Arturo Lopez Perez / プロファイル

- 情報

|

10+ 年

経験

|

194

製品

|

1018

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

It's not just a coincidence. The markets are incredibly tough to navigate and fiercely competitive. When you step into the market, you're going head-to-head with some of the sharpest minds on the planet, ready to take your money without a second thought, devour you like a chicken in a stew, and leave your bones bare on the plate.

We've all lost money in the markets. Every single one of us. Anyone who says they've never lost money in the markets is lying. Even me. I've lost astronomical amounts of money trading. I've lost more money than I'm willing to admit.

You're not alone.

I've lost money I could afford to part with, but also money I desperately needed. I've lost money to the point where I couldn't buy Christmas gifts for my family. I've lost money to the point of eating rice and canned meat until the end of the month. I've lost money to the point of selling stuff just to make ends meet. I've lost money to the point of biking to save on gas.

The markets have made me experience frustration, anxiety, sadness, anger, and shame. In that order. I've seen my dreams shatter overnight. The markets have beaten my ego like a piñata, reducing it to pulp repeatedly. The market has shaped my personality like a psychopath ex-wife.

The emotional rollercoaster of trading can either make you or break you; the choice is yours. Traders, by necessity, must develop impeccable emotional control. If you develop it, you can recover from setbacks. If not, you'll leave the markets with your tail between your legs, never to return.

The world is full of novice and undisciplined traders who venture into the markets without proper knowledge, abuse leverage, lose everything, and proceed to cry, complain to regulators, or jump out the window.

I've been trading successfully for over fifteen years, and I can confidently say that the difference between a successful trader and a loser lies in their ability to control themselves. In their ability to keep a cool head and maintain ironclad discipline when others opt for madness or despair. A successful trader must treat profits and losses as the impostors they are.

The irony of trading is that to succeed and amass wealth, you must first conquer yourself, control your ego, and learn to put the value of money in perspective. A good trader must keep their head on their shoulders while simultaneously being able to doubt themselves. They must trust their knowledge but keep learning. They must act decisively but not irresponsibly. They must respect money but not obsess over it.

Choosing trading setups, entries, exits, and managing risk is easy.

What's truly difficult is controlling yourself.

To make things worse, the financial industry is designed for you to lose money.

Numerous studies show that the emotional impact of losing 10% of your money is equivalent to the joy of winning 25%, and the financial industry capitalizes on that. Financial institutions make money when you open a new position or close an existing one. Your broker makes money when you change your mind. If you have no positions, your broker will send you optimistic news to buy. If you have positions, your broker will send you pessimistic news to sell. The broker's interface is filled with flashing colors like stuttering traffic lights, intending to cause you anxiety and encourage repetitive transactions.

I'll be brutally honest with you, in case you just fell off the turnip truck.

Financial entities are not your friends. No matter how many years you've been working with them, whether they're regulated and have prestigious awards. The broker's success lies in making you lose discipline to take money out of your pocket and put it in theirs.

Your success, on the other hand, lies in keeping a cool head.

Now, I'm going to say something that might surprise you.

After many years of profitable trading, I've come to the conclusion that to be a successful trader, you only need three things. Just three. The right mindset, understanding the markets, and having the right technical tools. That's it. Nothing more. Everything else is bells and whistles. The first two will allow you to control yourself, choose instruments, and structure your operations, and the third will give you an edge to exploit systematically against other participants.

The mindset is the most important thing for successful trading.

It's impossible to make money in the markets with the mindset of an employee, civil servant, or retiree. Thriving in the markets doesn't require great intelligence, but it does require the right mindset. In trading, like in life, you're your own worst enemy. You come to the markets pre-cursed, and if you're seeking income stability, the markets aren't for you.

Discipline will be your best friend in the markets, and the lack of it will be a terrible curse. Without discipline, the markets will turn your money into carrion for vultures. It's imperative that you develop your discipline before trading, and the best way to do that is outside of the markets, where the price for faltering is modest. The markets, on the other hand, will make you pay the highest price for your weaknesses. If you can't live a disciplined and systematic life before trading in the markets, you’ll send your money to money heaven.

You can start developing your discipline by waking up early and exercising in the morning. Join a crossfit gym, go for a bike ride, or swim fifteen hundred meters. It doesn't matter what, just do it. Whether it's cold or hot, snowing or raining, whether you feel like it or not. Implement a healthy diet and follow it with the systematic approach of a soldier. Throw the TV in the trash and acquire the habit of reading regularly on any topic that interests you: investments, trading, gardening, or philosophy, whatever floats your boat.

Let me repeat that so it sinks in. Don't try trading until you've developed discipline.

Next, you need to understand what markets are and how they work.

You must understand that the markets are an efficient information-discounting machine with a three-year time horizon, and the shorter the time horizon, the more efficient the market is at assigning prices.

This means that any publicly available information has already been discounted by the market before you can do anything about it: I don't care where it comes from. It doesn't matter what specialized media you read, what news sources you follow, or how many newsletters you're subscribed to: you won't be able to consistently extract money from the market using public domain information.

The markets are the great humiliator. The market's mission is to drive you crazy, make you make mistakes, snatch your money, and destroy your self-esteem. The markets enjoy doing what others don't expect and emptying the pockets of all those foolish enough to try to take theirs. The markets are a wealth transmission vehicle from the patient to the impatient and from the educated to the ignorant.

To make money in the short term in the markets, you must know things that others don't, have tools that others don't, and be more disciplined than your adversaries. If you want to make money in the short term, you must turn volatility into your best friend because it's the worst enemy of long-term holders.

The directionality of prices matters, but for a trader, volatility matters more.

Volatility is the nemesis of ignorant investors because it robs them of sleep and drives them to make all sorts of counterproductive decisions. You must understand that in the markets, other participants are your enemies, and volatility increases the probability that they will make mistakes due to anxiety or fear.

Volatility is your adversary's enemy and therefore, your best friend. The more long-term holders there are in a particular asset, the more lucrative it will be for a trader to operate it. You need victims from whom to mercilessly take money when negative emotions invade them. When long-term holders panic and sell valuable assets out of fear of price fluctuations, you must be there to take their money with a smile on your face.

The world is full of investors who are unable to accept market volatility and consequently make colossal mistakes time and time again. When volatility comes into play, investors stampede like frightened buffalo and throw their money off a cliff.

The best traders in the world are dedicated to picking up the money that long-term investors lose due to fear of volatility. In this sense, what instruments to trade matters much more than how you decide to trade them. Most traders don't understand this and fail miserably. You need to trade assets with many fearful long-term holders whom you can empty when they make mistakes and throw their money off the cliff, prey to panic.

The number of long-term holders in a particular asset indicates how attractive it is to trade, and volatility indicates when it's most profitable to do so. The more volatility there is, the more ignorant investors there will be making mistakes and generously donating their money to you.

Most investors lose money in the market for fear of losing money, which is the height of stupidity. They're undisciplined people or gamblers who haven't done their homework and therefore deserve to be stripped of their money mercilessly. He who is about to fall deserves to be pushed, as Nietzsche said.

If you understand the markets and choose what to trade wisely, you'll make fortunes.

Fortunes that others lose.

And finally, you need the right tools.

This is where I come into play. The tools of a good trader are technical indicators and robots. A good technical indicator will allow you to see things that others don't and take full advantage of situations that cause panic and despair to everyone else, as well as improve the timing of your trades.

On the other hand, trading robots will lighten your workload and allow you to focus on the discretionary aspects of trading, delegating order management, exit strategy, and countless other things.

If you trade the right markets, at the right time, and with the right tools, you'll crush it. You'll clean up. You'll be able to take a dump on top of your boss's desk. You'll be able wipe your butt with hundred-dollar bills. You'll feel like you've broken the bank at the Monte Carlo casino every year. You won't distinguish between Tuesdays and Saturdays. You'll have an irresistible conversation for the opposite sex. You'll go to the grocery store in a Ferrari. You'll be able to rent a yacht in the summer and fill it with naked chicks. You'll triple your dating game. You'll extend your sex life beyond fifty…

You get the idea.

If you have discipline and understand the markets, my indicators and robots can make you a fortune because they offer you a statistical edge that you can exploit systematically against your adversaries.

Let me repeat that so it sinks in. My trading tools can make you a boatload of money.

The good news is that most of my trading tools are completely free.

That means you'll get them free of charge. In exchange for nothing. For zero dollars. Zip. Nil. On the house. All you have to do to get them is enter your email, and I'll send them to your inbox faster than you can say "bull market".

Plain and simple. No nonsense. No bullshit. No strings attached.

People tend to dismiss everything free, assuming it has no value, but when it comes to my indicators and robots, you'd be mistaken to do so. On my website, you'll find high-quality free tools, better than the vast majority of paid alternatives you'll find online.

Now, I could brag about my experience as a programmer, the quality and uniqueness of my tools, how robust they are, the flexibility they offer, and the honesty with which I present them, but I'm not going to do that because that's what everyone else does. Instead of that, I prefer you download them and see for yourself.

But I can't give away all my work.

I'd love to offer all my indicators and robots completely free of charge, but it turns out that keeping them updated and answering your burning questions requires some effort and dedication.

Therefore, you should know that I also offer premium tools and I'm going to try to sell them to you because it's my duty. That's how it is. If I didn't, I'd be irresponsible and throwing my only talent down the drain.

I'm not going to beat around the bush.

The market wants your money, the broker wants your money, and I want your money.

But at least I'm being upfront with you and willing to play fair. I won't subject you to sophisticated conversion tunnels, unfulfillable promises, recurring charges, upsells, downsells, or relentless phone calls. There are no rags-to-riches tales here, no reels, shorts, or tweets designed to awaken your greed and urge you to buy something you don't need. What you see is what you get.

If you like my free tools or you've enjoyed my rant, consider the possibility of buying some of my indicators or robots. I'll be eternally grateful, and it will allow me to keep the show running, instead of just lounging around in my penthouse overlooking the ski slopes or chilling in the spa.

I'm aware that if I didn't give away most of my tools, but instead wrapped them in colorful paper and promoted them tirelessly on social media without rocking the boat, I would make much more money than I do now. But to be honest, all of that feels like too much effort to me.

I wish you the best of luck in your trading.

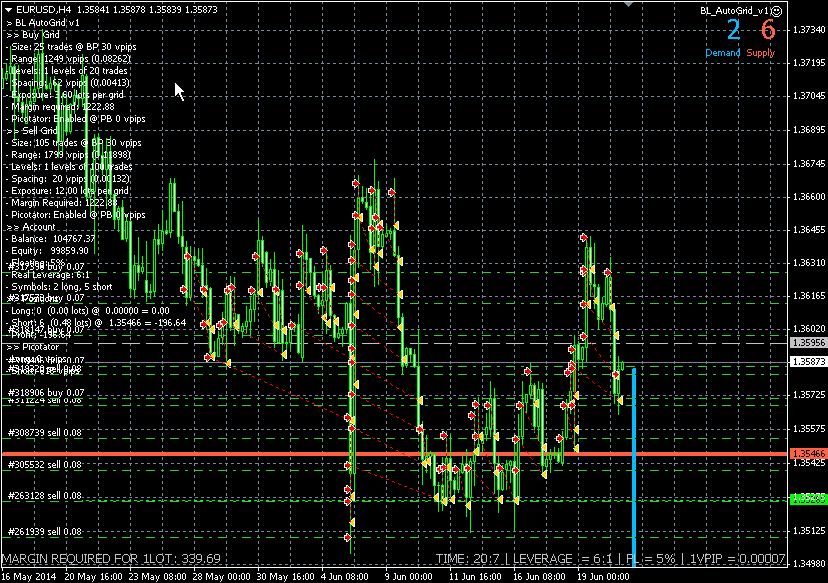

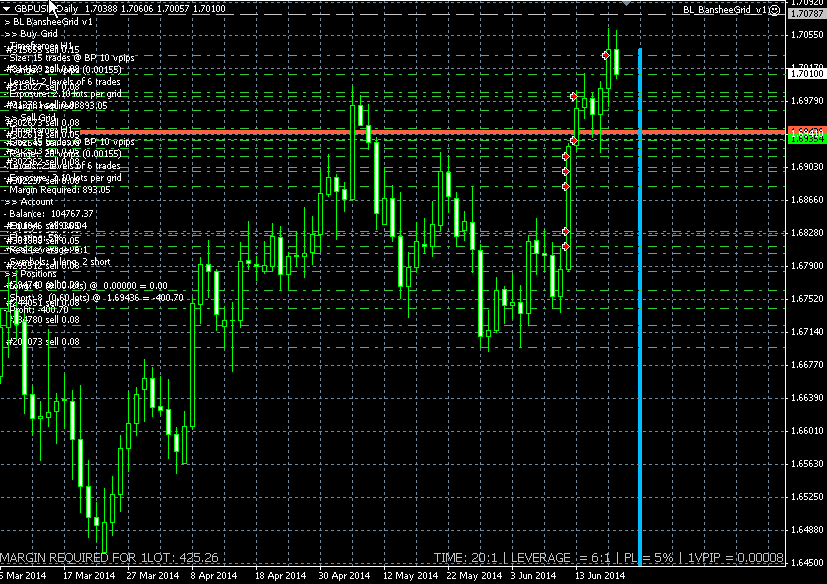

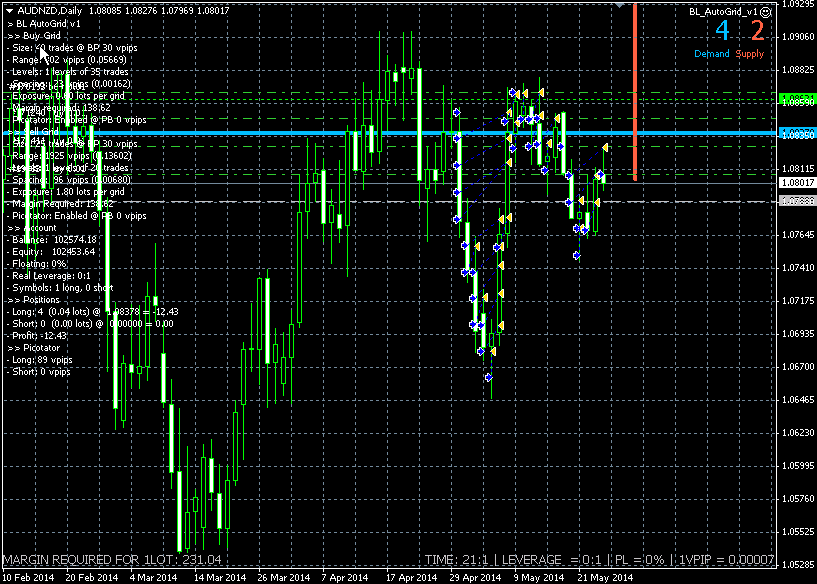

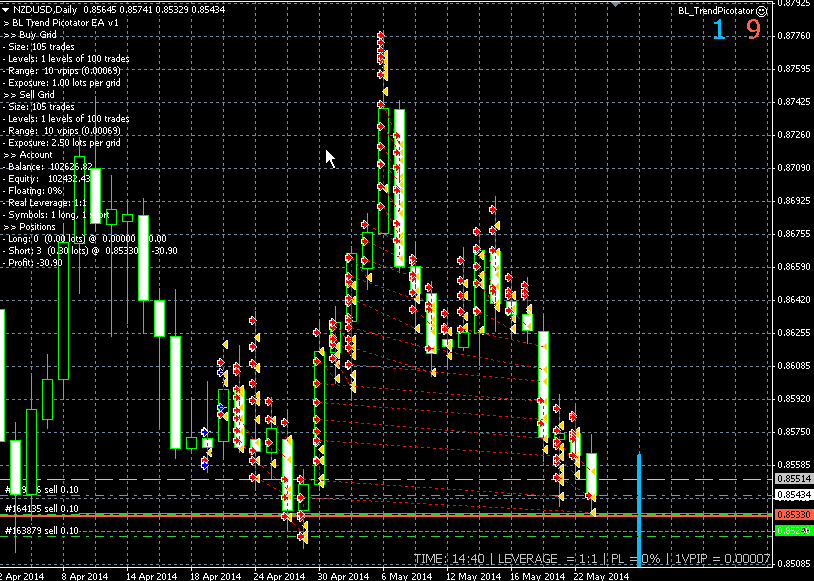

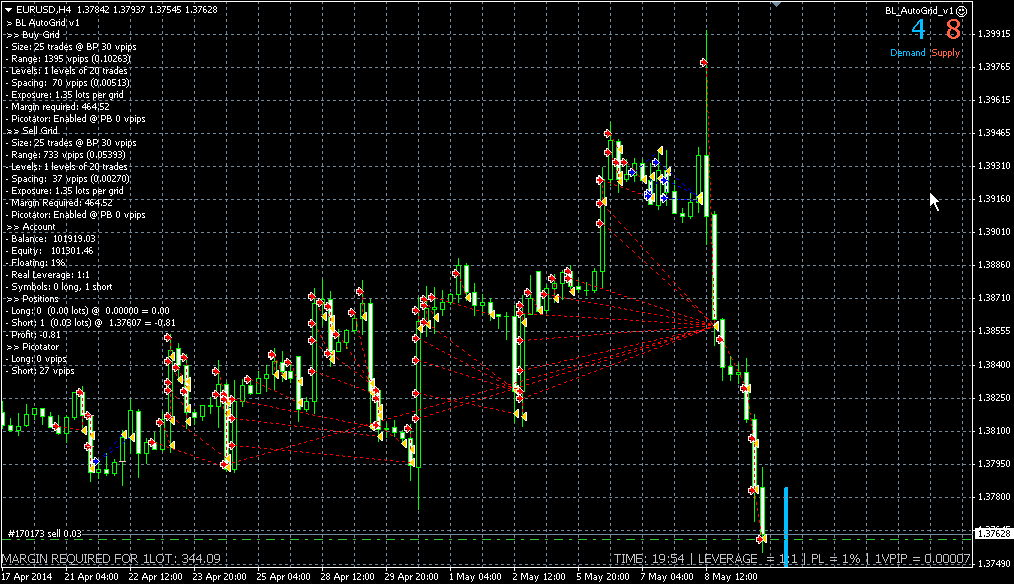

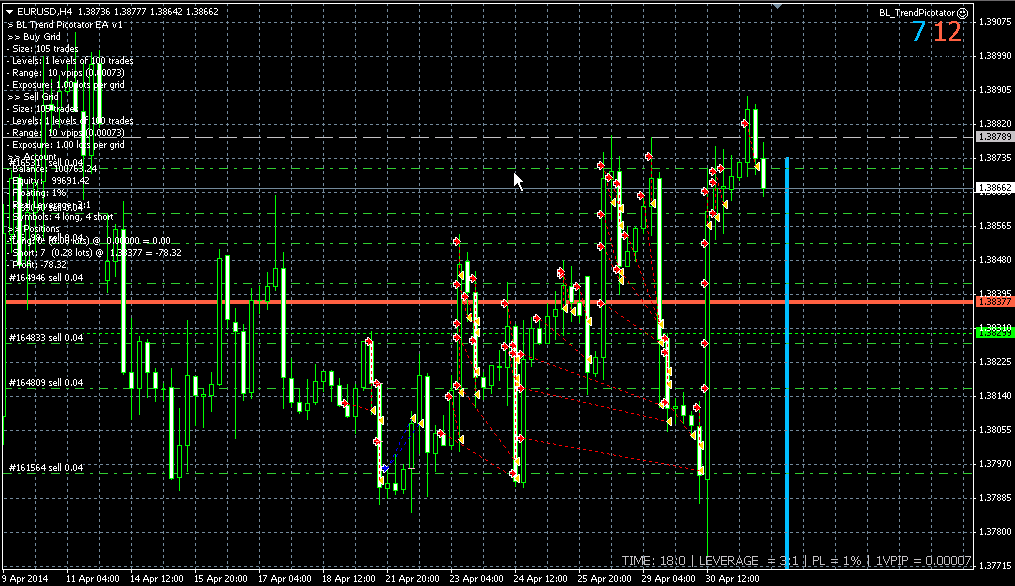

このインディケータは、過去の価格行動を分析して市場の売買圧力を予測します。過去を振り返り、現在の価格周辺の価格のピークと谷を分析します。これは、最新の確認インジケータです。 [ インストールガイド | 更新ガイド | トラブルシューティング | よくある質問 | すべての製品 ] 市場での売買圧力を予測する フレンジーを売って買うことに巻き込まれないようにする 設定も最適化も不要 インジケーターはすべての時間枠で機能します 非常に使いやすい 潜在的な供給価格と需要価格は、多くの市場参加者が負けポジションを維持し、損益分岐点でそれらを清算することを望んでいる価格です。したがって、これらの価格レベルで大規模な活動があります。 需要と供給の両方が数値として定量化されます 供給が需要を上回る場合、販売圧力が予想されます 供給が需要を下回っている場合、購入圧力が予想されます 供給が需要を上回っている場合はショートを探してください 供給が需要を下回っている場合は、長期を探してください 入力パラメータ 範囲:過去のピークと谷を検索するための現在の価格のボラティリティ乗数。 著者

このインディケータは、価格アクション分析とドンチャンチャネルのみを使用して、ジグザグ方式で価格の反転を検出します。再描画やバックペインティングを一切行わずに、短期取引向けに特別に設計されています。それは彼らの操作のタイミングを増やすことを目指している賢明なトレーダーにとって素晴らしいツールです。 [ インストールガイド | 更新ガイド | トラブルシューティング | よくある質問 | すべての製品 ] 驚くほど簡単に取引できます すべての時間枠で価値を提供します 自己分析統計を実装します 電子メール/音声/視覚アラートを実装します 可変長のブレイクアウトと混雑ゾーンに基づいて、インディケータは価格アクションのみを使用して取引を選択し、市場が非常に高速に行っていることに反応します。 過去のシグナルの潜在的な利益が表示されます この指標は、独自の品質とパフォーマンスを分析します 負けブレイクアウトは強調表示され、説明されます インジケータは、非バックペインティングおよび非再ペイントです

このインディケータは、価格アクション分析とドンチャンチャネルのみを使用して、ジグザグ方式で価格の反転を検出します。再描画やバックペインティングを一切行わずに、短期取引向けに特別に設計されています。それは彼らの操作のタイミングを増やすことを目指している賢明なトレーダーにとって素晴らしいツールです。 [ インストールガイド | 更新ガイド | トラブルシューティング | よくある質問 | すべての製品 ] 驚くほど簡単に取引できます すべての時間枠で価値を提供します 自己分析統計を実装します 電子メール/音声/視覚アラートを実装します 可変長のブレイクアウトと混雑ゾーンに基づいて、インディケータは価格アクションのみを使用して取引を選択し、市場が非常に高速に行っていることに反応します。 過去のシグナルの潜在的な利益が表示されます この指標は、独自の品質とパフォーマンスを分析します 負けブレイクアウトは強調表示され、説明されます インジケータは、非バックペインティングおよび非再ペイントです

このインディケータは、過去の価格行動を分析して市場の売買圧力を予測します。過去を振り返り、現在の価格周辺の価格のピークと谷を分析します。これは、最新の確認インジケータです。 [ インストールガイド | 更新ガイド | トラブルシューティング | よくある質問 | すべての製品 ] 市場での売買圧力を予測する フレンジーを売って買うことに巻き込まれないようにする 設定も最適化も不要 インジケーターはすべての時間枠で機能します 非常に使いやすい 潜在的な供給価格と需要価格は、多くの市場参加者が負けポジションを維持し、損益分岐点でそれらを清算することを望んでいる価格です。したがって、これらの価格レベルで大規模な活動があります。 需要と供給の両方が数値として定量化されます 供給が需要を上回る場合、販売圧力が予想されます 供給が需要を下回っている場合、購入圧力が予想されます 供給が需要を上回っている場合はショートを探してください 供給が需要を下回っている場合は、長期を探してください 入力パラメータ 範囲:過去のピークと谷を検索するための現在の価格のボラティリティ乗数。 著者

This indicator calculates how much has an instrument won or lost in percentage terms on each bar displayed in the chart. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ] Identify market patterns Find decisive price movements Be suspicious about overbought/oversold situations It is an extremely easy to use indicator... The blue histogram represents winning bars The red histogram represents losing bars The gray line represents the average win/loss per bar Labels are

このインジケータは、AB = CDリトレースメントパターンを検出します。 AB = CDリトレースメントパターンは、初期価格セグメントが部分的にリトレースされ、プルバックの完了から等距離の動きが続く4ポイントの価格構造であり、すべての調和パターンの基本的な基盤です。 [ インストールガイド | 更新ガイド | トラブルシューティング | よくある質問 | すべての製品 ] カスタマイズ可能なパターンサイズ カスタマイズ可能なACおよびBD比率 カスタマイズ可能なブレイクアウト期間 カスタマイズ可能な線、色、サイズ CD fiboレベルに基づいてSLおよびTPレベルを表示します パターンとブレイクアウトの視覚/音声/プッシュ/メールアラート AB = CDリトレースメントは、かなり拡大して再描画できます。物事を簡単にするために、このインディケーターはひねりを実装します。トレードをシグナルする前に、正しい方向へのドンチャンブレイクアウトを待ちます。最終結果は、非常に信頼性の高い取引シグナルを備えた再描画インジケーターです。ドンチャンのブレイクアウト期間が入力として入力されます。

http://www.pointzero-trading.com/ManagedAccounts

This indicator evaluates the market sentiment using raw price action measurements, and it is an amazing trading confirmation. It can be used to take a trend-trade approach or a contrarian approach using reversal patterns. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ] Find early reversals Confirm short-term trades Detect indecision on the market Take contrarian trades near support and resistance levels Trade inside bars confirmed by overall direction of the market

This indicator evaluates the market sentiment using raw price action measurements, and it is an amazing trading confirmation. It can be used to take a trend-trade approach or a contrarian approach using reversal patterns. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ] Find early reversals Confirm short-term trades Detect indecision on the market Take contrarian trades near support and resistance levels Trade inside bars confirmed by overall direction of the market

http://www.pointzero-trading.com/

この指標は、ボラティリティと価格の方向性を同時に評価し、次のイベントを見つけます。 [ インストールガイド | 更新ガイド | トラブルシューティング | よくある質問 | すべての製品 ] 決定的かつ突然の価格変動 大きなハンマー/シューティングスターパターン ほとんどの市場参加者に支えられた強力なブレイクアウト 優柔不断だが不安定な市場状況 それは非常に使いやすいインジケータです... 青いヒストグラムは強気のインパルスを表します 赤いヒストグラムは弱気のインパルスを表します 灰色のヒストグラムは現在のボラティリティを表します 移動平均は平均ボラティリティです このインジケーターは、あらゆる種類のアラートを実装します インジケーターは再描画もバックペイントもしません ...簡単な取引の意味を持ちます。 強気の衝動が平均ボラティリティを超えたときに購入できます 弱気の衝動が平均ボラティリティを超えたときに売ることができます