Can should should show lines and arrows when conditions meet .

The goal of the Trend Line Theory strategy is to find out if a breakout is valid by evaluating:

a) The trend

b) The number of pullback - swings

c) The relative swing length

d) The swing retracement percentage

To do that, let’s see how we can use trendlines to target the end of a retracement and enter in the direction of the larger trend.

The basic logic in price action analysis is that the stronger a move is the more likely the price will continue to move in that direction.

The same holds true of pullbacks during a trend.

The stronger a pullback is the more likely it is that it will turn into a full blown reversal at the end. And, conversely, the weaker a pullback is the more likely it will be just a retracement and the more likely that the original trend will resume.

And this is where John Hill’s Trend Line Theory will help us, namely in determining the strength or weakness of a pullback.

Note that in order to use this strategy there needs to be what John calls a complex pullback, which is just a pullback with at least 3 swings in it.

In essence, the strategy consists of drawing two trendlines and then analyzing how they interact with each other and with price.

Those 2 trendlines are the 0-2 and the 0-4 line, as John calls them.

• Point 0 is always the starting point of the pullback. So, that would be the high in an uptrend and the low in a downtrend.

• Point 1 is the ending point of the first swing inside of the pullback.

• Point 2 is the ending point of the second swing inside of the pullback.

• Point 3 is the ending point of the third swing inside of the pullback.

• Point 4 is the ending point of the fourth swing inside of the pullback.

Now, to get the 0-2 and 0-4 line all we need to do is connect the respective points inside of the pullback. It doesn’t matter which swing point is higher or lower, just connect the 0-2 and the 0-4 points.

So, after drawing the two lines we can get a sense of the strength of the pullback by analyzing the trendlines.

If line 0-4 is steeper then the pullback has momentum and may turn into a complete reversal of the larger trend. Don’t enter on the breakout of line 0-4.

If line 0-2 is steeper then the pullback is weak and the larger trend is more likely to resume. Enter on the breakout of the 0-4 line in the direction of the larger trend.

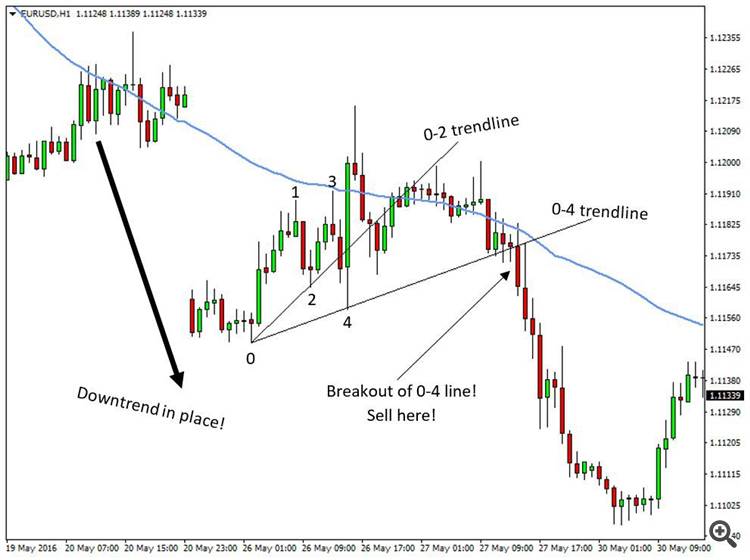

Let’s look at a few examples so that you can better understand this strategy. First an example of the trendline theory in a downtrend on the EUR/USD pair.

To determine the trend on this chart, we are using a 50-period simple moving average represented with the blue line. The price is clearly below of the MA for most of the time and the MA is sloping down indicating strength of the larger trend.

• The start of the pullback is the swing low of the initial down move on the left and it’s marked with the number 0 on the chart.

• In line with John Hill’s trend line theory, the first swing high inside of the pullback is marked with number 1 on the chart

• The first swing low inside of the pullback is marked with number 2 on the chart

• The second swing high inside of the pullback is marked with number 3 on the chart

• The second swing low inside of the pullback is marked with number 4 on the chart

Похожие заказы

Hi, I have a clear MT5 EA wrapper project with locked TSCEA, requiring enhanced execution logic (“pending OR better market” order handling). I can share detailed spec. Please let me know your availability and quote range. Thanks, Tom Pike ------------------------------------------------------------------------------------------------------------------------------ Title: MT5 Wrapper EA – “Limit Order OR Better

I need a professional MT5 Expert Advisor coded to combine two strategies: SMC Strategy (Smart Money Concept) using H1 candlesticks, supply/demand zones, and market structure shifts. Breakout Strategy using M15, M30, H1, and H4 candlesticks, with the same rules as SMC but based on pre‑session highs/lows and breakout confirmations. Parameters: Adjustable Lot size: adjustable (default 0.01) Positions per trade: 2 Stop

Hello, I want help coding an ICT strategy: entering 5M FVGs in the direction of bias/DOL between 3–4 AM NYC. The problem is that finding the bias/DOL is discretionary—are there indicators or ways to make it codable? Anyone that can do this should message me

I need an expert who trades gold on 1-minute and 5-minute timeframes and delivers good results. What are your capabilities for this task? What experience do you have in doing this? If you have any previous trading patterns, please share them with me

🔥 ICT_OneTrade_2R Precision. Discipline. Consistency. ICT_OneTrade_2R is a professional Expert Advisor designed for traders who value structured execution and controlled risk. This system is built around a fixed Risk-to-Reward ratio of 1:2 (RR 2.0) — meaning every trade is planned with precision: Risk 1 → Target 2. No randomness. No overtrading. Just one high-quality trade per session. ⚙️ Key Features ✔ Fixed RR 1:2

I'm looking for ea based on below requirement Buy trade When 1st candle (previous candle) is sell candle then the 2nd candle (current candle) turn buy and past the opening price of 1st candle put instant buy Hidden TP - 20pips Hidden SL - 1st candle lowest price then add another 10 pips (5 digit)

I’m looking for developer to build an AI-assisted trading system for Metatader 5 . You to deliver, working MT5 module, AI module (Python or compatible), source codes for both This phase is focused strictly on core logic and AI integration , not UI or dashboards. Kindly reach out only if you have experience on AI integration and prove of past work

Description: I am looking for a professional MQL4 developer/quant trader with a proven track record in EA optimization. This project involves optimizing a third-party EA that currently has a 2-year live track record. The Task: In-Sample Optimization: Optimize the EA parameters using historical data prior to January 1, 2024. Out-of-Sample (Walk-Forward): Validate the optimized settings against the period of

Trade settings: --------------------------------- fixed lot size ….. 0.0 Buy /Sell distance market order…. 0.0 - 700.0 points Buy / Sell distance pending order Entry---- 0.0 - 700.0 points Max Trade------ 10.0 Min spread...… 0.0 points Max spread..... 3000.0 points Daily profit percentage ….. 0.0 - 100 % Global Stoploss Percentage----- 0.0 - 100 % Max Daily loss Percentage ------0.0 - 100 % Stop level = 0.0 point

📌 General 🔸 Pair: XAUUSD (Gold) 🔸 Timeframe: M1 only 🔸 Strategy: Funded account ❌ No over-trading 📊 Trade Frequency Rules 🔹 One win OR one loss per day only 🔹 If trade goes Break-Even, another trades allowed same day 🔹 If trade hits TP or SL, trading must stop for that day 🔹 Only one active trade at a time 💰 Risk & Reward 🔹 Risk per trade: 1% 🔹 Risk–Reward (RR): 1:3 🔹 Break-Even rule: At 1:1 RR SL must