Oleg Papkov / Perfil

- Información

|

9+ años

experiencia

|

11

productos

|

232

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

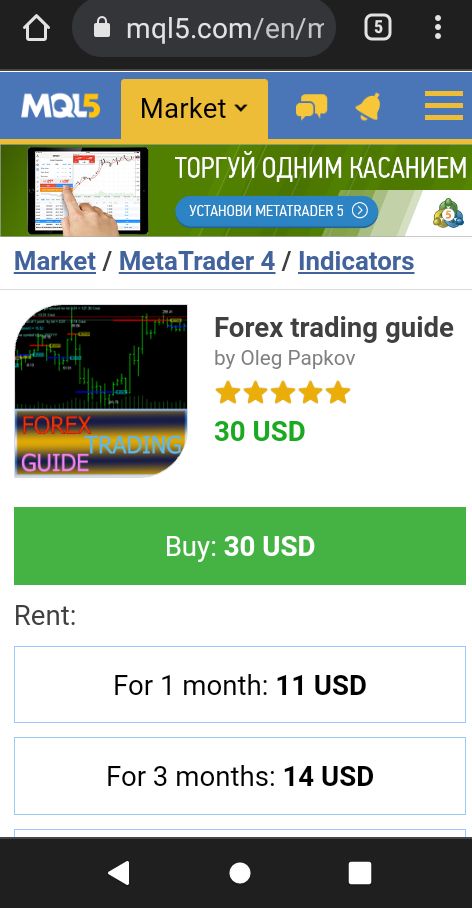

The Forex Trading Guide indicator works based on the standard RSI indicator with an adjustable period. Crossing the internal level calculated mathematically, the indicator gives a signal for opening a trade in a certain direction, showing it on the price chart with the corresponding line (blue - deal up, red - deal down) and the price label of the corresponding color. In other words, if the previous directive was to deal down (the line and the price label in red), then the next directive will be to reverse the deal, deal up (the line and the price label in blue). Appearance of a deal directive is preceded by the appearance of a white line with the price label, colored accordingly. That is, the appearance of a white price label indicates that the intersection of the signal levels has taken place in the indicator;s calculations, and it is necessary to reverse the deal.

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The Forex Trading Guide indicator works based on the standard RSI indicator with an adjustable period. Crossing the internal level calculated mathematically, the indicator gives a signal for opening a trade in a certain direction, showing it on the price chart with the corresponding line (blue - deal up, red - deal down) and the price label of the corresponding color. In other words, if the previous directive was to deal down (the line and the price label in red), then the next directive will be to reverse the deal, deal up (the line and the price label in blue). Appearance of a deal directive is preceded by the appearance of a white line with the price label, colored accordingly. That is, the appearance of a white price label indicates that the intersection of the signal levels has taken place in the indicator;s calculations, and it is necessary to reverse the deal.

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The Forex Trading Guide indicator works based on the standard RSI indicator with an adjustable period. Crossing the internal level calculated mathematically, the indicator gives a signal for opening a trade in a certain direction, showing it on the price chart with the corresponding line (blue - deal up, red - deal down) and the price label of the corresponding color. In other words, if the previous directive was to deal down (the line and the price label in red), then the next directive will be to reverse the deal, deal up (the line and the price label in blue). Appearance of a deal directive is preceded by the appearance of a white line with the price label, colored accordingly. That is, the appearance of a white price label indicates that the intersection of the signal levels has taken place in the indicator;s calculations, and it is necessary to reverse the deal.

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

The indicator is drawn from the leftmost visible bar to the bar with index 0, i.e. current. The very first leftmost bar (if it is visible on the chart) will be the starting bar for the indicator calculations.

The indicator provides the ability to link the current or manually specified spread, selected lot, selected exchange rate of the national currency to the deposit currency, as well as the multiplier (equal to 100, in case a cent account is used) and price levels assigned by the indicator in order to plot the profitability curve, which shows the estimated accuracy. The profitability curve is designed to simplify the selection of an instrument and its spread for the deposit. The indicator reports the required account margin and the value of one point in the national currency for the selected lot size. It also shows the costs for the current or manually specified spread. The type of the instrument, the direct, indirect quotes and cross rates are reported.

The strategy profitability curve (estimated accuracy) is based on the calculated amount of points between the signal lines with consideration of the spread for the specified lot. The equivalents in the recalculated national currency according to the data entered in the input parameters are indicated above and below the signal lines.

https://www.mql5.com/en/market/product/23038?source=Site+Profile+Seller#description

https://www.mql5.com/ru/market/product/23038?source=Site+Profile+Seller

https://www.mql5.com/ru/users/novocel_ol/seller

El Asesor experto semiautomático Grid stability plus opera según las señales del indicador RSI . Las operaciones se realizan en diferentes direcciones cuando el indicador alcanza valores de 30 o 70 . Si el indicador es superior a 70, se selecciona la dirección Corta para las operaciones iniciales. Si el indicador es superior a 70 , se selecciona la dirección Corta para las operaciones iniciales, y si el indicador es inferior a 30 , se selecciona la dirección Larga . Las operaciones rentables se

El EA utiliza el indicador Estocástico. Se abren operaciones Largas y Cortas cada una en su propio rango de niveles del indicador. El lote de operaciones cambia en función del nivel de riesgo establecido y de los resultados de las operaciones anteriores. El EA tiene dos modos de uso. 1 - sin utilizar la red de promediación. 2 - utilizando la red de promediación. Para elegir, de acuerdo a sus preferencias. Los ajustes para estos modos son diferentes. La configuración predeterminada está

Ship Cruise El asesor de Ship Cruise Opera sobre las señales del indicador RSI . Las transacciones se realizan en una dirección u otra cuando el indicador alcanza los valores de 30 o 70 . Las transacciones rentables se cierran en Take Profit . Las pérdidas son manejadas por un asesor experto en el método de promediación, se construye una red de transacciones en la misma dirección, se calcula el nivel de equilibrio y cuando el precio alcanza este nivel, la red se cierra en Take Profit . El