ExpandGrid EG104

- 专家

- Leonel Bauta

- 版本: 104.38

- 更新: 26 八月 2020

- 激活: 10

EG104 EA, originally ExpandGrid, is a collection of grid styles that have been optimized by intense tests, results from demos and real accounts and results from studies and parameter variations. It is delivered with the default parameters, so the trader does not need to change them to use the EA, just drop it to the chart, enable the style setting magic number and let it play.

This EA works with its default values out of the box, but flexibility has always been a priority during developing it. It means the trader may change default values and use different styles simultaneously. By using start/end times the EA may run one style during active sessions and a different style during sleeping sessions, it may run styles in parallel or interlaced and with its own set of parameters. The trader is able, by combining these styles, to create a well complex algorithm no one created before. Its flexibility creates its unlimited potential by itself or by the trader’s imagination.

Style must be enabled first, to do so, set magic number greater than zero. If you enable more than one style, use different magic numbers.

Grid Styles

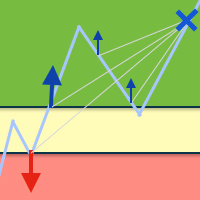

- symmetry - limit order style. It buys and sells simultaneously, closing winning positions at grid levels and averaging breakeven points of losing positions by an order quantity multiplier. The center of the grid moves as new orders execute.

- Channel-static - stop order style. It places and order and if at grid level it is losing, the EA multiply quantity by a multiplier and open positions on the opposite direction. The center of the grid does not move creating a static channel.

- Channel-floating - same as Channel-static where the difference is the center of the grid that moves as new orders execute.

Parameters

- MagicNumber: Set magic number to a value greater than zero to enable the style. MagicNumber is used to identify styles. It must be a different value for each style.

- StartLotQty: Is the initial order lot quantity, additional orders will use a multiple of this value. Grid target is this value times the grid size in pips. Smaller as possible is recommended. Default is 0.01.

- s_WeightDirection=true: In symmetry mode, when this parameter is true, the EA will use its proprietary formulas to weight direction. If EA calculates long direction, it will double long StartLotQty for buy orders, if it calculates short direction, it will double sell orders. if direction is unknown, none direction will be doubled. Example, if EA define long and s_StartLotQty=0.01, the EA will enter 0.02 for buys and 0.01 for sells.

- s_WeightQtyMulti=1. When this parameter is greater than one, the start lot size for the weight side will be multiplied. Example, if s_WeightQtyMulti=2 and the EA calculate that the direction should be long, then the EA will open twice longs than shorts.

- GridSizePips: the size/distance of the grid levels in pips. If this value is zero, expandGrid (EG) will calculate the grid size using daily ATR or daily range values, divided by Grid_Factor. If Grid_Increments and Grid_Factor are used, Grid_Increments will take precedence.

- GridSizeFactor: When GridSizePips=0, a value from 1 to 15 can be used to calculate the grid size/distance. A small value increases the grid size and do open fewer orders, biggest values decrease grid size and scalp more. I see it as a scalping intensity level.

When Grid_Factor and Grid_Increments are both zero, ExpandGrid will use the spread in pips (not points) as grid size. - OrderMultiplier: value used to multiply next order quantity.

- s_AccumulationFiltered=true: Delay accumulation order execution by M1 fractals and M1 moving average cross over. True value is recommended to pause execution on news releases or fast market moves.

- ChannelMultiplier: Order multiplier for Channel style. It is used when price touches opposite direction of the grid.

- StartTime/EndTime: ExpandGrid will not open new positions outside the time specified.

- TakeProfit: I do recommend keeping this value as zero (default). Set it to 0.01 for closure modes.

- Exit_By_M1MA=true: When this parameter is true, the EA will check first its profit target and second the mean price related to a M1 moving average. If cycle is long and price trade above M1 MA the cycle will not close. If cycle is short and price trade below M1 MA the cycle will not close. The EA will try to maximize profits.

- BreakEvenLevel: The EA will set target to 0.01 when this level quantity is reached. Default is recommended.

- Max_Money_Loss: Maximum money loss per grid style. It is recommended to keep it at zero (disabled)

- MaximunOrders=0: When this parameter has a value greater than zero, the EA will pause trading if accumulation orders are gather than its value.

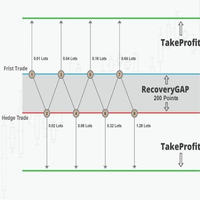

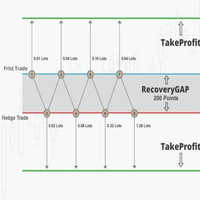

- NeutralizeBalancePercent=0: Now a grid cycle can be neutralize/hedge by EG104 NeutralizeBalancePercent or by DayTarget global NeutralizeBalancePercent or by neutralize horizontal line or by manual intervention. If you use this parameter, I do recommend values greater than 60%

- FlatOnFriday: Will set the target to 0.01 and stops creating new cycles on Fridays after 14 GMT Hours.

- Dynamic_Grid: The objective of this parameter is to reduce quantities and manage fast moves in the same direction when the style is symmetry or ScalperGrid (limit order style), and to expand channels when price is ranging or in consolidations eliminating multiple order zigzags. (Stop order styles).

- Dynamic_Percent_Increase: Grid increasing/expanding percentage, default is 20.

- ResumeNTZd=false. When this parameter is false, after the cycle is neutralized/hedged, the EA will pause execution. You must continue trading manually or using TradingLines. When this parameter is true, the EA will continue trading as normal, closing and opening orders at it levels. If NeutralizeBalancePercent has a value, you may get multiple neutralizations/profit taking orders. This scenario may expand the recovery zone and make the cycle look like it is losing more money.

- CONTINUE: It will open new grid cycle after targeted, if this parameter is set to false, the EA will stops the grid after all the positions closes. ExpandGrid will continue managing opened positions.

It is highly recommended to test this EA on a demo account before trading live.

This is really one of the best EA I've ever used. Works perfect with different currency pairs.