Is 3 SMA Spread

- 指标

- Oleksandr Medviediev

- 版本: 1.4

- 更新: 16 十二月 2021

- 激活: 20

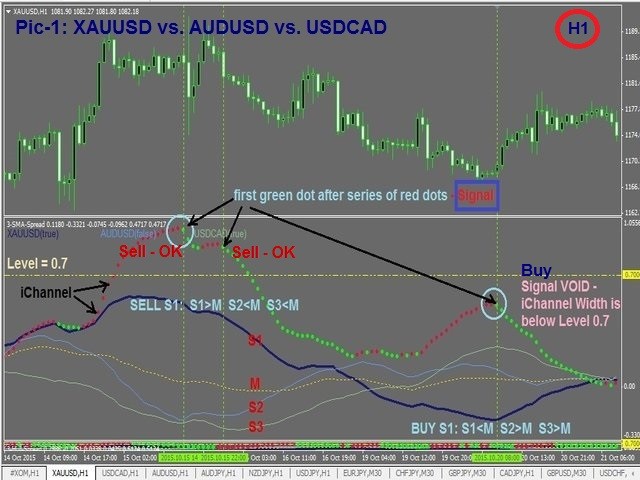

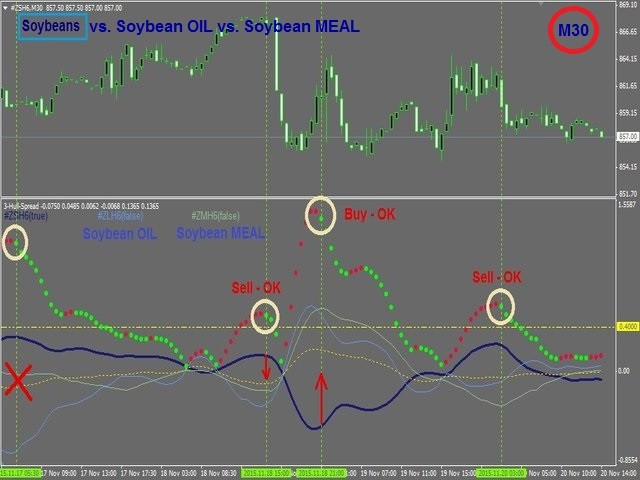

3-SMA-Spread - 通过构建可视化 iChannel(参见下面的公式)来显示 3(三)种不同工具的市场价差的跨工具指标,该 iChannel 根据每个工具的输入按比例更改其宽度(基于 SMA 的“统计套利”) 。

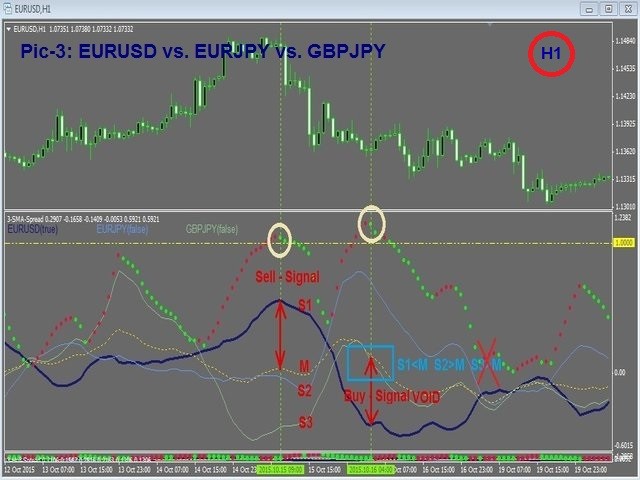

核心原则:每次出现差异后,跟随“它们的”符号价格的价格线不断趋向于回到“合成”中心的总和。 换句话说,由 3 个“相关”工具//对组成的系统不断努力恢复其平均值(所谓的“均值回归”效应)。

适用于任何仪器/TF(必须打开所有使用的仪器的图表/TF)

同步到位。 当前栏关闭后 -- 不重新绘制/不重新绘制

“SetIndexBuffer”适用于所有变量(可在 EA 中使用)

自动检测 4 位数和 5 位数价格

以下公式用于构建 iChannel:

价格线符号 1 - 指标打开的图表

价格线符号 2 - 加上负相关工具的“reversal=true”模式

价格线符号 3 - рplus "reversal=true" 负相关工具的模式

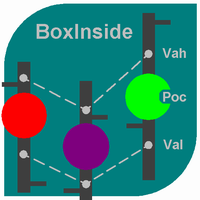

中线 М =“合成”中央 (S1 + S2 + S3)/3(黄色虚线)

iChannel = (S1-M) + (S2-M) + (S3-M)(红点和绿点)

该公式允许在一张图表上组合各种工具(见图 1),例如:

黄金美元 ~1100

澳元兑美元 ~0.7

美元加元 ~1.33

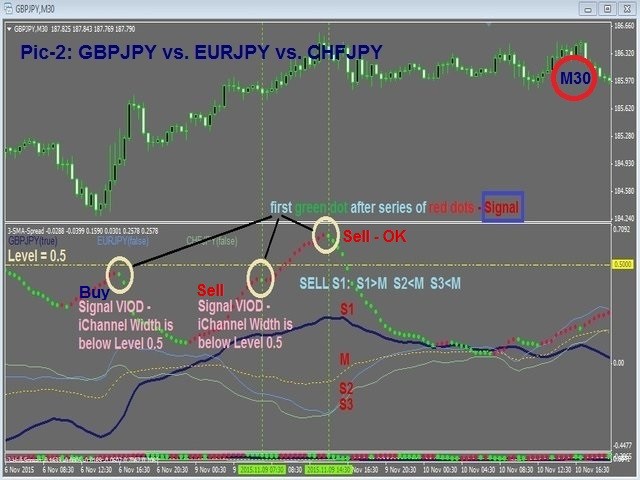

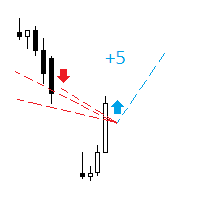

信号条件:

#1. iChannel 的宽度开始变窄(一系列红点之后的第一个绿点)

#2. iChannel 的宽度 > 电平

#3。 价格线 S1 位于中线 М 的一侧,价格线 S2 和 S3 位于中线 М 的另一侧 -- 如下:

信号买入符号-1:S1<M S2>M S3>M -- 注意:iChannel 宽度(红点和绿点)正在变宽或变窄

信号卖出符号-1:S1>M S2<M S3<M -- 注意:iChannel 宽度(红点和绿点)正在变宽或变窄

参数:

Inp_Fast_MA - 快速移动平均线的周期

Inp_Slow_MA - 慢速移动平均线周期

Inp_MA_Method - SMA 参数

Inp_MA_PriceType - SMA 参数

Inp_Symbol_1 - Symbol-1(默认为 GBPJPY)

Inp_Symbol_2 - 交易品种 2(默认为 EURJPY)

Inp_S2_revers - =True,如果 Symbol-2 与 Symbol-1 具有负相关性

Inp_Symbol_3 - 符号 3(默认为 CHFJPY)

Inp_S3_revers - =True,如果 Symbol-3 与 Symbol-1 具有负相关性

其他有用的信息:

高度相关的三向仪器的典型示例:

黄金与黄金形成货币对 AUDUSD、USDCAD 和 NZDUSD

黄金 vs. 原油/WTI 和布伦特/BRN

股票与指数(S&P500、纳斯达克、道琼斯指数等)

2016 年 3 月豆粕 (ZMH16) 对比 2016 年 3 月豆油 (ZLH16) 对比 2016 年 3 月大豆 (ZSH16) 等

120 种经典 3 向货币对组合的完整列表 - 请参阅评论部分中的链接。

注意:对于经典的三向组合(仅参与 3 种货币),中线 М 将始终是一条直线。

具有经过证明的盈利能力的最佳、最有效、可靠产品

具有经过证明的盈利能力的最佳、最有效、可靠产品