DYJ Hedging

- 专家

- Daying Cao

- 版本: 2.8

- 更新: 7 七月 2020

- 激活: 5

The DYJ Hedging is based on the following idea: crossing of two Moving Average lines (Fast and slow ) is used as a signal for opening positions.

The DYJ Hedging searches for position opening conditions only on a new bar (performs operations at the moment of new bar emergence), while Total Profit is controlled on every tick. When a condition for opening a position is found (a check is performed for the Base symbol on which the EA is running), the EA opens two positions at once: on the Base symbol and on the Hedge symbol.

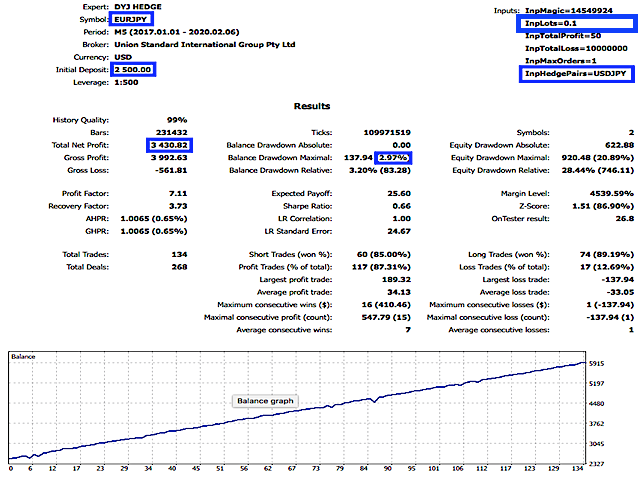

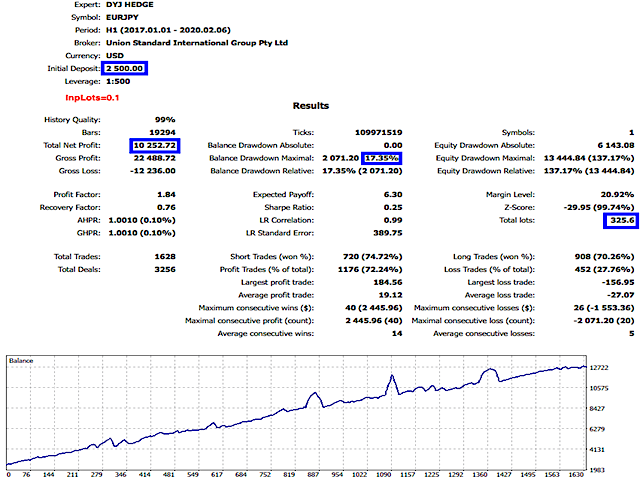

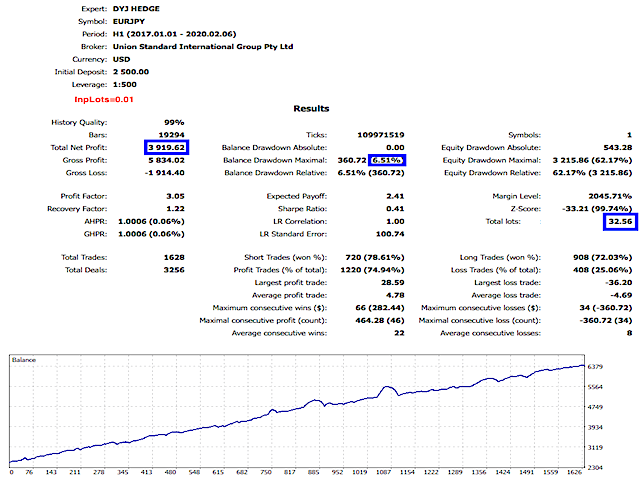

An example of launch on the EURJPY symbol, while the Hedge symbol is USDJPY:

Note: MT5 backtesting cannot simulate all currency signal markets!

Input Parameters

- InpMagic = 14549924 -- magic number

- InpBasePairs = GBPUSD,EURUSD,USDJPY,USDCHF,XAUUSD,XAGUSD,USDCAD -- Comma-separated list of hedge symbols .

- InpHedgePairs = USDJPY,EURJPY,USDCHF,EURCHF -- Comma-separated list of hedge symbols . not used if empty;

- InpPercentRisk = 0 -- Risk (%) [0=False]

- InpLots = 0.1 -- Lots

- InpTotalProfit = 50 -- Profit target for closing all positions

- InpTotalLoss = 1000 -- Loss target for closing all positions

- InpEquityDelta = 1.1 -- Equity target multiple for closing all positions

- InpBaseMaxOrders = 1 -- Base Pairs Counts

- InpMaxOrders = 1 -- Max Orders

- InpMaxSpread = 20 -- Max Spread

- InpPipStep = 300 -- Order step

- InpTakeProfit = 0.0 -- TakeProfit

- InpStopLoss = 0.0 -- StopLoss

- InpTrailingStop = 0 -- Trailing Stop (in pips)

- InpTrailingStep = 0; -- Trailing Step (in pips)

- InpIncreasedProfit = 10 -- Increased Profit($) for GrowthRat

- InpDistanceDivisor = 3 // Pending Distance fraction. Do not use pending if it is 0.