Martin Njoroge / プロファイル

- 情報

|

10+ 年

経験

|

1

製品

|

52

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Martin Njoroge

EUR/USD Forecast for Today (Dec 8, 2025)

Bias: Cautiously Bullish, but volatility expected ahead of tomorrow's Fed meeting.

Current Price: ~1.1656

Likely Trading Range: 1.1600 - 1.1730

Key Levels to Watch:

Resistance (Sell Targets):

1.1680: Immediate resistance. A break here opens the path to 1.1700.

1.1730: Strong resistance (Fibonacci level). Likely to reject price on first touch.

Support (Buy Zones):

1.1600: First solid support. Good for scalping longs.

1.1590: Critical level. If price breaks below this, the bullish trend is broken.

Strategy:

Bullish: Look for buys near 1.1600 with stops below 1.1580. Target 1.1680.

Bearish: Look for shorts if price rejects 1.1680 or 1.1730.

Note: Be careful of low liquidity/choppiness today as traders wait for the Fed news tomorrow.

EUR/USD Forecast for Today (Dec 8, 2025)

Bias: Cautiously Bullish, but volatility expected ahead of tomorrow's Fed meeting.

Current Price: ~1.1656

Likely Trading Range: 1.1600 - 1.1730

Key Levels to Watch:

Resistance (Sell Targets):

1.1680: Immediate resistance. A break here opens the path to 1.1700.

1.1730: Strong resistance (Fibonacci level). Likely to reject price on first touch.

Support (Buy Zones):

1.1600: First solid support. Good for scalping longs.

1.1590: Critical level. If price breaks below this, the bullish trend is broken.

Strategy:

Bullish: Look for buys near 1.1600 with stops below 1.1580. Target 1.1680.

Bearish: Look for shorts if price rejects 1.1680 or 1.1730.

Note: Be careful of low liquidity/choppiness today as traders wait for the Fed news tomorrow.

Fed Expectations for Tomorrow (Dec 9-10 Meeting)

The Consensus:

Rate Cut: The market is pricing in an 87% chance of a 0.25% rate cut.

The "Dot Plot": Traders will be watching the "Dot Plot" (Fed's future predictions). The market expects aggressive cuts in 2026, but the Fed might signal a slower path.

Impact on EUR/USD:

Scenario A (Dovish Cut): Fed cuts 0.25% AND signals more cuts soon. -> EUR/USD Rallies (Dollar weakens).

Scenario B (Hawkish Cut): Fed cuts 0.25% BUT says "inflation is sticky, we might pause". -> EUR/USD Drops (Dollar strengthens).

Scenario C (No Cut): Shock. -> EUR/USD Crashes heavily.

Verdict: A rate cut is priced in. The volatility will come from what Powell says about 2026.

Bias: Cautiously Bullish, but volatility expected ahead of tomorrow's Fed meeting.

Current Price: ~1.1656

Likely Trading Range: 1.1600 - 1.1730

Key Levels to Watch:

Resistance (Sell Targets):

1.1680: Immediate resistance. A break here opens the path to 1.1700.

1.1730: Strong resistance (Fibonacci level). Likely to reject price on first touch.

Support (Buy Zones):

1.1600: First solid support. Good for scalping longs.

1.1590: Critical level. If price breaks below this, the bullish trend is broken.

Strategy:

Bullish: Look for buys near 1.1600 with stops below 1.1580. Target 1.1680.

Bearish: Look for shorts if price rejects 1.1680 or 1.1730.

Note: Be careful of low liquidity/choppiness today as traders wait for the Fed news tomorrow.

EUR/USD Forecast for Today (Dec 8, 2025)

Bias: Cautiously Bullish, but volatility expected ahead of tomorrow's Fed meeting.

Current Price: ~1.1656

Likely Trading Range: 1.1600 - 1.1730

Key Levels to Watch:

Resistance (Sell Targets):

1.1680: Immediate resistance. A break here opens the path to 1.1700.

1.1730: Strong resistance (Fibonacci level). Likely to reject price on first touch.

Support (Buy Zones):

1.1600: First solid support. Good for scalping longs.

1.1590: Critical level. If price breaks below this, the bullish trend is broken.

Strategy:

Bullish: Look for buys near 1.1600 with stops below 1.1580. Target 1.1680.

Bearish: Look for shorts if price rejects 1.1680 or 1.1730.

Note: Be careful of low liquidity/choppiness today as traders wait for the Fed news tomorrow.

Fed Expectations for Tomorrow (Dec 9-10 Meeting)

The Consensus:

Rate Cut: The market is pricing in an 87% chance of a 0.25% rate cut.

The "Dot Plot": Traders will be watching the "Dot Plot" (Fed's future predictions). The market expects aggressive cuts in 2026, but the Fed might signal a slower path.

Impact on EUR/USD:

Scenario A (Dovish Cut): Fed cuts 0.25% AND signals more cuts soon. -> EUR/USD Rallies (Dollar weakens).

Scenario B (Hawkish Cut): Fed cuts 0.25% BUT says "inflation is sticky, we might pause". -> EUR/USD Drops (Dollar strengthens).

Scenario C (No Cut): Shock. -> EUR/USD Crashes heavily.

Verdict: A rate cut is priced in. The volatility will come from what Powell says about 2026.

Martin Njoroge

Prop Firms vs. Personal Forex Trading: A Comprehensive Guide

This guide compares trading with a Proprietary Trading Firm ("Prop Firm") versus trading your own capital in the Forex market.

Executive Summary

Feature Prop Firm Trading Personal Forex Trading

Capital High (Provided by firm, e.g., $10k - $200k) Low to Medium (Your own savings)

Risk Low (Limited to evaluation fee) High (Your entire account balance)

Profit Split 80% - 90% to You 100% to You

Rules Strict (Drawdown limits, profit targets) None (Total autonomy)

Barrier to Entry Skill-based (Must pass evaluation) Capital-based (Must have money)

Psychology Performance pressure, discipline enforced Fear of loss, emotional trading

1. What is a Prop Firm?

A Proprietary Trading Firm is a company that provides capital to traders.

The Deal: You trade their money. If you make a profit, you keep a large share (typically 80-90%). If you lose money, the firm covers the losses, but you lose your account if you hit a specific "drawdown" limit.

The Catch: You must pass an Evaluation (or "Challenge") to prove you are profitable and disciplined. This usually costs a fee (e.g., $100 - $500).

2. Investment Outcome Comparison

Scenario A: Personal Trading

Investment: $1,000 of your own money.

Return: You make 10% in a month.

Outcome: Profit = $100.

Risk: You could lose the entire $1,000.

Scenario B: Prop Firm Trading

Investment: ~$100 (Evaluation fee for a $10,000 account).

Return: You make 10% on the $10,000 account.

Gross Profit: $1,000.

Your Share (80%): $800.

Risk: You lose the $100 fee if you fail. You never owe the firm for trading losses.

Verdict: Prop firms offer significantly higher Return on Investment (ROI) because you are leveraging other people's money. However, the probability of realizing that return depends entirely on your skill to pass the challenge and keep the account.

3. Pros & Cons

Prop Firms

✅ Pros:

Leverage: Trade with $100k while only risking a few hundred dollars.

Capped Risk: You cannot go into debt. The most you lose is the fee.

Discipline: Strict rules force you to manage risk properly.

Scaling: Good firms increase your capital if you are consistent.

❌ Cons:

Strict Rules: Hitting a daily drawdown (e.g., losing 5% in a day) often means instant termination.

Evaluation Fees: If you fail the challenge, the money is gone.

Profit Split: You don't keep 100% (though 80-90% of a large pot is usually better than 100% of a small one).

Not Your Asset: You don't own the account. They can change rules or shut down.

Personal Trading

✅ Pros:

Total Freedom: No rules. Trade news, hold over weekends, risk what you want.

100% Profit: Every penny you make is yours.

Compound Interest: You can grow a small account into a large one over years (very hard but possible).

Security: Your money is in a regulated broker account in your name.

❌ Cons:

Capital Risk: It is your hard-earned money on the line.

Slow Growth: Growing a $500 account to a living wage takes years or extreme risk.

Psychological Stress: Losing your own money hurts more than losing a funded account.

4. Which is Better?

Choose a Prop Firm if:

You have skill but no capital.

You want to generate monthly income rather than build long-term wealth.

You need strict rules to keep your discipline in check.

You are comfortable with the pressure of performance targets.

Choose Personal Trading if:

You have capital to risk.

You want to build long-term wealth through compounding.

You hate rules and want total control over your strategy.

You trade strategies that prop firms ban (e.g., certain HFTs, news straddling).

Conclusion

For most retail traders, Prop Firms are "better" in terms of risk/reward outcome. The ability to control $100,000 for a $500 fee is mathematically superior to trading your own $500. However, it requires you to be a profitable, disciplined trader. If you are a beginner, you will likely lose money in both, but prop firm fees are "cheaper" tuition than blowing up a large personal account.

This guide compares trading with a Proprietary Trading Firm ("Prop Firm") versus trading your own capital in the Forex market.

Executive Summary

Feature Prop Firm Trading Personal Forex Trading

Capital High (Provided by firm, e.g., $10k - $200k) Low to Medium (Your own savings)

Risk Low (Limited to evaluation fee) High (Your entire account balance)

Profit Split 80% - 90% to You 100% to You

Rules Strict (Drawdown limits, profit targets) None (Total autonomy)

Barrier to Entry Skill-based (Must pass evaluation) Capital-based (Must have money)

Psychology Performance pressure, discipline enforced Fear of loss, emotional trading

1. What is a Prop Firm?

A Proprietary Trading Firm is a company that provides capital to traders.

The Deal: You trade their money. If you make a profit, you keep a large share (typically 80-90%). If you lose money, the firm covers the losses, but you lose your account if you hit a specific "drawdown" limit.

The Catch: You must pass an Evaluation (or "Challenge") to prove you are profitable and disciplined. This usually costs a fee (e.g., $100 - $500).

2. Investment Outcome Comparison

Scenario A: Personal Trading

Investment: $1,000 of your own money.

Return: You make 10% in a month.

Outcome: Profit = $100.

Risk: You could lose the entire $1,000.

Scenario B: Prop Firm Trading

Investment: ~$100 (Evaluation fee for a $10,000 account).

Return: You make 10% on the $10,000 account.

Gross Profit: $1,000.

Your Share (80%): $800.

Risk: You lose the $100 fee if you fail. You never owe the firm for trading losses.

Verdict: Prop firms offer significantly higher Return on Investment (ROI) because you are leveraging other people's money. However, the probability of realizing that return depends entirely on your skill to pass the challenge and keep the account.

3. Pros & Cons

Prop Firms

✅ Pros:

Leverage: Trade with $100k while only risking a few hundred dollars.

Capped Risk: You cannot go into debt. The most you lose is the fee.

Discipline: Strict rules force you to manage risk properly.

Scaling: Good firms increase your capital if you are consistent.

❌ Cons:

Strict Rules: Hitting a daily drawdown (e.g., losing 5% in a day) often means instant termination.

Evaluation Fees: If you fail the challenge, the money is gone.

Profit Split: You don't keep 100% (though 80-90% of a large pot is usually better than 100% of a small one).

Not Your Asset: You don't own the account. They can change rules or shut down.

Personal Trading

✅ Pros:

Total Freedom: No rules. Trade news, hold over weekends, risk what you want.

100% Profit: Every penny you make is yours.

Compound Interest: You can grow a small account into a large one over years (very hard but possible).

Security: Your money is in a regulated broker account in your name.

❌ Cons:

Capital Risk: It is your hard-earned money on the line.

Slow Growth: Growing a $500 account to a living wage takes years or extreme risk.

Psychological Stress: Losing your own money hurts more than losing a funded account.

4. Which is Better?

Choose a Prop Firm if:

You have skill but no capital.

You want to generate monthly income rather than build long-term wealth.

You need strict rules to keep your discipline in check.

You are comfortable with the pressure of performance targets.

Choose Personal Trading if:

You have capital to risk.

You want to build long-term wealth through compounding.

You hate rules and want total control over your strategy.

You trade strategies that prop firms ban (e.g., certain HFTs, news straddling).

Conclusion

For most retail traders, Prop Firms are "better" in terms of risk/reward outcome. The ability to control $100,000 for a $500 fee is mathematically superior to trading your own $500. However, it requires you to be a profitable, disciplined trader. If you are a beginner, you will likely lose money in both, but prop firm fees are "cheaper" tuition than blowing up a large personal account.

Martin Njoroge

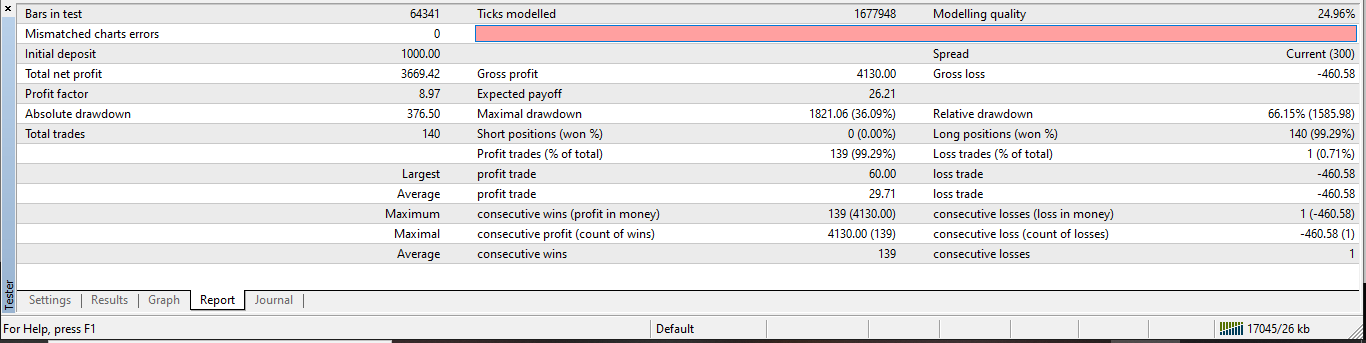

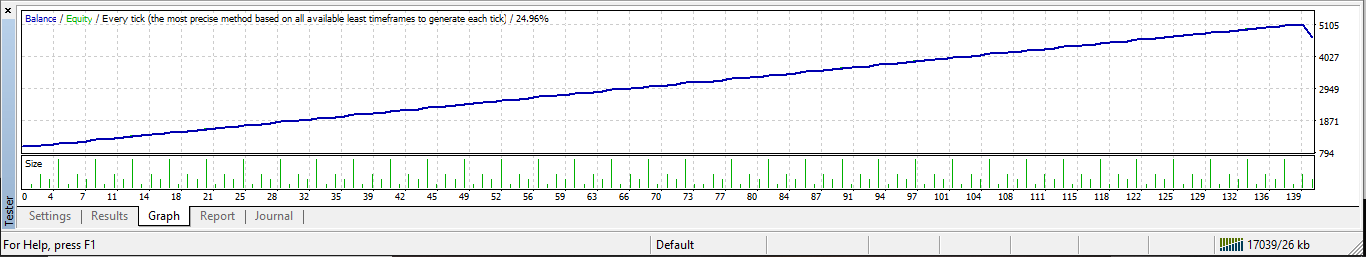

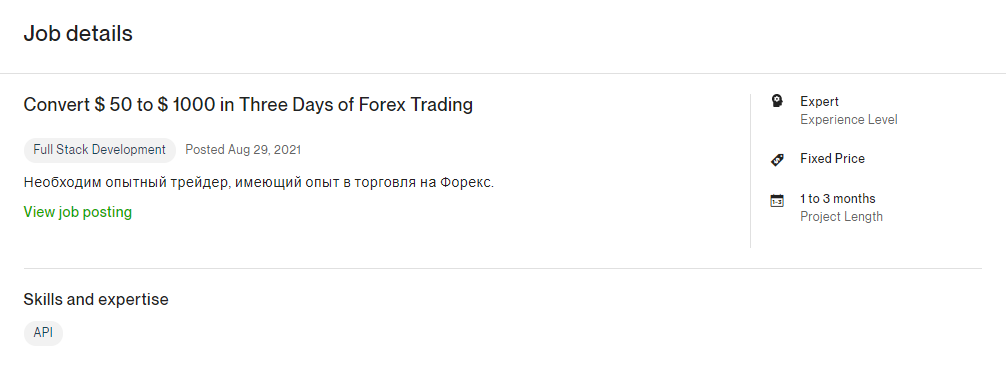

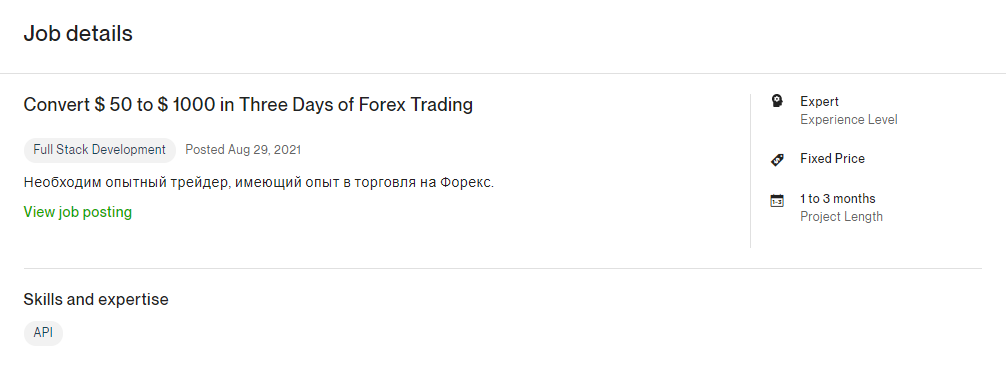

Sink or swim! A client posted a job on Upwork wanting a trader who shall grow his account by leaps and bounds within a very short time. This bot was made to achieve this feat!

https://lnkd.in/dsZdkEAB

https://lnkd.in/dsZdkEAB

Martin Njoroge

Bitcoin harsh rate drops by 25% as China crackdown on mining rigs. What does this mean for Bitcoin? Like any asset where supply is low the prices soar. This is it! It's time to buy Bitcoins! Position yourself now while its very cheap! Its about to soar on wings of Eagles.

Martin Njoroge

An exiting new Robot is available. Currency Cruncher. This one will only be sold directly to clients. It can trade almost everything. It will be integrated with the perfect gold bot signal. Priced at $10000. Totally worth it. To contact me on whatsapp if interested +254703207457. Thank you all for your support. Happy trading!

Martin Njoroge

https://www.facebook.com/job_opening/351735622506103/?source=renew_post&__cft__[0]=AZXIIULjjj6E-MUPh_htsQ1ZTRKsKgjZOAueiNFdxkqIHJmNSR1qxV2fsDySUb4DrLwUjSrHvUBCMyxMkthD6SUiMAA-9cZR3yjzf0Q3uzoSwIB8EcwUQrmmHqSnvRPlIaMnz9WmDgKSeeSfNgQQfaNbVYEbbjo1lAw0jgNIUJrb_NN0fW5XJKHUeUPu9EADc7AW4lKPy73JeGJuIcTjTPb0&__tn__=H-R

Martin Njoroge

パブリッシュされたプロダクト

EMA Loop Daily Chart (69% wins backtest data) Has an open trade all of the time except when a trade is closed by the take-profit. Buy or sell signal triggered when EMA 1 crosses EMA 2. No stoploss is used. Trade is closed when a signal for the opposite trade entry is received. Has promising results for the Daily chart of EUR/USD Parameters Used EMA 1 – (6) < (20) Buy EMA2 – (6) > (20) Sell Money Management Uses Betting Fibonacci with the initialization value being (0.01 lots). Lot size

Martin Njoroge

People per hour is another awesome freelance site for professional Forex traders and MT4/MT5 developers. People often post jobs looking for someone to trade for them or make them a custom expert advisor. You can also sell your services there. Join with my link below and get a £30 spending voucher:

https://goo.gl/8Td63X

https://goo.gl/8Td63X

Martin Njoroge

Are you looking for potential investors? Are you looking for a market to sell you products? Do you want to network with like minded people? Create an account with Fiverr and start selling or outsourcing your services today. Its free and it will take you just a few minutes to set up you Gig...

Martin Njoroge

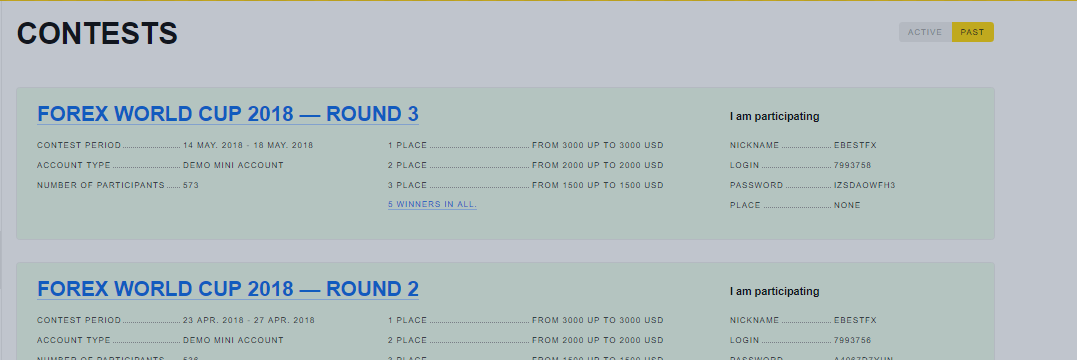

Open an account with Exness https://goo.gl/ft93FA to participate in their first round of trading contests in 2018. The trader with the highest equity at the end of the 4 day competition wins 3000 USD. The contest is risk free and will be done in their demo account...

Martin Njoroge

パブリッシュされた投稿NZD/USD FUNDAMENTAL ANALYSIS

NZD/USD may trade lower as markets digest New Zealand's disappointing QoQ and YoY Gross Domestic Product. These figures reveal that the economy's expansion was slower than expected. The market sentiment has turned bearish with 64.5% of traders opening short positions...

ソーシャルネットワーク上でシェアする · 1

121

Martin Njoroge

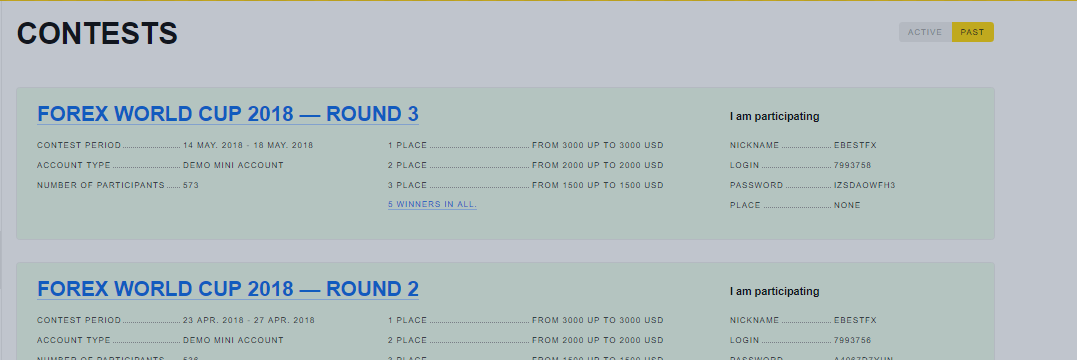

I have entered a long position on USDCAD based on Technical analysis. It's a little late in the trend but as long as prices trade within the channel and above the fib support, I expect the prices to continue higher. Its important to take note of Economic releases during the week as this may affect the setup. Have a happy trading week and remember to trade responsibly.

Martin Njoroge

Major USD Macroeconomic Events 11-17 March 2018

13th March Tuesday

Headline Inflation figure. FED will be looking at the CPI figure to determine whether there will be an interest rate hike in their March meeting. The previous figure was 2.1% while forecast is at 2.2%. A higher than expected figure should be taken as bullish.

14th March Wednesday

Retail sales. It’s the foremost indicator of consumer spending. A higher than expected figure should be taken as bullish for the dollar.

15th March Thursday

Weekly jobless claims. Previous figure at 231k, forecast at 225k. A lower than expected figure should be taken as bullish.

16th March Friday

Building permit February; JOLTs job Openings January; Industrial product index m/m February; U. of Mich. Sentiment.

13th March Tuesday

Headline Inflation figure. FED will be looking at the CPI figure to determine whether there will be an interest rate hike in their March meeting. The previous figure was 2.1% while forecast is at 2.2%. A higher than expected figure should be taken as bullish.

14th March Wednesday

Retail sales. It’s the foremost indicator of consumer spending. A higher than expected figure should be taken as bullish for the dollar.

15th March Thursday

Weekly jobless claims. Previous figure at 231k, forecast at 225k. A lower than expected figure should be taken as bullish.

16th March Friday

Building permit February; JOLTs job Openings January; Industrial product index m/m February; U. of Mich. Sentiment.

Martin Njoroge

This will be a volatile week with many important macro economic data and key Central bank speakers.

Martin Njoroge

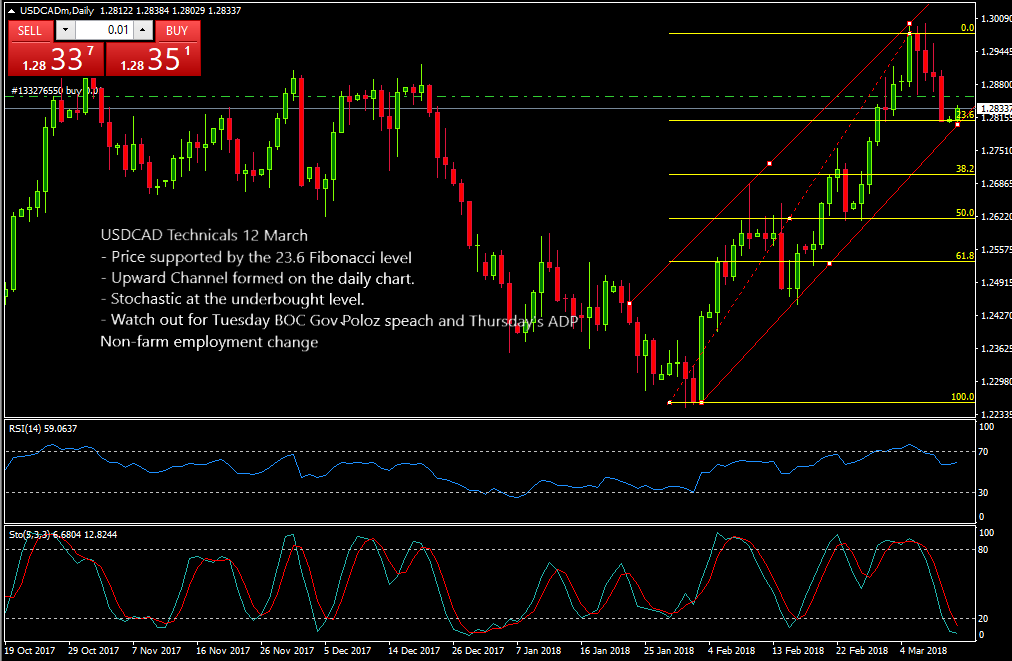

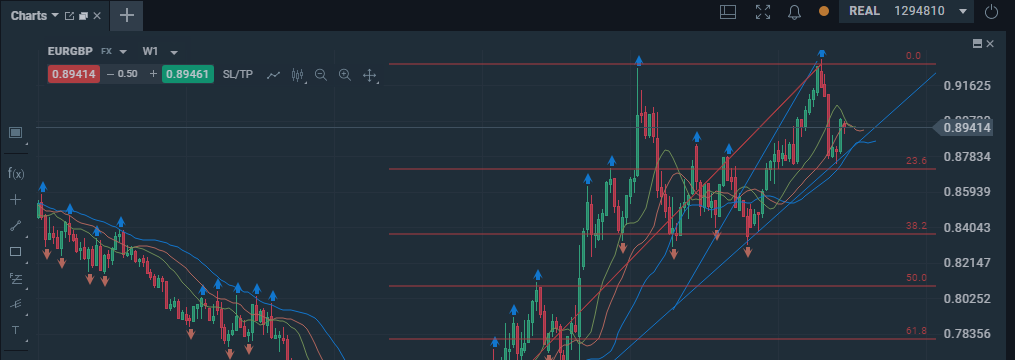

- EUR/GBP Major support is at 0.836 level at the 38.2 Fibonacci retracement level - The General trend of the pair has been on an uptrend since 2015 - The near time trend support lies at the 0.8808 level - The pair has formed a resistance - Since the trend is bullish I am to long the pair...

ソーシャルネットワーク上でシェアする · 1

145

Martin Njoroge

Why Struggle with complex strategies? Applying good money management to this strategy and you'll be trading better than a professional.

Martin Njoroge

Since December 28th the GBP/USD pair has been respecting 200mva on the 15 min chart as a strong Resistance. This has been creating nice entry points for short positions.

: