Mark Carmona / プロファイル

- 情報

|

no

経験

|

1

製品

|

1

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Mark Carmona

Hello traders,

One of the most common problems I see among retail traders is trading against the higher timeframe trend. Many good setups fail simply because they are taken without proper market context.

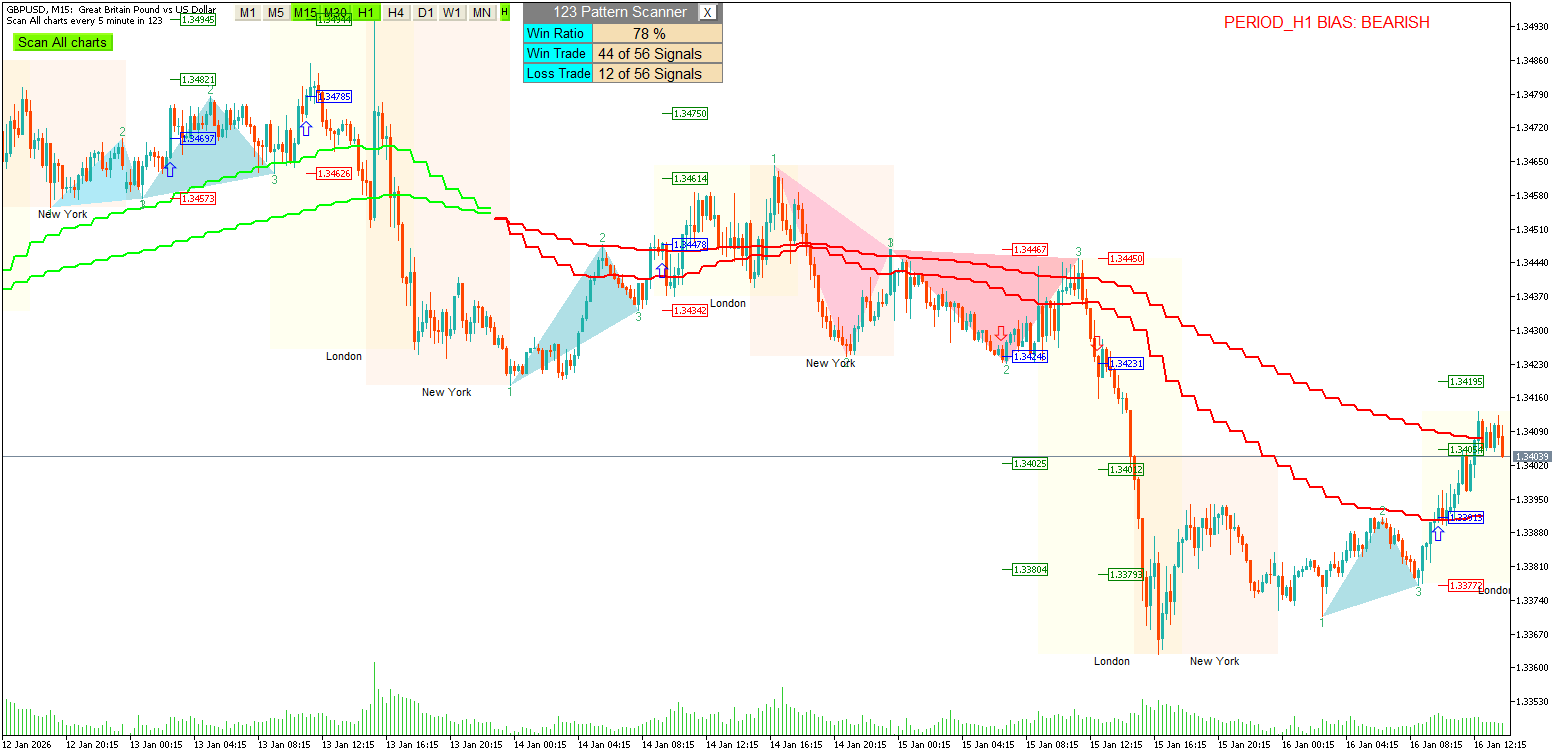

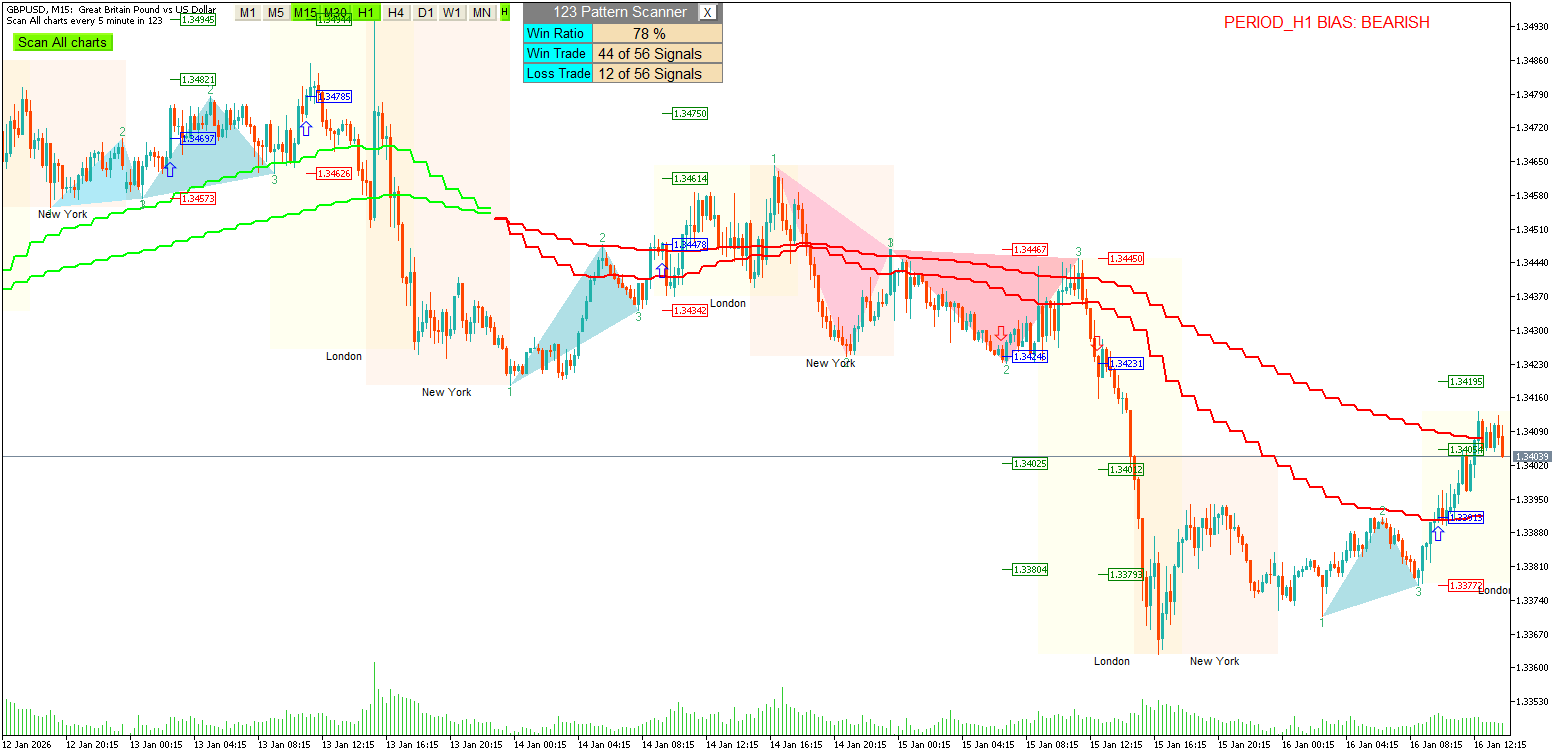

This topic is about higher timeframe bias trading and how it can be applied effectively using a non-repainting EMA-based multi-timeframe indicator in MetaTrader 5.

🔹 What Is Higher Timeframe Bias?

Higher timeframe bias defines the overall market direction using a timeframe higher than the one you trade on.

Examples:

Trading on M15 → bias from H1 or H4

Trading on M5 → bias from M30 or H1

The idea is simple:

Trade with the dominant trend, not against it.

🔹 Why Higher Timeframe Bias Matters

Lower timeframes contain a lot of noise. Without higher timeframe context, traders often:

Trade pullbacks as reversals

Enter against the dominant trend

Overtrade during consolidation

Using higher timeframe bias helps:

Filter low-probability trades

Improve consistency

Reduce emotional decision-making

🔹 EMA-Based Bias (Fast vs Slow EMA)

A simple and objective way to define bias is by comparing two EMAs on a higher timeframe:

Fast EMA above Slow EMA → Bullish bias

Fast EMA below Slow EMA → Bearish bias

When projected correctly onto a lower timeframe, this gives traders a clear directional framework.

The key requirement here is non-repainting logic.

🔹 Why Non-Repainting Is Critical

Many multi-timeframe indicators repaint, meaning historical bias changes after new candles appear. This creates false confidence and unreliable results.

A proper higher timeframe bias tool should:

Use closed higher timeframe candles only

Never repaint

Show the same behavior live as it does historically

This is especially important for strategy development and backtesting.

🔹 How I Personally Use Bias

My typical workflow:

Define higher timeframe bias (H1, H4, or D1)

Trade only in the direction of that bias

Ignore counter-trend setups

Use my own entry logic on the lower timeframe

Bias is not a signal — it is a filter.

🔹 Indicator Mention (For Those Interested)

For traders who want a clean implementation of this concept, I use a Higher Timeframe Bias Filter for MetaTrader 5 that displays:

Non-repainting MTF EMA bias

Step or smooth visualization

Clear bullish / bearish coloring

Optional bias text on the chart

Alerts on bias changes

Fully configurable higher timeframe

It’s designed to stay lightweight and work with any strategy.

(You can find it in the MQL5 Market under Higher Timeframe Bias Filter.)

🔹 Who This Approach Is For

This bias framework works well for:

Scalpers

Day traders

Swing traders

Price action traders

EMA / trend-following strategies

If your entries are decent but results feel inconsistent, adding higher timeframe bias can make a big difference.

🔹 Final Thoughts

Most strategies don’t fail because of bad entries — they fail because of bad directional bias.

Higher timeframe bias provides:

Structure

Clarity

Discipline

I’m happy to answer questions or discuss how others apply higher timeframe bias in their trading.

Good trading to everyone 👍

Higher Timeframe Bias Filter - https://www.mql5.com/en/market/product/161837?source=Site+Profile

One of the most common problems I see among retail traders is trading against the higher timeframe trend. Many good setups fail simply because they are taken without proper market context.

This topic is about higher timeframe bias trading and how it can be applied effectively using a non-repainting EMA-based multi-timeframe indicator in MetaTrader 5.

🔹 What Is Higher Timeframe Bias?

Higher timeframe bias defines the overall market direction using a timeframe higher than the one you trade on.

Examples:

Trading on M15 → bias from H1 or H4

Trading on M5 → bias from M30 or H1

The idea is simple:

Trade with the dominant trend, not against it.

🔹 Why Higher Timeframe Bias Matters

Lower timeframes contain a lot of noise. Without higher timeframe context, traders often:

Trade pullbacks as reversals

Enter against the dominant trend

Overtrade during consolidation

Using higher timeframe bias helps:

Filter low-probability trades

Improve consistency

Reduce emotional decision-making

🔹 EMA-Based Bias (Fast vs Slow EMA)

A simple and objective way to define bias is by comparing two EMAs on a higher timeframe:

Fast EMA above Slow EMA → Bullish bias

Fast EMA below Slow EMA → Bearish bias

When projected correctly onto a lower timeframe, this gives traders a clear directional framework.

The key requirement here is non-repainting logic.

🔹 Why Non-Repainting Is Critical

Many multi-timeframe indicators repaint, meaning historical bias changes after new candles appear. This creates false confidence and unreliable results.

A proper higher timeframe bias tool should:

Use closed higher timeframe candles only

Never repaint

Show the same behavior live as it does historically

This is especially important for strategy development and backtesting.

🔹 How I Personally Use Bias

My typical workflow:

Define higher timeframe bias (H1, H4, or D1)

Trade only in the direction of that bias

Ignore counter-trend setups

Use my own entry logic on the lower timeframe

Bias is not a signal — it is a filter.

🔹 Indicator Mention (For Those Interested)

For traders who want a clean implementation of this concept, I use a Higher Timeframe Bias Filter for MetaTrader 5 that displays:

Non-repainting MTF EMA bias

Step or smooth visualization

Clear bullish / bearish coloring

Optional bias text on the chart

Alerts on bias changes

Fully configurable higher timeframe

It’s designed to stay lightweight and work with any strategy.

(You can find it in the MQL5 Market under Higher Timeframe Bias Filter.)

🔹 Who This Approach Is For

This bias framework works well for:

Scalpers

Day traders

Swing traders

Price action traders

EMA / trend-following strategies

If your entries are decent but results feel inconsistent, adding higher timeframe bias can make a big difference.

🔹 Final Thoughts

Most strategies don’t fail because of bad entries — they fail because of bad directional bias.

Higher timeframe bias provides:

Structure

Clarity

Discipline

I’m happy to answer questions or discuss how others apply higher timeframe bias in their trading.

Good trading to everyone 👍

Higher Timeframe Bias Filter - https://www.mql5.com/en/market/product/161837?source=Site+Profile

Mark Carmona

パブリッシュされたプロダクト

Trade in the direction of the higher timeframe with confidence. HTF Bias Filter is a non-repainting higher timeframe bias indicator that projects EMA-based trend direction from any higher timeframe (H1, H4, D1, etc.) onto your lower timeframe chart. It helps traders filter bad trades , stay aligned with the dominant trend, and improve consistency. 🔹 What Problem It Solves Many traders lose money by trading against the higher timeframe trend . This indicator solves that problem by clearly

: