Dragan Opacic / Perfil

- Información

|

11+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Amigos

190

Solicitudes

Enviadas

Dragan Opacic

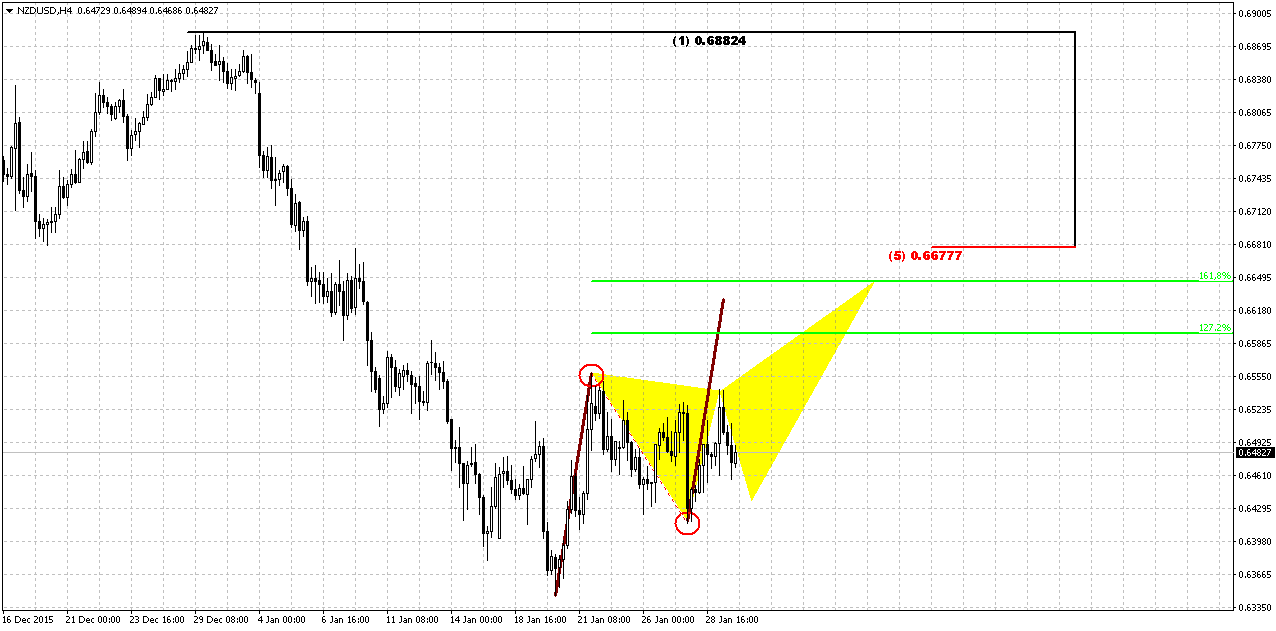

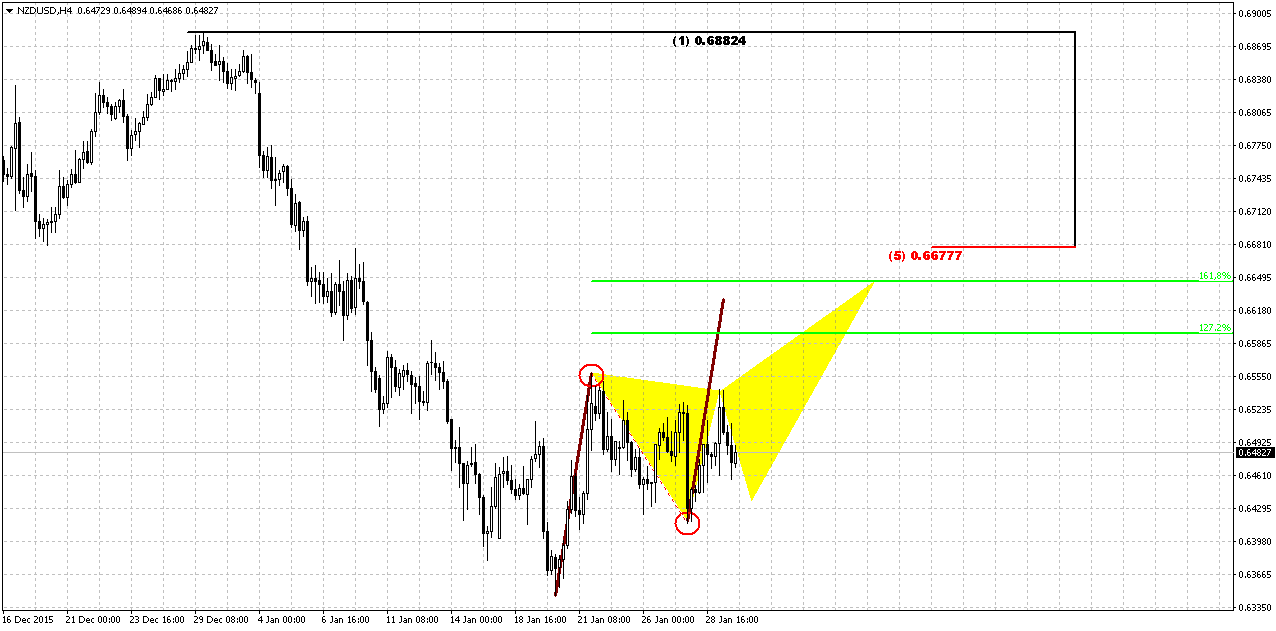

Here we could try to specify definite levels where we will be able to estimate precise direction. Action reminds weekly picture but just minor scale. Again, NZD forms upside reversal swing and AB-CD retracement after that. CD leg is fast drop but it already has been taken out by upward swing. This picture keeps valid as upside AB=CD as potential Butterfly "sell" pattern. Hence, we could get bearish context either if market will drop below 0.64 and erase both patterns or will reach their targets.

If market will drop below 0.64, then we could get bearish butterfly. As you can see picture is very similar to daily EUR one.

Oppositely bullish context will be valid. If market will take out 0.6550 top, then potential bearish butterfly will fail and chances on upside continuation will increase.

But to be honest, guys, by looking how NZD holds and behaves right now, it seems that deeper upside retracement is very probable.

At the same time, mostly we do not care what will happen - either market will move up a bit more or it will drop below 0.64. Our task is to get proper bearish entry point. And may be higher retracement would be better, since we will get better price.

If market will drop below 0.64, then we could get bearish butterfly. As you can see picture is very similar to daily EUR one.

Oppositely bullish context will be valid. If market will take out 0.6550 top, then potential bearish butterfly will fail and chances on upside continuation will increase.

But to be honest, guys, by looking how NZD holds and behaves right now, it seems that deeper upside retracement is very probable.

At the same time, mostly we do not care what will happen - either market will move up a bit more or it will drop below 0.64. Our task is to get proper bearish entry point. And may be higher retracement would be better, since we will get better price.

Dragan Opacic

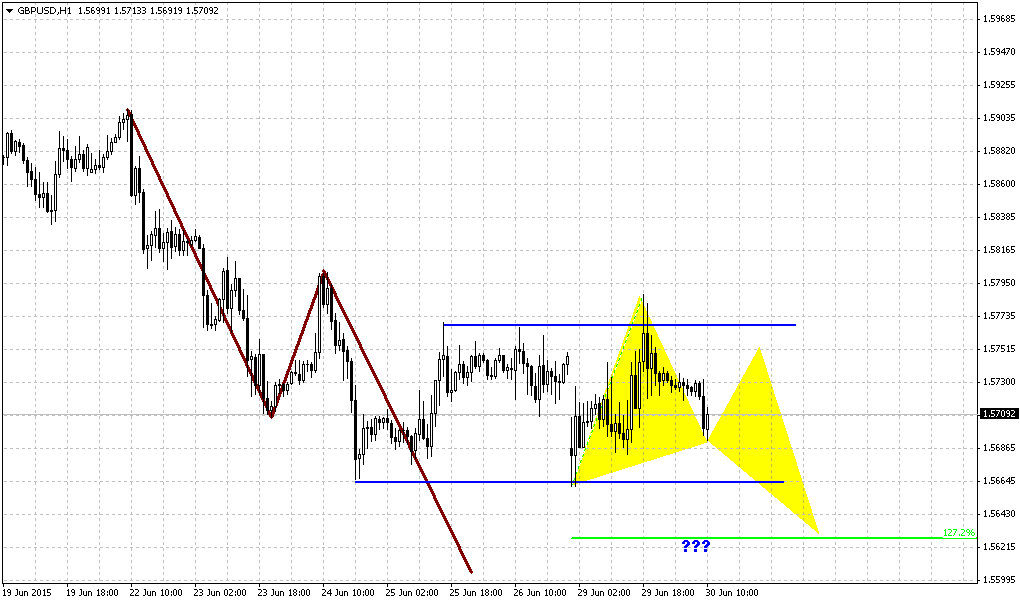

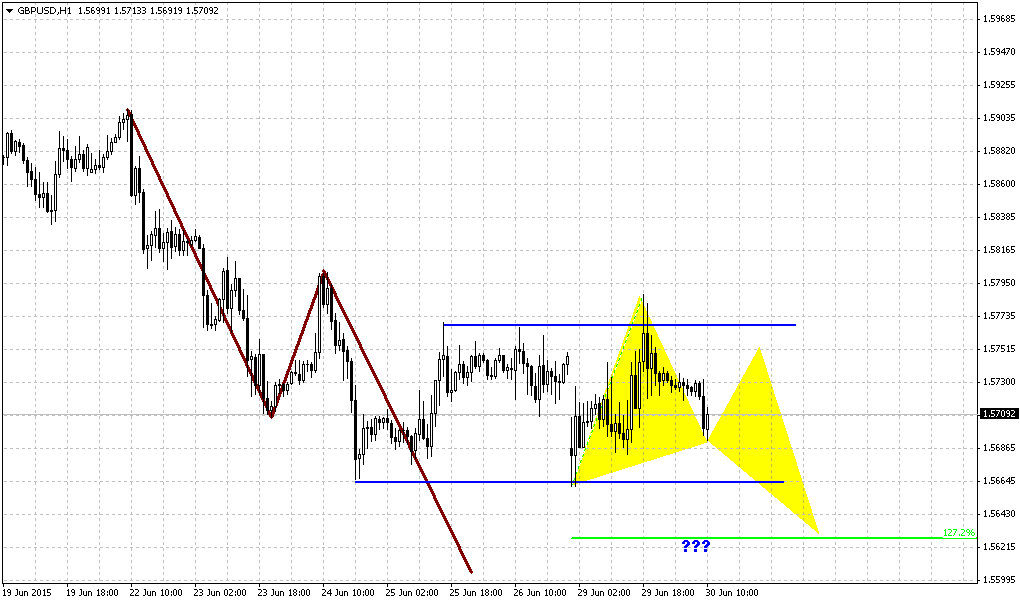

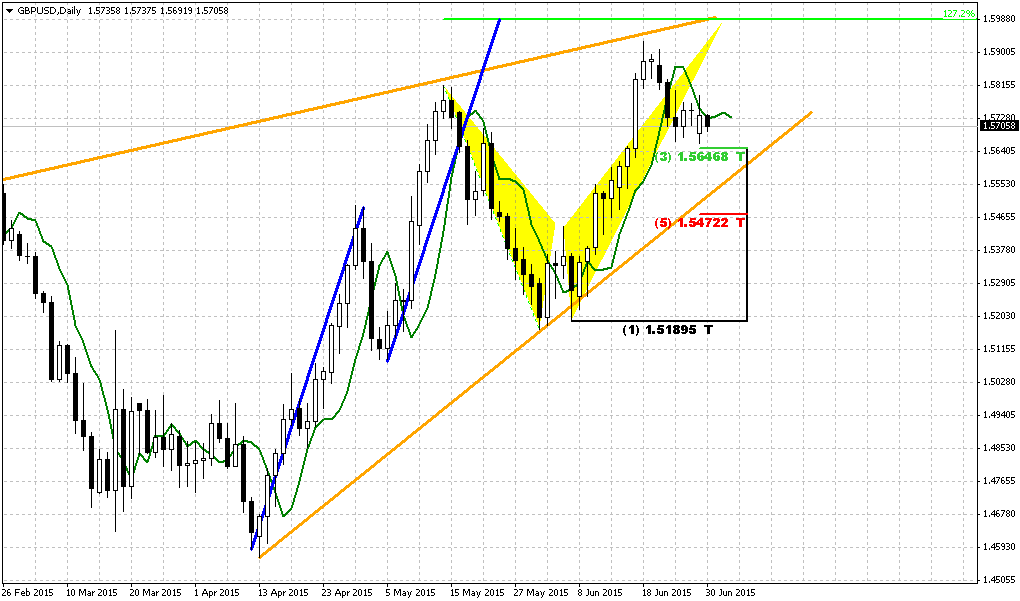

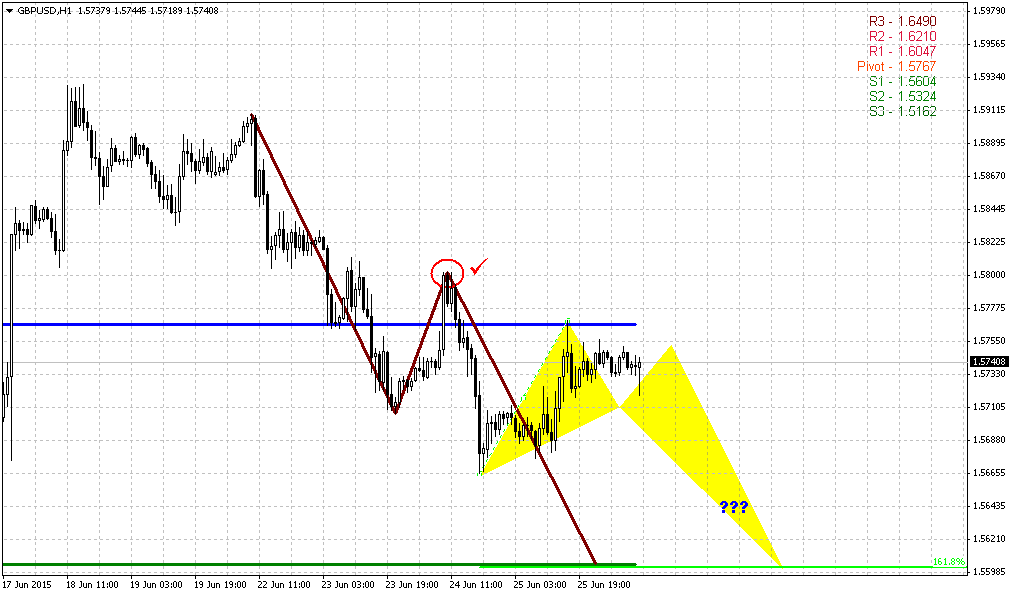

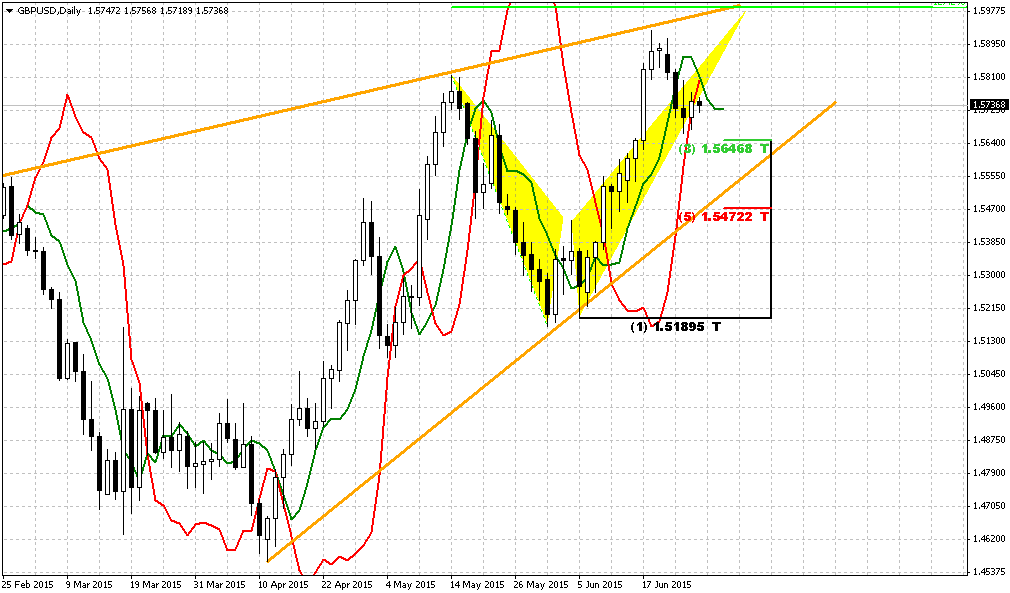

On hourly chart we could get, say, Butterfly Buy that will complete AB=CD around 1.56, grab the stops and after that market could turn up:

That's being said we expect 2-step action. Immediate fast bearish reaction on default, may be to 1.56 level and second - upside recovery to 1.60 area. (source: Sive M.)

That's being said we expect 2-step action. Immediate fast bearish reaction on default, may be to 1.56 level and second - upside recovery to 1.60 area. (source: Sive M.)

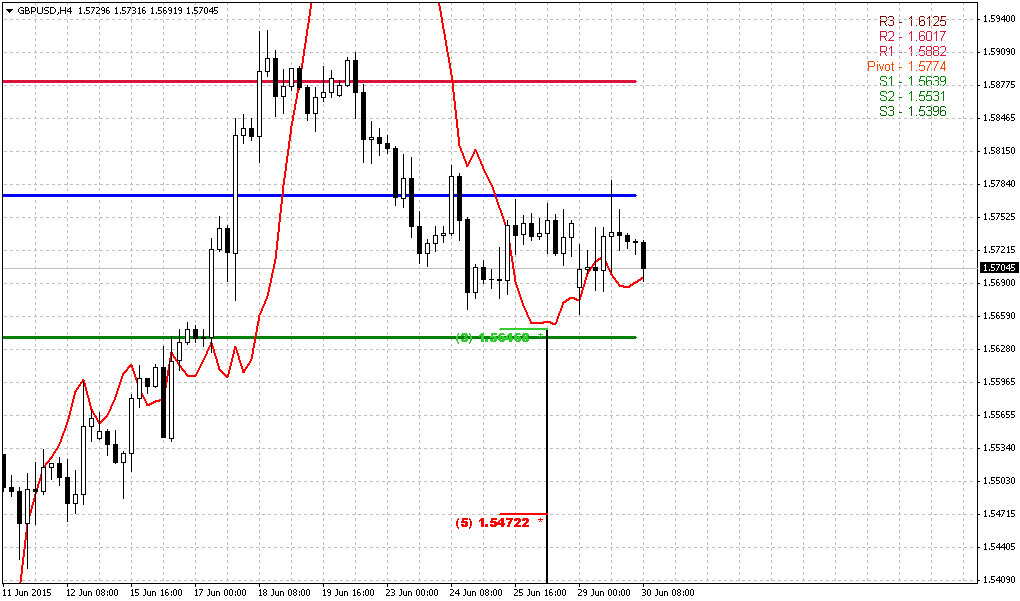

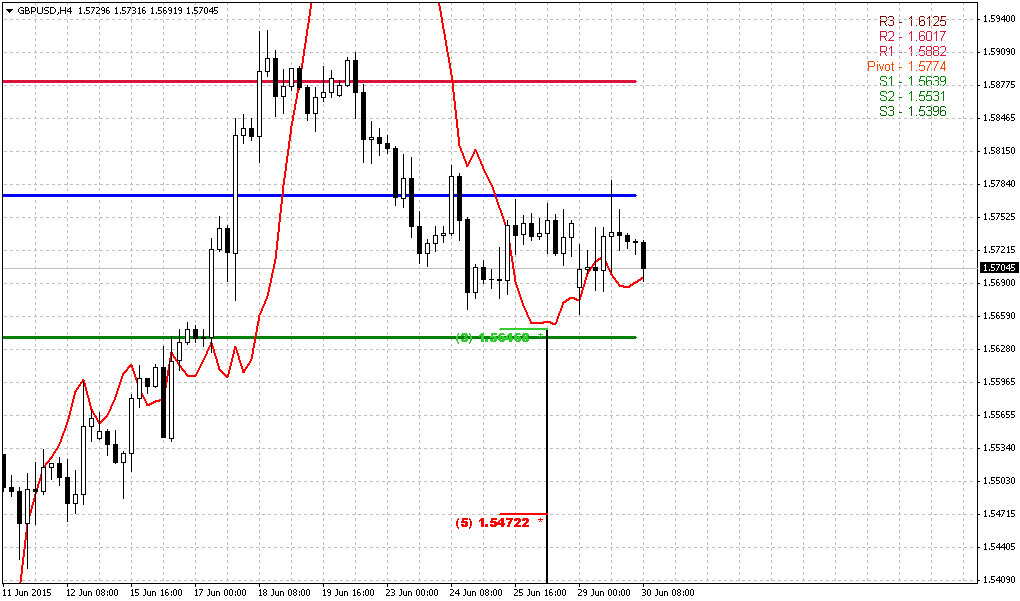

Dragan Opacic

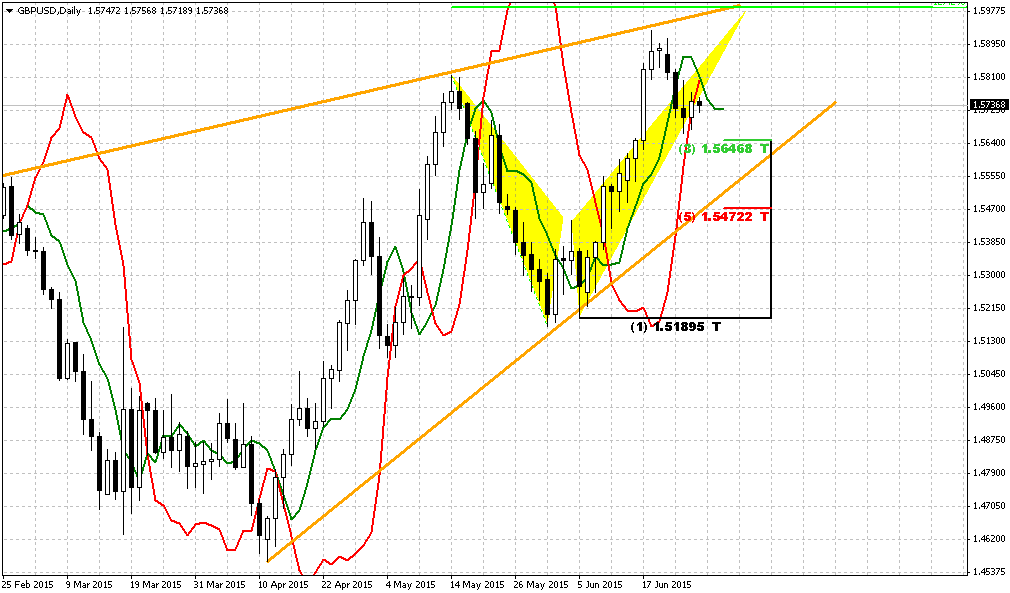

We could say that both of you are right, but these scenarios have different time scale. Thus, If Greece will default, bearish reaction will come first but it will be short-term and fast, while bullish scenario will come second and will be dominate. Currently, guys, GBP is the only currency in EU that could give protection from turmoil. CHF is too expensive, JPY is different asset, thus, in EU, only GBP rest. And GBP probably will benefit from this quality. That's why we still expect reaching of 1.60 area, but may be after nervous short-term splash down:

Here, some signs of bearish dynamic pressure are present - trend holds bullish but market mostly stands flat. (source: Sive M.)

Here, some signs of bearish dynamic pressure are present - trend holds bullish but market mostly stands flat. (source: Sive M.)

Dragan Opacic

So, guys, we've talked much about economical side of Greek crisis. But we have also political one and geopolitical. It could happen that ecnomical default will be just the beginning. The major point stands in exceptional geopolitical role of Greece in Europe. Greece is a NATO member and Grexit, possible turn to the East keeps big geopolitical menace. US and EU need to keep Greece under control by any way. If Greece will announce default, and people will support this decision, Greece will start to turn out from EU and treat them as betrayers - they have betrayed them when Greece was needed help.

EU and US will try to stop this geopolitical exit out from control by all ways that they have.

And we can't exclude most radical scenarios, that were used in Lybia, Ukraine, Armenia to sweep Syriza out of control and change the governemnt.

Actually I wish to know Onenikos opinion on this subject, his comments are very useful.

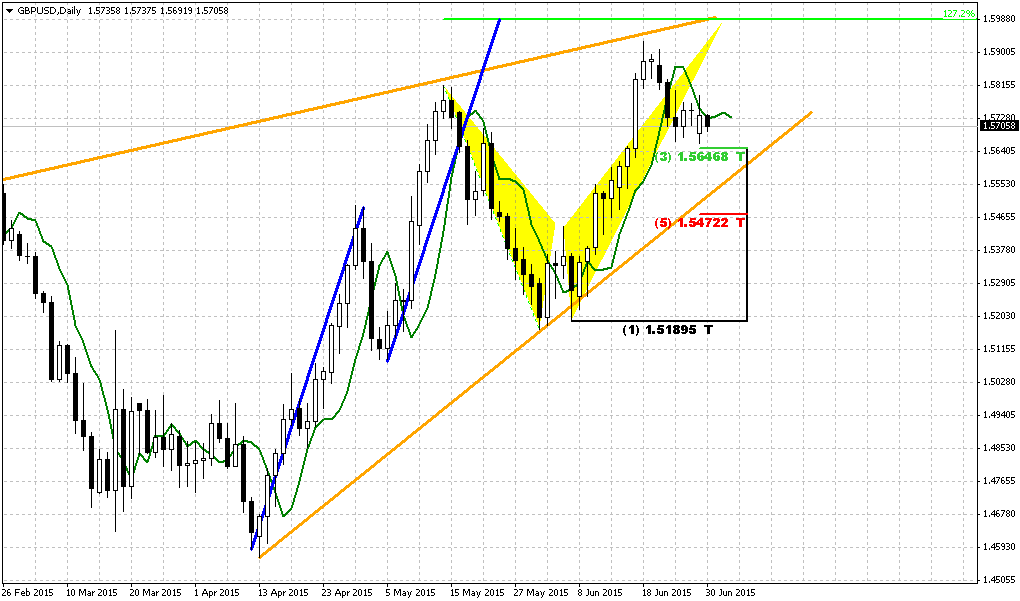

Now let's back to Forex. As our analysis on EUR is still valid, let's update our view on GBP, although situation there is not fascinating as well. On daily chart we have the same patterns as on last week - uncompleted AB=CD and butterfly "sell". Market stumble and moves nowhere, mostly stands indecision on Greece expectation.

Technically, this situation could be treated as bullish as bearish . You could say that if market has not turned to upside action and we didn't get B&B "Buy" - it looks bearish . From the other side, market even has not quite reached 3/8 Fib support and is not dropping further: (source: Sive M.)

EU and US will try to stop this geopolitical exit out from control by all ways that they have.

And we can't exclude most radical scenarios, that were used in Lybia, Ukraine, Armenia to sweep Syriza out of control and change the governemnt.

Actually I wish to know Onenikos opinion on this subject, his comments are very useful.

Now let's back to Forex. As our analysis on EUR is still valid, let's update our view on GBP, although situation there is not fascinating as well. On daily chart we have the same patterns as on last week - uncompleted AB=CD and butterfly "sell". Market stumble and moves nowhere, mostly stands indecision on Greece expectation.

Technically, this situation could be treated as bullish as bearish . You could say that if market has not turned to upside action and we didn't get B&B "Buy" - it looks bearish . From the other side, market even has not quite reached 3/8 Fib support and is not dropping further: (source: Sive M.)

