Uwe Goetzke / Perfil

- Informações

|

11+ anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

In the beginning of the nineties I developed commercial stock market programs.

I have a very solid background as a professional programmer and a software architect having designed and implemented several commercial programs since 1980.

So I know how to program and all about market theory ;)

Now I am trying to get a big foot into forex...

How do forex prices move? (I just look on the smaller timeframes up to M5)

as waves - in trend direction up and down, or sidewards ;)

in jumps - on news

in spikes - on speaches, as we have some kind of real time interpretation/expectation

Concerning waves we find different types, depending on volatlity of currency or liquidity of the market for the currency.

At some point we can identifiy that a counter trend is starting and we have to reverse our strategy until we have again a trend.

So, to automate strategies we have to look for self adapting methods as there are no constant parameters.

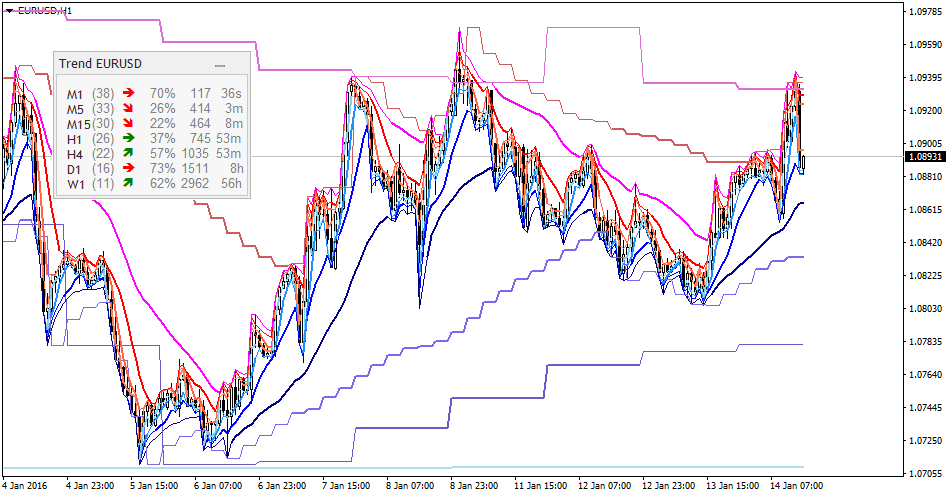

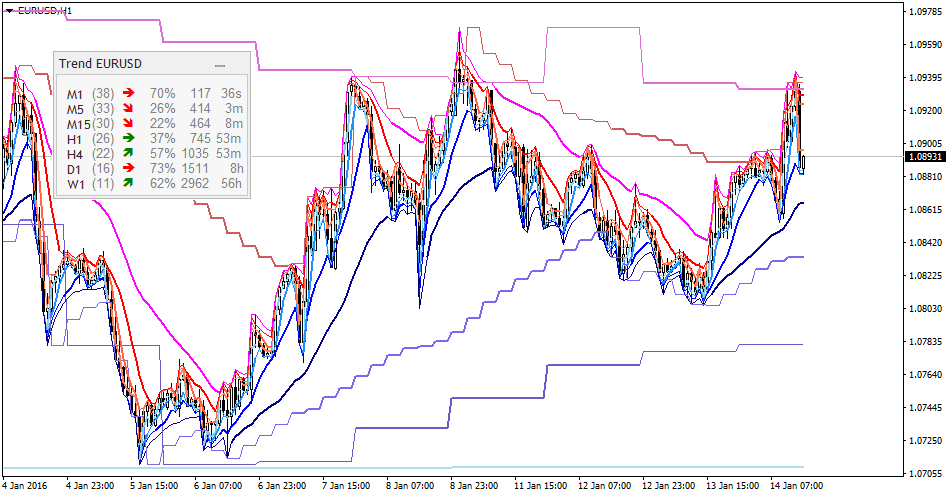

The state of the market should be determined from short (M1,M5,M15), medium (M15,H1,H4) and longer term observations (H4,D1,W1).

On each time frame calculate an lower and upper bound and segment the range into several bands (more bands on longer time frames).

Depending where the price is located in the bands I see 7 states which could be calculated:

up, moving higher than a previous high. Do not sell.

down, moving lower than a previous low. Do not buy.

counter trend up, a specific time in the trend has passed. The last high point is lower than the previous high point.

counter trend down, a specific time in the trend has passed. The last low point is higher than the previous low point.

squeeze, current range is smaller than a previous range.Protect your position with buy-stop or sell stop in the opposite direction (or do both to enter the market on break-out)

range-up, the price is in the bounds of a previous high & low and moving up

range-down, the price is in the bounds of a previous high & low and moving down

Partial exits in a trend (we never know what happens next, so let us protect any gains):

I uses a number of linear regressions lines as protective trend lines. Their periods might depend on the choosen currency and its volitility.

In a pull back of a trend, one of linear regression protective trend lines is hit and a partial exit out of the position is done.

I call this the "gear change method" ;-)

For example the EA uses linear regressions of period 50 (gear4 = the fastest), 100 (gear3) , 200 (gear2) and 400 (gear1).

If in an uptrend the price hits on ites way down the lr50, a fourth of the position is sold and the trend follower switches one gear lower.

If lr100 is hit, we switch in this example to lr200, and again sell another fourth of the original position size.

And so on.

So if lr400 is hit the position is closed.

I have a very solid background as a professional programmer and a software architect having designed and implemented several commercial programs since 1980.

So I know how to program and all about market theory ;)

Now I am trying to get a big foot into forex...

How do forex prices move? (I just look on the smaller timeframes up to M5)

as waves - in trend direction up and down, or sidewards ;)

in jumps - on news

in spikes - on speaches, as we have some kind of real time interpretation/expectation

Concerning waves we find different types, depending on volatlity of currency or liquidity of the market for the currency.

At some point we can identifiy that a counter trend is starting and we have to reverse our strategy until we have again a trend.

So, to automate strategies we have to look for self adapting methods as there are no constant parameters.

The state of the market should be determined from short (M1,M5,M15), medium (M15,H1,H4) and longer term observations (H4,D1,W1).

On each time frame calculate an lower and upper bound and segment the range into several bands (more bands on longer time frames).

Depending where the price is located in the bands I see 7 states which could be calculated:

up, moving higher than a previous high. Do not sell.

down, moving lower than a previous low. Do not buy.

counter trend up, a specific time in the trend has passed. The last high point is lower than the previous high point.

counter trend down, a specific time in the trend has passed. The last low point is higher than the previous low point.

squeeze, current range is smaller than a previous range.Protect your position with buy-stop or sell stop in the opposite direction (or do both to enter the market on break-out)

range-up, the price is in the bounds of a previous high & low and moving up

range-down, the price is in the bounds of a previous high & low and moving down

Partial exits in a trend (we never know what happens next, so let us protect any gains):

I uses a number of linear regressions lines as protective trend lines. Their periods might depend on the choosen currency and its volitility.

In a pull back of a trend, one of linear regression protective trend lines is hit and a partial exit out of the position is done.

I call this the "gear change method" ;-)

For example the EA uses linear regressions of period 50 (gear4 = the fastest), 100 (gear3) , 200 (gear2) and 400 (gear1).

If in an uptrend the price hits on ites way down the lr50, a fourth of the position is sold and the trend follower switches one gear lower.

If lr100 is hit, we switch in this example to lr200, and again sell another fourth of the original position size.

And so on.

So if lr400 is hit the position is closed.

Uwe Goetzke

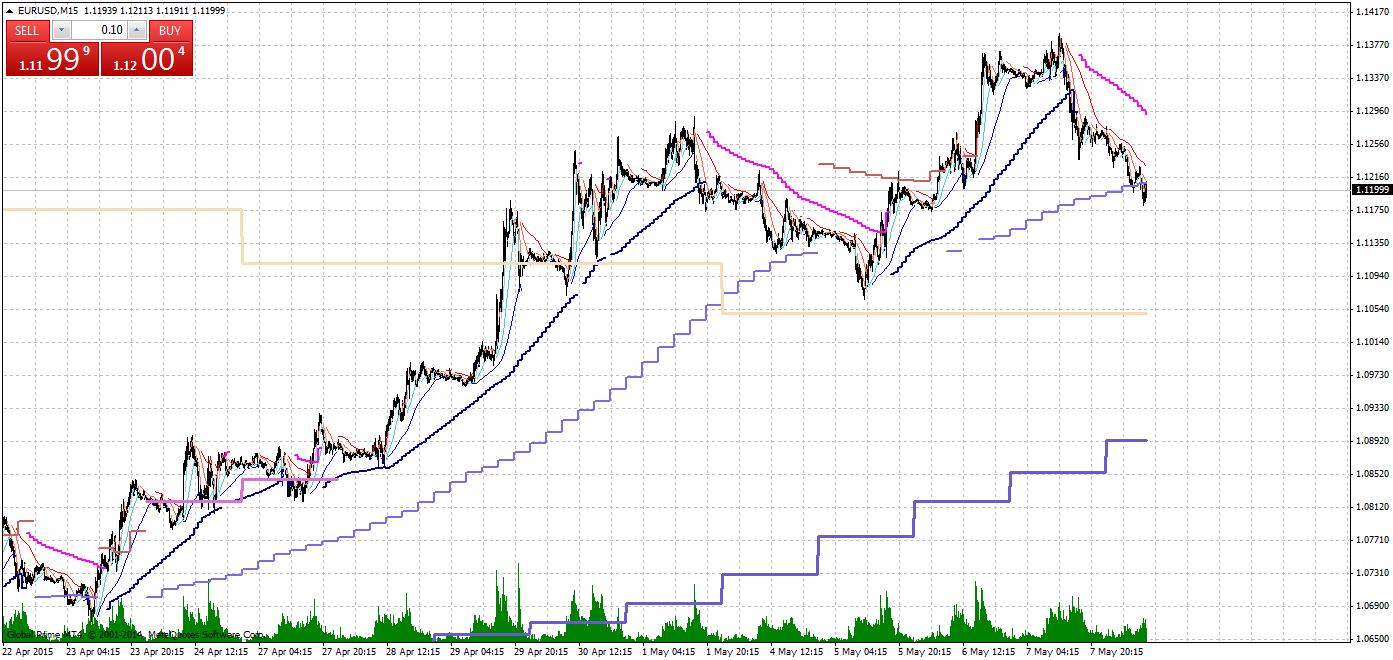

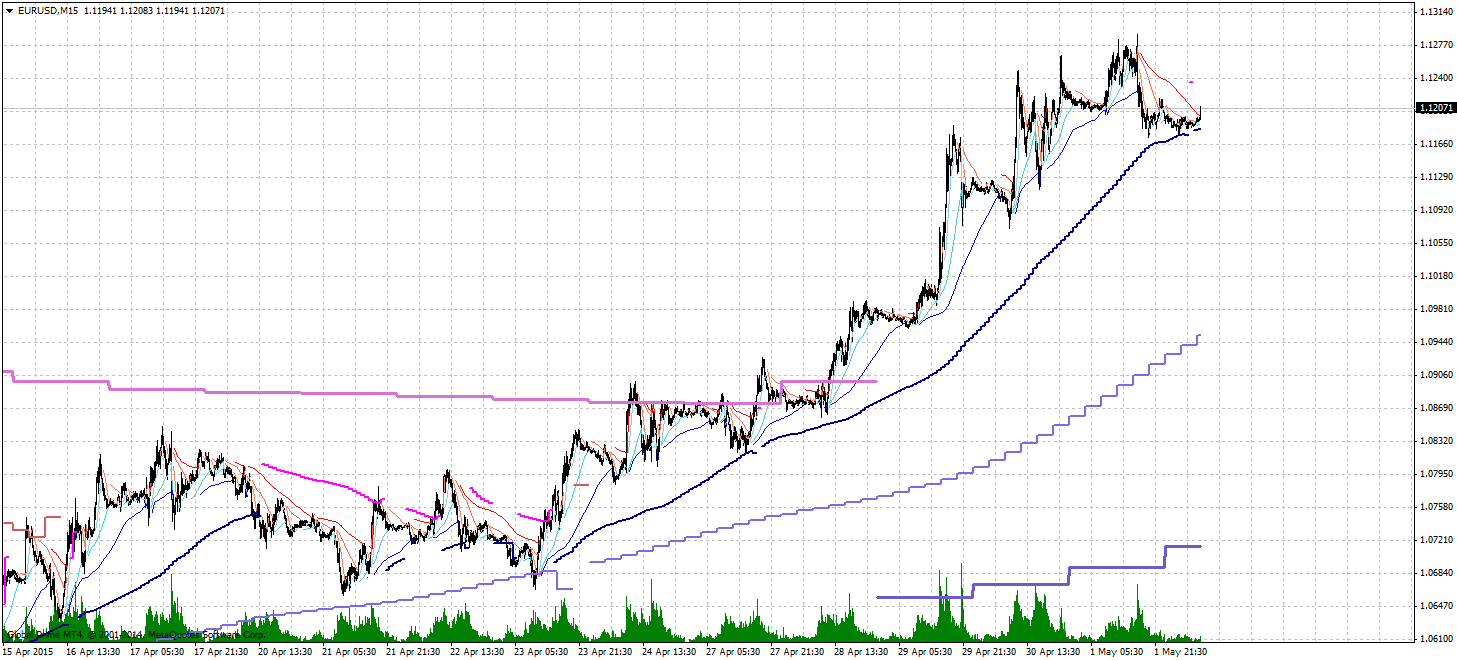

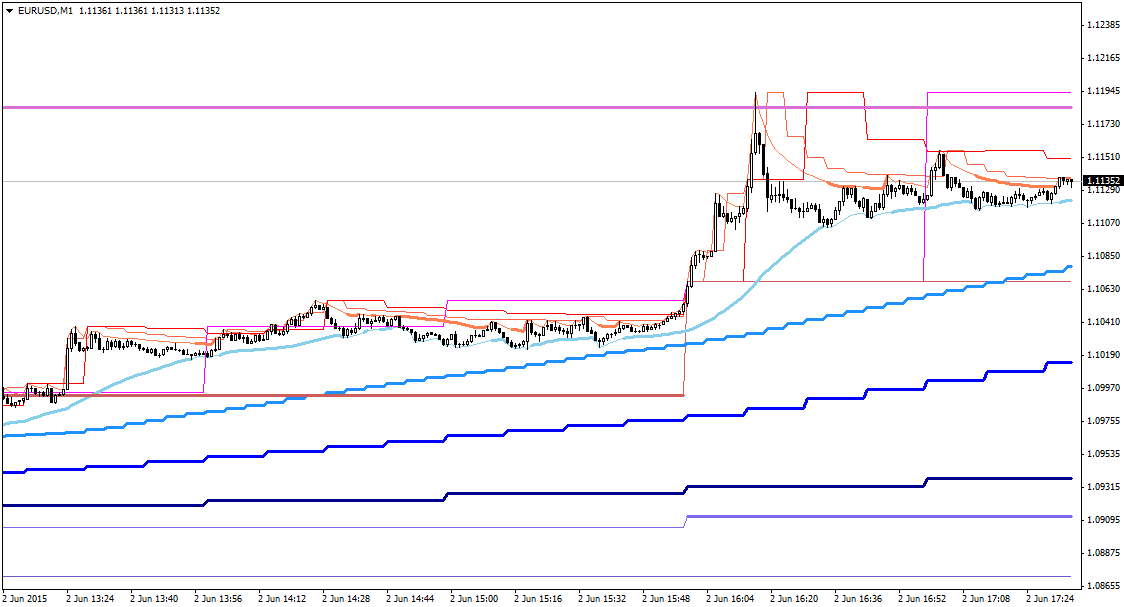

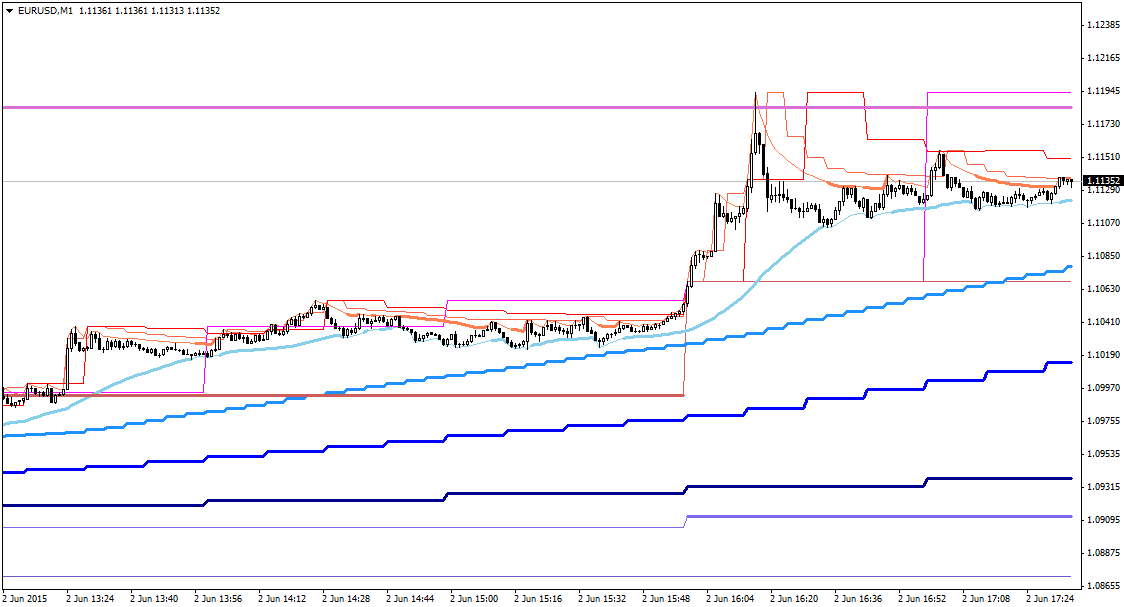

EURUSD timeframe H1 show the prices bouncing at the calculated support levels of D1 perfect bounds indicator.

Uwe Goetzke

The PerfectBoundsTrend indicator shows very nicely the reactions as the bounds get hit.

https://www.mql5.com/en/market/product/9654

https://www.mql5.com/en/market/product/9654

Uwe Goetzke

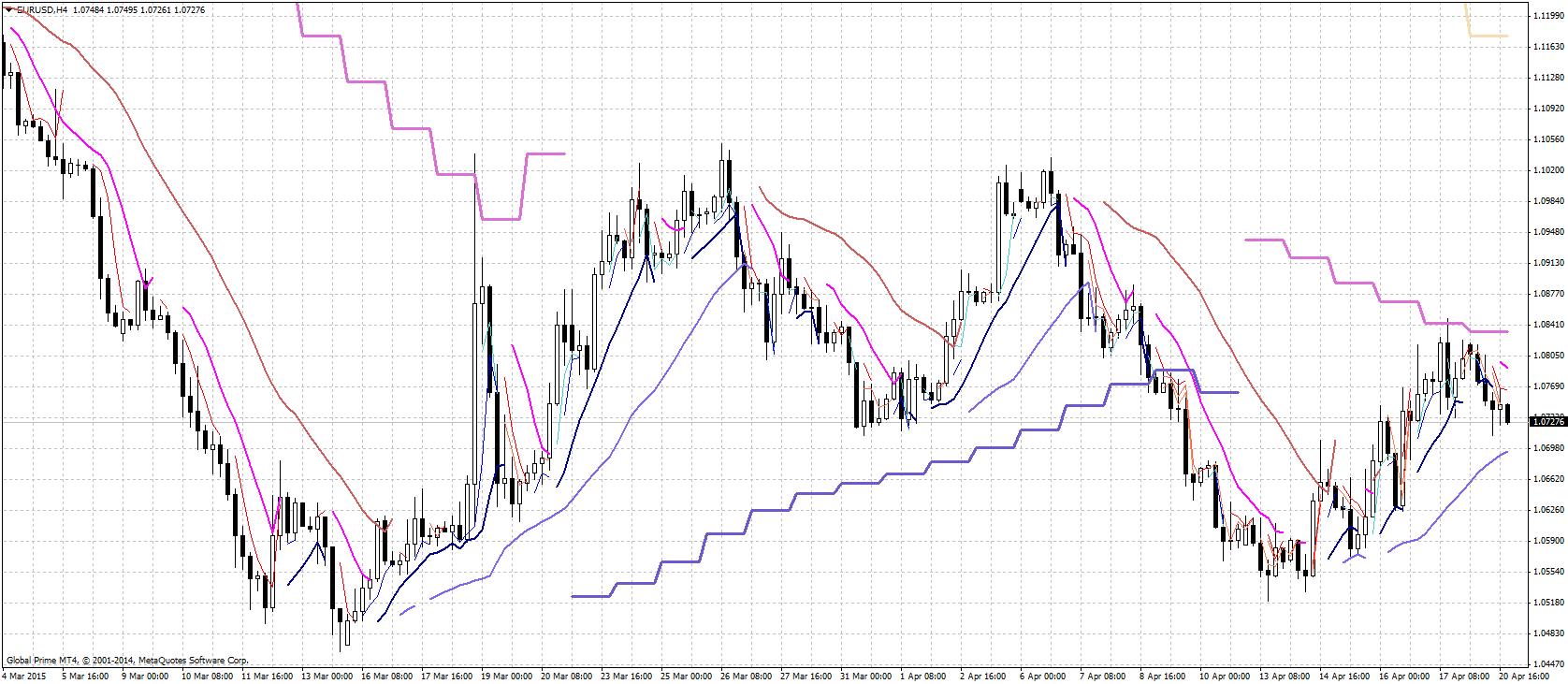

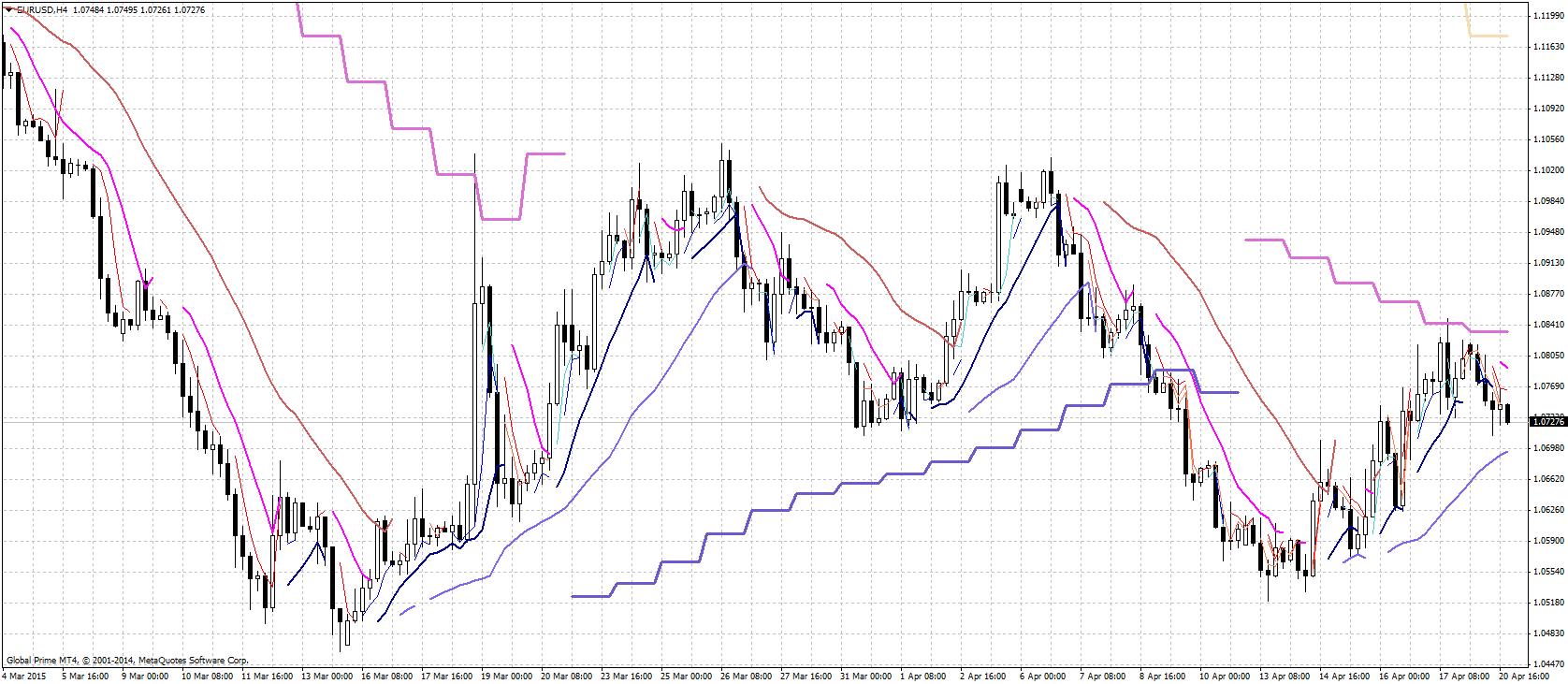

EURUSD H4, the last weeks with trend lines, sidewards for now with sveral day long trends in period h4

Uwe Goetzke

Participating in the 2012 championship, although I am sure the EA will not succeed. But the experience of participating and improving the ideas is the base for a future participation.

: