Mauricio Vellasquez / プロファイル

- 情報

|

no

経験

|

9

製品

|

21

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

無料AIシグナル: https://ratioxtrade.com/signals

フルアクセス(すべてのEAとインジケーター): Ratio Xをサポートし、すべての製品と毎月のアップデートを単一価格で入手できます。 https://ratioxtrade.com

お問い合わせ (Telegram): @ratioxtrading

Experience the next evolution of algorithmic trading.

Our EA features fully integrated Artificial Intelligence, directly connected to OpenAI — no external setup or additional fees required.

✅ Adaptive trading decisions powered by real AI

✅ Built-in risk control, trailing management, and dynamic filters

✅ 100% automated and optimized for XAUUSD (H1)

✅ Zero monthly or hidden costs

👉 Discover now on the MQL5 Market: Ratio X Quantum AI

⚠️ IMPORTANT NOTICE: ✅ OpenAI GPT-4 Artificial Intelligence INCLUDED - You pay NOTHING extra. All API costs are on us.

📖 After purchase, IMMEDIATELY read the first comment in the "Comments" tab to access the Complete User Guide.

The Story of How Ordinary Traders Are Turning $30 into $13,642 in 90 Days

Imagine waking up on any given Monday and discovering that your Expert Advisor just executed 277 profitable trades while you slept.

This isn't fantasy. It's exactly what happened with Ratio X AI Quantum v1.1 in the backtest from July to September 2025.

$30 turned into $13,642.69 in just 3 months.

But here's the most impressive part...

Why 97% of Your Trades Are Winners (And How This Is Possible)

Most EAs on the market use basic indicators from the 90s. RSI, MACD, moving averages... all looking at the SAME chart, making the SAME decisions, losing the SAME money.

Ratio X AI Quantum is different.

It literally has an Artificial Intelligence brain analyzing:

7 timeframes simultaneously (each with equal weight in decision-making)

Institutional volume and order flow in real-time

Supply and demand zones where big players accumulate positions

15 OHLC candles per timeframe to detect patterns humans can't see

Market regime (Trend, Range, Volatile, or Crisis) automatically adjusting the strategy

While other EAs try to guess the next move, Ratio X AI Quantum is already 5 steps ahead.

"But What If The Market Turns Against Me?"

Great question. That's why we built 6 layers of protection into the system:

Layer 1: Automatic News Filter - Pauses trading 30 minutes before and after high-impact events

Layer 2: Circuit Breakers - Automatically shuts down if drawdown exceeds your limits

Layer 3: Smart Trailing Stop with 3 levels - Protects profits while maximizing gains

Layer 4: Dynamic Risk Management - Adjusts position sizes based on volatility

Layer 5: Spread Filter - Doesn't trade when costs are high

Layer 6: Market Regime Analysis - Changes strategy in crisis markets

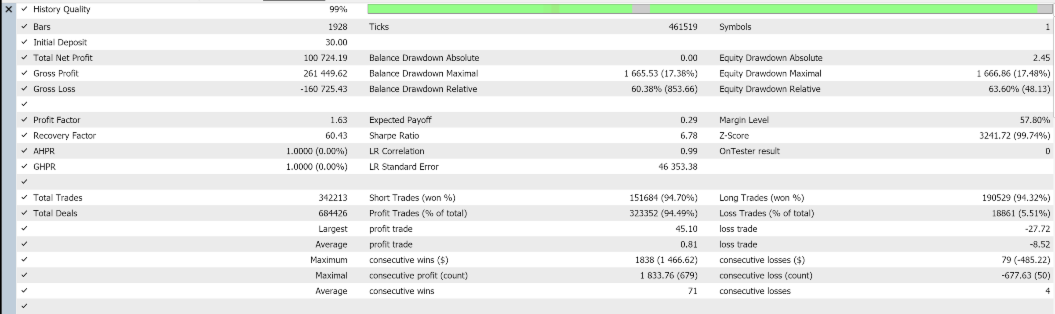

The Numbers Don't Lie (And They're Auditable)

If you don't believe this data, see for yourself: https://drive.google.com/drive/folders/1W3_1oXQAxo6wF6WNOTXQZSm73tGb3sW8?usp=sharing

There you'll find the original MetaTrader 5 .xlsx files with ALL backtest data. Every trade. Every entry. Every exit. 100% transparent.

Backtest #1 (Jul-Sep 2025):

Initial capital: $30

Net profit: $13,642.69

Profit factor: 4.36

Win rate: 97.48%

Maximum drawdown: only $31.48

Capital multiplication: 454x

Backtest #2 (Oct 2025 - Just 16 Days):

Initial capital: $30

Net profit: $13,273.10

Win rate: 96.77%

ROI in 16 days: 44,243%

What Makes This EA Unique (And Why You've Never Seen Anything Like It)

1. Professional AI Brain (NO EXTRA COSTS)

It's not a disguised "if-then". It's real OpenAI GPT-4 analyzing the market like an institutional trader with 20 years of experience. And the best part: you pay NOTHING extra for this. API costs are 100% on us.

2. Multi-Timeframe Analysis with Volume

While you look at one chart, it analyzes 7 simultaneously. Each timeframe has its RSI, MACD, EMAs, ATR, candle patterns, volume, and supply/demand zones calculated in real-time.

3. Smart Execution

4 execution modes (Market, Limit, TWAP, Smart) that adapt to liquidity. When the market is illiquid, it splits orders. When it's volatile, it adjusts slippage.

4. AI-Powered Trailing Stop

The artificial intelligence itself sets 3 trailing stop levels based on current market conditions. It's not fixed. It's dynamic. It's intelligent.

5. Scientific Position Sizing

Kelly Criterion for mathematical growth maximization

Volatility-Based for automatic market adjustment

Risk Parity for portfolio balancing

Fixed Risk for conservatives

"Ok, But Does It Work in Real Markets?"

Every line of code was written with these in mind:

Capital protection (6 security systems)

Consistency (97%+ proven win rate)

Scalability (from $30 to $13k+ repeatedly)

And the best part: you don't need to believe us.

Test it yourself.

The backtests are available on Google Drive. The results are reproducible.

Who This EA Is Perfect For

✅ Traders who want consistent results - 97% win rate isn't luck

✅ Those with little capital - Started with just $30 in tests

✅ Busy people - Operates 24/5 without your supervision

✅ Experienced traders - Advanced settings for optimization

✅ Cautious beginners - 6 layers of capital protection

✅ Those who want professional AI without monthly fees - OpenAI included for free

Who It's NOT For

❌ Those seeking "get rich overnight" (takes 90 days, not 1)

❌ Those who don't have $30 to start

❌ Those who want 100% guarantee (financial markets have risks)

What You Get

EA Ratio X AI Quantum v1.1 (.ex5 file)

OpenAI GPT-4 Artificial Intelligence (no extra costs - API paid by us)

Complete manual for installation and configuration (first comment in Comments tab)

Optimized settings for XAUUSD

Technical support for installation

Free updates for version 1.x

Access to complete backtests for your own analysis

The Truth About Automated Trading

Most EAs on the market are garbage. We know that.

They're basic indicators with pretty marketing. They work for 2 weeks then burn your account.

Ratio X AI Quantum is different because it was built with:

Real Artificial Intelligence (OpenAI GPT-4, not marketing)

Institutional risk management (not gambling)

Auditable results (see for yourself on Google Drive)

No hidden costs (AI included for free)

Your Decision

You can continue:

Losing money with basic EAs

Paying absurd monthly fees for "AI signals"

Trading manually and missing opportunities

Watching other traders grow their accounts

Or you can make the decision that 454 traders have already made:

Put Artificial Intelligence to work 24/5 multiplying your capital.

The backtests show $30 turning into $13,642.

Verify it yourself: https://drive.google.com/drive/folders/1W3_1oXQAxo6wF6WNOTXQZSm73tGb3sW8?usp=sharing

The math is simple: 454x multiplication.

The decision is yours.

Ratio X AI Quantum v1.1 The Only EA with an AI Brain That Transforms $30 into $13k Artificial Intelligence Included - No Extra Costs

P.S.: While you read this, the EA could be executing your first 277 profitable trades of the day. Every minute stopped is money not multiplied.

P.P.S.: Remember: we're not promising "instant wealth". We're showing real, auditable backtests (Google Drive link above), with 97% win rate and 454x multiplication in 90 days. The difference is we have the numbers to prove it.

P.P.P.S.: After purchase, don't forget: go straight to the "Comments" tab and read the first comment with the complete user guide. Everything you need to start multiplying your capital today is there.

You just attach it to the chart, set up your configuration, and voilà, the AI does the rest of the work. How much do you think this would be worth?

Ratio X AI Gold Fury - XAUUSD取引のためのAI駆動エキスパートアドバイザー プロフェッショナルなテクニカル分析とDeepSeek人工知能を組み合わせた高度な取引システムで、金市場での機会を最大化します。 このEAの違い 硬直的にコード化されたルールを持つ従来のエキスパートアドバイザーとは異なり、Ratio X AI Gold Furyは人工知能を使用して市場のコンテキストを分析します。ただし、AIの推奨を盲目的に従うことはありません。代わりに、取引を実行する前にAIの承認とリスク管理の検証の両方を必要とします。 主な機能 AI推奨SL/TP: 現在の市場状況に基づいて、AIに最適なストップロスとテイクプロフィットのレベルを決定させます トレーリングストップシステム: 取引が有利に動くにつれて自動的に利益を確定します AutoLotポジションサイジング: 残高のパーセンテージを使用したリスクベースのボリューム計算 マジックナンバーサポート: 複数のEAインスタンスを同時に実行 ユニバーサルシンボルサポート

Ratio X Breakout EA — 精密なブレイクアウト実行 Ratio X Breakout EA は、自律型のトレーディングシステムであり、 ローソク足のブレイクアウト によって引き起こされる方向性のある値動きを捉えるために設計されています。そのロジックはシンプルでありながら堅牢です。ユーザーが定義した リファレンスキャンドル を基準とし、価格がその構造を明確に突破した時のみ市場に参入します。その結果、明確さと適応性を重視した規律あるブレイクアウト手法が実現されます。 コアメソドロジー システムの中心は リファレンスキャンドル (例:M5、13:30)です。EA はその高値と安値をマークします。その範囲を外れて実体がクローズした最初のローソク足が、その日の 方向バイアス を決定します: 高値を上抜けてクローズ → 買いバイアスのみ 安値を下抜けてクローズ → 売りバイアスのみ 方向が確認されると、EA

Ratio X Freshbot Gold EA — インテリジェント・トレンド&モメンタム・システム Ratio X Freshbot Gold EA は、 XAUUSD(金) を H1 および H4 の時間枠で取引するために精密に設計された完全自動のトレーディングシステムです。そのアーキテクチャは、 トレンド予測 と モメンタム確認 を組み合わせ、複数のテクニカル分析を統合して一貫性のある規律正しい実行フレームワークを形成しています。 このシステムは、方向性を判断するために 指数平滑移動平均線(50 EMA と 200 EMA) を使用し、 RSI で強さを確認し、 MACD でモメンタムを確認します。このマルチファクターアプローチにより、EA はノイズを除去し、高確率のシグナルが揃ったときのみ取引を行い、精度とリスク管理のバランスを実現します。 多くの投機的なシステムとは異なり、Ratio X Freshbot Gold EA は マーチンゲール 、 グリッド 、または制御不能なスケーリングを使用しません。各ポジションは 独立 しており、 リスク管理 下にあり、

Overview

Adding AI to MT5 Expert Advisors (EAs) enables more contextual, multi-signal decisions, but increases engineering complexity, cost, and governance needs.

Architecture

API integration: The EA sends market snapshots to cloud models through MT5’s WebRequest. Users must explicitly allow outbound calls and allowlist the service URL (e.g., api.openai.com).

Data model: Build a structured payload that aggregates multiple timeframes (M5/M15–M30/H1–H4/D1–W1) and key indicators (RSI, short/long EMAs, MACD, ATR, volatility, trend direction).

Multi-timeframe logic:

Short term: noise filtering and entries.

Intraday: pattern recognition.

Medium term: trend confirmation.

Long term: regime context.

This depth adds nuance but raises data and compute demands.

Regime detection & adaptation

States: trending, range-bound, high volatility, crisis.

Signals: autocorrelation and volatility stats for classification.

Position sizing: combine Kelly-style fractions (win rate/payoff) with volatility-scaled exposure to throttle risk in unstable periods.

Risk architecture

Layered controls: circuit breakers, max drawdown caps, VaR monitoring, correlation limits, daily loss limits.

Dynamic risk: adjust parameters in real time based on market state and system P&L.

Metrics: live Sharpe, Calmar, Sortino, and Expected Shortfall for risk-adjusted tracking.

Implementation challenges

Latency: API round-trips ~200–2000 ms plus model compute can cause slippage.

Mitigations: retries, graceful fallbacks to local logic, and smart execution (TWAP/VWAP).

Data quality: handle gaps/outliers and normalize across timeframes.

Cost: API usage grows with frequency and payload size; moderate operation is often ~US$6–20/month.

Compliance: maintain auditable logs of AI decisions, confidence scores, and inputs; disclose model limits and failure modes.

Testing & validation

Backtesting: avoid look-ahead bias and overfitting; use out-of-sample and multi-regime datasets.

Forward testing: start on demo, deploy minimal size, scale gradually on stable performance, and monitor continuously.

Engineering best practices

Resilience: robust error handling (bounded retries, timeouts, fallbacks).

Efficiency: rate-limit API calls, cache intermediate results, optimize data structures, and clean up resources.

What’s next

Tech trends: on-device/edge models (lower latency/cost), federated learning, real-time adaptation, multi-agent strategies.

Infra shifts: edge computing, 5G, and deeper cloud integration for scalable, low-latency pipelines.

Bottom line

AI can materially enhance MT5 decision quality.

Success depends on sound architecture, multi-layer risk controls, rigorous back/forward testing, active monitoring, and clear cost accounting.

Treat AI as a decision co-pilot—not an infallible oracle.

Disclaimer

Trading involves substantial risk of loss. AI systems can fail or be wrong. Past performance does not guarantee future results. Test thoroughly and never risk capital you cannot afford to lose. Educational content only; not financial advice.

Ratio X — MT5向けAI駆動型トレーディングシステム 重要: 完全に動作するにはOpenAI APIキーが必要です。トレードを開始する前に、ターミナル設定でMT5 WebRequestを有効にしてください。購入後、コメントセクションで完全な設定ガイドをご利用いただけます。 価格 初期価格:$37 USD 20ユーザーごとに$10値上がりします。 Ratio Xの違い Ratio XはOpenAI GPT-4o-miniを統合して市場のコンテキストを解釈し、ルールベースのリスクエンジンが規律を適用します。トレードは、AI提案とリスク検証の両方が合意した場合にのみ実行されます。 主なアプローチ: AI駆動型分析は、RSI、EMA、MACD、ATR、市場レジーム、口座メトリクス、および各時間枠ごとの最後の30本のOHLCローソク足を含む構造化データを送信し、信頼度スコアと根拠を含むトレード提案を受け取ります 信頼度閾値に加えてVaR、ドローダウン、制限、およびマージンチェックによる二重保護システムを、あらゆる注文の前に実施