Dragan Opacic

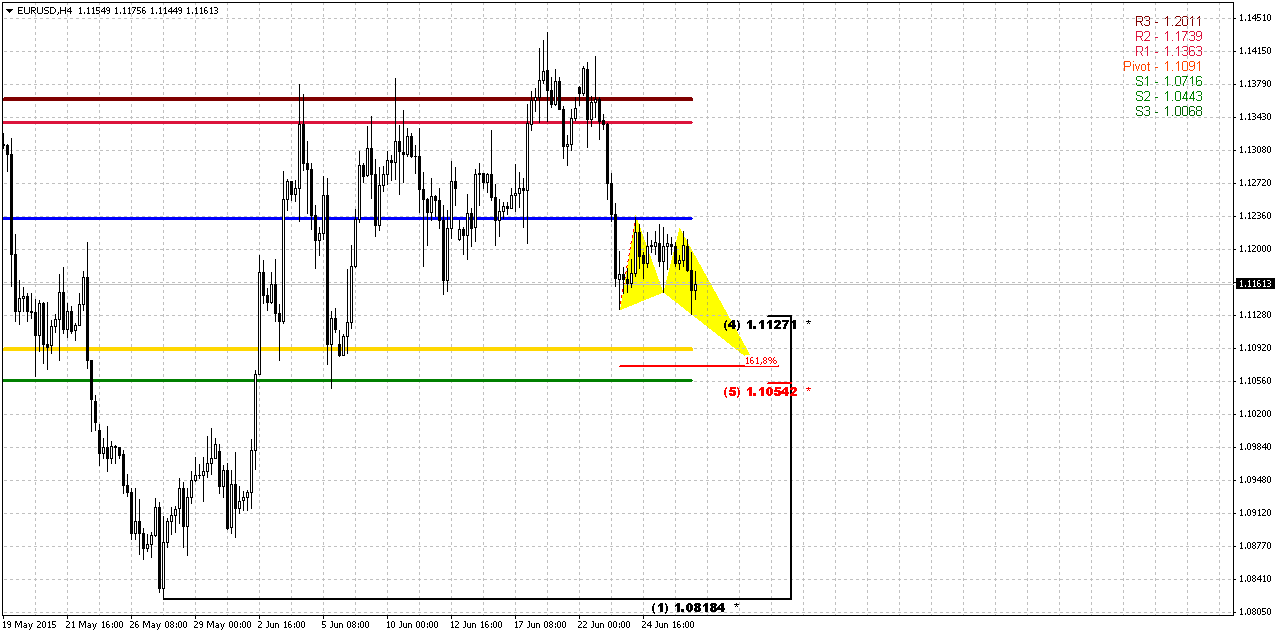

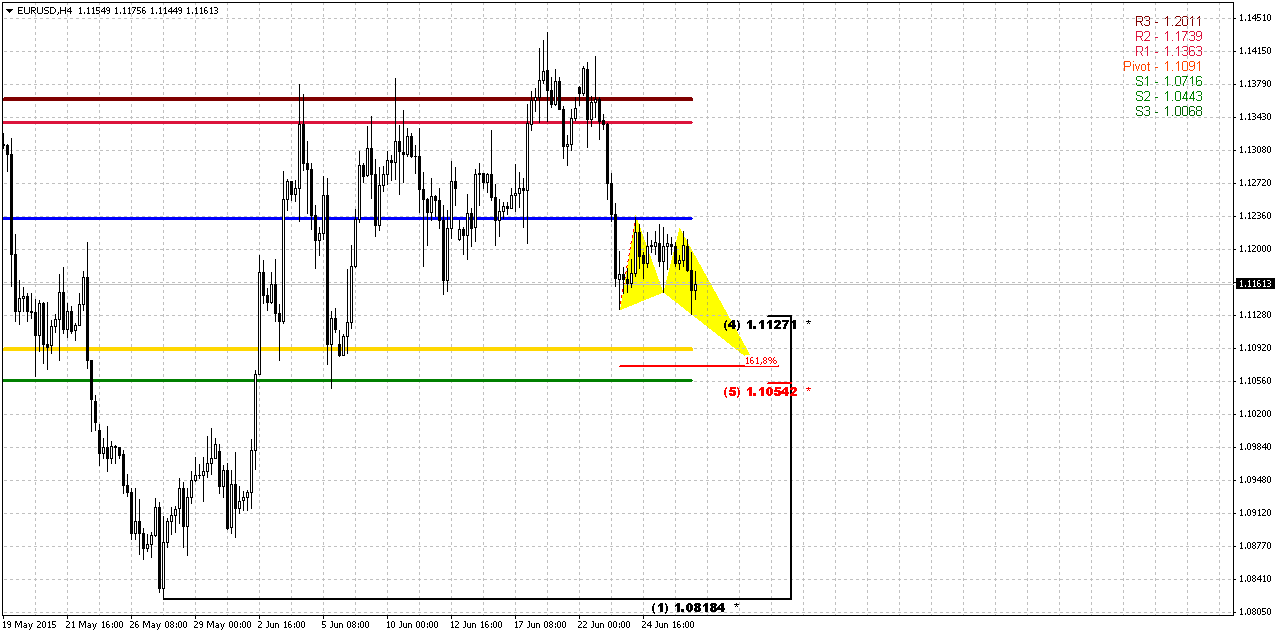

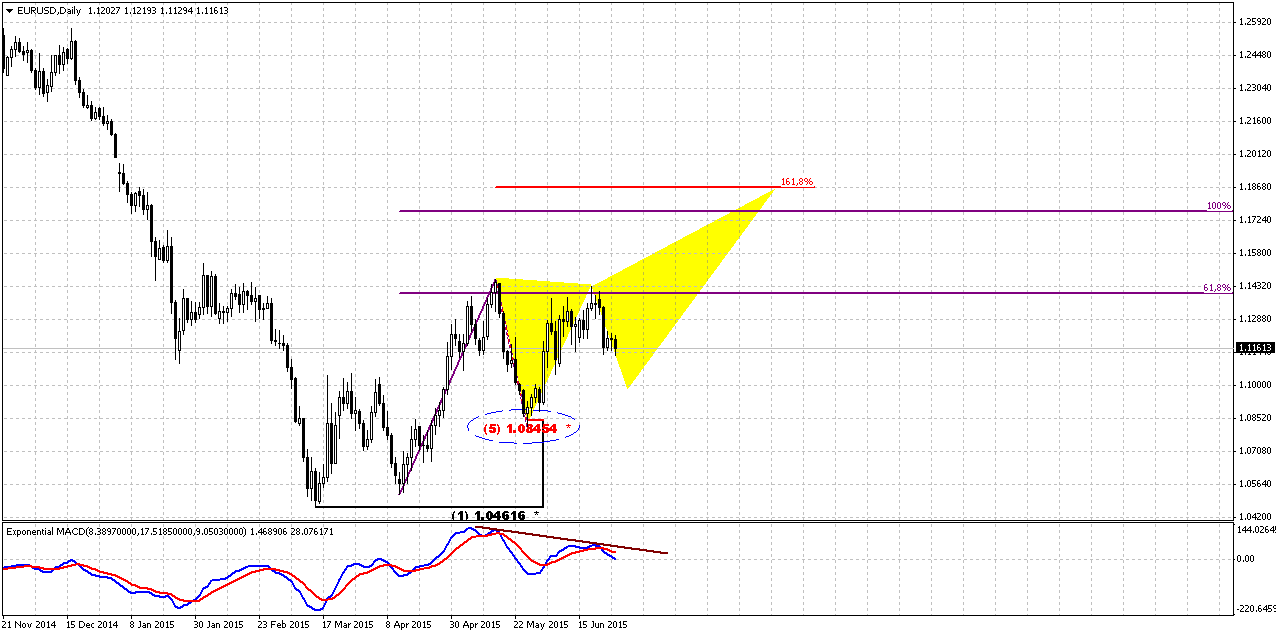

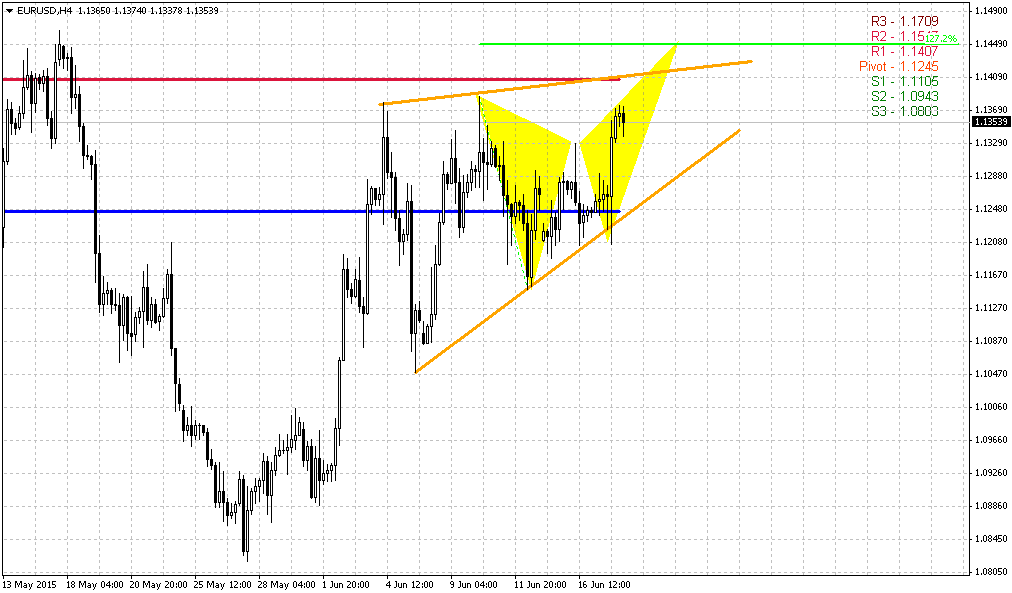

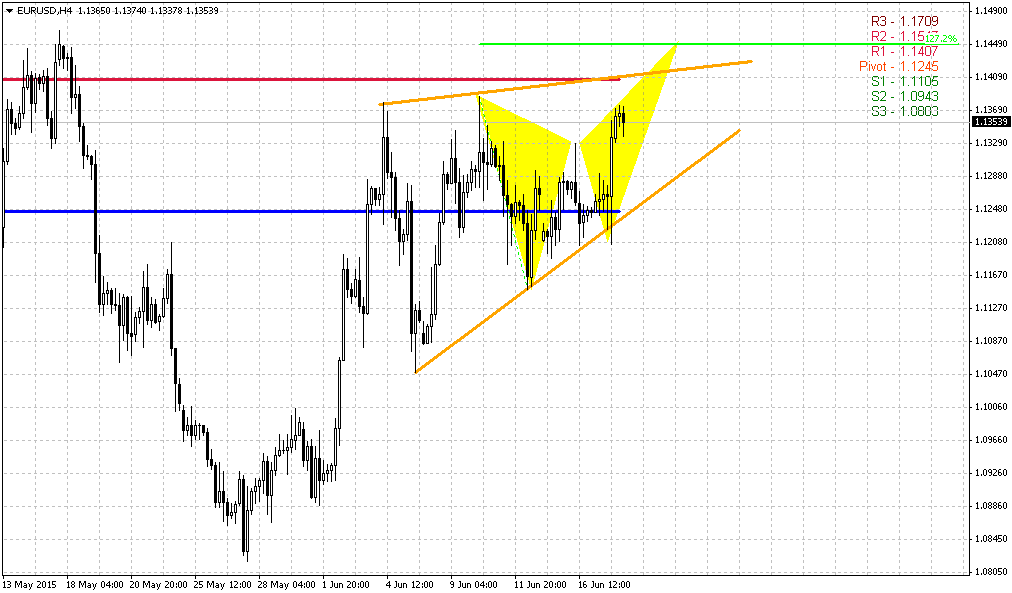

4-Hour

Since till breakout of either 1.1450 or 1.08 will spend considerable period of time, on Monday we could monitor retracement down. There is strong support cluster around 1.1050-1.1130 that includes Fib levels, MPP, WPS1 and potential target of butterfly “Buy”. If EUR really intends to move higher or take another attempt to break through 1.1450, it probably should stop downward action here, at least temporary. If not, and market will pass through it, then there will be minimal chances that 1.08 will survive. Conclusion:

Currently chances on retracement to 1.18-1.20 area are still exist, but mostly it will depend on political decision on Greek debt. Technically we will be able to estimate further direction by watching for 2 levels – 1.1450 and 1.08.

(source: Sive M.)

Since till breakout of either 1.1450 or 1.08 will spend considerable period of time, on Monday we could monitor retracement down. There is strong support cluster around 1.1050-1.1130 that includes Fib levels, MPP, WPS1 and potential target of butterfly “Buy”. If EUR really intends to move higher or take another attempt to break through 1.1450, it probably should stop downward action here, at least temporary. If not, and market will pass through it, then there will be minimal chances that 1.08 will survive. Conclusion:

Currently chances on retracement to 1.18-1.20 area are still exist, but mostly it will depend on political decision on Greek debt. Technically we will be able to estimate further direction by watching for 2 levels – 1.1450 and 1.08.

(source: Sive M.)

