know as the trading zone.

All our Harmonic Pattern indicator comes with this pattern completion zone. Hence, Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner come with the Pattern Completion Zone. This means that with these products, you can manage your trading risk like the professional trader does.

In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below, we provide the landing page for Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner for your information.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Indeed, the X3 Chart Pattern Scanner is the most advanced Harmonic Pattern and Elliott Wave pattern scanner. Beside, X3 Chart Pattern Scanner provides many other powerful features like the customizable option and advanced channel and so on

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

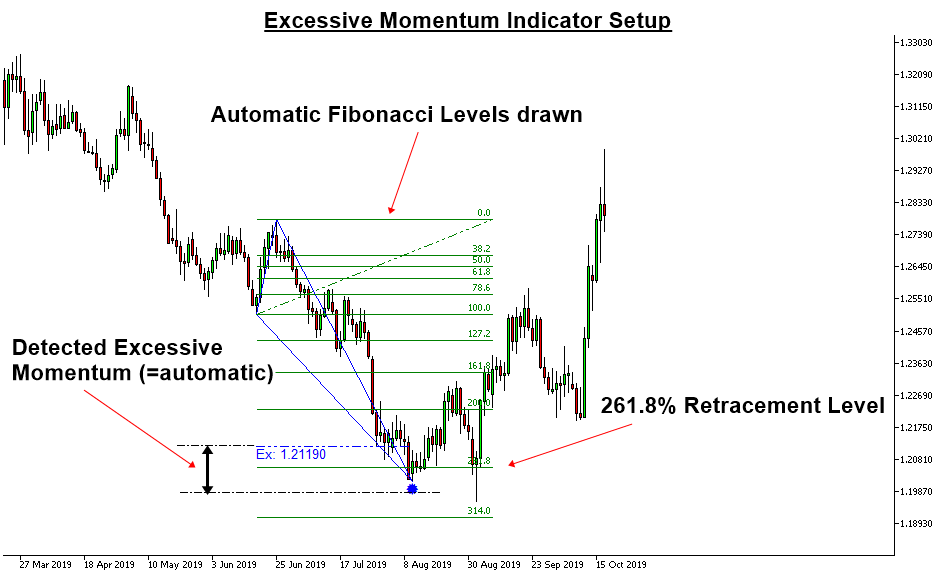

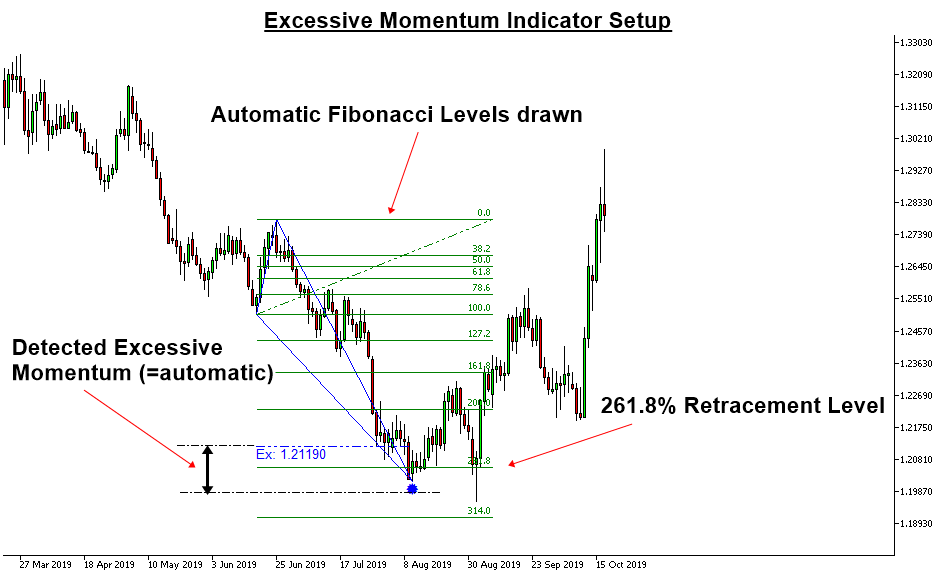

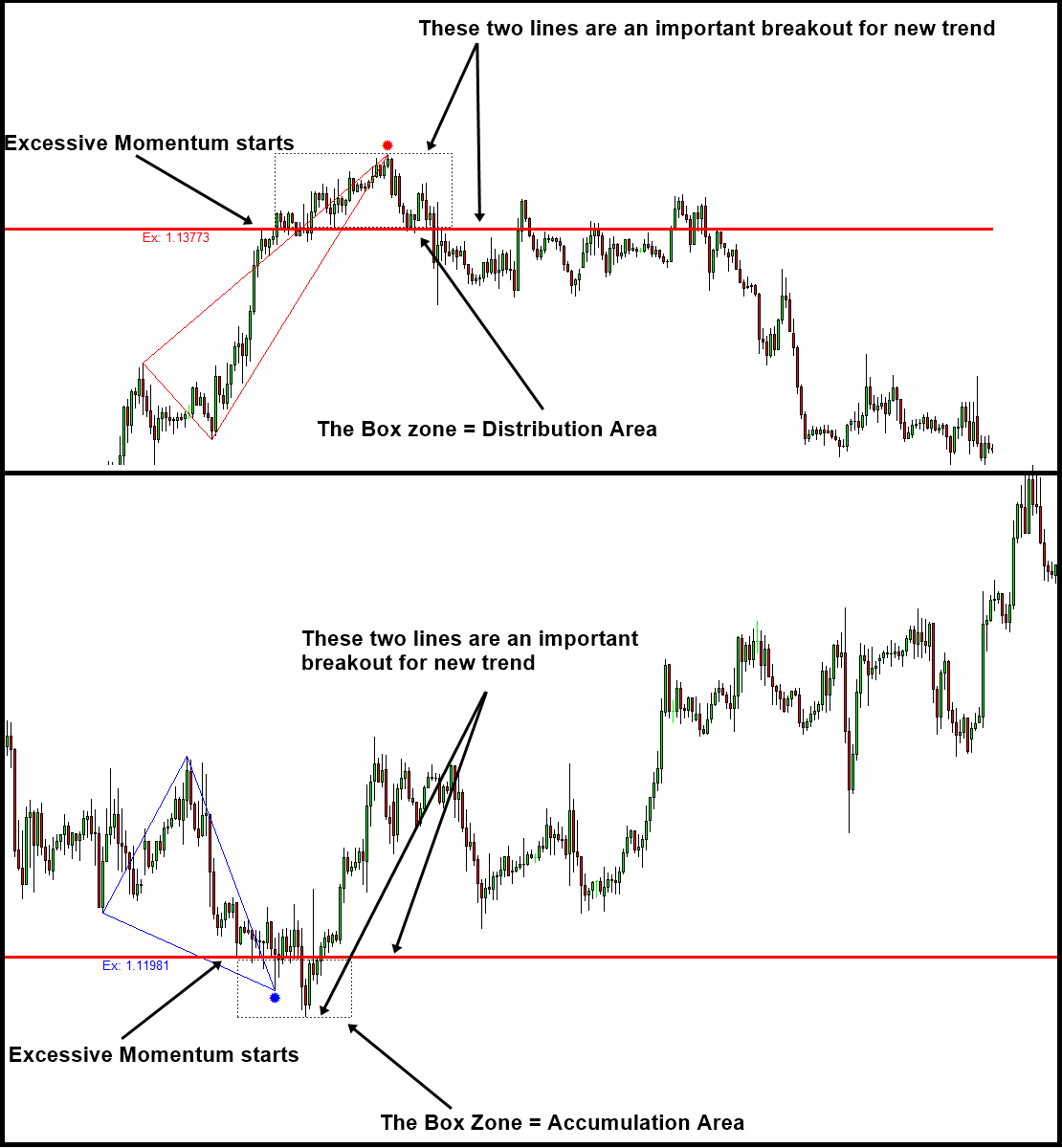

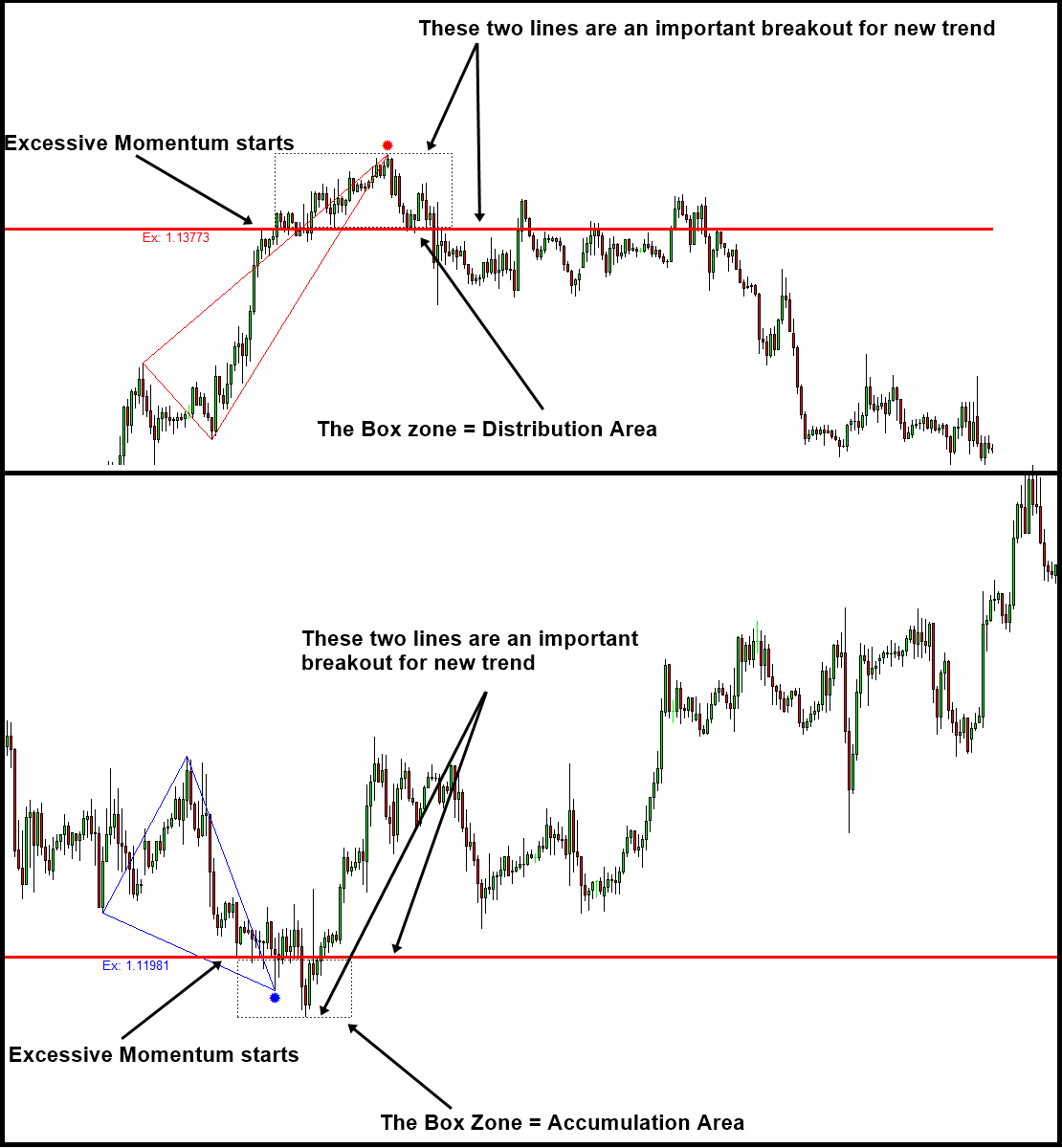

Introduction to Excessive Momentum Indicator

Momentum trading is often used by the experienced trader. One innovative way to use the momentum trading is to trade with the excessive momentum. Excessive momentum is the technique to identify unusually strong supply or unusually strong demand by analyzing the price series. Why do we need to care about the unusually strong supply or unusually strong demand in our trading? It is because unusually strong supply or unusually strong demand are the sign of the end of the current trend ( or birth of new trend). As you probably guess, when the new trend is born, you can ride the highest profit as possible. Hence, the excessive momentum can provide you the attractive entries for your trading.

Excessive Momentum Indicator provides you the ability to detect the excessive momentum in Forex and Stock chart. Let us start this simple introduction. Firstly, understand that the excessive momentum could possibly point out some anomaly movement or anomaly momentum in the market. To help your understanding, you can consider the insufficient momentum (i.e. exceptionally low volatility market or sideways market) as the opposite concept against excessive momentum. Our Excessive momentum indicator provides the automatic way of measuring the excessive momentum in your chart.

Once Excessive momentum is detected, then it will draw the Fibonacci Levels in the important area in your chart automatically. Then you can take this as your trading entry. It is simple and easy to trade. Most importantly, it is the powerful momentum indicator that alarm you the important trading entry and exit in advance.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

You can watch this YouTube Video about this Excessive Momentum Indicator.

Youtube: https://www.youtube.com/watch?v=oztARcXsAVA

You can read the full article: introduction to Momentum Trading. In this article, you will find how to unlock the potential of the excessive momentum trading. In addition, this article will provide you some introduction to Volume Spread Analysis.

https://algotrading-investment.com/2018/10/29/introduction-to-momentum-trading/

Momentum trading is often used by the experienced trader. One innovative way to use the momentum trading is to trade with the excessive momentum. Excessive momentum is the technique to identify unusually strong supply or unusually strong demand by analyzing the price series. Why do we need to care about the unusually strong supply or unusually strong demand in our trading? It is because unusually strong supply or unusually strong demand are the sign of the end of the current trend ( or birth of new trend). As you probably guess, when the new trend is born, you can ride the highest profit as possible. Hence, the excessive momentum can provide you the attractive entries for your trading.

Excessive Momentum Indicator provides you the ability to detect the excessive momentum in Forex and Stock chart. Let us start this simple introduction. Firstly, understand that the excessive momentum could possibly point out some anomaly movement or anomaly momentum in the market. To help your understanding, you can consider the insufficient momentum (i.e. exceptionally low volatility market or sideways market) as the opposite concept against excessive momentum. Our Excessive momentum indicator provides the automatic way of measuring the excessive momentum in your chart.

Once Excessive momentum is detected, then it will draw the Fibonacci Levels in the important area in your chart automatically. Then you can take this as your trading entry. It is simple and easy to trade. Most importantly, it is the powerful momentum indicator that alarm you the important trading entry and exit in advance.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

You can watch this YouTube Video about this Excessive Momentum Indicator.

Youtube: https://www.youtube.com/watch?v=oztARcXsAVA

You can read the full article: introduction to Momentum Trading. In this article, you will find how to unlock the potential of the excessive momentum trading. In addition, this article will provide you some introduction to Volume Spread Analysis.

https://algotrading-investment.com/2018/10/29/introduction-to-momentum-trading/

Young Ho Seo

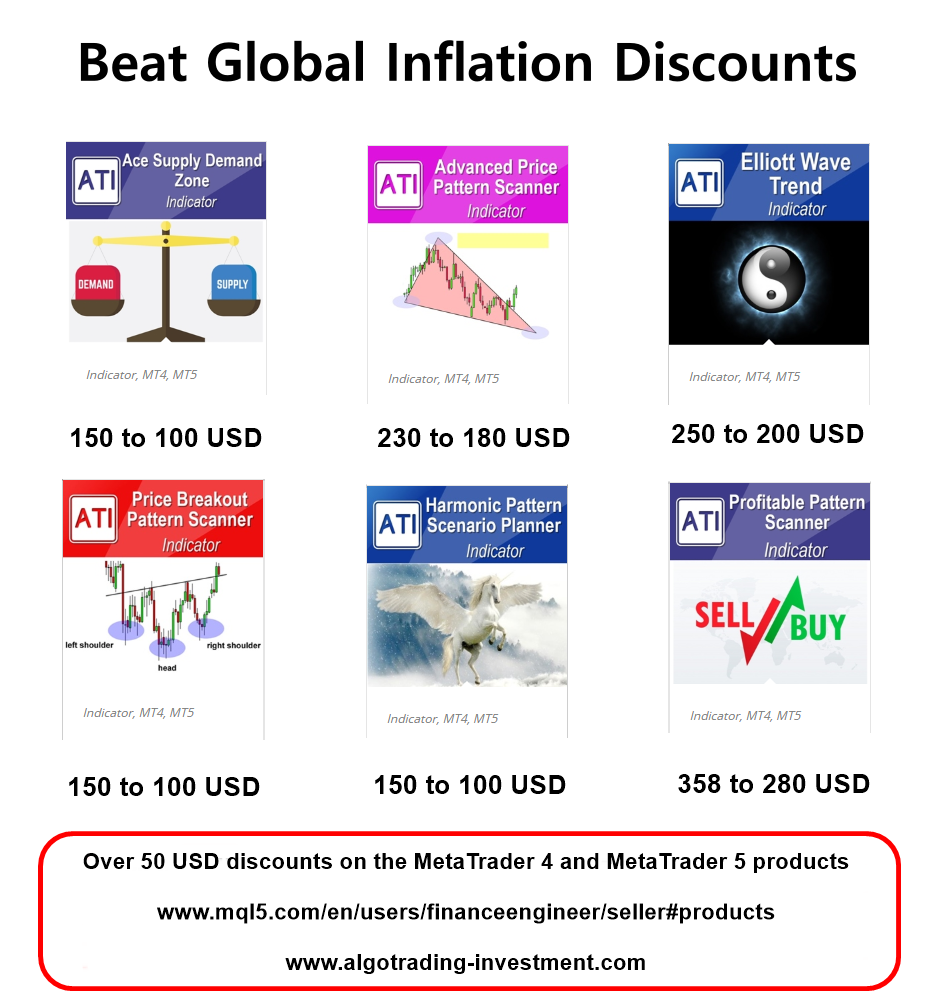

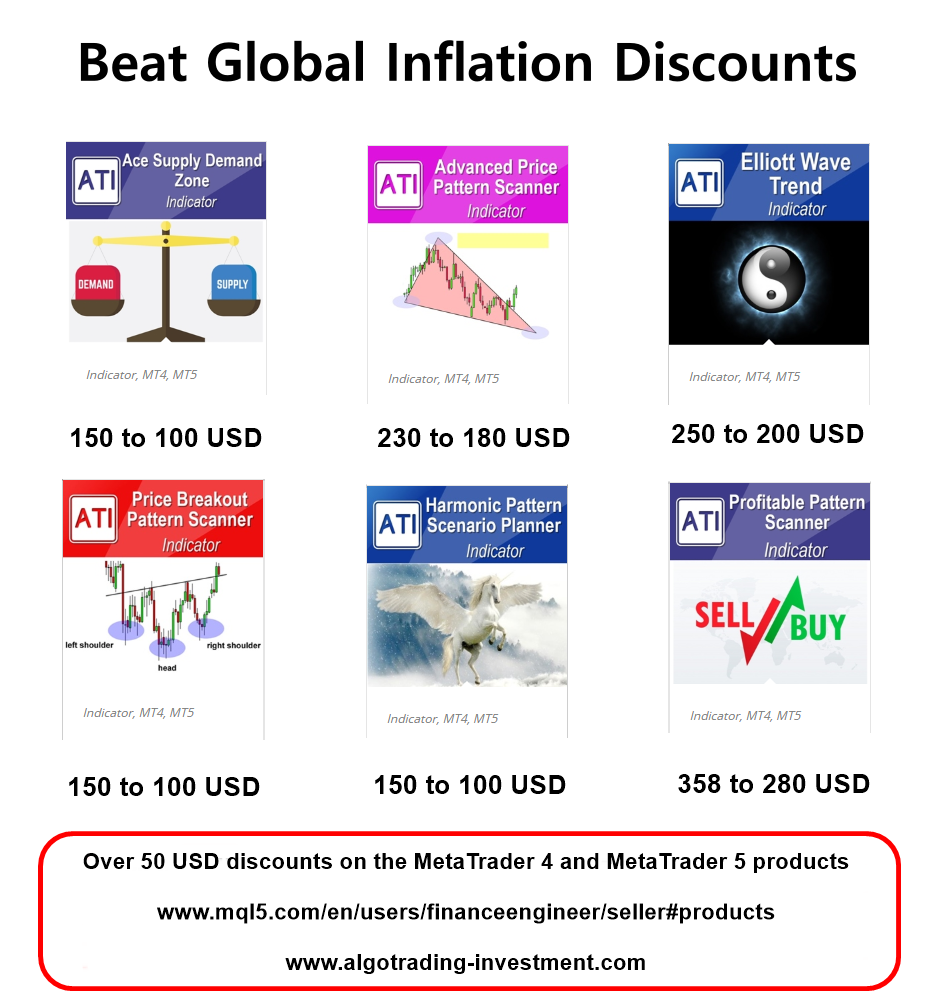

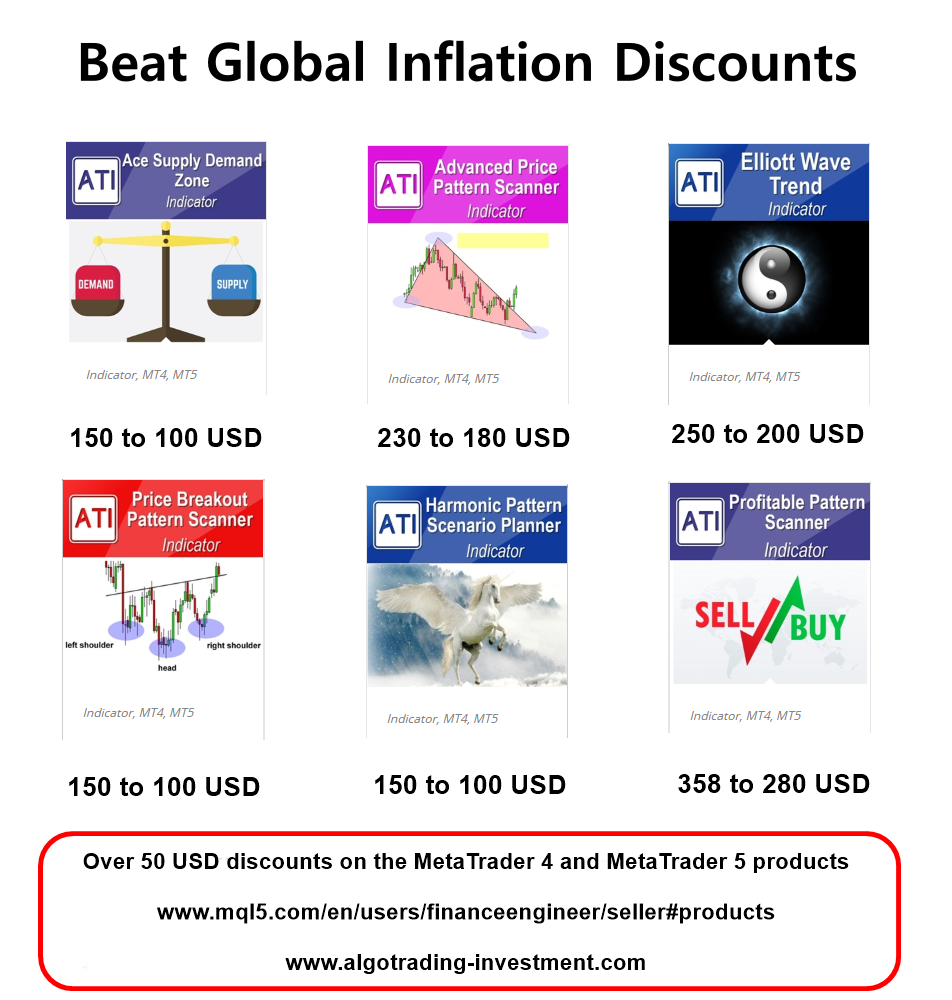

Beat Global Inflation Together Discounts

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there was a war. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there was a war. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Young Ho Seo

Non Repainting and Non Lagging Harmonic Pattern Scanner

X3 Chart Pattern Scanner is the world first Non Repainting and Non Lagging Harmonic Pattern Scanner. Harmonic pattern indicator and scanner help you to automatically detect the Harmonic Patterns like Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on. If you have used the automated Harmonic Pattern Scanner, then you probably know some specific facts about the harmnic pattern indicators in regards to repainting. Repaintng is a fact you should know about when you buy Harmonic Pattern indicators and Scanners on the internet. It does not matter which website you get from or which company you get from or what price you get from, the automated Harmonic Pattern indicator and Scanner can be repainting and if not, then they will lag behind the actual Harmonic Pattern signal. In addition, they will not show the fully synchronized real time signal like you can observe the historical signals in your chart. This can confuse the real trading performance or success rate of your trading strategy with Harmonic Pattern.

Despite of the fact that many trader uses Harmonic Pattern indicators and Scanners, this happens due to the technological limitation. Harmonic Pattern provides the fast signal entry comparing to other techncial indicator. Instead of this fast signal, they are repainting. Hence, there is a trade off between the fast signal and repainting. Think about the moving average or other technical indiactor. In terms of the trading signal, they mostly lags behind the actual turning point due to the smoothing algorithm used in the techncial indicator. This is to say that it is very hard to build the Harmonic Pattern Detection indicator that gives you the fast trading signal without repainting. Even if someone build that non repainting Harmonic Pattern indicator, finding the consistency between real time signal and historical signals are another story. But everyone want to have this sort of dream Harmonic Pattern Indicator even though techncially such a harmonic pattern indicator is really hard to build.

After the intensive research, X3 Chart Pattern Scanner is the game changer for everyone. It does not repaint or lag. It will provide you pattern at turning point but you do not have to worry about if incomplete harmonic pattern will disappear from the chart or not. It will provide the real trading signal as you can see in the historical signals in your chart. You can backtest your trading logic with any secondary confirmation from your chart. Hence, you can base your trading entry and exits as you perceived from your chart. In another words, you can trade as you see from your chart. All other Harmonic Pattern scanner does not provide this sort of direct backtesting capability in your chart.

As a bonus, X3 Chart Pattern Scanner provides around 52 Japanese candlestick patterns + Advanced automatic channel function to improve your trading performance. Of course, there are tons of other powerful features for your trading. You can find those features from the landing page of X3 Chart Pattern Scanner. Below is the link to X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

Here are some YouTube Videos about Non Repainting Harmonic Pattern Scanner. This Youtube video will explain some features of X3 Chart Pattern Scanner, the non repainting, non lagging harmonic pattern and Elliott Wave pattern indicator. Please watch the video to find out more about the non repainting Harmonic Pattern indicator.

YouTube: https://www.youtube.com/watch?v=uMlmMquefGQ&feature=youtu.be

YouTube: https://www.youtube.com/watch?v=2HMWZfchaEM

However, if you do not mind repainting or historical backtesting, then we provide the powerful Harmonic Pattern indicator at affordable price. For example, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are the repainting Harmonic Pattern Indicator with tons of powerful features. You can have a look what powerful features are included inside Harmonic Pattern Plus and Harmonic Pattern Scenario Planner from the link below. Most importantly, they come at affordable price and they are easy to use. Please have a look at the link below.

https://algotrading-investment.com/2018/11/03/harmonic-pattern-plus-introduction-2/

X3 Chart Pattern Scanner is the world first Non Repainting and Non Lagging Harmonic Pattern Scanner. Harmonic pattern indicator and scanner help you to automatically detect the Harmonic Patterns like Gartley Pattern, Butterfly Pattern, Bat Pattern, Crab Pattern, Cypher Pattern, 5-0 Pattern and so on. If you have used the automated Harmonic Pattern Scanner, then you probably know some specific facts about the harmnic pattern indicators in regards to repainting. Repaintng is a fact you should know about when you buy Harmonic Pattern indicators and Scanners on the internet. It does not matter which website you get from or which company you get from or what price you get from, the automated Harmonic Pattern indicator and Scanner can be repainting and if not, then they will lag behind the actual Harmonic Pattern signal. In addition, they will not show the fully synchronized real time signal like you can observe the historical signals in your chart. This can confuse the real trading performance or success rate of your trading strategy with Harmonic Pattern.

Despite of the fact that many trader uses Harmonic Pattern indicators and Scanners, this happens due to the technological limitation. Harmonic Pattern provides the fast signal entry comparing to other techncial indicator. Instead of this fast signal, they are repainting. Hence, there is a trade off between the fast signal and repainting. Think about the moving average or other technical indiactor. In terms of the trading signal, they mostly lags behind the actual turning point due to the smoothing algorithm used in the techncial indicator. This is to say that it is very hard to build the Harmonic Pattern Detection indicator that gives you the fast trading signal without repainting. Even if someone build that non repainting Harmonic Pattern indicator, finding the consistency between real time signal and historical signals are another story. But everyone want to have this sort of dream Harmonic Pattern Indicator even though techncially such a harmonic pattern indicator is really hard to build.

After the intensive research, X3 Chart Pattern Scanner is the game changer for everyone. It does not repaint or lag. It will provide you pattern at turning point but you do not have to worry about if incomplete harmonic pattern will disappear from the chart or not. It will provide the real trading signal as you can see in the historical signals in your chart. You can backtest your trading logic with any secondary confirmation from your chart. Hence, you can base your trading entry and exits as you perceived from your chart. In another words, you can trade as you see from your chart. All other Harmonic Pattern scanner does not provide this sort of direct backtesting capability in your chart.

As a bonus, X3 Chart Pattern Scanner provides around 52 Japanese candlestick patterns + Advanced automatic channel function to improve your trading performance. Of course, there are tons of other powerful features for your trading. You can find those features from the landing page of X3 Chart Pattern Scanner. Below is the link to X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

Here are some YouTube Videos about Non Repainting Harmonic Pattern Scanner. This Youtube video will explain some features of X3 Chart Pattern Scanner, the non repainting, non lagging harmonic pattern and Elliott Wave pattern indicator. Please watch the video to find out more about the non repainting Harmonic Pattern indicator.

YouTube: https://www.youtube.com/watch?v=uMlmMquefGQ&feature=youtu.be

YouTube: https://www.youtube.com/watch?v=2HMWZfchaEM

However, if you do not mind repainting or historical backtesting, then we provide the powerful Harmonic Pattern indicator at affordable price. For example, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are the repainting Harmonic Pattern Indicator with tons of powerful features. You can have a look what powerful features are included inside Harmonic Pattern Plus and Harmonic Pattern Scenario Planner from the link below. Most importantly, they come at affordable price and they are easy to use. Please have a look at the link below.

https://algotrading-investment.com/2018/11/03/harmonic-pattern-plus-introduction-2/

Young Ho Seo

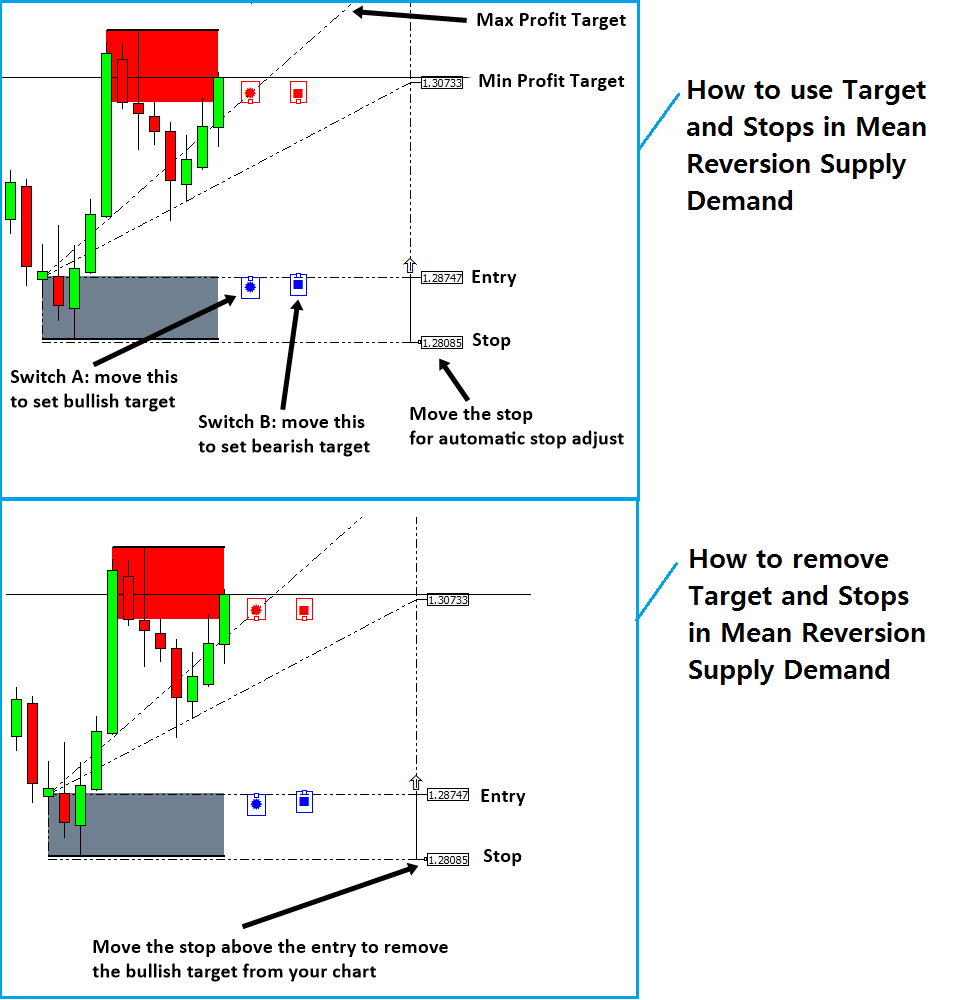

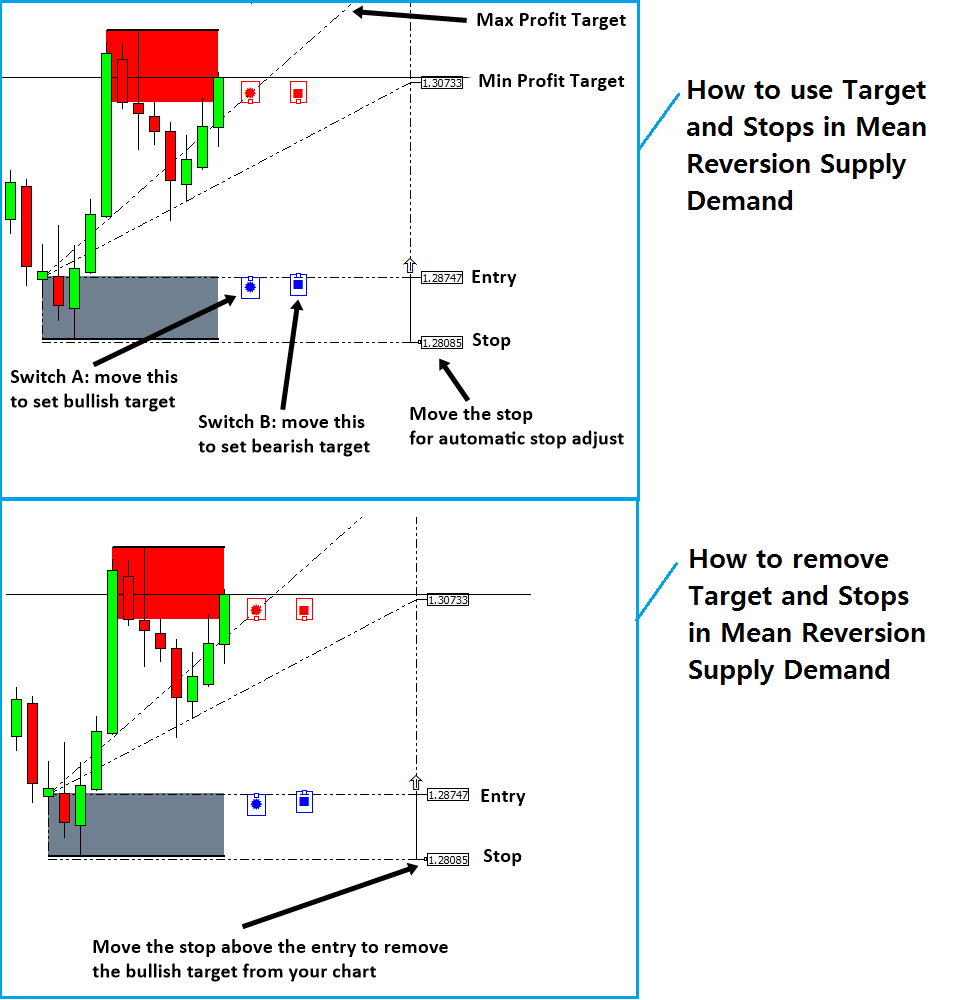

Ace Supply Demand Zone Indicator – How to Remove Take Profit and Stop Loss Levels

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

Powerful Non Repainting Supply Demand Zone MetaTrader Indicator

Ace Supply Demand Zone is the non-repainting Supply Demand indicator. This supply demand indicator is very useful to trade with the market turning point. Its trading strategy is based on the price pattern detection like Drop-Base-Rally, Rally-Base-Drop and so on. Since you have an access to fresh supply and demand zone as well as the historical supply demand zone, you can achieve much better profiling on price movement in Forex market. In addition, the trading zone idea provides you an excellent way of managing your trading risk. This is really useful if you have at least learnt how to use the support and resistance trading, which is the most popular technical analysis in Forex and Stock market.

With the Ability to trade the original supply demand zone trading, you can also perform highly accurate Angled Supply Demand zone trading as a bonus. With a lot of sophisticated gadgets built inside, Ace Supply Demand Zone indicator will provide you unmatched performance against other Supply Demand zone indicator out there.

Here is the link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Ace Supply Demand Zone is the non-repainting Supply Demand indicator. This supply demand indicator is very useful to trade with the market turning point. Its trading strategy is based on the price pattern detection like Drop-Base-Rally, Rally-Base-Drop and so on. Since you have an access to fresh supply and demand zone as well as the historical supply demand zone, you can achieve much better profiling on price movement in Forex market. In addition, the trading zone idea provides you an excellent way of managing your trading risk. This is really useful if you have at least learnt how to use the support and resistance trading, which is the most popular technical analysis in Forex and Stock market.

With the Ability to trade the original supply demand zone trading, you can also perform highly accurate Angled Supply Demand zone trading as a bonus. With a lot of sophisticated gadgets built inside, Ace Supply Demand Zone indicator will provide you unmatched performance against other Supply Demand zone indicator out there.

Here is the link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Young Ho Seo

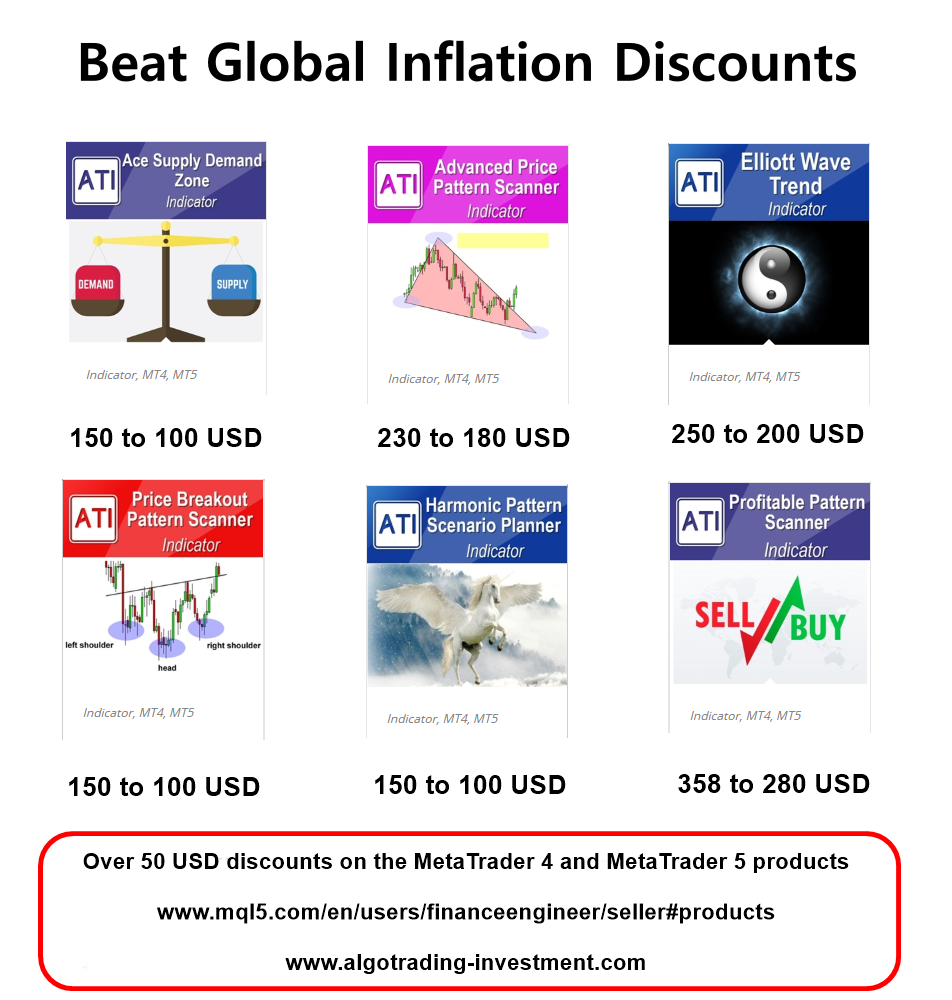

Beat Global Inflation Together Discounts

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there was a war. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there was a war. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Young Ho Seo

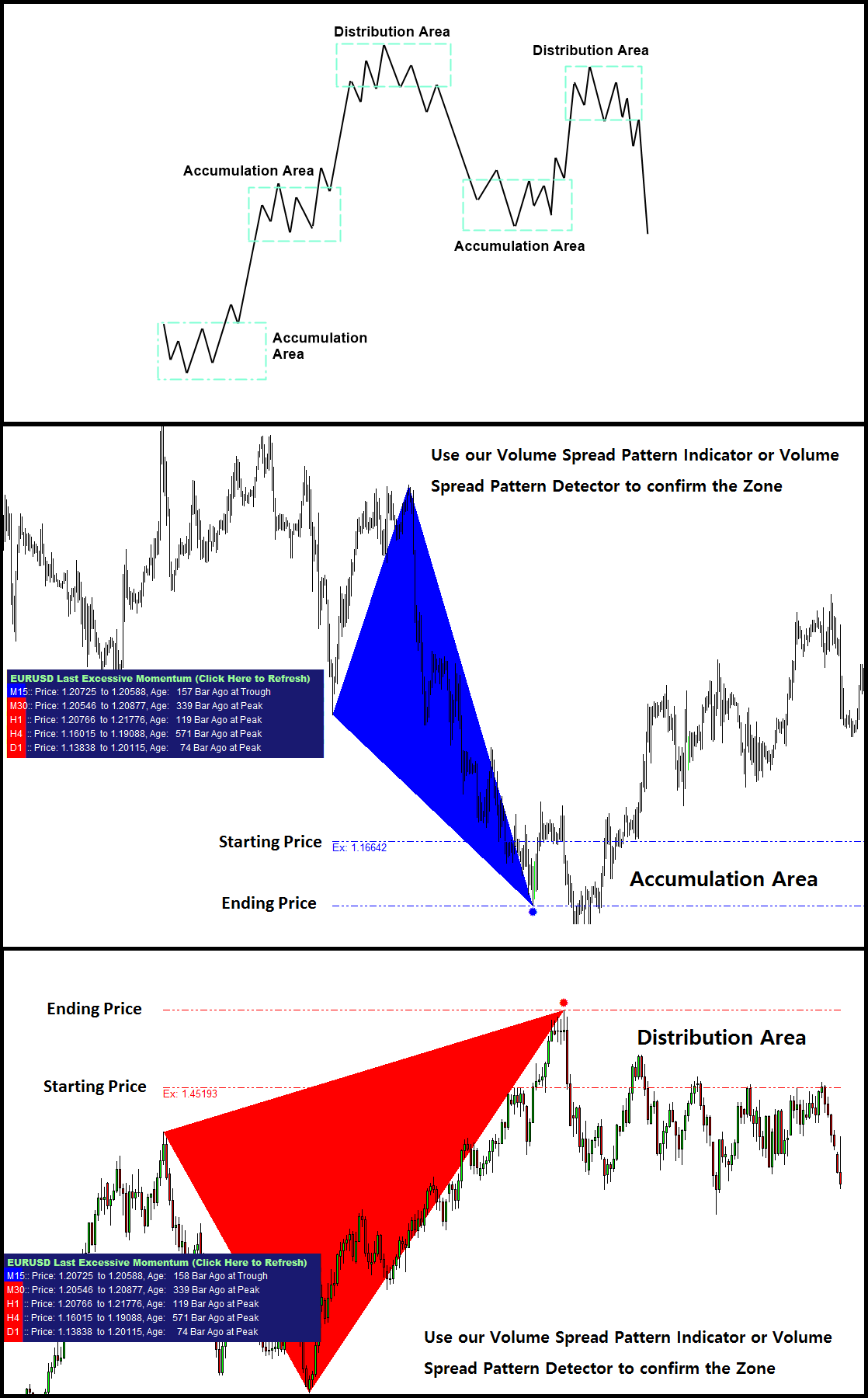

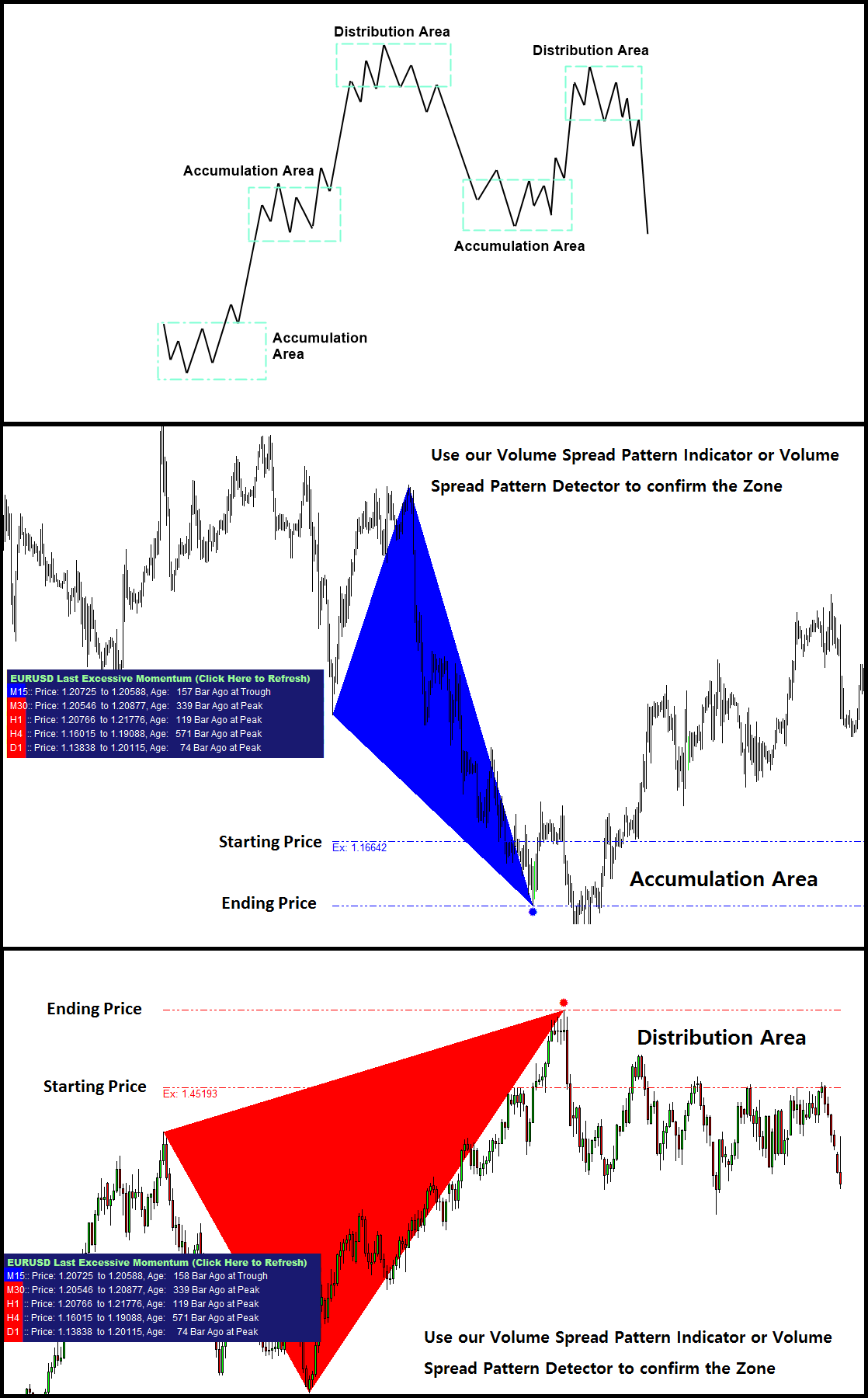

Volume Spread Analysis Indicator List

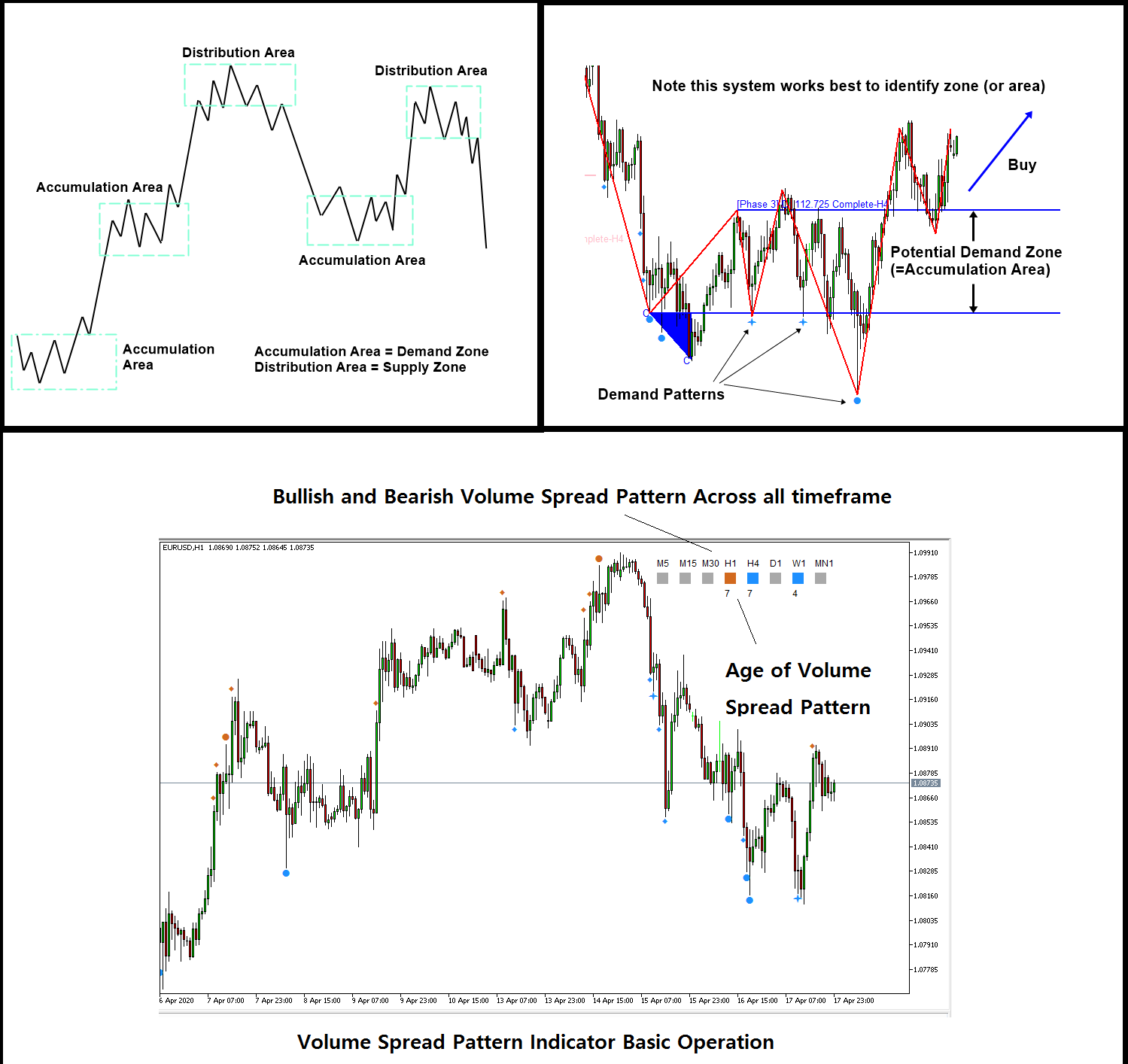

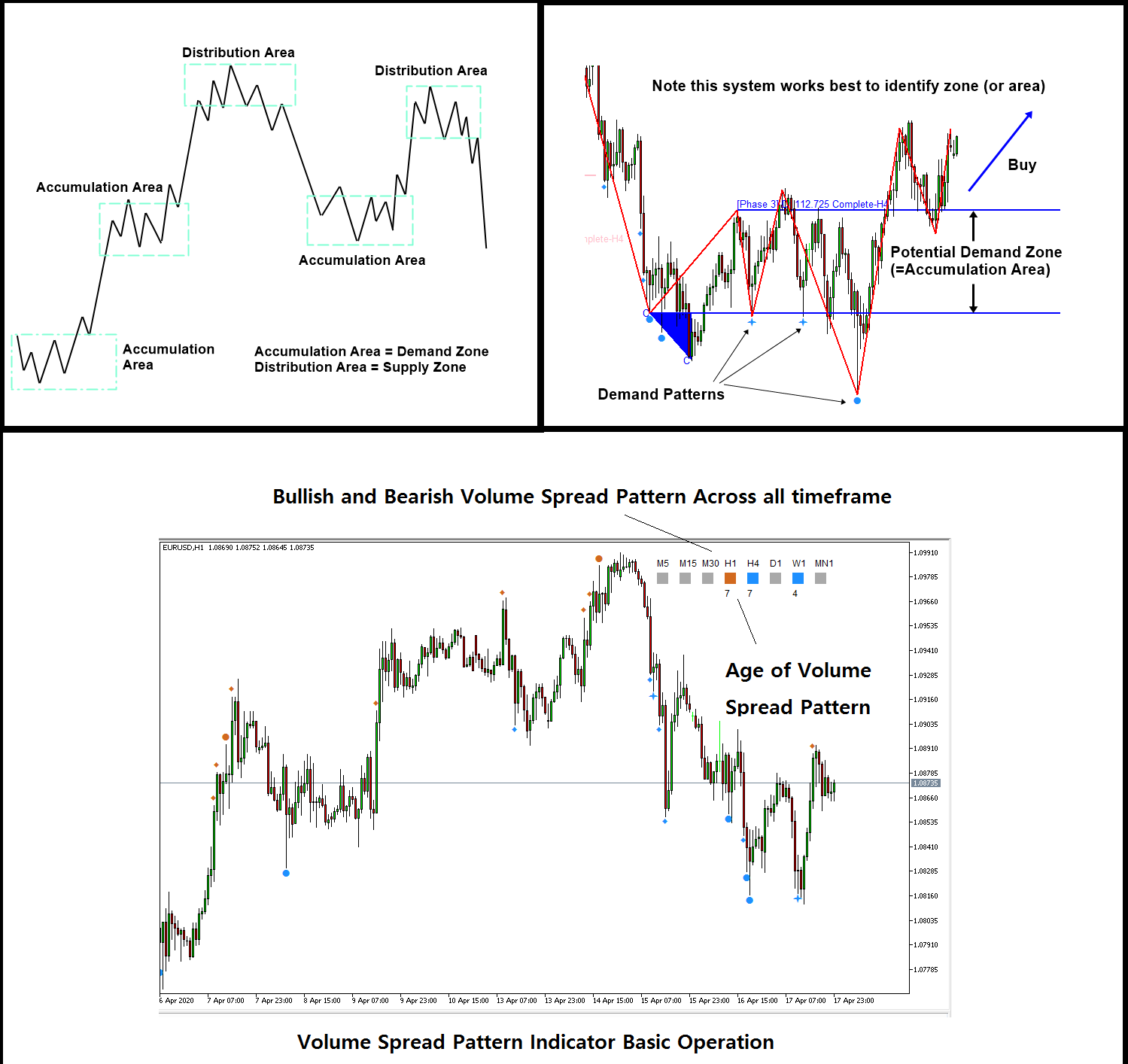

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Momentum Indicator): https://youtu.be/oztARcXsAVA

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Momentum Indicator): https://youtu.be/oztARcXsAVA

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

Young Ho Seo

Harmonic Pattern Indicator Explained

In this article, we will explain the type of Harmonic Pattern Indicator used for Forex and Stock trading. Firstly, there are several variations of Harmonic pattern indicators in history of Price Action and Pattern Trading community. Not all the harmonic pattern indicators are the same. In the past the main variations of Harmonic pattern indicators can be categorized as following three different types.

Type 1: Non lagging (fast signal) but repainting – option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint.

Type 2: Lagging (slow signal) but non repainting – no option to enter at turning point. Indicator does not show the failed pattern but last pattern does not repaint.

Type 3: Detecting pattern at point C but repainting – option to enter at turning point. Indicator detect pattern too early and you have to wait until the point D. Pattern may not achieve point D. Indicator does not show the failed pattern and last pattern can repaint.

Type 1. Non lagging (fast signal) but repainting

First type is non lagging but repainting harmonic indicators. This sort of Harmonic pattern indicator is the typical harmonic pattern indicators used by many traders. The advantage is that you do get the signal early as possible. You have an opportunity to trade from the turning point all the ways down to the continued trend. The disadvantage is that you are not able to test your strategy in chart because this type of harmonic pattern indicator does not show the entry of the failed patterns in chart but only successful one. In fact, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are under this category. They would provide the fastest signal but you will not able to test your strategy in your chart because they do not show the failed entry in chart.

Type 2. Lagging (slow signal) but non repainting

The second type is that lagging but non repainting. Some people use pretty words like minimal lag Harmonic pattern indicator or etc. But really lagging is just lagging. You can not make it really pretty though. As the literal meaning of lagging indicates, this type of harmonic pattern indicators provide you the lagging signal comparing to the first type. It will only provide you the signal after some times passed the turning point. Hence, you do not have an option to consider your entry from turning point. Depending on the pattern size, sometimes, the lagging can be only several bars but it can range up to several dozens of bars like 30 or 60 bars. Sometimes, your entry might be at the first reversal after the turning point. Hence you have be careful with this sort of entry. The advantage is that you will not experience repaint with the latest pattern though. I am not sure if non repainting property can offset the disadvantage of lagging signals because professional harmonic pattern traders are looking for the turning point entry.

Type 3. Detecting pattern at point C but repainting

The third type is that detecting pattern at C point completion not at D point completion. This type of Harmonic pattern indicator do exists. This type of Harmonic Pattern indicators detect patterns way too early at the point C. For this reason, you have to wait quite some time to trade at point D. If you are trade on higher time frame like H1 or H4 or D1, you might have to wait at least half days to several days. You might run out of your patience quickly with this type of Harmonic Pattern indicator by just waiting and waiting. Since, it is detecting pattern at point D, you are not able to see any failed entry in your chart either. So it does repaint. What is worse is that the pattern can be disappeared while you have been waiting some time. You are just wasting your time in this case.

Some people asked me if they can trade from point C to D. The answer is no because we only recommend to trade patterns after we have done intensive research. We did not do research on trading from point C to D.

By summarizing above three types of harmonic pattern indicator, we can draw some interesting conclusion. Non lagging means repainting and lagging means non repainting. There seems to be some balance between fast signal and repainting issues. It might be the universal or physical law.

4. Main problem of Harmonic Pattern Trading for starter

At the moment, the main problem of Harmonic pattern trading is that indicator or scanner does not show the failed patterns in chart. In fact, no harmonic pattern indicator or scanner shows anyway. Hence this is not the problem for you only but for entire harmonic pattern trader ( also including Elliott Wave pattern trader too). Because Harmonic pattern indicators (Type 1, 2 and 3) show only successful patterns in chart, some people take them as true success rate. This look like success rate of 90% or something.

But, this is not the true success rate. There are many failed patterns and they are just not shown in chart. Then why harmonic pattern indicator or scanner do not show the failed patterns in chart? Is it because we want to hide the failed patterns in the intention to show some false information to trader? Answer is no and never. We are all honest people. Simply it was considered as being impossible to create such a pattern detection algorithm showing failed patterns in chart. So the reason was simply because of the technological barrier.

Hence, experienced Harmonic pattern trader live with this fact every day including myself and others because no such a tool showing failed historical pattern in chart anywhere. We just use our experience to fill the missing information about the failed patterns.

For starters, however this makes difficult to visually understand and test strategy with patterns from chart. They have to rely on external source to learn strategy. This is hard for starters and even for experienced harmonic pattern trader. Sometimes, starters believe that harmonic pattern indicator provide the success rate that was counted from successful patterns only in chart like 90% or something as they do not know that harmonic pattern indicator (Type 1, 2 and 3) does not show failed patterns in chart.. This should be not the right motivation to get involved with harmonic pattern trading. The right motivation to trade with harmonic pattern is that you have an option to trade from turning point.

Now the question, can we have non lagging and non repainting harmonic pattern indicator showing failed historical patterns in chart? The answer is yes. We have broken the critical technological barrier. Now you can have non repainting and non lagging harmonic pattern indicator giving you the true success rate in your chart.

This would be great guidance and trading resource on its own. Because you can easily learn how to use pattern together with other technical and fundamental tools, this would relieve strategy concern for all harmonic pattern trader. You have to remember that non repainting and non lagging harmonic pattern indicator is superior than above three pattern indicators (Type 1, 2 and 3). However, because non repainting and non lagging harmonic pattern indicator shows failed patterns in chart, you might get the opposite perception. Please don’t. Repainting or lagging harmonic pattern indicator (Type 1, 2 and 3) will have equally bad or even more number of failed patterns comparing to non repainting and non lagging one.

For your advantage, it is always better to work with the indicator giving you the realistic success rate for your trading. Then you will quickly learn how to improve your trading. In long run, non repainting and non lagging harmonic pattern indicator is definitely good one to stick with. You can add extra filter or other secondary confirmation. These efforts are real because you can measure the realistic outcome with non repainting and non lagging indicator. Remember that you can readily find out the true winning system with non repainting and non lagging harmonic pattern indicator whereas it is very hard for repainting or lagging indicators (Type 1, 2 and 3).

5. Can we have non lagging but non repainting Harmonic pattern Indicator?

Now the question, can we have non lagging and non repainting harmonic pattern indicator? The answer is yes. This is the next generation of Harmonic pattern indicator which was born from intensive scientific research. We shipped the technology to our Profitable Pattern Scanner. We have provided it for the first time in history.

This type of non repainting and non lagging indicator will provide you the fastest signal entry like first type of harmonic pattern indicator. At the same time, it will show you the failed entry in your chart. Hence you can build and tune your strategy in your chart with other technical indicators at ease or even in backtesting mode. Since you can trade as you see from chart, the confidence of your trading will increase dramatically. This is the true hybrid of all above three types of harmonic pattern indicators. With little bit of knowledge on Pattern Completion Interval, you could take the entry at your favored risk to rewards ratio. We also provide Potential Continuation Zone to perfect your harmonic pattern trading. In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below is the direct link to X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5 platform.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

In this article, we will explain the type of Harmonic Pattern Indicator used for Forex and Stock trading. Firstly, there are several variations of Harmonic pattern indicators in history of Price Action and Pattern Trading community. Not all the harmonic pattern indicators are the same. In the past the main variations of Harmonic pattern indicators can be categorized as following three different types.

Type 1: Non lagging (fast signal) but repainting – option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint.

Type 2: Lagging (slow signal) but non repainting – no option to enter at turning point. Indicator does not show the failed pattern but last pattern does not repaint.

Type 3: Detecting pattern at point C but repainting – option to enter at turning point. Indicator detect pattern too early and you have to wait until the point D. Pattern may not achieve point D. Indicator does not show the failed pattern and last pattern can repaint.

Type 1. Non lagging (fast signal) but repainting

First type is non lagging but repainting harmonic indicators. This sort of Harmonic pattern indicator is the typical harmonic pattern indicators used by many traders. The advantage is that you do get the signal early as possible. You have an opportunity to trade from the turning point all the ways down to the continued trend. The disadvantage is that you are not able to test your strategy in chart because this type of harmonic pattern indicator does not show the entry of the failed patterns in chart but only successful one. In fact, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are under this category. They would provide the fastest signal but you will not able to test your strategy in your chart because they do not show the failed entry in chart.

Type 2. Lagging (slow signal) but non repainting

The second type is that lagging but non repainting. Some people use pretty words like minimal lag Harmonic pattern indicator or etc. But really lagging is just lagging. You can not make it really pretty though. As the literal meaning of lagging indicates, this type of harmonic pattern indicators provide you the lagging signal comparing to the first type. It will only provide you the signal after some times passed the turning point. Hence, you do not have an option to consider your entry from turning point. Depending on the pattern size, sometimes, the lagging can be only several bars but it can range up to several dozens of bars like 30 or 60 bars. Sometimes, your entry might be at the first reversal after the turning point. Hence you have be careful with this sort of entry. The advantage is that you will not experience repaint with the latest pattern though. I am not sure if non repainting property can offset the disadvantage of lagging signals because professional harmonic pattern traders are looking for the turning point entry.

Type 3. Detecting pattern at point C but repainting

The third type is that detecting pattern at C point completion not at D point completion. This type of Harmonic pattern indicator do exists. This type of Harmonic Pattern indicators detect patterns way too early at the point C. For this reason, you have to wait quite some time to trade at point D. If you are trade on higher time frame like H1 or H4 or D1, you might have to wait at least half days to several days. You might run out of your patience quickly with this type of Harmonic Pattern indicator by just waiting and waiting. Since, it is detecting pattern at point D, you are not able to see any failed entry in your chart either. So it does repaint. What is worse is that the pattern can be disappeared while you have been waiting some time. You are just wasting your time in this case.

Some people asked me if they can trade from point C to D. The answer is no because we only recommend to trade patterns after we have done intensive research. We did not do research on trading from point C to D.

By summarizing above three types of harmonic pattern indicator, we can draw some interesting conclusion. Non lagging means repainting and lagging means non repainting. There seems to be some balance between fast signal and repainting issues. It might be the universal or physical law.

4. Main problem of Harmonic Pattern Trading for starter

At the moment, the main problem of Harmonic pattern trading is that indicator or scanner does not show the failed patterns in chart. In fact, no harmonic pattern indicator or scanner shows anyway. Hence this is not the problem for you only but for entire harmonic pattern trader ( also including Elliott Wave pattern trader too). Because Harmonic pattern indicators (Type 1, 2 and 3) show only successful patterns in chart, some people take them as true success rate. This look like success rate of 90% or something.

But, this is not the true success rate. There are many failed patterns and they are just not shown in chart. Then why harmonic pattern indicator or scanner do not show the failed patterns in chart? Is it because we want to hide the failed patterns in the intention to show some false information to trader? Answer is no and never. We are all honest people. Simply it was considered as being impossible to create such a pattern detection algorithm showing failed patterns in chart. So the reason was simply because of the technological barrier.

Hence, experienced Harmonic pattern trader live with this fact every day including myself and others because no such a tool showing failed historical pattern in chart anywhere. We just use our experience to fill the missing information about the failed patterns.