Ichimoku Cloud Super Rider

- Эксперты

- Robofx Technologies LLC

- Версия: 2.0

- Обновлено: 9 марта 2020

- Активации: 10

Ichimoku Cloud Super Rider is easy to use full automated EA that designed to generate profits by gaining multiple smaller profits with variable lot size control - The EA watches so many things based on the Ichimoku theory to calculates the risk for the given market. At the lesser confident market, the lesser lot sizes traded and vise versa. Because of the principle, narrower split are better, no or small commissions are better.

Recommended minimum deposit is >$100 although bigger numbers are better as the variable lot size control works well with >$1000 due to the minimum lot size for the accounts.

The EA works with EURUSD M5.

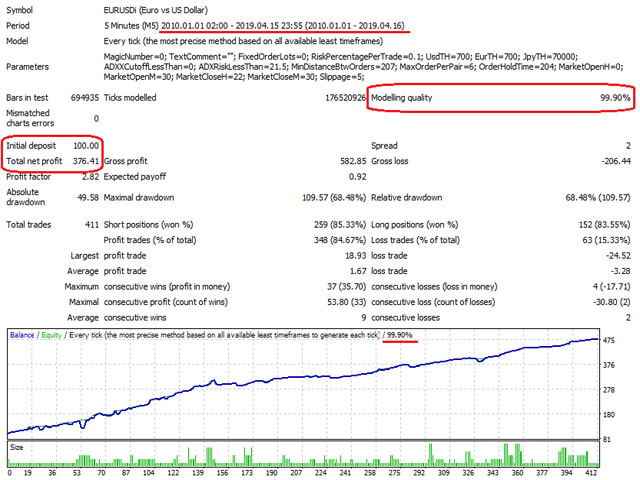

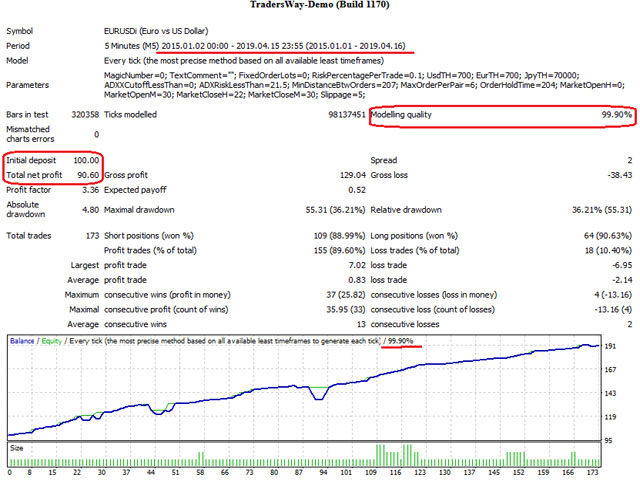

For the backtest, make sure to download all the history data available for M1 to MN1 for the period from few months earlier of the test starting date to current for the indicators to work correctly.

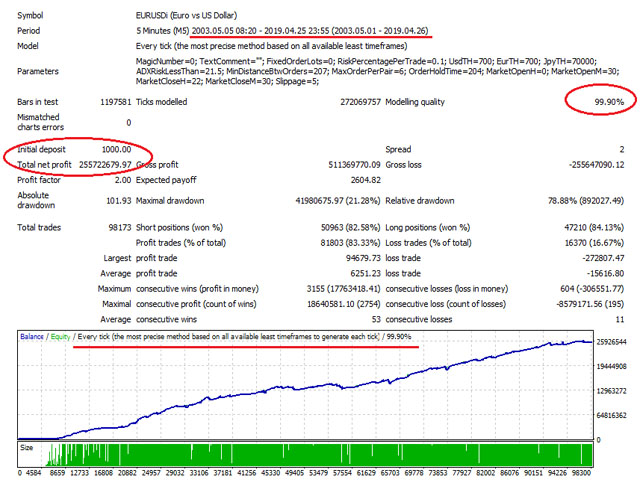

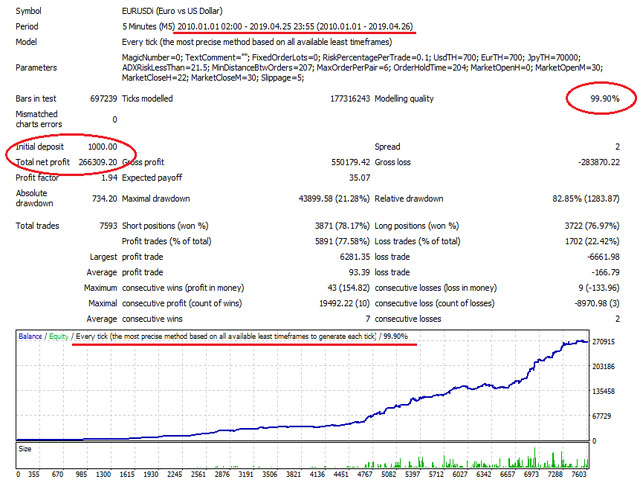

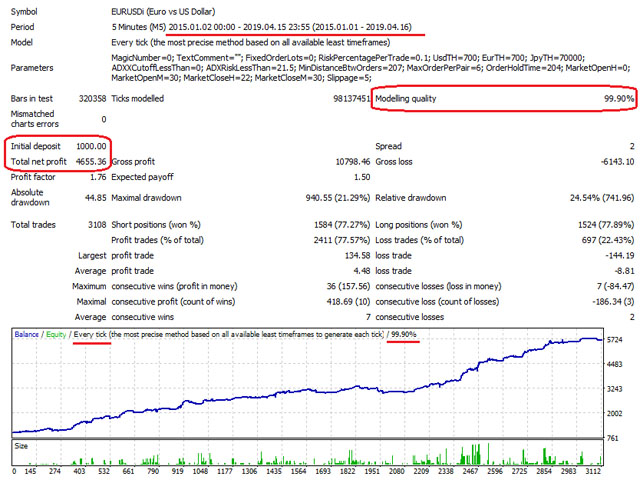

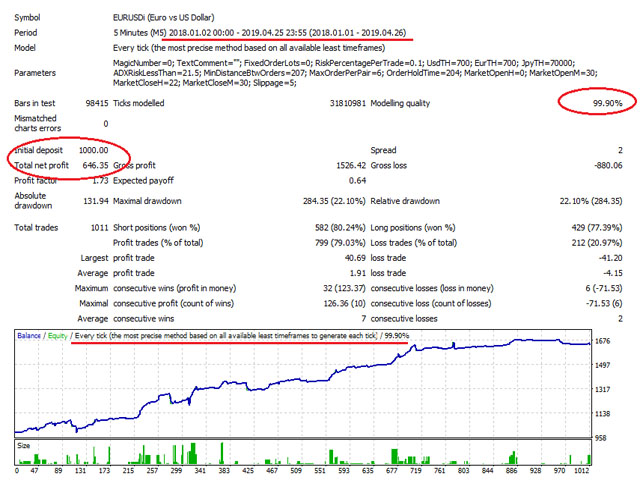

*My 99.9% quality results were tested with Ducascopy and TickDataManager.

UI

UI has the boxes to indicate the cloud vs price status for each timeframe to glance M1 to MN1 status on one chart.

Blue box = Senkouspan A is above Senkouspan B. Red box = Senkouspan A is below Senkouspan B. Yellow box = A and B are at the same price.

Letter 'A' = the price is above the cloud. 'B' = below the cloud. 'C' = in the cloud meaning the price is between Senkouspan A and B.

*In Visual mode backtest, only the M5 indicator works due to the MT4 backtest limitations.

Input Parameters

MagicNumber : Magic number. Can be left 0 to assign one automatically.

TextComment : Comment to supply for each trade if its desired.

RiskPercentagePerTrade : Risk value. Bigger the numbers, EA places bigger lots for a trade. Default is 0.1.

MaxOrdePerPair : EA will place more than one trade when the market goes against to it. The number limits how many trades can be placed to compensate.

MarketOpenH : On Mondays, EA won't start trading until the time passes the time specified by MarketOpenH for hour and MarketOpenM for minutes to avoid large spread.

MarketOpenM: : On Mondays, EA won't start trading until the time passes the time specified by MarketOpenH for hour and MarketOpenM for minutes to avoid large spread.

MarketCloseH : On Fridays, EA won't trade after the time specified by MarketOpenH for hour and MarketOpenM for minutes to avoid large spread.

MarketCloseM : On Fridays, EA won't trade after the time specified by MarketOpenH for hour and MarketOpenM for minutes to avoid large spread.

Slippage : Maximum slippages allowed.

Пользователь не оставил комментарий к оценке