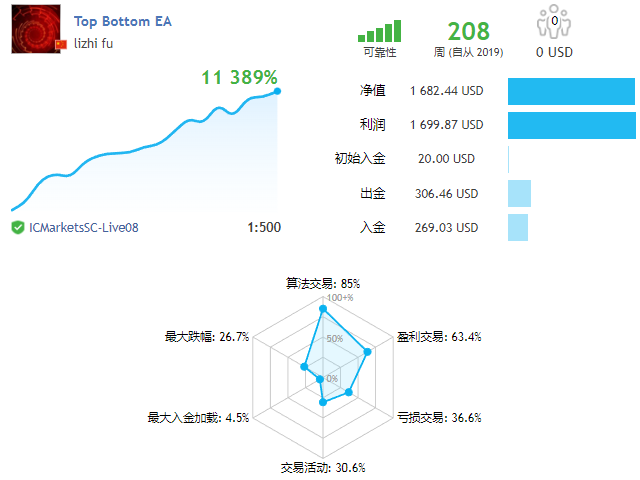

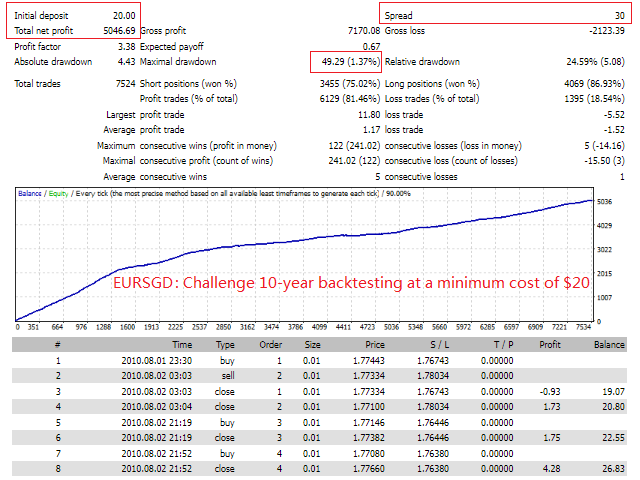

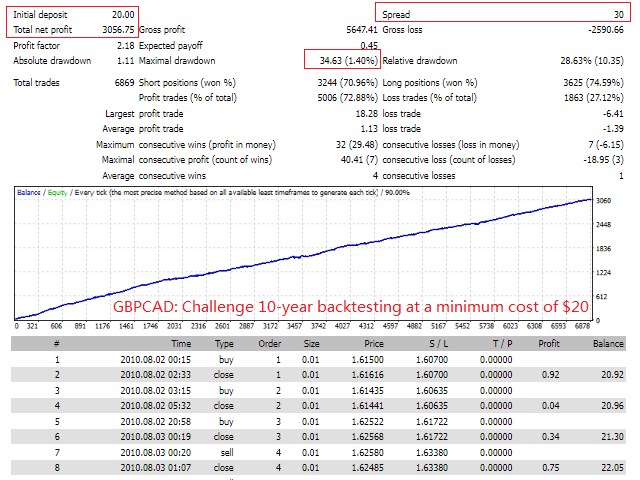

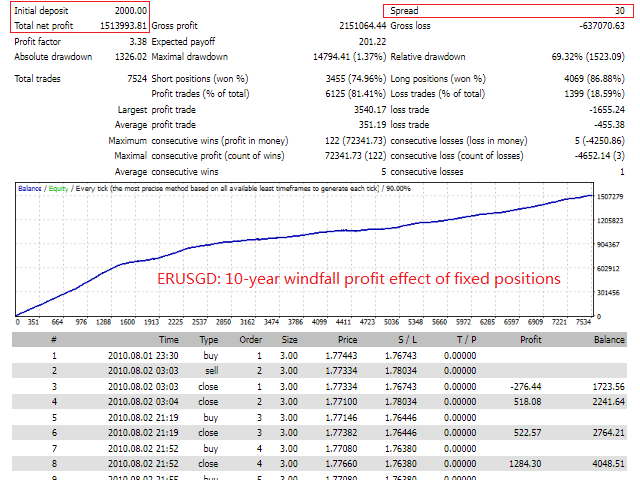

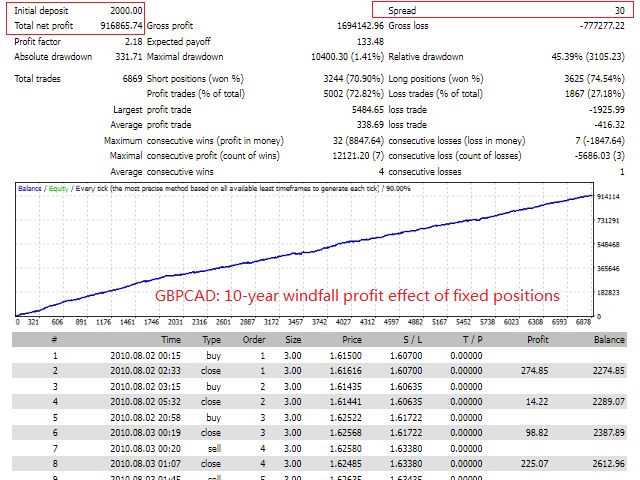

TopBottomEA's advantage: the first support for small capital work EA, real trading for more than 4 years; this EA based on volatility adaptive mechanism, only one single at a time, each single with a stop-loss, an average of about 4 orders per day, holding a single length of 12 hours or so, with a limit of $ 20 principal challenge backtesting ran through more than 10 years.

Every interval of three days to increase the price of $ 100, the price process: 998 --> 1098 --> 1198...... Up to the target price of $ 4999 until, after the purchase, EA work period, you can and our real observation account trading record comparison.

To join the public group:

click here Challenge Minimum Funds Real Account :

https://www.mql5.com/zh/signals/1575208 Quality [Reliability] 5 frames.During the New Crown virus, EA trading broke down for a year and the server expired for reasons.

Support currency: GBPCAD, EURSGD,other varieties will be added one after another, we aim to make money, only choose the best, the currency is not more in the fine, so that the income is more stable.

Support cycle: M1 chart

Recommended platforms: icmarkets platform original spread account, fpmarkets platform raw spread account, exness platform zero-point account. In order to gain more and unified effect, it is best to use the icmarkets platform, so that it is convenient to compare with our real observation account trading records.

Position recommendations: for the retracement of sensitive friends recommended 1000 position two coins were hung 0.03 hands; for the retracement of insensitive friends, it is recommended that 1000 position two coins were hung 0.05 hands.

How to use: Load into GBPCAD and EURSGD 1M charts respectively, no need to adjust any parameters, just follow the position recommendations to adjust the lot size.

Risk warning: Please use the EA strictly in accordance with the recommendations and suggestions listed above. If you change the currency pair or do not adjust your position lot size as recommended, you do so at your own risk.

The erection of the correct use of EA mentality and philosophy:

1, whether there is a single by the market decision, maybe a day a single are not, maybe a day top a few days of single volume, the greater the market the more single volume.

2, a perfect EA curve is often up and down fluctuating back and forth to grow up. Only Martin class strategy curve is straight, but at any time will return to zero.

3, do not trade with a quick success mentality, a good EA is not every day a profit, each EA has its specific most suitable market, in 80% of the unsuitable market may be a flat profit and loss or a small profit, in 20% of the suitable market may be a fast pull-up profit, can not tolerate 80% of the ordeal, there is no 20% fast pull-up gains.

4, in the spirit of sound investment mentality, under the premise of sound, the pursuit of reasonable long-term stable returns; against relying on luck, no stop-loss, dead carry, etc., behind the lurking huge risks; stop-loss for profit, in the constant stop-loss and stop gain in the boom of stable long-term gains.

5, manual manipulation requires a mindset, the use of EA also requires a good mindset, the use of EA is like planting vegetables, the more frequent attention the more growth is missing, because you are slowly experiencing this time process, always think too slow. When you do not care when you do not know the growth is very high, please erect the right investment mindset, do not be impatient.

6, slow = fast: is when the EA framework in 【once only a single, strict stop loss】 constraints, can stabilize the growth, it means that the risk is controllable, that is, slow is equal to fast.

7, fast = burst: is when the EA framework in [no stop loss, dead carry single] under the loose conditions, it means that the risk is uncontrollable, that is, fast is equal to burst.

Parameter description:

Lost // lot size of opened trades on signal

Compoundinterestswitch // The compound interest switch, by default, is off.

Risk // Compound interest position value, the higher the number the larger the position.

ParameterSwitching //false state is an automatic parameter, true state is an adjustable parameter (the parameters controlled by the switch are: Volatility, StopLoss, Profit)

Volatility //volatility parameter, the larger the parameter the lower the volume of orders

StopLoss // Stop Loss parameter

Profit // stop loss parameter

Pointdifferencelimit // spread parameter, does not work when the platform spread exceeds it

Displayswitch // data panel switch, default is off

Magic //Grinding Art No.

CommentName //Comment parameter, you can name it as you like

good