Dragan Opacic

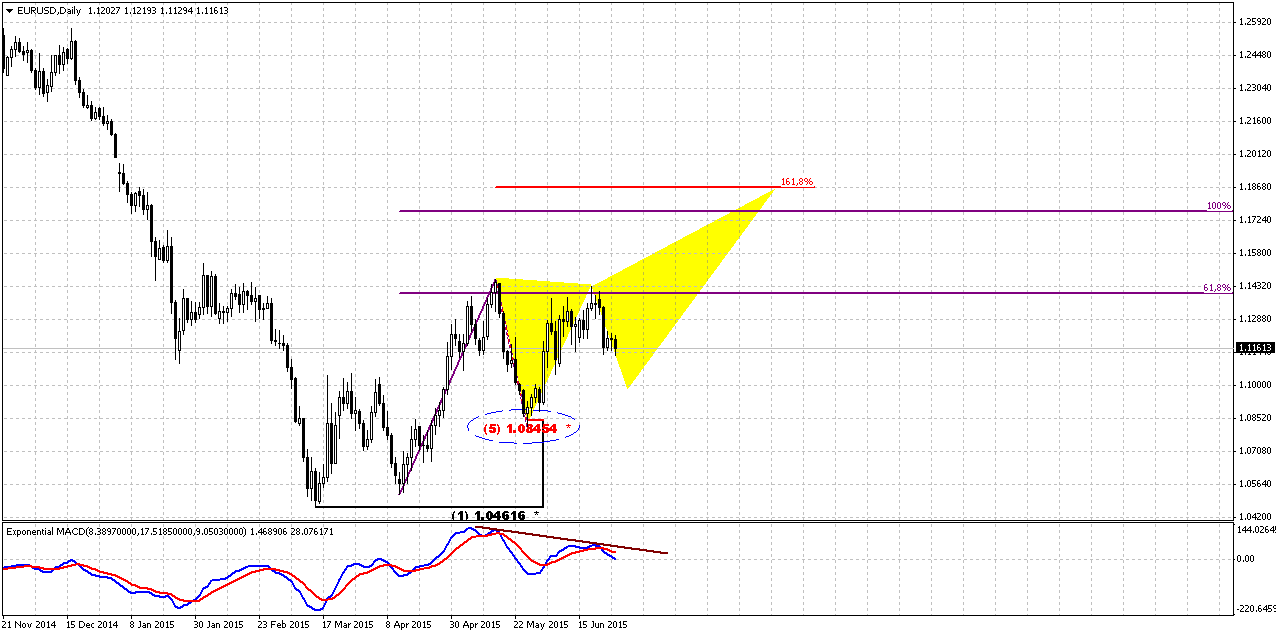

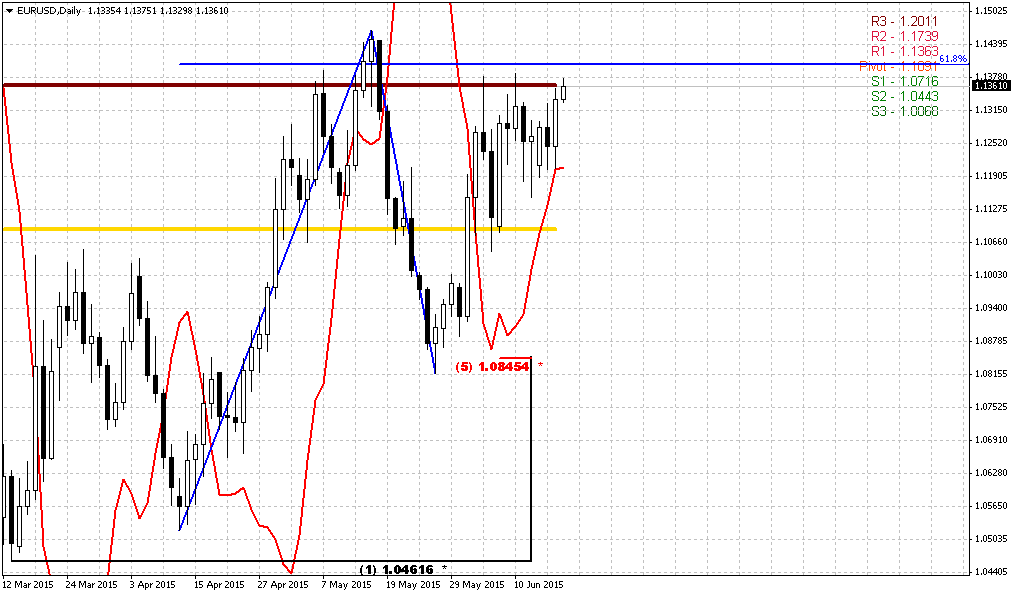

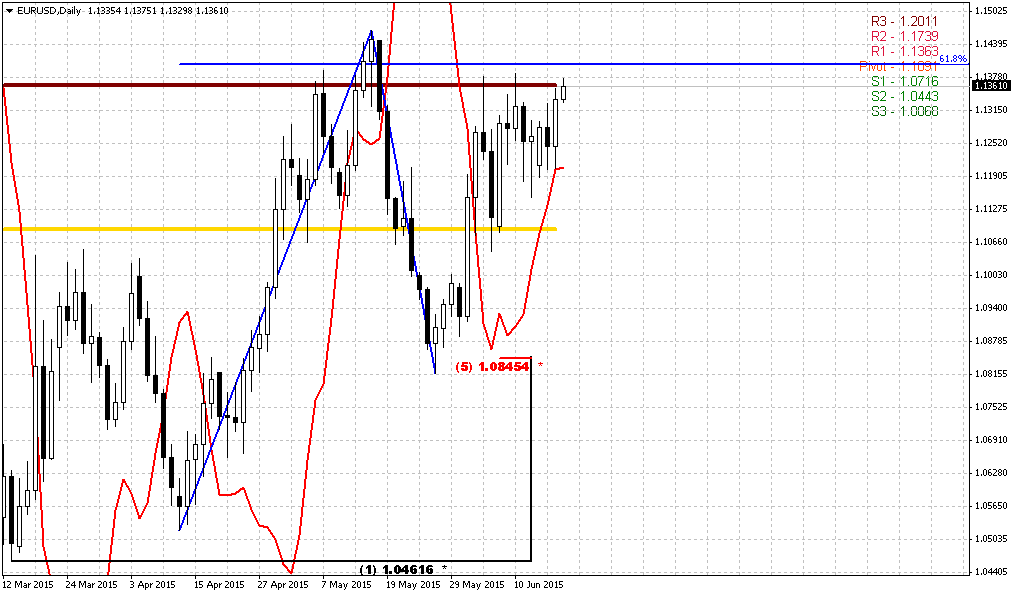

Daily

So, as fundamentally Greece keeps valid both scenarios, technical picture as well corresponds it and also could turn to different directions. There are two major levels on daily chart that we have to monitor on coming week. First one is 1.1450. We see that this is not just strong resistance, but also minor AB-CD target. Current move down technically looks absolutely natural, since this is minor retracement after 0.618 target has been completed. If market will move above 1.1450, it will keep valid AB-CD and could start butterfly “Sell”. Both patterns have the same target around 1.18. We’ve mentioned this level on weekly and monthly chart as well. This scenario could launch monthly B&B “Sell” pattern. But to be honest, guys, I do not believe much in this perspective, mostly because I’m not sure on Greece debt peaceful solution.

Second level is 1.08. Moving below this level will cancel as butterfly as current AB-CD and could put the starting point for long-term move to parity. Currently we also have some kind of bearish divergence with MACD right at strong resistance level. Besides, overall action looks like triangle or pennant on higher time frame charts. Anyway, we call for patience. Do not hurry to take trade here, wait for clarity. (source: Sive M.)

So, as fundamentally Greece keeps valid both scenarios, technical picture as well corresponds it and also could turn to different directions. There are two major levels on daily chart that we have to monitor on coming week. First one is 1.1450. We see that this is not just strong resistance, but also minor AB-CD target. Current move down technically looks absolutely natural, since this is minor retracement after 0.618 target has been completed. If market will move above 1.1450, it will keep valid AB-CD and could start butterfly “Sell”. Both patterns have the same target around 1.18. We’ve mentioned this level on weekly and monthly chart as well. This scenario could launch monthly B&B “Sell” pattern. But to be honest, guys, I do not believe much in this perspective, mostly because I’m not sure on Greece debt peaceful solution.

Second level is 1.08. Moving below this level will cancel as butterfly as current AB-CD and could put the starting point for long-term move to parity. Currently we also have some kind of bearish divergence with MACD right at strong resistance level. Besides, overall action looks like triangle or pennant on higher time frame charts. Anyway, we call for patience. Do not hurry to take trade here, wait for clarity. (source: Sive M.)

Dragan Opacic

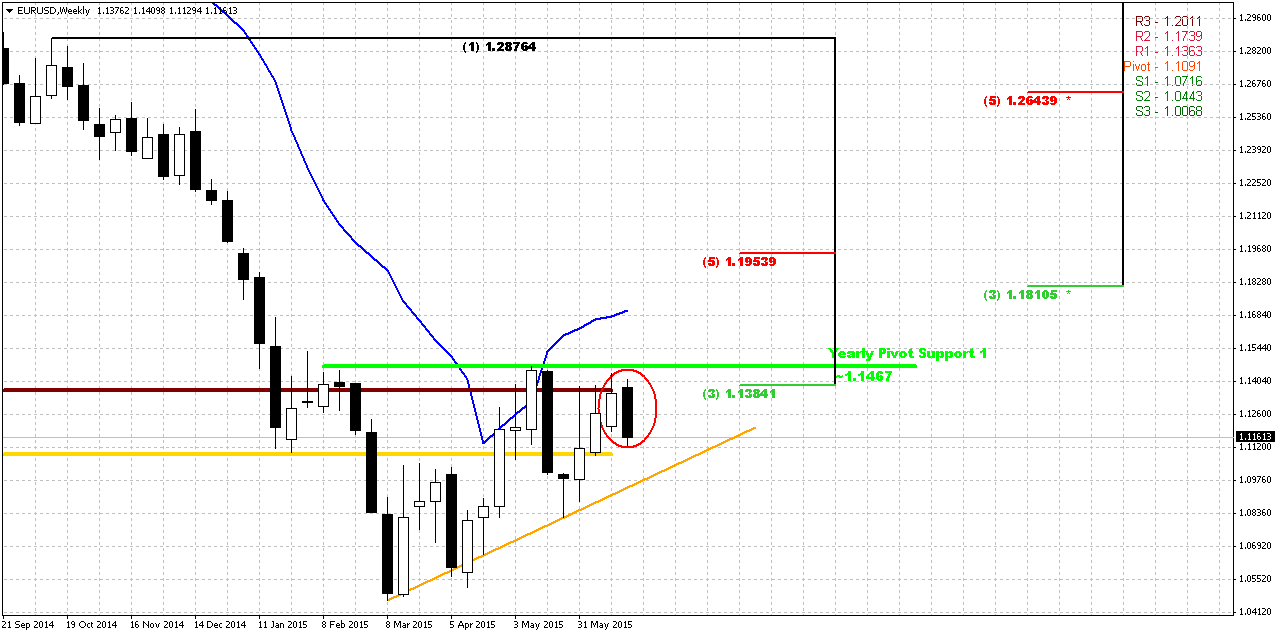

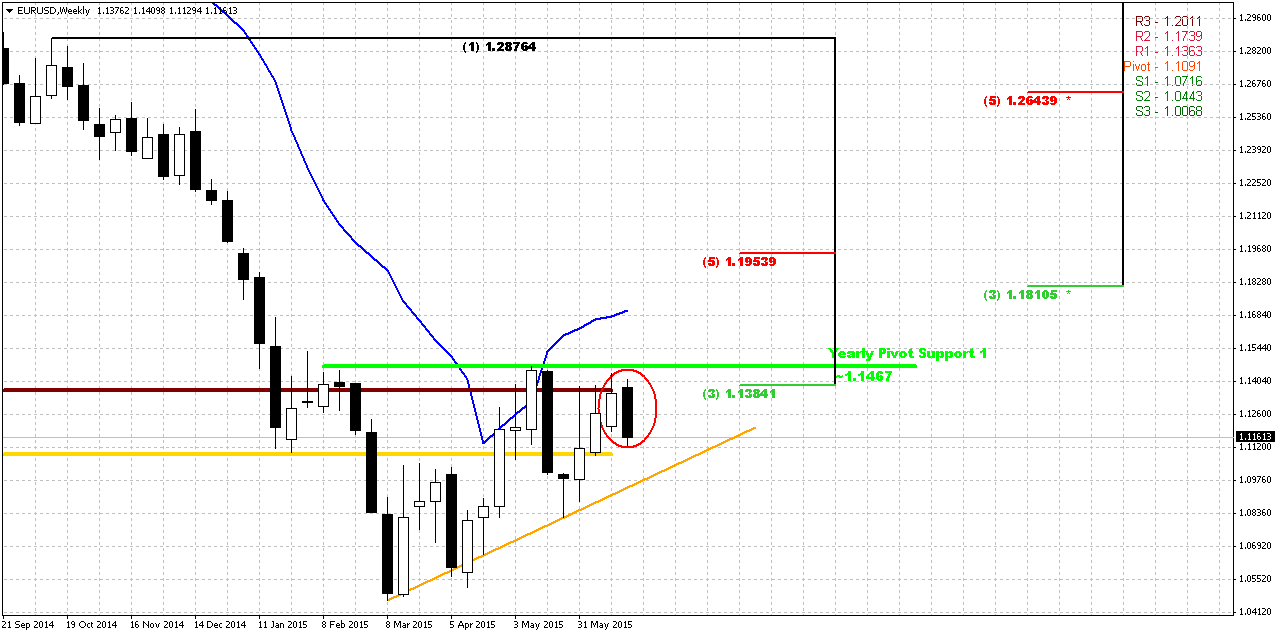

Weekly

Trend is bullish on weekly chart but technical picture significantly has changed here. Previous bounce down was absolutely logical, since EUR has met Fib resistance, MPS1 former YPS1 and overbought. Right now we’ve got another bearish engulfing pattern at the same place, but market is not overbought any more. Previous bearish engulfing is also valid. Since 1.1450 shows itself as strong resistance and our next target is 1.18-1.1950 K-resistance, it would be better to take long position if EUR will break through 1.15 area. For those of you, who would like to trade EUR short – you could try to take position on candlestick patterns. Or, second scenario, wait for downward breakout of 1.08 level. This probably will destroy any potential patterns, such as butterfly “Sell” or may be even H&S and will lead to further weakness of EUR. Market even could shift to butterfly “Buy” pattern with 1.618 extension at the same level – parity. You could draw it by yourself, probably. (source: Sive M.)

Trend is bullish on weekly chart but technical picture significantly has changed here. Previous bounce down was absolutely logical, since EUR has met Fib resistance, MPS1 former YPS1 and overbought. Right now we’ve got another bearish engulfing pattern at the same place, but market is not overbought any more. Previous bearish engulfing is also valid. Since 1.1450 shows itself as strong resistance and our next target is 1.18-1.1950 K-resistance, it would be better to take long position if EUR will break through 1.15 area. For those of you, who would like to trade EUR short – you could try to take position on candlestick patterns. Or, second scenario, wait for downward breakout of 1.08 level. This probably will destroy any potential patterns, such as butterfly “Sell” or may be even H&S and will lead to further weakness of EUR. Market even could shift to butterfly “Buy” pattern with 1.618 extension at the same level – parity. You could draw it by yourself, probably. (source: Sive M.)

Dragan Opacic

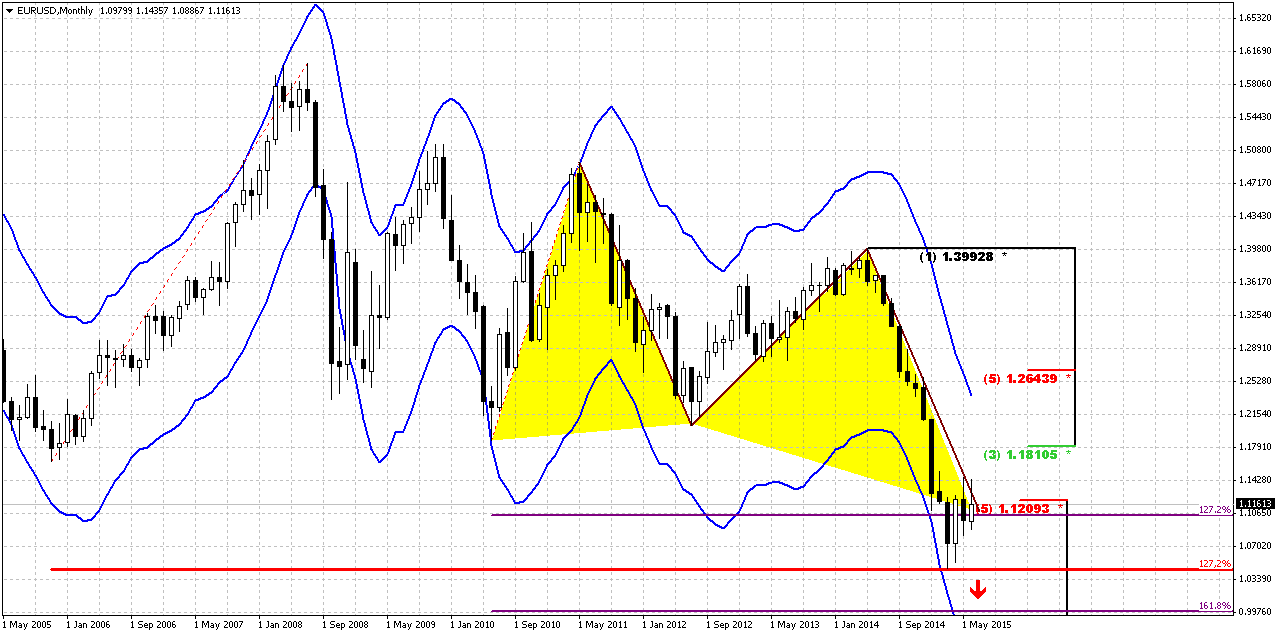

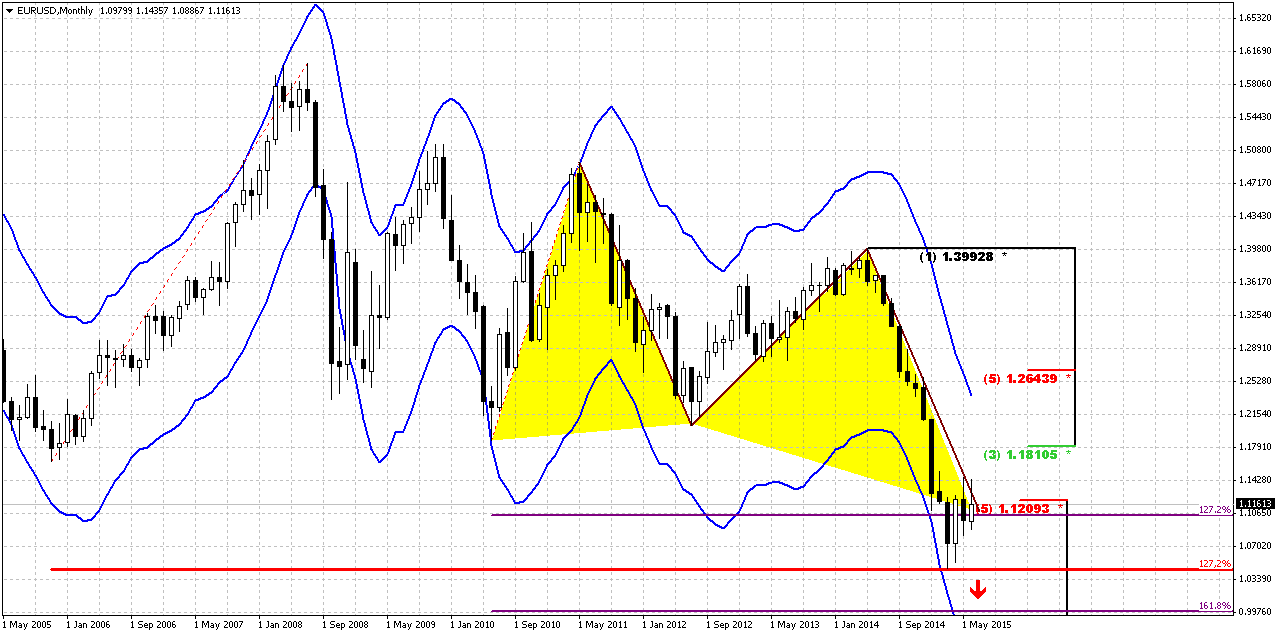

Monthly

Technical picture right now is secondary issue, until situation around Greek debt will be resolved. Still, as we have estimated previously 1.05 is 1.27 extension of huge upside swing in 2005-2008 that also has created large & wide butterfly pattern. Recent action does not quite look like normal butterfly wing, but extension is valid and 1.05 is precisely 1.27 ratio. At the same time we have here another supportive targets, as most recent AB=CD, oversold and 1.27 of recent butterfly.

April has closed and confirmed nicely looking bullish engulfing pattern. We know that most probable target of this pattern is length of the bars counted upside. This will give us approximately 3/8 Fib resistance 1.1810 area. Could we call this situation as “Stretch”? By features probably yes, since market is oversold at support , but by letter not quite, since 1.12 level mostly was broken and the area where market stopped was not a Fib level. Still, applying here Stretch target (middle between OB and OS bands) we will get an area of 50% resistance of most recent swing down around 1.22 area. But most recent action, guys, makes us worry for perspective of upside retracement. After engulfing pattern been formed, EUR can’t turn to upside action within 2 months and can’t pass through 1.1450 area. This is not good sign for bulls. Of cause, we expect downward continuation as we’ve said, but previously we’ve thought that it will happen after upside retracement.

Now about our recent talk on possible B&B or DRPO here. We’ve said that B&B seems more probable. Currently June close price stands above 3x3 DMA, it is a question whether final June close will be above 3x3 DMA and definitely market will not reach 1.18 Fib resistance . So we will keep watching for DiNapoli directional patterns but probably they will appear not as fast as we have expected.

Still, our next long-term target stands the same – parity as 1.618 completion point of recent butterfly. Currently we should treat this bounce up, even to 1.22 area, only as retracement within bear trend. Yes, tactically fundamentals have become weaker in US with dovish recent Fed comments, and open door for pause in bearish trend, but overall picture has not changed drastically yet.

(source: Sive M.)

Technical picture right now is secondary issue, until situation around Greek debt will be resolved. Still, as we have estimated previously 1.05 is 1.27 extension of huge upside swing in 2005-2008 that also has created large & wide butterfly pattern. Recent action does not quite look like normal butterfly wing, but extension is valid and 1.05 is precisely 1.27 ratio. At the same time we have here another supportive targets, as most recent AB=CD, oversold and 1.27 of recent butterfly.

April has closed and confirmed nicely looking bullish engulfing pattern. We know that most probable target of this pattern is length of the bars counted upside. This will give us approximately 3/8 Fib resistance 1.1810 area. Could we call this situation as “Stretch”? By features probably yes, since market is oversold at support , but by letter not quite, since 1.12 level mostly was broken and the area where market stopped was not a Fib level. Still, applying here Stretch target (middle between OB and OS bands) we will get an area of 50% resistance of most recent swing down around 1.22 area. But most recent action, guys, makes us worry for perspective of upside retracement. After engulfing pattern been formed, EUR can’t turn to upside action within 2 months and can’t pass through 1.1450 area. This is not good sign for bulls. Of cause, we expect downward continuation as we’ve said, but previously we’ve thought that it will happen after upside retracement.

Now about our recent talk on possible B&B or DRPO here. We’ve said that B&B seems more probable. Currently June close price stands above 3x3 DMA, it is a question whether final June close will be above 3x3 DMA and definitely market will not reach 1.18 Fib resistance . So we will keep watching for DiNapoli directional patterns but probably they will appear not as fast as we have expected.

Still, our next long-term target stands the same – parity as 1.618 completion point of recent butterfly. Currently we should treat this bounce up, even to 1.22 area, only as retracement within bear trend. Yes, tactically fundamentals have become weaker in US with dovish recent Fed comments, and open door for pause in bearish trend, but overall picture has not changed drastically yet.

(source: Sive M.)

Dragan Opacic

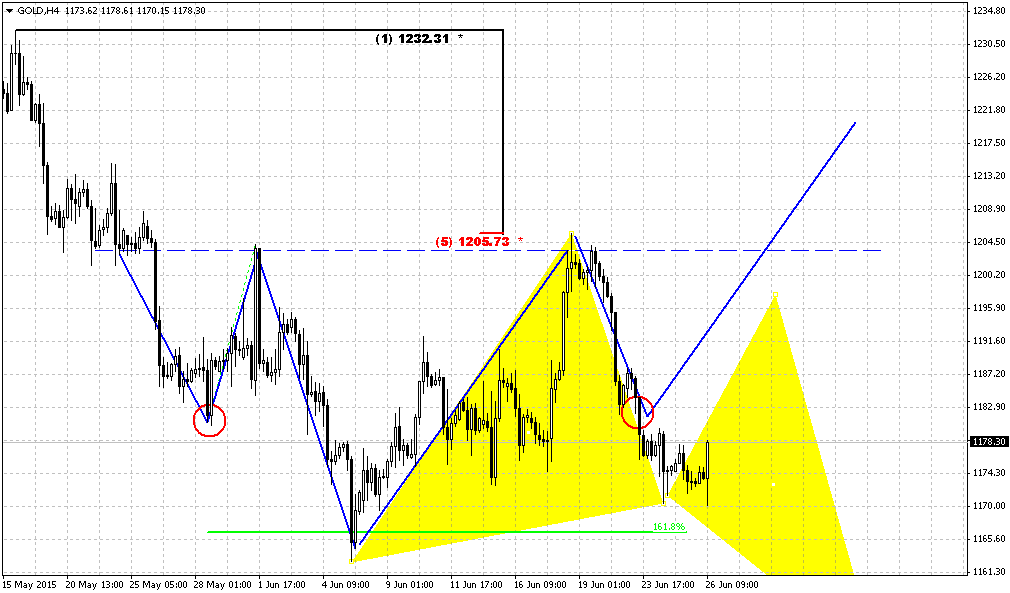

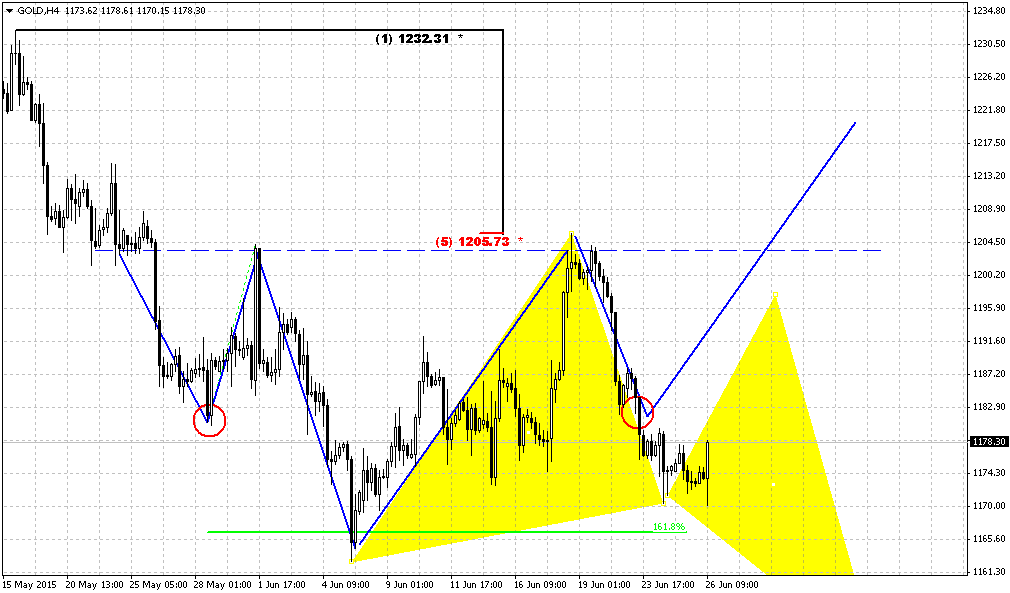

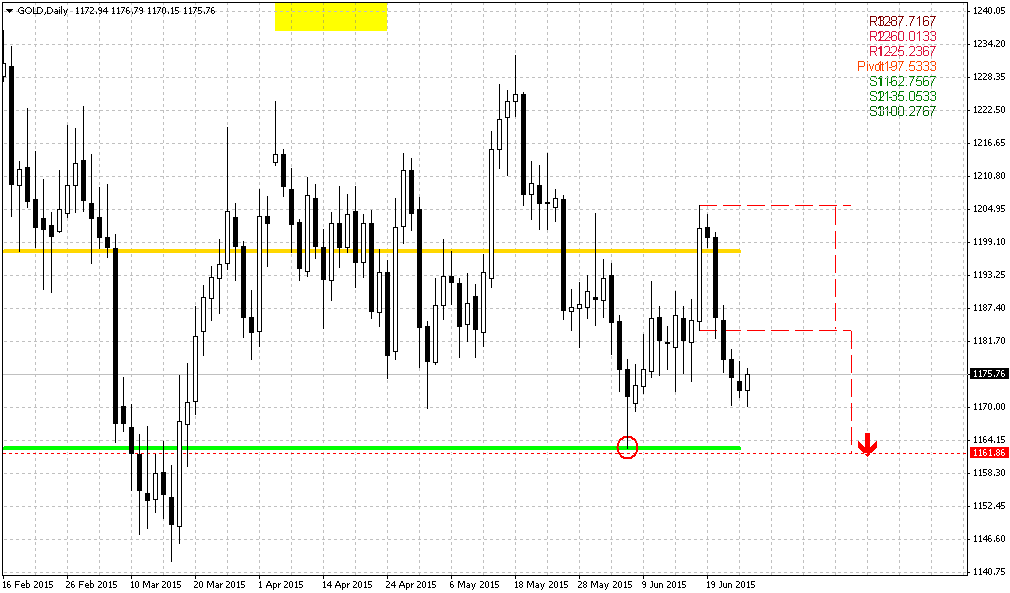

On 4-hour chart we see market's attempt to move higher. But currently, appearing of bearish butterfly looks more probable rather than rally up. As market stably stands below 1180 - we probably will not get H&S pattern. Current upward action could become second part of big butterfly. Currently its better avoid any bets until we willn't get solution on Greece. (source: Sive M.)

Dragan Opacic

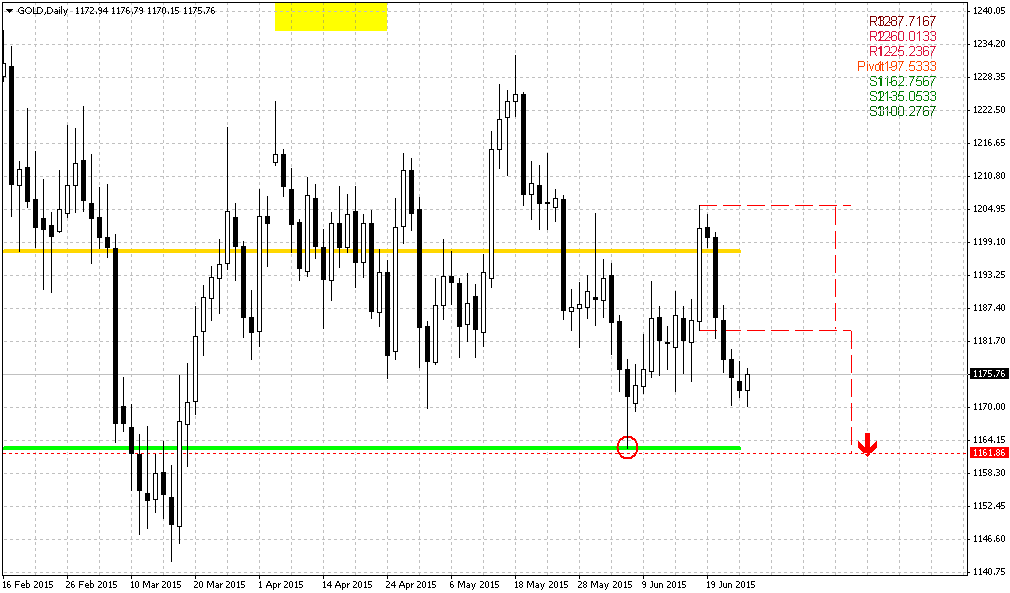

So, no solution on Greece - no action on Gold. The one thing that hints on possible troubles is SPDR storages. Investors probably decide to add some physical gold on some case. What if Greece really will default?

Currently guys, there is no exit for Tsipras, despite what Greece will choose. EU needs to keep Greece under control and if Tsipras will accept EU offer and bring new unpopular reforms and social spending contraction - this will be an end fo Syriza and Tsipras as Prime Minister. If they will deny EU offer - this will be an end for Greece economy, at least in short term. For Syriza this also hardly will be positive... So, it's difficult choice.

On daily chart trend is bearish but market has taken some pause in downward action. 1160 level will be very important for us by many reasons - not only as target of evening star pattern, but as breakeven between two different AB-CD's. IF market wll drop below 1160 - it will erase upside big AB-CD and start downward AB-CD... and this could be important: (source: Sive M.)

Currently guys, there is no exit for Tsipras, despite what Greece will choose. EU needs to keep Greece under control and if Tsipras will accept EU offer and bring new unpopular reforms and social spending contraction - this will be an end fo Syriza and Tsipras as Prime Minister. If they will deny EU offer - this will be an end for Greece economy, at least in short term. For Syriza this also hardly will be positive... So, it's difficult choice.

On daily chart trend is bearish but market has taken some pause in downward action. 1160 level will be very important for us by many reasons - not only as target of evening star pattern, but as breakeven between two different AB-CD's. IF market wll drop below 1160 - it will erase upside big AB-CD and start downward AB-CD... and this could be important: (source: Sive M.)

Dragan Opacic

Current situation does not provide us easy decisions. Here are scenarios that we could apply:

1. Conservative - do nothing, wait for possible reaching of 1.56 area. For example, market could form butterfly "Buy" here. It's 1.618 extension coincides with AB-CD target, WPS1 and Fib level. This could give us Agreement, and may be even reverse H&S on next week.

2. Attempt to play on grabber. Take long position with stop under grabber's low.

3. Combine previous two ways, apply scale-in. Say, take some part of position right now, but with stop below 1.56. If market will follow 1st scenario - add more around 1.56. If it will turn to rally here - we will have at least part of position.

Here we also could watch for 1.58 level. Since this is "C" point of AB-CD, if market will take it out - it could be a confirmation that GBP hardly will return back to 1.56 and chances on upside continuation will increase.

So, as you can see currently this setup as not as clear as it was initially... (source: Sive M.)

1. Conservative - do nothing, wait for possible reaching of 1.56 area. For example, market could form butterfly "Buy" here. It's 1.618 extension coincides with AB-CD target, WPS1 and Fib level. This could give us Agreement, and may be even reverse H&S on next week.

2. Attempt to play on grabber. Take long position with stop under grabber's low.

3. Combine previous two ways, apply scale-in. Say, take some part of position right now, but with stop below 1.56. If market will follow 1st scenario - add more around 1.56. If it will turn to rally here - we will have at least part of position.

Here we also could watch for 1.58 level. Since this is "C" point of AB-CD, if market will take it out - it could be a confirmation that GBP hardly will return back to 1.56 and chances on upside continuation will increase.

So, as you can see currently this setup as not as clear as it was initially... (source: Sive M.)

Dragan Opacic

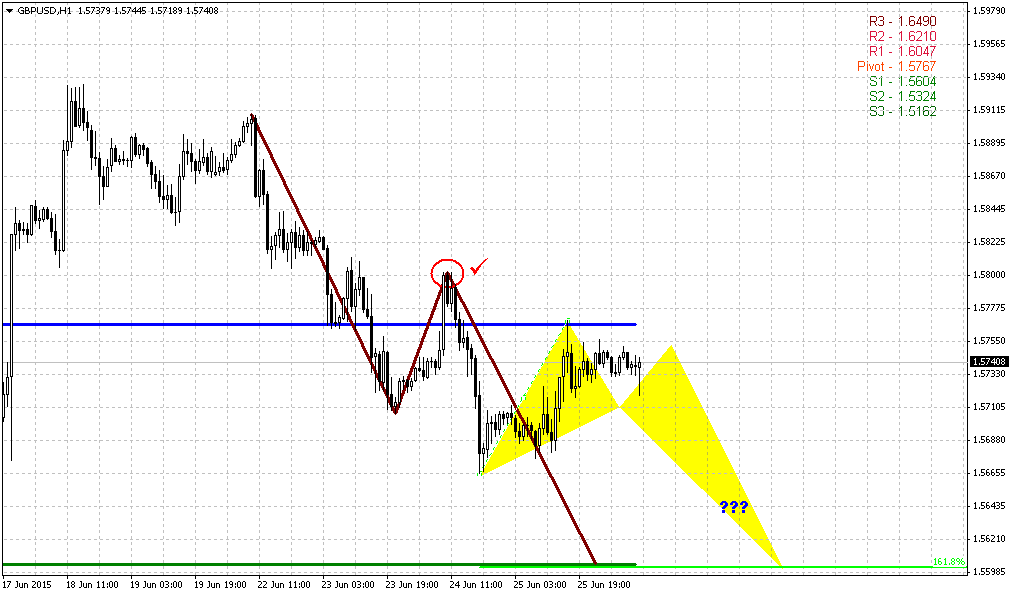

So, guys, markets are still waiting for Greece, Merkel has appointed ultimate date for resolving this question is on Monday.

So, let's try to finalize our GBP trade. On daily chart yesterday market has not reached 3/8 support but has formed bullish stop grabber instead of that. It leads us to following conclusions. First is, grabber itself could lead market to 1.60 target. Second - althgough we haven't got B&B, it does not mean that market will not be able to reach Fib support . Other words, risk of reaching 1.56-1.5645 area is still exists... (source: Sive M.)

So, let's try to finalize our GBP trade. On daily chart yesterday market has not reached 3/8 support but has formed bullish stop grabber instead of that. It leads us to following conclusions. First is, grabber itself could lead market to 1.60 target. Second - althgough we haven't got B&B, it does not mean that market will not be able to reach Fib support . Other words, risk of reaching 1.56-1.5645 area is still exists... (source: Sive M.)

Dragan Opacic

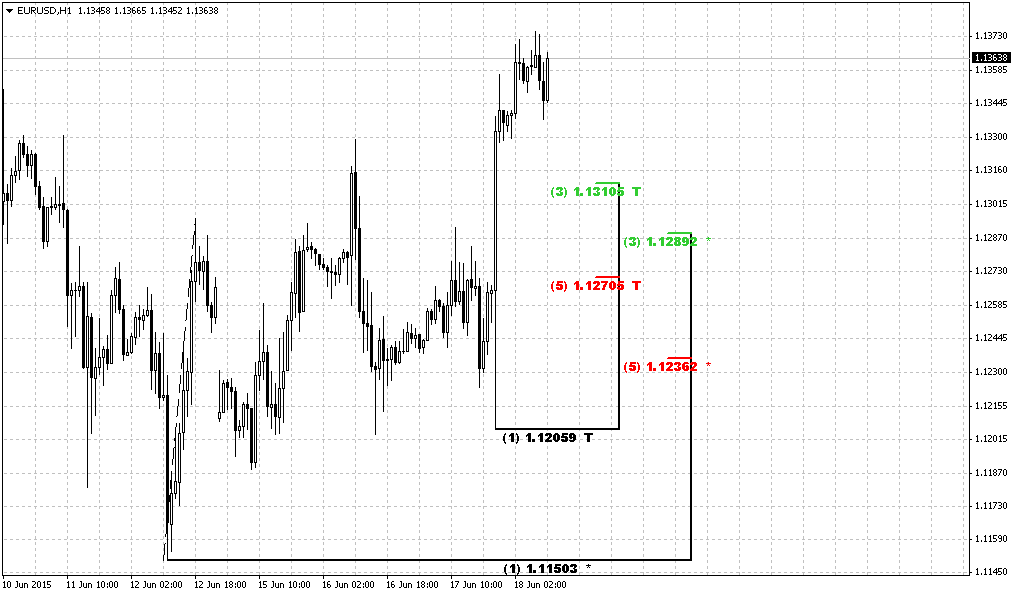

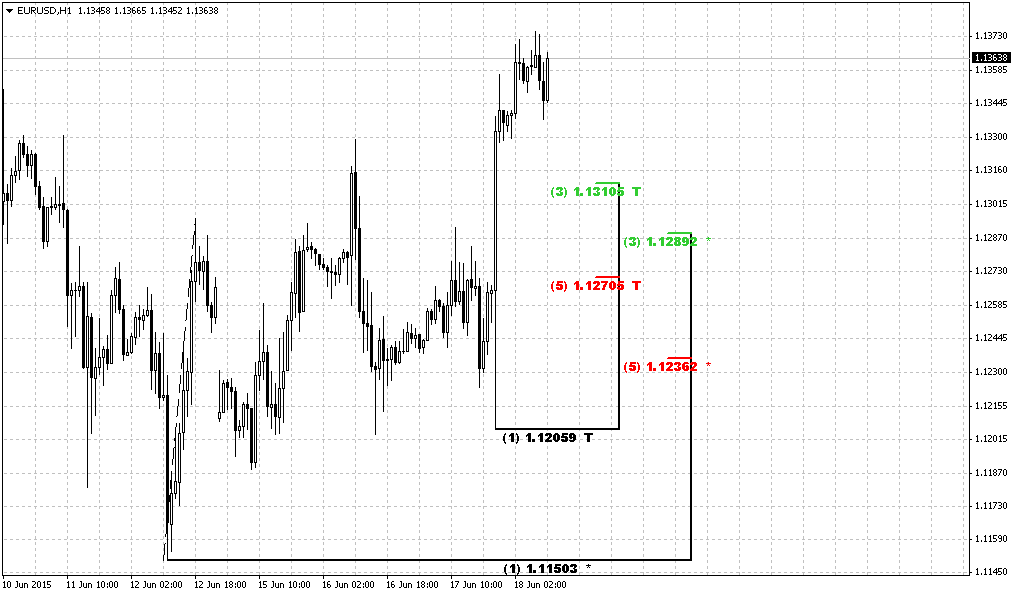

Currently we do not see any other setups for trading on EUR. As Greece deadlne is soon, it would better to not marry any positions and trade short-term. May be this setup with butterfly will work. Watch for retracement, if you would like to take long position here: (source: Sive M.)

Dragan Opacic

Unfortunately we didn't get bullish grabber yesterday, at least on FX Pro data. May be some of you have it, on other brokers...

On 4-hour chart most probable pattern that could point on target is butterfly "Sell": (source: Sive M.)

On 4-hour chart most probable pattern that could point on target is butterfly "Sell": (source: Sive M.)

Dragan Opacic

So, guys, miracle has not happened and Fed has made comments in typical manner - nothing definite, most comments were a bit dovish compares to expectation. Very careful atitude to employment and inflation tells that we will get only 1 rate hike at best in 2015...

Greece question still stands far from resolving and probably will become a dominant question for EUR till the end of the month. Meantime, In very short-term perspective, as we've said EUR could show upward action for 100-150 pips.

On daily chart EUR again has reached resistance around MPR1 and this is third touch of this level. As we've said market has uncompleted minor AB-CD target at 1.1450 area and now chances are not bad that it finally could be reached.

If even today we will not get and Greek solution, hardly market will show significant reaction, since there are 2 more weeks till deadline. Thus, EUR could focus on "working with recent Fed information" today... (source: SIve M.)

Greece question still stands far from resolving and probably will become a dominant question for EUR till the end of the month. Meantime, In very short-term perspective, as we've said EUR could show upward action for 100-150 pips.

On daily chart EUR again has reached resistance around MPR1 and this is third touch of this level. As we've said market has uncompleted minor AB-CD target at 1.1450 area and now chances are not bad that it finally could be reached.

If even today we will not get and Greek solution, hardly market will show significant reaction, since there are 2 more weeks till deadline. Thus, EUR could focus on "working with recent Fed information" today... (source: SIve M.)

: