Extremums Hybrids

- インディケータ

- Tatiana Savkevych

- バージョン: 1.0

- アクティベーション: 5

Extremums Hybrid — High-Precision Structural Analysis Tool

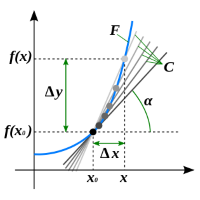

Extremums Hybrid is a professional-grade analytical indicator designed to identify key market reversal points and structural shifts with institutional precision. Unlike standard zigzag indicators, it utilizes a hybrid filtering logic that combines price action, volatility (ATR), and volume (VSA).

Key Features

-

Adaptive Extremum Detection: Uses a dynamic lookback period to filter out market noise and focus on significant highs and lows.

-

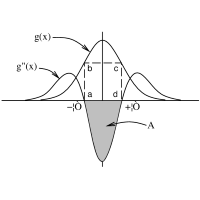

Volatility-Adjusted Filtering: Integrates an ATR-based multiplier to ensure the indicator adapts to changing market conditions (calm vs. volatile).

-

VSA Integration: The optional VSA (Volume Spread Analysis) filter confirms price extremes with volume spikes, increasing the probability of a true reversal.

-

Market Structure Mapping: Automatically plots "Structure High/Low" lines, helping traders identify break-of-structure (BOS) and trend continuations.

-

Clean Visualization: High-contrast arrows and dotted structure lines provide a clutter-free chart experience, perfect for both manual trading and EA integration.

Input Parameters

-

Lookback: Number of bars to analyze for peak/valley detection.

-

Min Distance: Minimum distance between consecutive extremums to avoid "false signals."

-

ATR Multiplier: Adjusts sensitivity based on current market volatility.

-

Use VSA Filter: Enable/disable volume confirmation for extremums.

-

VSA Multiplier: Sensitivity of the volume filter relative to the average volume.