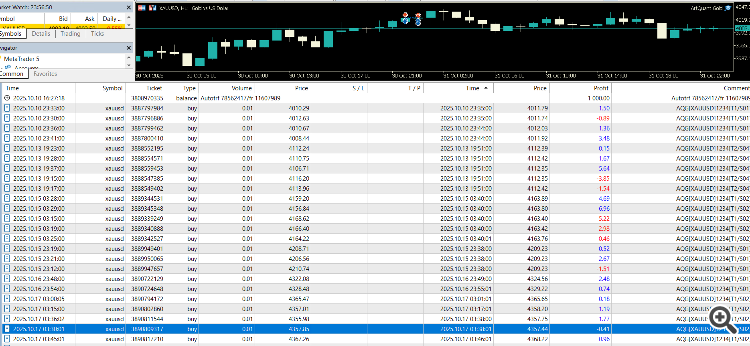

I’ve created a real account signal linked to this EA so that you can monitor its live performance transparently.

This is useful both for potential buyers, who can see how the system performs in real market conditions, and for existing users, who may want to compare their trades with mine.

Miroslav9808 #: I will not use this robot anymore.It blow my account today already very risky. Miruslav sad today.

Let me be very clear once again. The EA does not and will never open 0.7 lot trades unless the account balance is at least 30.000 USD. I have personally confirmed this using the Strategy Tester with default settings and automatic risk enabled. So if your account was smaller (and judging by the losses I estimate it was between 5.000 and 10.000 USD), then the only explanation is that you manually forced the lot size to 0.7, overriding the EA’s internal risk management.

EA opened five positions of 0.7 lots in XAUUSD, and all of them were closed at the exact same time with a total loss of nearly 3.000 USD. That’s a textbook StopOut, and it was not caused by the EA, but by the user taking excessive risk, no risk control, and no understanding of what they were doing.

Let me say it clearly. There are no bad EAs, only users who don’t know what they’re doing. And when someone is new to trading, the first step should always be to read the manual, test in demo, and learn how to configure the system properly.

You’ve also done this before. Back on June 25, just eight days after your purchase, you left a misleading review saying the EA "doesn’t trade" despite privately admitting it had already made a good trade. You asked me if the EA could make 100 USD per day from a 1.000 USD account, or deliver 5 to 10 percent profit per day with max 5 percent drawdown. I told you clearly that those expectations are unrealistic and dangerous. I even offered to personally connect to your VPS and help, something no seller is required to do.

And now you’re back, once again blaming the robot for something you did manually, by forcing large lot sizes and ignoring the EA’s built-in protections.

I am sorry you lost money, but please be honest with yourself. This did not happen because of the robot, it happened because you completely ignored the most basic principles of risk management.

I hope this experience helps you reflect and take trading more seriously in the future.

This EA has reached several dozen sales but still very few reviews. Leaving a review is something that benefits all of us: the more feedback the product receives, the more attention and dedication I can give it. That means more improvements and updates for everyone.

I am not begging or forcing anyone, I am simply pointing out the reality of this business. If a product does not get visibility and support, the author’s interest naturally decreases, and that affects its future development. Reviews help prevent that and keep the project alive and evolving.

Launch price: $199 The price will gradually increase after each sales block as part of a value-based launch strategy. The earlier you purchase ArtQuant Pound, the better price you will get. (No artificial discounts or aggressive promotions. The price increase reflects the long-term quality and performance of the system.)

ArtQuant Pound is a professional Expert Advisor (EA) specifically designed to trade GBPUSD, built with a robust and adaptive structure focused on long-term stability.

Its internal logic combines automated technical analysis, dynamic risk control, and an intelligent grid execution model without martingale or lot multiplication.

Unlike many systems that rely on volume scaling or over-fitted strategies, ArtQuant Pound follows a disciplined and realistic approach, adapting to actual market behavior through intelligent exposure management and fully configurable parameters.

Key Features

Optimized exclusively for GBPUSD

Grid-based strategy without martingale (no lot scaling between entries)

Multi-layer logic using price action, market flow behavior, and internal filters

Configurable drawdown control to protect capital at all times

Execution based on market conditions, not fixed timers or cycles

Timeframe independent (event-driven logic, not candle-driven)

Input Parameters

The following parameters are available in the EA, explained in the same order they appear in the settings:

Start EA in pause mode: allows you to safely start the EA paused and adjust settings before trading begins

Trading symbol: defines the symbol to trade. Default value is “GBPUSD”

Lot calculation method: choose between fixed lots, automatic lots, or balance-based lots

Automatic lot risk levels: defines the risk applied when using automatic lot sizing, from low to very high

Fixed lot: exact lot size used in fixed mode

Fixed per balance: account balance required per fixed lot

Balance percentage: calculates lot size as a percentage of the current balance

Minimum balance for volume: minimum balance required to open a trade with the selected volume

Drawdown control mode: enables internal drawdown protection logic with optional auto-shutdown

Drawdown value: maximum drawdown allowed (percentage or absolute value)

Push notifications MQID: enables mobile notifications through MQID

Magic number: unique identifier to separate this EA’s trades from others

Maximum spread: maximum allowed spread for trade execution

Show panel: enables or disables on-screen status panel

Panel font and size: customize type and size of the displayed font

Panel comment: label text displayed on the chart and trade comments

Line style and width: defines the grid, TP, and BE line appearance

Line colors: sets colors for Take Profit, Break Even, and Grid levels

Requirements and Recommendations

Trading symbol: GBPUSD

Account type: Hedging

Minimum deposit: $1000 (with 1:500 leverage)

Broker: IC Markets or any broker with low spreads and reliable execution

Timeframe: Any (the system is not candle-dependent)

VPS: Highly recommended for continuous 24/7 operation

Support and Communication

Support is provided exclusively through the “Comments” section of this MQL5 page or via private message inside the MQL5 platform.

No external platforms such as Telegram or Discord are used, ensuring a focused, spam-free, and professional support environment.

Important

Requests for discounts or private deals will be ignored.

Prices are fixed and transparent. Any future price changes will be announced publicly, never privately.

A Note on the Reality of Algorithmic Trading

Be cautious with any EA that shows perfect equity curves, zero drawdown, or identical results under all conditions.

Such behavior indicates overfitting—backtests tuned too precisely to past data with poor adaptability to live markets.

These systems are, in essence, time bombs.

ArtQuant Pound is not designed to impress with unrealistic charts. It is designed to survive, adapt, and grow with solid logic and responsible execution. Consistency is achieved through realistic, well-structured logic, not cosmetic backtests.

Copyright and Authorized Distribution

This product is an original creation protected by intellectual property and copyright laws.

Selling, redistributing, or reproducing ArtQuant Pound outside of MQL5.com is strictly prohibited.

This MQL5 product page is the only official and authorized source for purchase and support.

Any unauthorized sharing, resale, or modification of this product will be considered a direct violation of the author’s rights and prosecuted accordingly.

Oct 10-31, 2025 (3 weeks) Profit: 284.59 (could be highest historically for low risk - only expecting 40-50 usd profit for 0.01 lot size per month based on BT) Balance: 1000 usd Lot size: 0.01-0.02 (will maintain 0.01 next month for accurate monitoring) Highest no. grid: 7 DD: 22.97% (but happened when lot size was changed to 0.02 temporarily, if you have 2k balance with 0.02 lot thats 11.48% DD only)

- The 1.6 release is the most complete and refined update of ArtQuant Gold so far. In historical tests from 2018 until today it shows better overall performance compared to version 1.5. It achieves higher growth and a larger number of trades while maintaining a similar risk profile and more stable equity behaviour over the full test period. In some specific time segments the difference may be small, but across the entire testable range the improvement is consistent.

- The strategy logic and the automatic lot sizing system have been adjusted. For that reason it is strongly recommended to run new backtests or demo forward tests to determine the appropriate risk level for your account size and personal risk tolerance. Existing .set files from version 1.5 may not be suitable for this release, so new configuration files should be created and saved if necessary.

- Risk selection in automatic mode has been simplified. There are now only three clear levels available: Low (Safer), Medium (Max. recommended) and High (Aggressive/Dangerous). This change makes it easier to choose an option that matches the user’s risk profile without analysing multiple intermediate values.

- The panel has been improved to show only relevant information based on the selected lot calculation mode. Parameters that do not apply are displayed as “---”. This reduces unnecessary visual information and makes it easier to understand the current configuration during live operation.

- The default maximum spread filter has been modified from 1000 to 100. This allows better filtering during periods of high volatility when spreads widen. It is important to adjust this value carefully. If it is set too low the EA may not open trades. If it is set too high it will not filter out volatile market conditions.

- A maximum allowed slippage parameter has also been added. This should be adjusted with the same logic as the spread. A restrictive value may block trade execution, while an excessively high value might allow unfavourable price deviations.

- Several internal parts of the code have been reviewed and refined to improve stability and consistency.

- Before using this version on a live account it is advisable to review the main parameters, perform new tests to confirm the chosen risk level and save new .set files once a suitable configuration has been found.

Risk: Auto (Medium)

Hi everyone!

I’ve created a real account signal linked to this EA so that you can monitor its live performance transparently.

This is useful both for potential buyers, who can see how the system performs in real market conditions, and for existing users, who may want to compare their trades with mine.

You can find the signal here: https://www.mql5.com/en/signals/2311351

I will not use this robot anymore.It blow my account today already very risky.

Miruslav sad today.

Let me be very clear once again. The EA does not and will never open 0.7 lot trades unless the account balance is at least 30.000 USD. I have personally confirmed this using the Strategy Tester with default settings and automatic risk enabled. So if your account was smaller (and judging by the losses I estimate it was between 5.000 and 10.000 USD), then the only explanation is that you manually forced the lot size to 0.7, overriding the EA’s internal risk management.

EA opened five positions of 0.7 lots in XAUUSD, and all of them were closed at the exact same time with a total loss of nearly 3.000 USD. That’s a textbook StopOut, and it was not caused by the EA, but by the user taking excessive risk, no risk control, and no understanding of what they were doing.

Let me say it clearly. There are no bad EAs, only users who don’t know what they’re doing. And when someone is new to trading, the first step should always be to read the manual, test in demo, and learn how to configure the system properly.

You’ve also done this before. Back on June 25, just eight days after your purchase, you left a misleading review saying the EA "doesn’t trade" despite privately admitting it had already made a good trade. You asked me if the EA could make 100 USD per day from a 1.000 USD account, or deliver 5 to 10 percent profit per day with max 5 percent drawdown. I told you clearly that those expectations are unrealistic and dangerous. I even offered to personally connect to your VPS and help, something no seller is required to do.

And now you’re back, once again blaming the robot for something you did manually, by forcing large lot sizes and ignoring the EA’s built-in protections.

This is not how trading works. This EA does exactly what it promises (see mi Signal - https://www.mql5.com/en/signals/2311351).

I am sorry you lost money, but please be honest with yourself. This did not happen because of the robot, it happened because you completely ignored the most basic principles of risk management.

I hope this experience helps you reflect and take trading more seriously in the future.

Thanks!

Hi.Can you support me

Hi! Of course! I sent him a private message.

A Market of Applications for the MetaTrader 5 Terminal

ArtQuant Pound

199.00 USD

Launch price: $199

The price will gradually increase after each sales block as part of a value-based launch strategy.

The earlier you purchase ArtQuant Pound, the better price you will get. (No artificial discounts or aggressive promotions. The price increase reflects the long-term quality and performance of the system.)

LIVE SIGNAL

ArtQuant Pound is a professional Expert Advisor (EA) specifically designed to trade GBPUSD, built with a robust and adaptive structure focused on long-term stability.

Its internal logic combines automated technical analysis, dynamic risk control, and an intelligent grid execution model without martingale or lot multiplication.

Unlike many systems that rely on volume scaling or over-fitted strategies, ArtQuant Pound follows a disciplined and realistic approach, adapting to actual market behavior through intelligent exposure management and fully configurable parameters.

Key Features

Input Parameters

The following parameters are available in the EA, explained in the same order they appear in the settings:

Requirements and Recommendations

Support and Communication

Important

A Note on the Reality of Algorithmic Trading

ArtQuant Pound is not designed to impress with unrealistic charts. It is designed to survive, adapt, and grow with solid logic and responsible execution.

Consistency is achieved through realistic, well-structured logic, not cosmetic backtests.

Copyright and Authorized Distribution

Oct 10-31, 2025 (3 weeks)

Profit: 284.59 (could be highest historically for low risk - only expecting 40-50 usd profit for 0.01 lot size per month based on BT)

Balance: 1000 usd

Lot size: 0.01-0.02 (will maintain 0.01 next month for accurate monitoring)

Highest no. grid: 7

DD: 22.97% (but happened when lot size was changed to 0.02 temporarily, if you have 2k balance with 0.02 lot thats 11.48% DD only)

- The 1.6 release is the most complete and refined update of ArtQuant Gold so far. In historical tests from 2018 until today it shows better overall performance compared to version 1.5. It achieves higher growth and a larger number of trades while maintaining a similar risk profile and more stable equity behaviour over the full test period. In some specific time segments the difference may be small, but across the entire testable range the improvement is consistent.

- The strategy logic and the automatic lot sizing system have been adjusted. For that reason it is strongly recommended to run new backtests or demo forward tests to determine the appropriate risk level for your account size and personal risk tolerance. Existing .set files from version 1.5 may not be suitable for this release, so new configuration files should be created and saved if necessary.

- Risk selection in automatic mode has been simplified. There are now only three clear levels available: Low (Safer), Medium (Max. recommended) and High (Aggressive/Dangerous). This change makes it easier to choose an option that matches the user’s risk profile without analysing multiple intermediate values.

- The panel has been improved to show only relevant information based on the selected lot calculation mode. Parameters that do not apply are displayed as “---”. This reduces unnecessary visual information and makes it easier to understand the current configuration during live operation.

- The default maximum spread filter has been modified from 1000 to 100. This allows better filtering during periods of high volatility when spreads widen. It is important to adjust this value carefully. If it is set too low the EA may not open trades. If it is set too high it will not filter out volatile market conditions.

- A maximum allowed slippage parameter has also been added. This should be adjusted with the same logic as the spread. A restrictive value may block trade execution, while an excessively high value might allow unfavourable price deviations.

- Several internal parts of the code have been reviewed and refined to improve stability and consistency.

- Before using this version on a live account it is advisable to review the main parameters, perform new tests to confirm the chosen risk level and save new .set files once a suitable configuration has been found.