Roberto Jacobs / Profilo

- Informazioni

|

10+ anni

esperienza

|

3

prodotti

|

78

versioni demo

|

|

28

lavori

|

0

segnali

|

0

iscritti

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

We Can Now Reflect on the FOMC - ANZ Analysts at ANZ explained that with the benefit of a couple more days and the fact that markets have settled somewhat, it is little easier now to reflect on the Fed’s decision and surprise dovishness last week...

Condividi sui social network · 1

116

Roberto Jacobs

London session outlook. Technical setups for EURUSD, GBPUSD, AUDUSD, USDJPY, FTSE 100, Gold, Crude Oil And DAX 30. Extensive Q/A session...

Condividi sui social network · 1

109

Roberto Jacobs

Analytical Review of the Stocks of International Paper Company

20 marzo 2016, 06:32

Analytical Review of the Stocks of International Paper Company International Paper Company, #IP [NYSE] Consumer goods, production of paper & packaging, USA Financial performance of the company: Index – S&P 500...

Condividi sui social network · 2

322

Roberto Jacobs

EUR/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 marzo 2016, 06:23

EUR/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016 EUR/USD: Wave analysis and forecast for 18.03 – 25.03: The pair is likely to decline within correction. Estimated pivot point is at the level of 1.1350. Our opinion: Sell the pair from correction below the level of 1.13501...

Condividi sui social network · 2

194

Roberto Jacobs

GBP/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 marzo 2016, 06:20

GBP/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016 GBP/USD: Wave analysis and forecast for 18.03 – 25.03: Correction is nearing completion. Estimated pivot point is at the level of 1.4115. Our opinion: In the short-term: buy the pair above the level of 1.4218 with the target of 1.4690...

Condividi sui social network · 2

158

Roberto Jacobs

USD/CHF: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 marzo 2016, 06:17

USD/CHF: Wave analysis and forecast for 18.03 – 25.03 - 2016 USD/CHF: Wave analysis and forecast for 18.03 – 25.03: Downtrend continues. Estimated pivot point is at the level of 0.9912. Our opinion: Sell the pair from correction below the level of 0.9912 with the target of 0.95 – 0.9470...

Condividi sui social network · 2

224

Roberto Jacobs

USD/JPY: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 marzo 2016, 04:57

USD/JPY: Wave analysis and forecast for 18.03 – 25.03 - 2016 USD/JPY: Wave analysis and forecast for 18.03 – 25.03: Downtrend continues. Estimated pivot point is at the level of 113.84. Our opinion: Sell the pair from correction below the level of 113.84 with the targets of 107.00 – 106.60...

Condividi sui social network · 2

166

Roberto Jacobs

USD/СAD: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 marzo 2016, 04:52

USD/СAD: Wave analysis and forecast for 18.03 – 25.03 - 2016 USD/СAD: Wave analysis and forecast for 18.03 – 25.03: Downtrend dominates. Estimated pivot point is at the level of 1.3396. Our opinion: Wait for the completion of correction and sell the pair below the level of 1...

Condividi sui social network · 2

138

Roberto Jacobs

Sergey Golubev

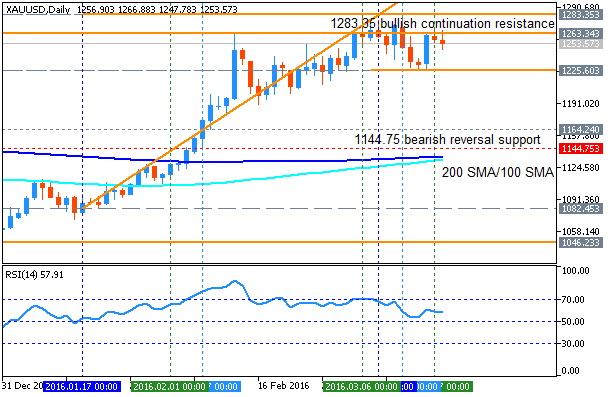

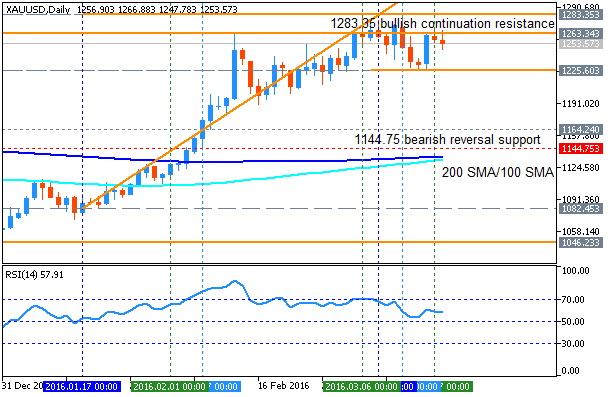

Commento all'argomento Forecast for Q1'16 - levels for GOLD (XAU/USD)

GOLD (XAU/USD): End Of Week Technicals - ranging within bullish resistance level and the bearish reversal support level Daily price is above 100-day SMA/200-day SMA area for the bullish market

Roberto Jacobs

The Four Most Important Things I've Learned in 50 Years of Trading - Larry Williams...

Condividi sui social network · 3

204

Roberto Jacobs

Forex Trading Strategies 2016 - Best 03 Tips To Make A Lot Of Profits

18 marzo 2016, 17:29

Forex Trading Strategies 2016 - Best 03 Tips To Make A Lot Of Profits...

Condividi sui social network · 1

166

1

Roberto Jacobs

Weekly Forex Review - 14th to the 18th of March 2016...

Condividi sui social network · 1

165

Roberto Jacobs

GBP/JPY Recovers but Still Down for the Week The pound is recovering across the board for the second day in a row and versus the yen continues to move off 2-week lows that reached on Thursday. GBP/JPY climbed recently to 161.77, reaching the highest level since Tuesday...

Condividi sui social network · 1

117

Roberto Jacobs

WTI Off Highs, Still Above $40.00 Crude oil prices are extending the rally today, posting fresh multi-month peaks above the $41.00 mark, albeit deflating a tad afterwards. WTI in fresh 2016 highs The barrel of West Texas Intermediate has managed to advance beyond the $41...

Condividi sui social network · 1

179

Roberto Jacobs

Belgium Consumer Confidence At 5-month Low Belgium's consumer confidence deteriorated for a third straight month to its lowest level in five months, survey data from the National Bank of Belgium showed Friday. The consumer confidence index dropped to -7 from -5 in February...

Condividi sui social network · 2

98

Roberto Jacobs

U.S. Consumer Sentiment Unexpectedly Drops To Five-Month Low In March

18 marzo 2016, 16:19

U.S. Consumer Sentiment Unexpectedly Drops To Five-Month Low In March Consumer sentiment in the U.S. has unexpectedly fallen to a five-month low in the month of March, the University of Michigan revealed in a report on Friday...

Condividi sui social network · 2

120

Roberto Jacobs

Dollar Slides Versus Most Majors Ahead Of Consumer Sentiment Index The University of Michigan is scheduled to release its preliminary consumer sentiment index for March at 10 am ET Friday. Economists expect the index to rise to 92.2 from 91...

Condividi sui social network · 2

112

: