Yupeng Xiao / Vendedor

Productos publicados

Este indicador ha sido modificado según el "Camino de la Tortuga". Genera un canal basado en el precio de apertura y los valores ATR de la barra actual. El Canal ATR de la Tortuga puede utilizarse para ayudar a identificar condiciones de sobrecompra y sobreventa en un mercado.

Cálculo Canal superior = Apertura + r1*ATR canal inferior = Open - r2*ATR Entre ellos Open es el precio de apertura de la barra actual. ATR es el valor ATR de la barra actual. r1, r2 son los ratios ATR.

Parámetros de ent

FREE

El coste de la operación causado por los diferenciales es un indicador importante a la hora de formular ratios de pérdidas y ganancias de la operación. La información sobre los costes de los diferenciales es particularmente importante para los operadores a corto plazo, especialmente para los operadores de scalping. Esta herramienta puede mostrar el coste del spread de todas las divisas Forex (incluyendo XAU y XAG) en la plataforma en diferentes tipos de cuenta (cuenta USD, cuenta EUR, etc.).

Cá

FREE

El coste de la operación causado por los diferenciales es un indicador importante a la hora de formular ratios de pérdidas y ganancias de la operación. La información sobre los costes de los diferenciales es particularmente importante para los operadores a corto plazo, especialmente para los operadores de scalping. Esta herramienta puede mostrar el coste del spread de todas las divisas Forex (incluyendo XAU y XAG) en la plataforma en diferentes tipos de cuenta (cuenta USD, cuenta EUR, etc.).

Cá

FREE

Este indicador fue modificado según el "Camino de la Tortuga". El indicador ATR se puede utilizar como referencia para establecer stop-loss o take-profit, y también se puede utilizar para confirmar el rango de precios diario (también aplicable a otros ciclos).

Cálculo El valor del rango real se calcula de la siguiente manera TR = MAX(H-L, H-PDC, PDC-L) Entre ellos H = Precio más alto de la barra actual L = Precio más bajo de la barra actual PDC = Precio de cierre de la barra anterior El average

FREE

Los costes del diferencial se refieren al importe de la pérdida causada por el diferencial, y los beneficios del swap se refieren al importe de los ingresos obtenidos por las posiciones overnight. Spread Costs es un indicador importante para los operadores a corto plazo, especialmente para los operadores de scalping, y Swap Benefits es un indicador importante para los operadores a largo plazo. Dado que los spreads y swaps en la plataforma MetaTrader 4 están todos expresados en puntos, necesitamo

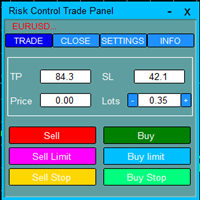

El Panel de Control de Riesgo está diseñado para ayudarle a operar con un solo clic. Esta herramienta puede calcular automáticamente los lotes de negociación en función del dinero de riesgo establecido, el StopLoss recomendado y el TakeProfit recomendado. En el menú de información, puede ver indicadores como el rango de precios semanal y el rango de precios mensual.

Características destacadas El tamaño del lote se calcula automáticamente en función del dinero de riesgo establecido por el usuari

Los costes del diferencial se refieren al importe de la pérdida causada por el diferencial, y los beneficios del swap se refieren al importe de los ingresos obtenidos por las posiciones overnight. Spread Costs es un indicador importante para los operadores a corto plazo, especialmente para los operadores de scalping, y Swap Benefits es un indicador importante para los operadores a largo plazo. Dado que los spreads y swaps en la plataforma MetaTrader 5 están todos expresados en puntos, necesitamo