Md Atikur Rahman / Perfil

- Información

|

2 años

experiencia

|

3

productos

|

14

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Throughout my journey, I have developed several products in the forex market and am now focused on bringing new and innovative solutions to the MetaTrader 4 and MetaTrader 5 platforms.

Also manually managed funds for investors.

Please check my applications in the MQL5 Market.

Expert Advisor:

Inspiration EA MT5: https://www.mql5.com/en/market/product/124551

Inspiration EA MT4: Upcoming…

Script:

OrderHelper MT5: https://www.mql5.com/en/market/product/94863

OrderHelper MT4: https://www.mql5.com/en/market/product/94876

Personal Contacts:

Telegram: https://t.me/AtikurRahmanAtik

Email: arrahman5893@gmail.com

Skype: arrahman5893@gmail.com

Inspiration EA es un Asesor Experto (EA) innovador y totalmente automatizado diseñado para operadores de Forex que buscan consistencia, precisión y beneficios mensuales sostenibles. Desarrollado a través de un largo período de análisis de datos de mercado, y backtesting, el EA ha codificado con sofisticados algoritmos, análisis multi-marco de tiempo, y una estrategia de negociación compleja que incorpora una combinación de patrones de mercado, análisis de soporte y resistencia, indicadores

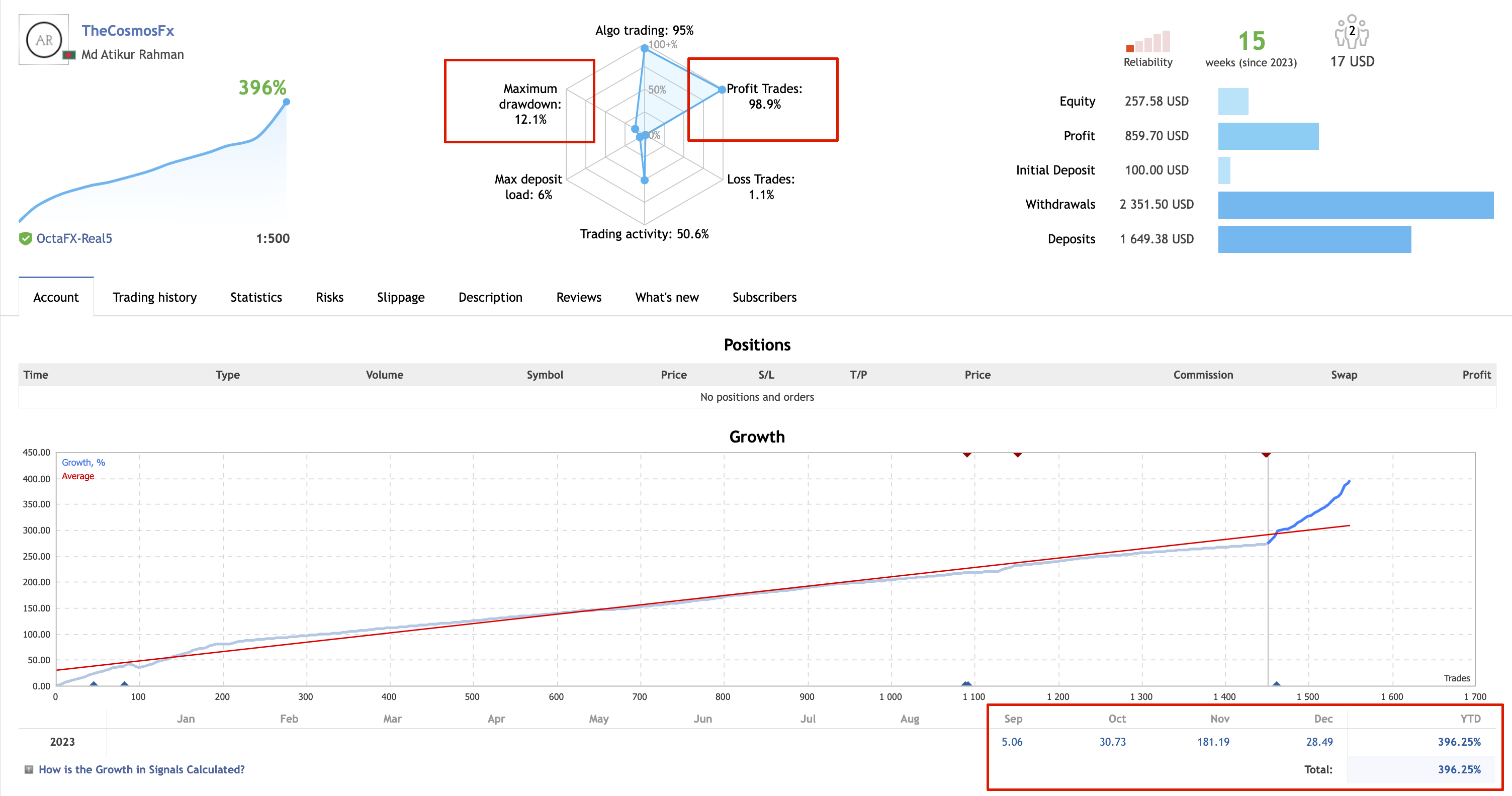

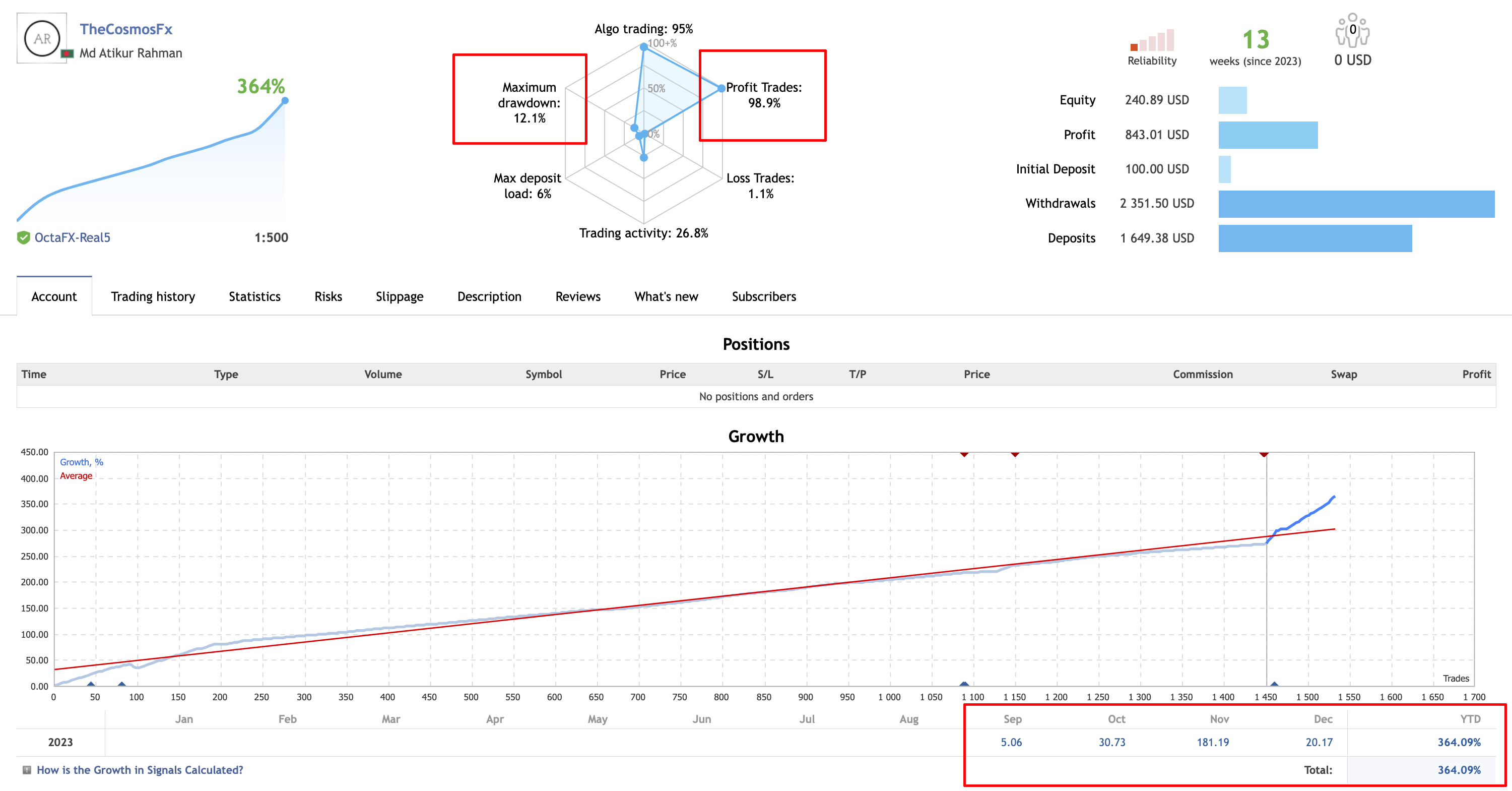

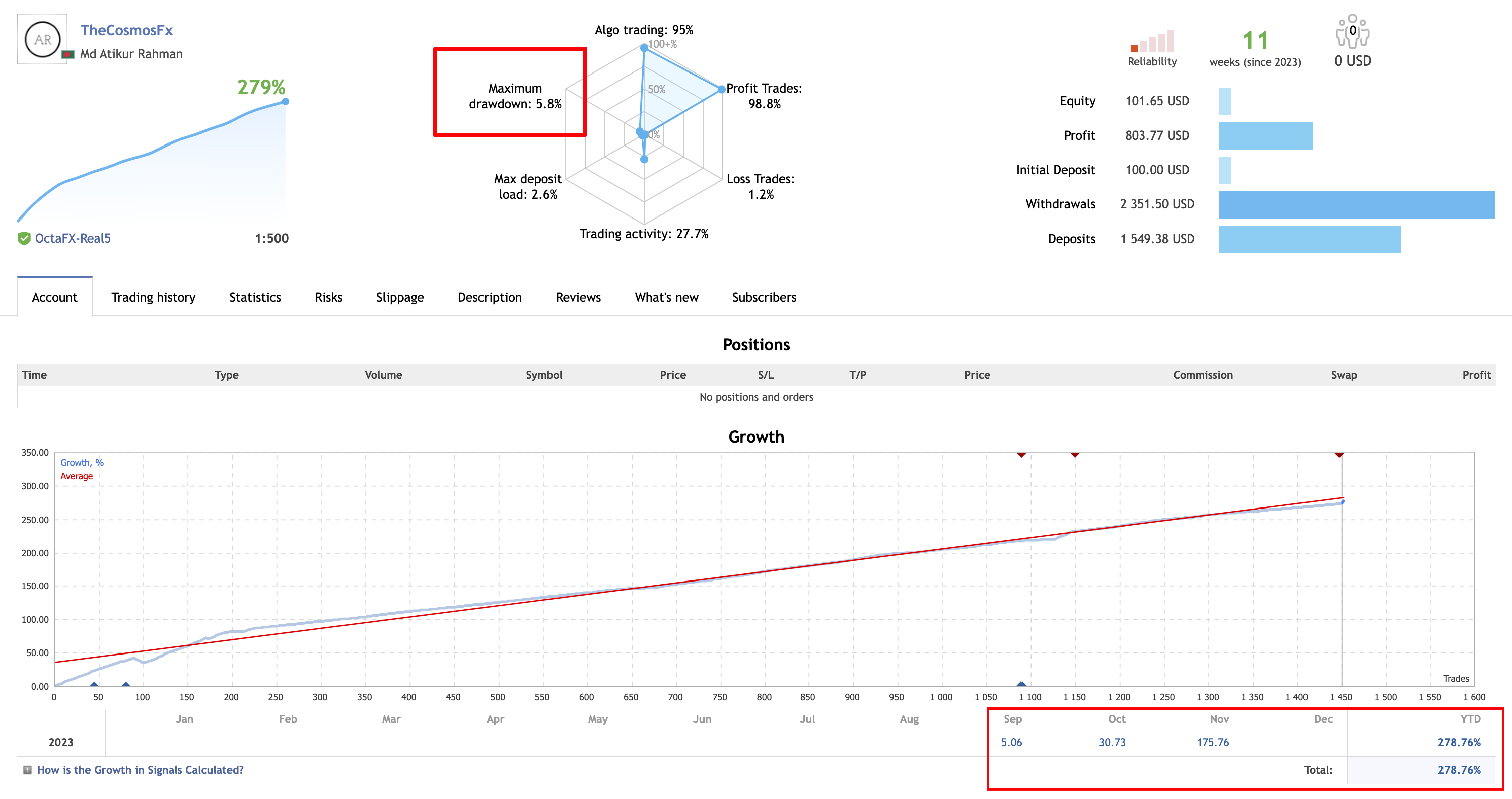

Total growth: 396%

December growth: 28%

TheCosmosFx: https://www.mql5.com/en/signals/2136578

After the FOMC meeting it may touch or break the latest new high at 2144 again through the buying season.

https://www.mql5.com/en/signals/2136578

https://www.mql5.com/en/signals/2136578

El script OrderHelper es muy fácil de usar. Aumentará su experiencia de trading. Porque está diseñado para abrir de una a múltiples órdenes rápidamente con un solo clic. Además de utilizar el script OrderHelper, los operadores pueden definir varios parámetros para las órdenes abiertas, tales como el símbolo, tipo de orden, tamaño del lote, stoploss, takeprofit y más. Básicamente, con este script los traders pueden gestionar sus órdenes abiertas de forma más eficiente y ahorrar su tiempo de

El script OrderHelper es muy fácil de usar. Aumentará su experiencia de trading. Porque está diseñado para abrir de una a múltiples órdenes rápidamente con un solo clic. Además de utilizar el script OrderHelper, los operadores pueden definir varios parámetros para las órdenes abiertas, tales como el símbolo, tipo de orden, tamaño del lote, stoploss, takeprofit y más. Básicamente, con este script los traders pueden gestionar sus órdenes abiertas de forma más eficiente y ahorrar su tiempo de

El script OrderHelper es muy fácil de usar. Aumentará su experiencia de trading. Porque está diseñado para abrir de una a múltiples órdenes rápidamente con un solo clic. Además de utilizar el script OrderHelper, los operadores pueden definir varios parámetros para las órdenes abiertas, tales como el símbolo, tipo de orden, tamaño del lote, stoploss, takeprofit y más. Básicamente, con este script los operadores pueden gestionar sus órdenes abiertas de forma más eficiente y ahorrar tiempo de

With at least a 25bps hike in the March meeting a done deal, the upcoming US inflation data is likely to serve as a reaffirmation for the rising path of the fed funds rate.

Month-on-month headline inflation is expected to come in at 0.8% (previous 0.6%).

Central Bank Notes:

The latest statement signalled a March hike

‘Quite a bit of room’ to raise rates without dampening employment

Possibility of hiking 50bps in March or possibly hiking at every meeting this year

The higher-than-expected US NFP is likely to raise expectations for a 50-bps hike of the Fed funds rate in March.

Central Bank Notes:

The latest statement signalled a March hike

‘Quite a bit of room’ to raise rates without dampening employment

Possibility of hiking 50bps in March or possibly hiking at every meeting this year

The US Fed is expected to keep to its bond-buying termination in March, hike rates by 0.25% in the same month and disclose more details on the use of the balance sheet reductions as a hedge against future inflation.

# After 1982 inflation, in 2022 US inflation hit 7% YoY, long term high inflation is not good for a country's economy

# Last week, the yield bond on the 2 and 10 year US Treasury bonds recorded for recent years and back again for correction

# The super-contagious virus Omicron is massively hampering the recovering of the global economy

# US Job sector is facing severe losses due to Omicron

# There is a state of war between Russia and Ukraine

# According to chief analysts, the Fed may raise interest rates three more times after March 2022. The dollar will be strong if Fed Chairman Jerome Powell hints at this week's FOMC meeting, or hints that may raise interest rates by 50 basis points (BPS) in March.

The precious metal is likely to gain amid tepid support for the greenback prior to the US central bank meeting, weakness on equities and record high inflation registered globally. The inflation-hedge is likely to look towards the highs from November 2021 around $1,877.

The US dollar may be vulnerable due to a Fed speak blackout before the FOMC meeting on 26 January but any losses are likely to be limited as the central bank has demonstrated a relatively consistent hawkish lean in the face of record inflation.