Sergey Golubev / Perfil

Newdigital

Sergey Golubev

Sergey Golubev

Comentário ao tópico Something Interesting to Read December 2013

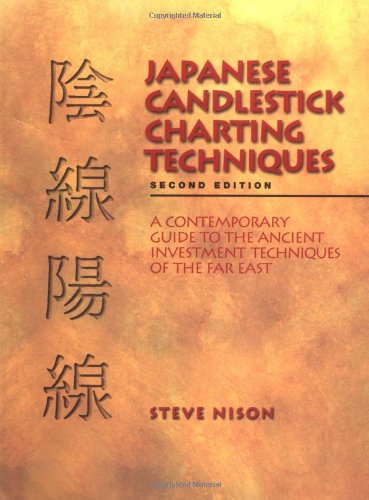

Japanese Candlestick Charting Techniques by Steven Nison This book introduces candlestick charting, which some investors may find useful in their trading. It sure helps to make charts more visual! A

Sergey Golubev

Renat Fatkhullin - MetaQuotes

Полтора миллиарда исполненных задач в MQL5 Cloud Network

Совсем недавно дошли до миллиарда, а затем объем расчетов стал расти существенно быстрее. Вот и до 1.5 миллиарда добрались : http://cloud.mql5.com

Sergey Golubev

Renat Fatkhullin - MetaQuotes

MetaQuotes Boxing Academy: http://youtu.be/mcmfAuDiz68

4

Sergey Golubev

Sergey Golubev

Comentário ao tópico 报刊评论

黄金创数月新低,美国GDP意外上修 2013年12月20日 22:21 欧洲时段,QE削减效应持续发酵,ICE美元指数小幅上行0.2%,反弹指向81整数位,贵金属轻微反弹修正,黄金仍在1200美元下方,白银短期相对强势,银价仍企稳月初低点上方,铜价回落在10日均线获得支持,时段内小幅上行重新站上3.30美元。 周

Sergey Golubev

Understanding Leverage (source - dailyfx)

The difference between trading stocks and futures is the amount of capital required to enter a trade. While this could be a very long and detailed section with examples of leverage, I am going to keep things simple and short cause it’s really not that difficult.

Using an example of a trader which we will say his name is “Dave” who wants to trade the SP500 index with their risk capital here are two examples that show how leverage drastically changed the outcome of a position.

Dave has a $10,000 account, and wants to swing trade the SP500 index.

Option #1: He buys $5000 worth of the SP500 ETF (SPY). And if the SP500 rises in value by 3% Dave would see a $150 gain on his trade. This ETF has no leverage and follows the performance of the stock market.

Option #2: Dave decides to buy 1 ES mini futures contract which is the SP500 Index futures contract. Using the same numbers as the previous option, the SP500 rises in value just 3%. How much money did Dave make on this trade? He made a whopping $2,625 on the same move that the ETF did, how is that possible?

Let me explain, when you buy a non-leveraged ETF like the SPY with $5000, you are literally only trading with a $5000 investment. But with futures, when you buy one ES mini contract which is worth roughly $5000, you are actually controlling roughly $75,000. So think if it as 17.5x leverage on your money.

So that 3% gain in the stock market is based off a $75,000 investment which is how you get $2625 or a 52.5% return on your money.

Futures trading in my opinion is not for beginner or intermediate traders. The only way your money should be involved with futures is if you truly understand how the market move and have strict money management rules, or us a system that trades and managed positions for you. Remember, leverage is a double edge sword that can make you wealthy or broke quickly if not traded appropriately.

The difference between trading stocks and futures is the amount of capital required to enter a trade. While this could be a very long and detailed section with examples of leverage, I am going to keep things simple and short cause it’s really not that difficult.

Using an example of a trader which we will say his name is “Dave” who wants to trade the SP500 index with their risk capital here are two examples that show how leverage drastically changed the outcome of a position.

Dave has a $10,000 account, and wants to swing trade the SP500 index.

Option #1: He buys $5000 worth of the SP500 ETF (SPY). And if the SP500 rises in value by 3% Dave would see a $150 gain on his trade. This ETF has no leverage and follows the performance of the stock market.

Option #2: Dave decides to buy 1 ES mini futures contract which is the SP500 Index futures contract. Using the same numbers as the previous option, the SP500 rises in value just 3%. How much money did Dave make on this trade? He made a whopping $2,625 on the same move that the ETF did, how is that possible?

Let me explain, when you buy a non-leveraged ETF like the SPY with $5000, you are literally only trading with a $5000 investment. But with futures, when you buy one ES mini contract which is worth roughly $5000, you are actually controlling roughly $75,000. So think if it as 17.5x leverage on your money.

So that 3% gain in the stock market is based off a $75,000 investment which is how you get $2625 or a 52.5% return on your money.

Futures trading in my opinion is not for beginner or intermediate traders. The only way your money should be involved with futures is if you truly understand how the market move and have strict money management rules, or us a system that trades and managed positions for you. Remember, leverage is a double edge sword that can make you wealthy or broke quickly if not traded appropriately.

Sergey Golubev

Muhammad Syamil Bin Abdullah

Comentário ao tópico Something Interesting to Read December 2013

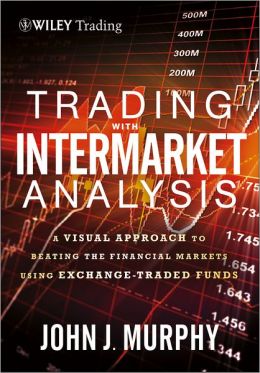

Trading With Intermarket Analysis : A Visual Approach To Beat the Financial Markets Using Exchange-Traded Funds by John J. Murphy With global markets and asset classes growing even more

Sergey Golubev

Sergey Golubev

Comentário ao tópico Something Interesting to Read December 2013

Trading in the Zone : Master the Market with Confidence, Discipline and a Winning Attitude Douglas uncovers the underlying reasons for lack of consistency and helps traders overcome the ingrained

Sergey Golubev

Sergey Golubev

Comentário ao tópico Something Interesting to Read December 2013

The Little Book of Currency Trading : How to Make Big Profits in the World of Forex (Little Books. Big Profits) by Kathy Lien An accessible guide to trading the fast-moving foreign exchange market The

Sergey Golubev

Sergey Golubev

Comentário ao tópico Something Interesting to Read December 2013

Kathy Lien : Day Trading and Swing Trading the Currency Market: Technical and Fundamental Strategies to Profit from Market Moves Discover a variety of technical and fundamental profit-making

Sergey Golubev

Sergey Golubev

Comentário ao tópico 如何开始学习MQL5

不使用额外的缓冲区,为中间计算进行系列价格的平均化 在本人的 《指标的经济计算原则》 一文中,我执行了相当有说服力的测试,证实了并非代码中对于自定义或技术指标的每一次调用,都是某制定指标中执行中间计算的最优方式。 如果我们将中间计算的代码置入指标,其执行速度看似比我们最终的执行速度快很多。

Sergey Golubev

Sergey Golubev

Comentário ao tópico Something Interesting to Read December 2013

Trader Vic---Methods of a Wall Street Master by Victor Sperandeo The view the author has is slightly biased in favor of the Austrian School of Economics. Some of his methods are novel---you wouldn't

Sergey Golubev

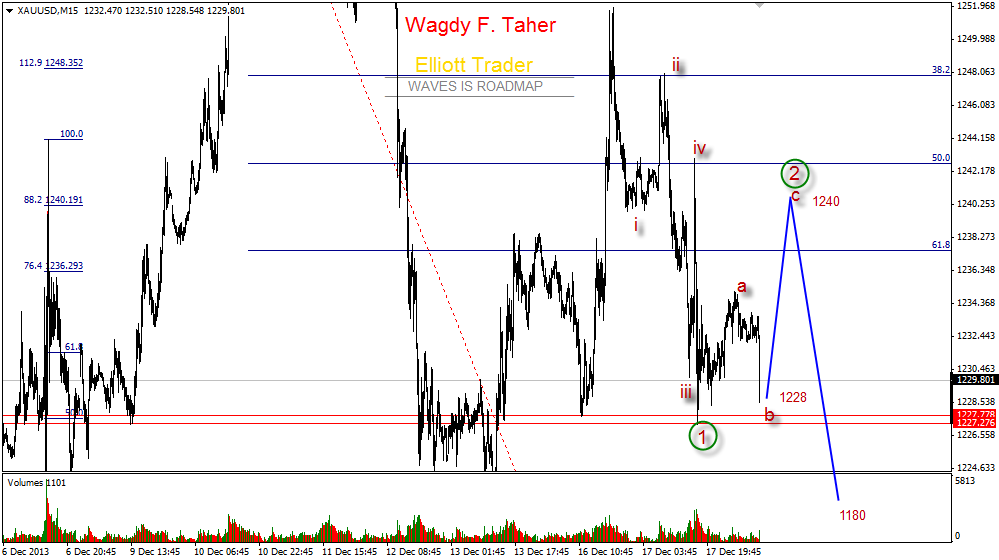

Wagdy Abdelrahman

GOLD (XAU/USD) - Weekly - BIG VISIO

Elliott Waves :

as seen the trend from historic high 1922 to Low 1180 is 3 waves (3-3-5) W , also noticed the the waves (1180-1415) is 3 waves also , hence it is susspected are looking for X @ levels 1550 - 1645 or bit higher i extnsion.

But , what is the construction of X , as seen it is susbeious that before going to c of X need to reserve seat for (Y) by making (b) extended beyond beginning of wave (a) .. @ levels 1084 and 1025 in extension before rebound to wave (X) ..

Conclusion :

Buyers don't disturb for the wave (b) extention beyond wave (a). still the target for levels 1555-1645.

Good-Luck

Elliott_Trader

Wagdy F Taher

Elliott Waves :

as seen the trend from historic high 1922 to Low 1180 is 3 waves (3-3-5) W , also noticed the the waves (1180-1415) is 3 waves also , hence it is susspected are looking for X @ levels 1550 - 1645 or bit higher i extnsion.

But , what is the construction of X , as seen it is susbeious that before going to c of X need to reserve seat for (Y) by making (b) extended beyond beginning of wave (a) .. @ levels 1084 and 1025 in extension before rebound to wave (X) ..

Conclusion :

Buyers don't disturb for the wave (b) extention beyond wave (a). still the target for levels 1555-1645.

Good-Luck

Elliott_Trader

Wagdy F Taher

1

Sergey Golubev

Alain Verleyen

Una lectura interesante.

Este es el tema de los libros relacionados con el comercio ( renta variable , divisas, etc ... ), los mercados financieros y la economía . Tenga en cuenta las siguientes reglas : imagen de tapa posterior , una breve descripción y un enlace oficial

Sergey Golubev

To Axel Christofer Hedfors - Happy Birthday

Sergey Golubev

Comentário ao tópico Traders Joking

Swedish House Mafia - Don't You Worry Child ft. John Martin This is the last track from them sorry. By the way - it is the birthday of Axwell now (Axel Christofer Hedfors) - he is 36 today

Sergey Golubev

Sergey Golubev

Comentário ao tópico Something Interesting to Read December 2013

Reminiscences of a Stock Operator by Edwin Lefèvre This book is a true page turner. It is a breath-taking recount of how a young boy managed to amass one of the largest fortunes by speculating despite

Sergey Golubev

经济学家李扬:中国央行正面临三大挑战—货币联盟、影子银行、互联网金融

Sergey Golubev

Comentário ao tópico 报刊评论

经济学家李扬:中国央行正面临三大挑战—货币联盟、影子银行、互联网金融 星期三, 十二月 18 2013, 04:30 GMT 近期中国社科院副院长李扬在出席银行业研讨会上称,当前中国央行正面临国际自由贸易联盟和超级货币联盟、影子银行及互联网金融等的挑战。 第

Sergey Golubev

Sergey Golubev

Comentário ao tópico Press review

AUDUSD and Fibonacci levels in trading (based on dailyfx article ) AUDUSD has been on a downtrend and may continue to push lower, Previous levels of Fibonacci support can act as resistance levels

: