Abdalla Mohamed Mahmoud Taha / Profile

- Information

|

8+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

1

signals

|

0

subscribers

|

my name Abdalla Mohamed, I have more than 11 years experience in forex market .

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

Abdalla Mohamed Mahmoud Taha

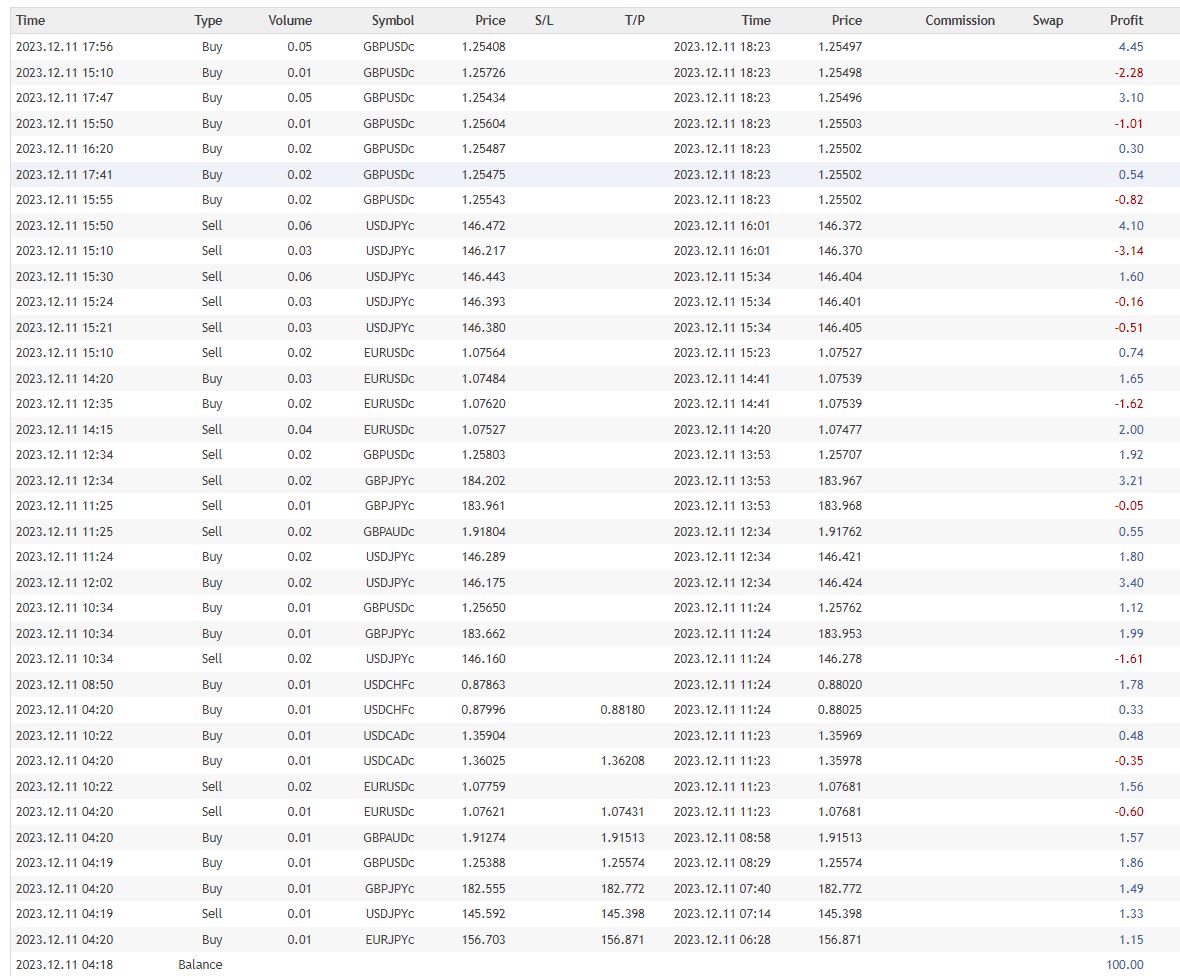

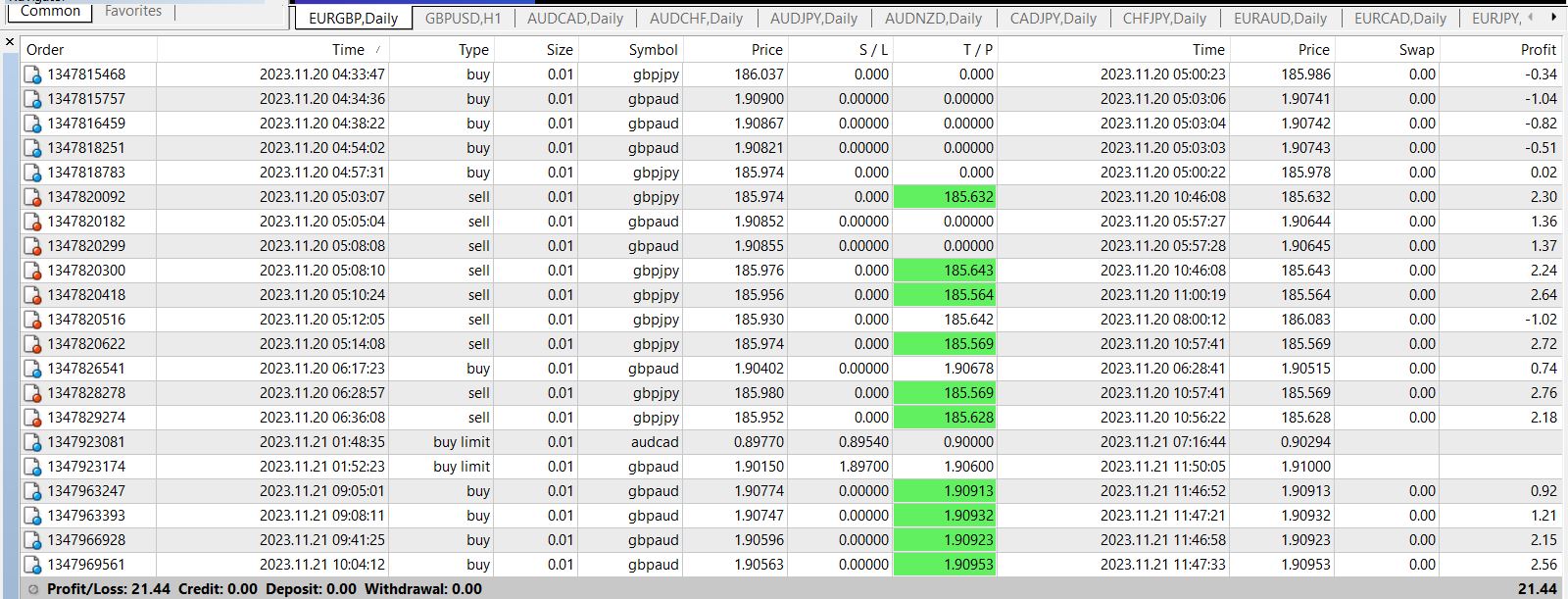

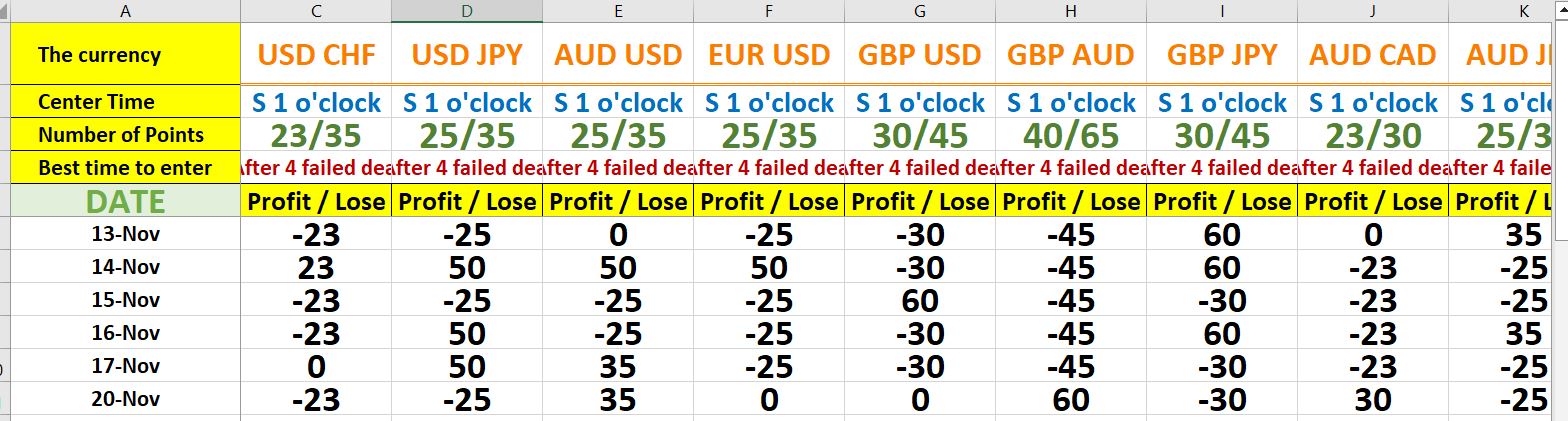

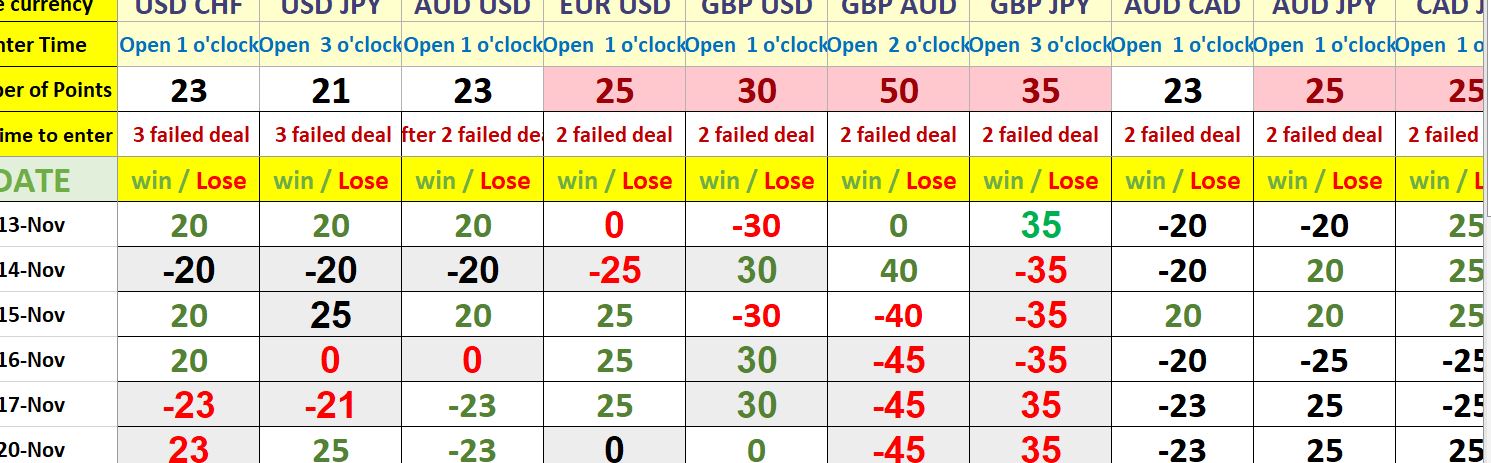

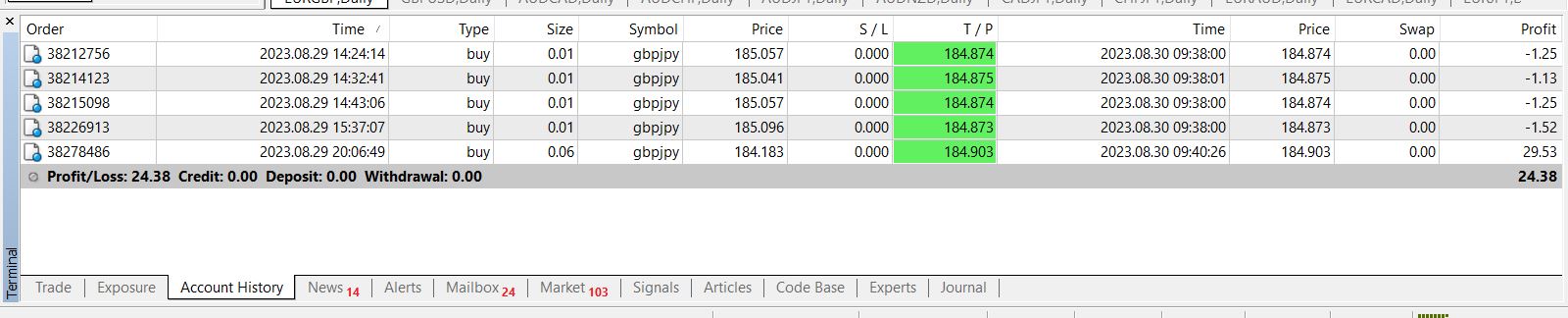

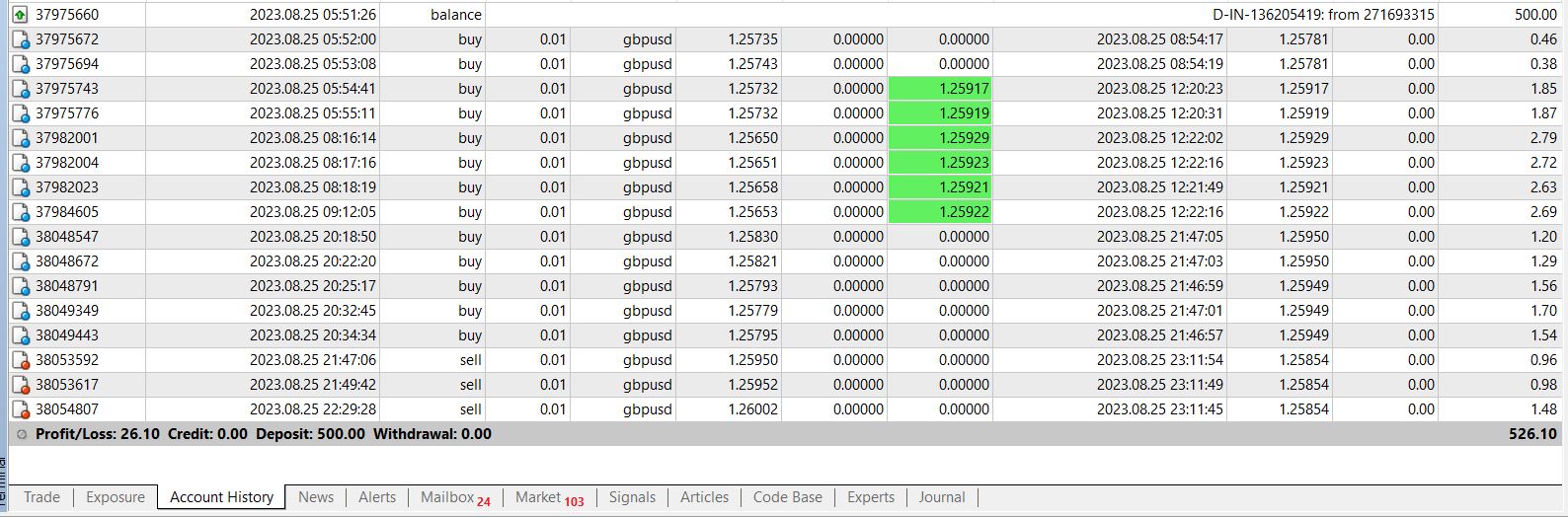

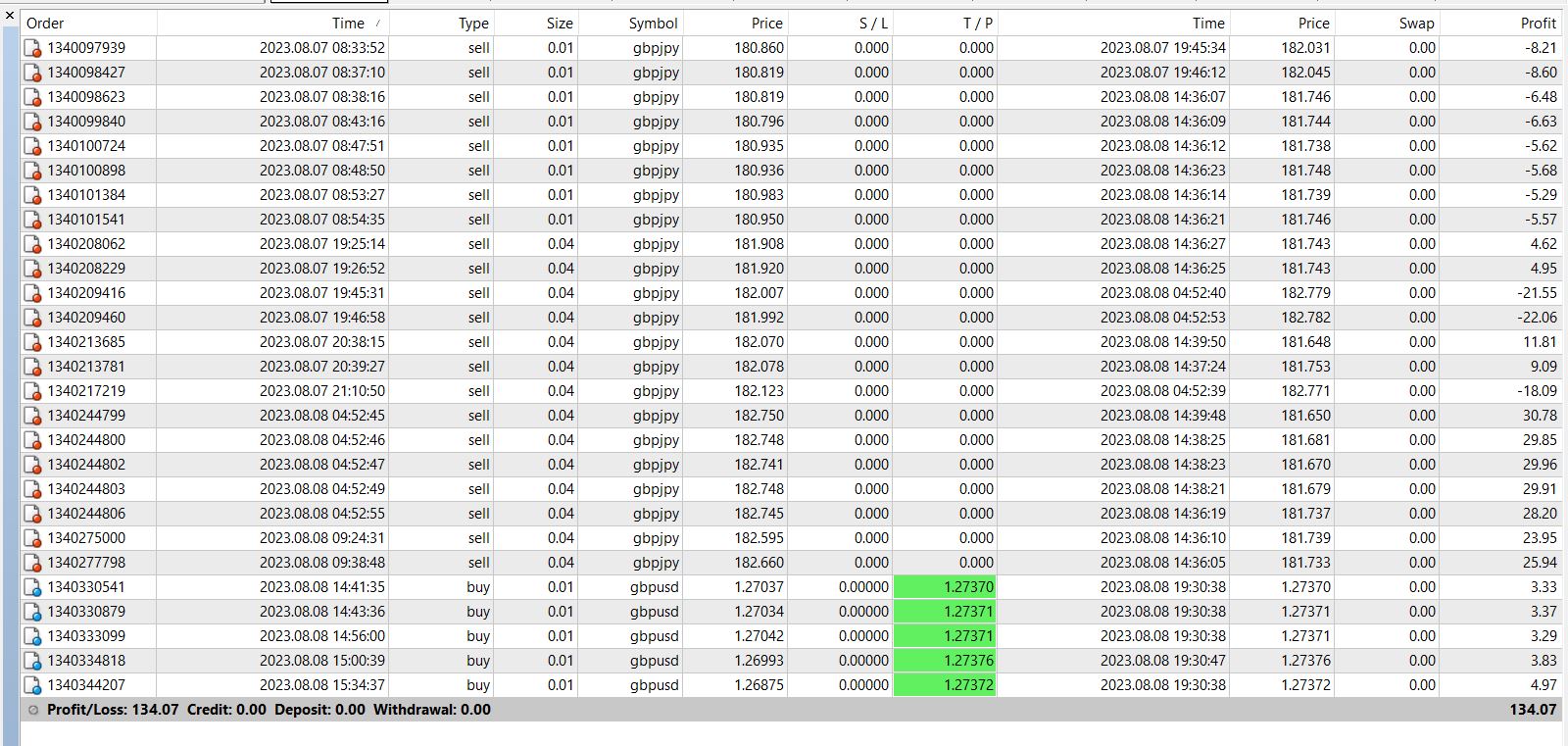

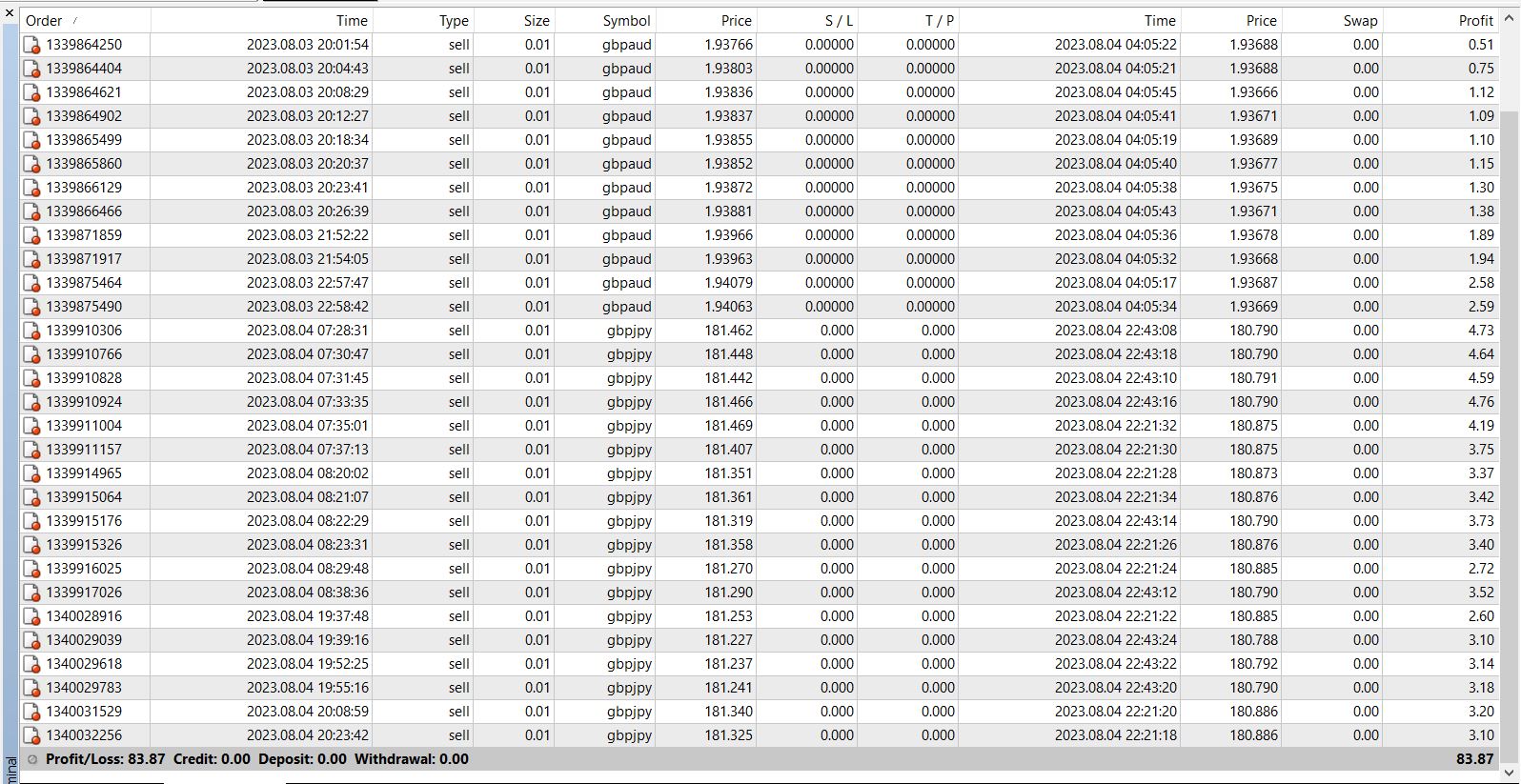

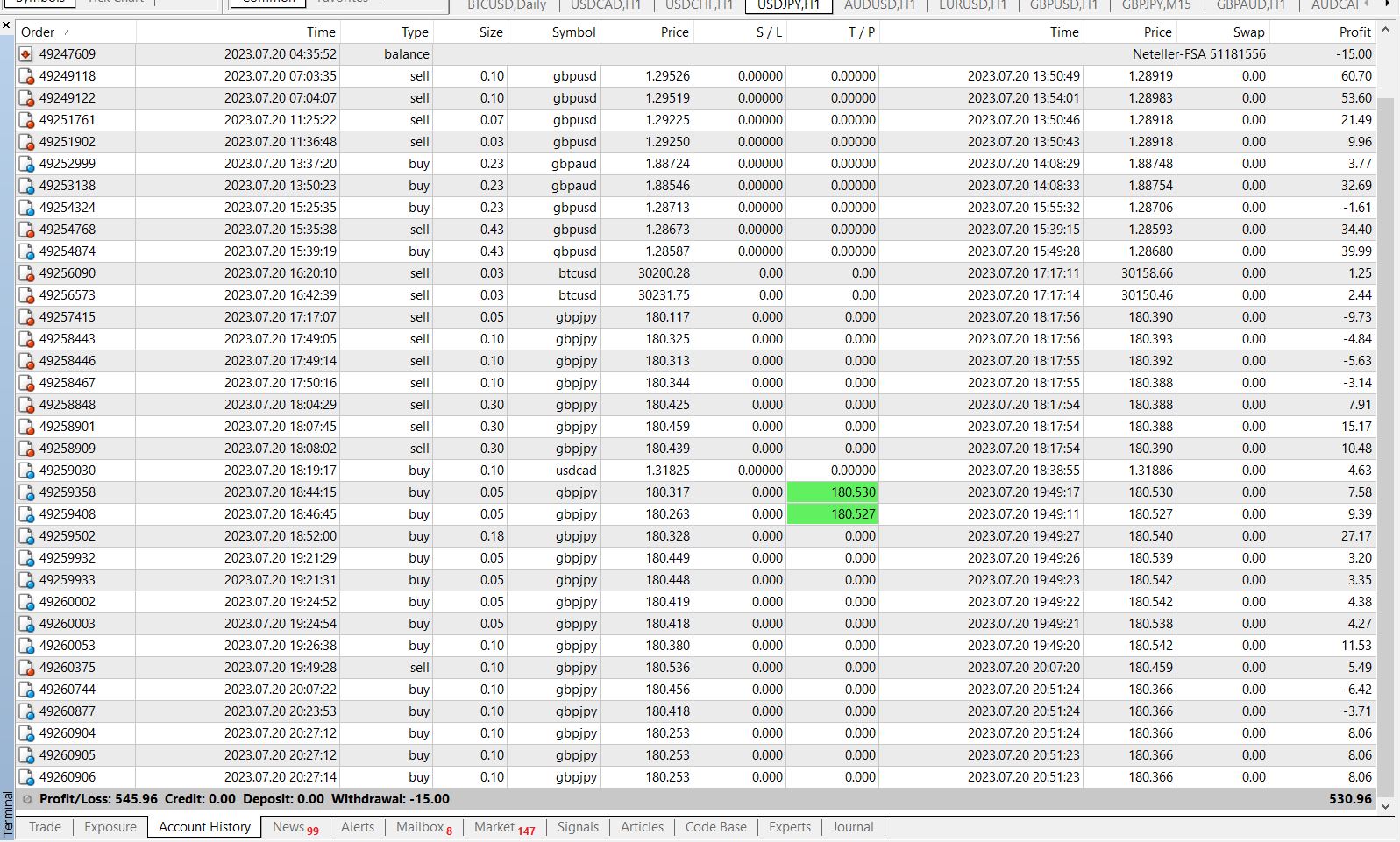

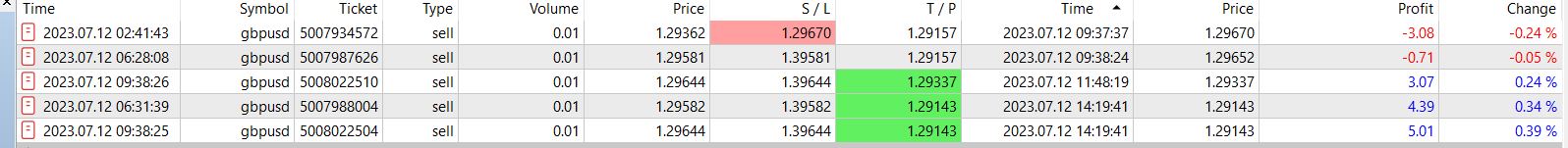

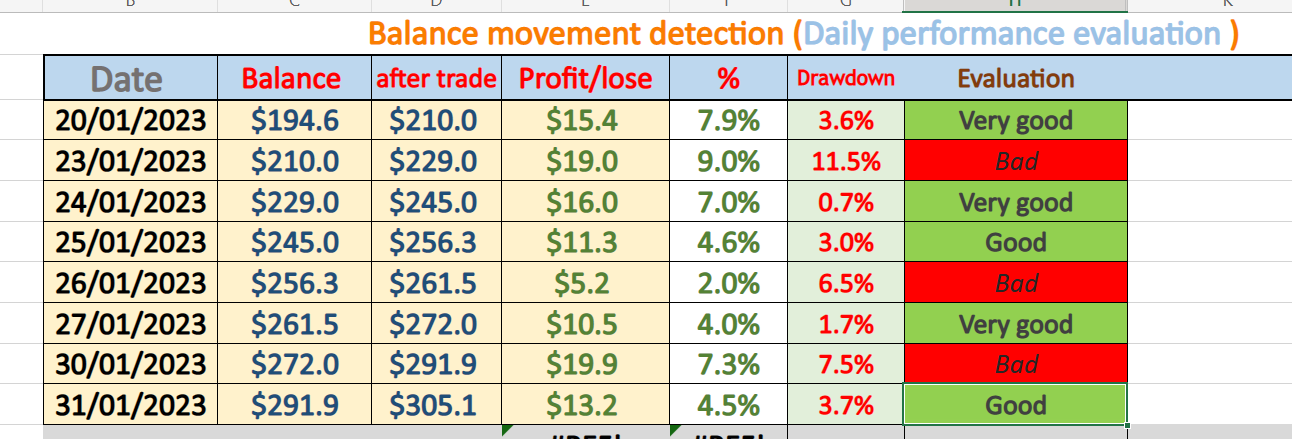

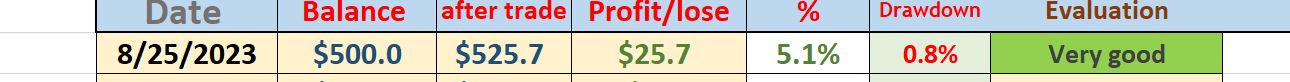

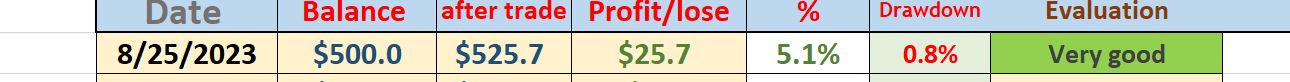

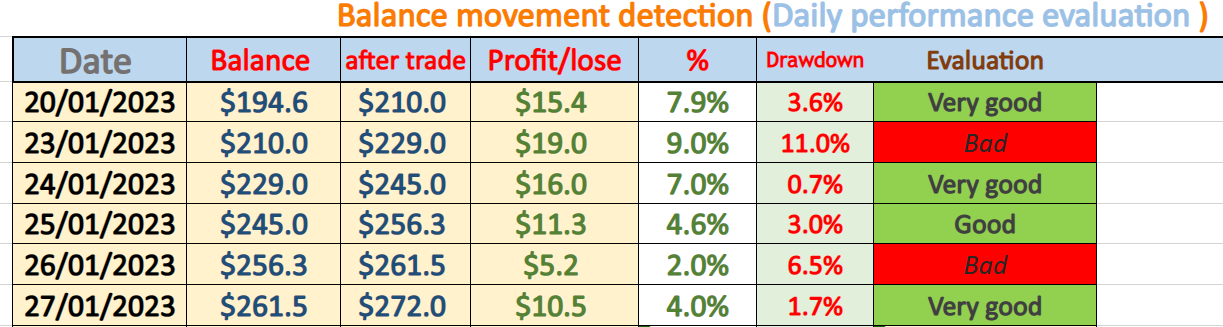

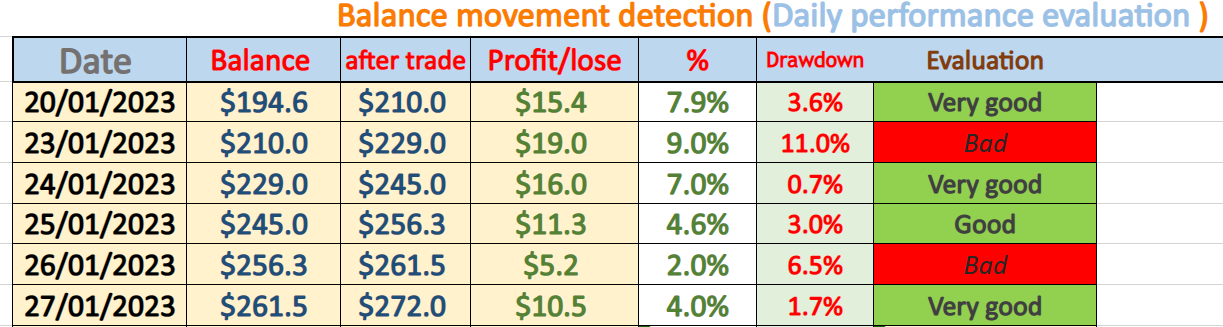

MQL5 EA PERFORMANCE UNTIL NOW

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

Abdalla Mohamed Mahmoud Taha

7 Tips To Overcome a Trading Burnout

Online trading may seem like an easy job to outsiders.

To them, all traders do is sit in front of a computer, read a bunch of news articles, put up some lines on a chart, and then money will magically appear.

forex burnout

But every trader will tell you that this is not the case.

Every single time a trader opens his platform, he knows that he will be exposed to a variety of stressful situations.

This makes us very susceptible to “mental burnout” or the collapse of the mind due to overwork or stress.

Mental burnout can be triggered many factors like overtrading, extreme market conditions, unrealistic expectations, and of course, losses.

The first thing you must understand about mental burnout is that, typically, there is not one single event that can trigger it. It is a gradual process that happens over a long period of time.

Burnout is also very broad as it doesn’t only affect one part of your life. It can manifest itself in school, at work, in your relationships, and sometimes even affect the burnout victim physically.

Here are some ways you can avoid getting burned out:

1. Pay attention to early warning signs

Burnout can sneak up on you without notice, so it’s very important to pay attention to the early warning signs.

Below are a few questions for you to ask to see if you’re about to burn out or are already burning out.

The more times you answer “yes,” the more likely you are about to experience a burnout:

Are you beginning to question why you should care about your trading plan?

Even with proper diet and fitness habits, are you having frequent migraines, muscle aches, and sickness?

Do you feel self-doubt?

Do you feel helpless, trapped, and unmotivated?

Do you hold off in closing a losing trade even though you know it’s already doomed anyway?

Have you started to eat more, take drugs, or consume more alcohol than usual?

Do you feel angry towards others for the smallest reasons?

2. Recall the feeling when you first started trading

Do you remember that light bulb moment when you first understood how fundamental and technical analysis made sense?

Did you feel giddy when you placed your very first trade?

Use that excitement you felt when you first started trading to renew your enthusiasm for the craft.

This way, you’d be able to focus more on the positive aspects and less on the stressful ones.

3. Find a trading buddy

They say that “misery loves company” and oftentimes it’s great to blow out steam with someone who understands exactly what you’re going through.

But instead of holding hands and cursing at the market when trades don’t go your way, share your trading thoughts with your buddy instead.

He might be able to help you determine your common mistakes and correct them, allowing you to avoid stress from these problems down the line.

4. Pamper yourself

We all have our own ways of unwinding – be it through a beach vacation, a yoga class or a few rounds of paintball. It’s important to know what does the trick for you… and then do it!

As much as you love trading, make sure that you also do something else that you enjoy regularly to avoid the dreaded burnout.

Taking measures to avoid burnout is well and good, but if you’re already experiencing it, then here are some tips that might help you recover:

5. Take it easy

When you’re feeling more stressed about your trading than usual, you run the risk of making things worse if you force yourself to trade more and work harder.

Taking a moment to unwind could help you clear your mind and make it easier for you to focus later on.

6. Ask for help

More often than not, trying to overcome a burnout on your own can result in twice the pressure you already feel.

In this case, there’s nothing wrong with consulting a friend or even a psychological counselor.

After all, it’s possible that burnout might be a product of a different concern other than trading and it’d be best to isolate which problem you really need to work on.

7. Take control

One of the major causes of burnout is the perceived loss of control over a situation, which is something that traders could be prone to given the market’s dynamic nature.

When you feel this kind of anxiety while trading, try to regain control by setting simpler goals.

These can be in the form of managing your time wisely, updating your trade journal regularly, or developing a trading plan and sticking to it.

How about you? Have you experienced trading burnout before? What have you done to overcome the condition?

Online trading may seem like an easy job to outsiders.

To them, all traders do is sit in front of a computer, read a bunch of news articles, put up some lines on a chart, and then money will magically appear.

forex burnout

But every trader will tell you that this is not the case.

Every single time a trader opens his platform, he knows that he will be exposed to a variety of stressful situations.

This makes us very susceptible to “mental burnout” or the collapse of the mind due to overwork or stress.

Mental burnout can be triggered many factors like overtrading, extreme market conditions, unrealistic expectations, and of course, losses.

The first thing you must understand about mental burnout is that, typically, there is not one single event that can trigger it. It is a gradual process that happens over a long period of time.

Burnout is also very broad as it doesn’t only affect one part of your life. It can manifest itself in school, at work, in your relationships, and sometimes even affect the burnout victim physically.

Here are some ways you can avoid getting burned out:

1. Pay attention to early warning signs

Burnout can sneak up on you without notice, so it’s very important to pay attention to the early warning signs.

Below are a few questions for you to ask to see if you’re about to burn out or are already burning out.

The more times you answer “yes,” the more likely you are about to experience a burnout:

Are you beginning to question why you should care about your trading plan?

Even with proper diet and fitness habits, are you having frequent migraines, muscle aches, and sickness?

Do you feel self-doubt?

Do you feel helpless, trapped, and unmotivated?

Do you hold off in closing a losing trade even though you know it’s already doomed anyway?

Have you started to eat more, take drugs, or consume more alcohol than usual?

Do you feel angry towards others for the smallest reasons?

2. Recall the feeling when you first started trading

Do you remember that light bulb moment when you first understood how fundamental and technical analysis made sense?

Did you feel giddy when you placed your very first trade?

Use that excitement you felt when you first started trading to renew your enthusiasm for the craft.

This way, you’d be able to focus more on the positive aspects and less on the stressful ones.

3. Find a trading buddy

They say that “misery loves company” and oftentimes it’s great to blow out steam with someone who understands exactly what you’re going through.

But instead of holding hands and cursing at the market when trades don’t go your way, share your trading thoughts with your buddy instead.

He might be able to help you determine your common mistakes and correct them, allowing you to avoid stress from these problems down the line.

4. Pamper yourself

We all have our own ways of unwinding – be it through a beach vacation, a yoga class or a few rounds of paintball. It’s important to know what does the trick for you… and then do it!

As much as you love trading, make sure that you also do something else that you enjoy regularly to avoid the dreaded burnout.

Taking measures to avoid burnout is well and good, but if you’re already experiencing it, then here are some tips that might help you recover:

5. Take it easy

When you’re feeling more stressed about your trading than usual, you run the risk of making things worse if you force yourself to trade more and work harder.

Taking a moment to unwind could help you clear your mind and make it easier for you to focus later on.

6. Ask for help

More often than not, trying to overcome a burnout on your own can result in twice the pressure you already feel.

In this case, there’s nothing wrong with consulting a friend or even a psychological counselor.

After all, it’s possible that burnout might be a product of a different concern other than trading and it’d be best to isolate which problem you really need to work on.

7. Take control

One of the major causes of burnout is the perceived loss of control over a situation, which is something that traders could be prone to given the market’s dynamic nature.

When you feel this kind of anxiety while trading, try to regain control by setting simpler goals.

These can be in the form of managing your time wisely, updating your trade journal regularly, or developing a trading plan and sticking to it.

How about you? Have you experienced trading burnout before? What have you done to overcome the condition?

Abdalla Mohamed Mahmoud Taha

MQL5 EA PERFORMANCE UNTIL NOW

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

Abdalla Mohamed Mahmoud Taha

3 Tips to Help You Trade Bigger Positions

Unfortunately, many traders have difficulty taking the next step and trading bigger positions. Some find it hard to risk wiping out the small profits they’ve worked hard for in the last couple of months, while some just can’t stomach risking bigger positions.

Taking on more risk definitely has its perks. But be warned… While it can give you bigger wins, increasing your risk can just as easily magnify your losses and wipe out your entire account. To avoid the pitfalls of trading big, I’ve come up with three simple tips to guide you with increasing your risk.

1. Make sure you’re in the green

Don’t even think about increasing your risk if you’re not even consistently profitable with trading small. If you can’t successfully trade small forex positions, what makes you think you’re gonna have any luck trading bigger ones?

If you think and feel that you’re ready but your account is still in the red, concentrate on pulling it back in the green first. That’s what demo and small accounts are for anyway.

Keep trading small positions until your performance justifies trading bigger. After all, you don’t want to compound your losses with bigger position sizes.

2. Take it slow and steady

Just as you wouldn’t rush to fighting elite world champions after just learning how to box, you shouldn’t rush yourself into increasing your trading size. You don’t want to bite off more than you can chew, do you?

Taking a gradual approach towards increasing your forex position sizes is the key to becoming comfortable with taking a larger risk. If you’re not completely comfortable with the amount of risk you’re taking, chances are, it’ll show on your account balance.

So rather than make one big leap, go for small, steady increases. It’s less likely to have an adverse effect on your trading mindset, and it’ll allow you to adjust to larger risks more smoothly.

3. Focus on percentages rather than dollar amounts

I’ll let you in on a little trading secret that’ll help you adjust to larger trading sizes: focus on percentages rather than dollar amounts.

Risking 1% on a $10,000 account is the same as risking $100. On the other hand, risking 1% on a $100,000 account is equivalent to risking $1,000. So you see, by risking the same percentage on a larger account, you’re basically trading larger.

It also helps to put profits and losses in the proper perspective when you focus on percentages. Losing 1% on a $100,000 account won’t feel too different from losing 1% on a $10,000 account. But when you put it in raw dollar terms ($1,000 versus $100), it’s a lot harder to stomach.

So there you have it, folks! You should be able to transition to trading bigger forex positions without a hitch if you take it slow and steady, and focus on percentages rather than dollar amounts. But above all, don’t make the mistake of increasing your risk if you’re not yet consistently profitable trading small.

Unfortunately, many traders have difficulty taking the next step and trading bigger positions. Some find it hard to risk wiping out the small profits they’ve worked hard for in the last couple of months, while some just can’t stomach risking bigger positions.

Taking on more risk definitely has its perks. But be warned… While it can give you bigger wins, increasing your risk can just as easily magnify your losses and wipe out your entire account. To avoid the pitfalls of trading big, I’ve come up with three simple tips to guide you with increasing your risk.

1. Make sure you’re in the green

Don’t even think about increasing your risk if you’re not even consistently profitable with trading small. If you can’t successfully trade small forex positions, what makes you think you’re gonna have any luck trading bigger ones?

If you think and feel that you’re ready but your account is still in the red, concentrate on pulling it back in the green first. That’s what demo and small accounts are for anyway.

Keep trading small positions until your performance justifies trading bigger. After all, you don’t want to compound your losses with bigger position sizes.

2. Take it slow and steady

Just as you wouldn’t rush to fighting elite world champions after just learning how to box, you shouldn’t rush yourself into increasing your trading size. You don’t want to bite off more than you can chew, do you?

Taking a gradual approach towards increasing your forex position sizes is the key to becoming comfortable with taking a larger risk. If you’re not completely comfortable with the amount of risk you’re taking, chances are, it’ll show on your account balance.

So rather than make one big leap, go for small, steady increases. It’s less likely to have an adverse effect on your trading mindset, and it’ll allow you to adjust to larger risks more smoothly.

3. Focus on percentages rather than dollar amounts

I’ll let you in on a little trading secret that’ll help you adjust to larger trading sizes: focus on percentages rather than dollar amounts.

Risking 1% on a $10,000 account is the same as risking $100. On the other hand, risking 1% on a $100,000 account is equivalent to risking $1,000. So you see, by risking the same percentage on a larger account, you’re basically trading larger.

It also helps to put profits and losses in the proper perspective when you focus on percentages. Losing 1% on a $100,000 account won’t feel too different from losing 1% on a $10,000 account. But when you put it in raw dollar terms ($1,000 versus $100), it’s a lot harder to stomach.

So there you have it, folks! You should be able to transition to trading bigger forex positions without a hitch if you take it slow and steady, and focus on percentages rather than dollar amounts. But above all, don’t make the mistake of increasing your risk if you’re not yet consistently profitable trading small.

Abdalla Mohamed Mahmoud Taha

Why Traders Can See the Same Chart Differently

Trader’s Perspective

Have you ever witnessed a situation in which two forex traders interpret the same chart in an entirely different way? If so, you’ve seen a prime example of how two people can look at the same exact thing and see different things. This is often referred to as the trader’s “perspective” or “perception.”

While we could debate endlessly about which trader’s perspective is correct (and believe me, traders do debate this endlessly), that’s not the goal of this post. On the contrary, we just want to discuss this interesting phenomenon to learn why it occurs in the first place. So, why can two traders look at the same chart and see different things?

Keep reading to figure it out!

They Use Different Trading Strategies

Factor number one has to do with the trading strategies that each trader uses. Some traders are what we call “traditionalists.” They tend to rely mostly on technical analysis, utilizing things like support and resistance levels, Fibonacci retracements, moving averages, and other similar indicators.

On the other hand, there are also traders who prefer to follow trends. These types of traders are often referred to as “trend followers.” As you can probably guess, they rely less on technical analysis and instead focus on identifying and following trends. The point is that the type of strategy a trader uses will likely impact how they see a given chart.

For example, a traditionalist might look at a chart and see a clear uptrend. However, a trend follower might see the same exact chart and interpret it as being in a consolidation phase before potentially resuming the downtrend. As you can probably imagine, this difference in perspective can lead to entirely different trading decisions.

Recency Bias is a Common Cause Of Trader’s Perspective

Another factor that can impact a trader’s perspective is something called recency bias. This refers to the human tendency to place more emphasis on recent events than on events that occurred in the past.

For example, suppose you’re considering investing in a new company. You might be more likely to invest if the company’s stock has been increasing steadily over the past few months. However, this doesn’t necessarily mean that the company is a good investment; the stock could just as easily fall in the future.

The same is true in the world of forex trading. Traders who are influenced by recency bias might be more likely to buy a currency if it has been rising in value recently, regardless of whether or not it is actually overpriced. In general, it’s important to be aware of recency bias and try to make decisions based on all available information, not just the most recent data points.

Traders May Have Contrasting Emotional States

Another factor that can impact a trader’s perspective is their emotional state. Some traders are very emotionally invested in their trades, while others take a more detached approach.

For example, a trader who is feeling anxious about a trade might be more likely to exit the trade prematurely, even if there is still potential for profit. On the other hand, a trader who is feeling confident about a trade might be more likely to hold onto the trade for too long, even if the market is starting to turn against them.

Of course, emotions are not always bad; they can actually be helpful in some cases. For example, a trader who is feeling confident about a trade might be more likely to take on additional risk and potentially achieve a higher return. However, it is important to be aware of how your emotions can influence your trading decisions.

Pros And Amateurs Have Different Perspectives

One final factor that can impact a trader’s perspective is their experience level. Novice traders are more likely to make mistakes, such as buying a currency when it is overpriced or selling a currency when it is underpriced.

On the other hand, experienced traders are more likely to have a better understanding of the market and make trades that are more likely to be profitable. Of course, even experienced traders can make mistakes; no one is perfect. However, the difference in experience can still lead to contrasting perspectives.

Trader’s Perspective Summary

In conclusion, there are many factors that can impact a trader’s perspective. Some of these factors, such as recency bias and emotional state, are outside of the trader’s control. But a few other factors, such as risk profile and experience level, are within the trader’s control.

It is important to be aware of all of these factors and how they might influence your trading decisions. By doing so, you can make sure that you are making the best possible decisions for your trading strategy.

Author Bio

Charlie Svensson is a fast and engaging freelance writer who works for the college paper help agency. He is a master of finance-related content writing and blogging. Besides that, Charlie likes writing about education, social media, marketing, SEO, motivation, and self-growth.

Trader’s Perspective

Have you ever witnessed a situation in which two forex traders interpret the same chart in an entirely different way? If so, you’ve seen a prime example of how two people can look at the same exact thing and see different things. This is often referred to as the trader’s “perspective” or “perception.”

While we could debate endlessly about which trader’s perspective is correct (and believe me, traders do debate this endlessly), that’s not the goal of this post. On the contrary, we just want to discuss this interesting phenomenon to learn why it occurs in the first place. So, why can two traders look at the same chart and see different things?

Keep reading to figure it out!

They Use Different Trading Strategies

Factor number one has to do with the trading strategies that each trader uses. Some traders are what we call “traditionalists.” They tend to rely mostly on technical analysis, utilizing things like support and resistance levels, Fibonacci retracements, moving averages, and other similar indicators.

On the other hand, there are also traders who prefer to follow trends. These types of traders are often referred to as “trend followers.” As you can probably guess, they rely less on technical analysis and instead focus on identifying and following trends. The point is that the type of strategy a trader uses will likely impact how they see a given chart.

For example, a traditionalist might look at a chart and see a clear uptrend. However, a trend follower might see the same exact chart and interpret it as being in a consolidation phase before potentially resuming the downtrend. As you can probably imagine, this difference in perspective can lead to entirely different trading decisions.

Recency Bias is a Common Cause Of Trader’s Perspective

Another factor that can impact a trader’s perspective is something called recency bias. This refers to the human tendency to place more emphasis on recent events than on events that occurred in the past.

For example, suppose you’re considering investing in a new company. You might be more likely to invest if the company’s stock has been increasing steadily over the past few months. However, this doesn’t necessarily mean that the company is a good investment; the stock could just as easily fall in the future.

The same is true in the world of forex trading. Traders who are influenced by recency bias might be more likely to buy a currency if it has been rising in value recently, regardless of whether or not it is actually overpriced. In general, it’s important to be aware of recency bias and try to make decisions based on all available information, not just the most recent data points.

Traders May Have Contrasting Emotional States

Another factor that can impact a trader’s perspective is their emotional state. Some traders are very emotionally invested in their trades, while others take a more detached approach.

For example, a trader who is feeling anxious about a trade might be more likely to exit the trade prematurely, even if there is still potential for profit. On the other hand, a trader who is feeling confident about a trade might be more likely to hold onto the trade for too long, even if the market is starting to turn against them.

Of course, emotions are not always bad; they can actually be helpful in some cases. For example, a trader who is feeling confident about a trade might be more likely to take on additional risk and potentially achieve a higher return. However, it is important to be aware of how your emotions can influence your trading decisions.

Pros And Amateurs Have Different Perspectives

One final factor that can impact a trader’s perspective is their experience level. Novice traders are more likely to make mistakes, such as buying a currency when it is overpriced or selling a currency when it is underpriced.

On the other hand, experienced traders are more likely to have a better understanding of the market and make trades that are more likely to be profitable. Of course, even experienced traders can make mistakes; no one is perfect. However, the difference in experience can still lead to contrasting perspectives.

Trader’s Perspective Summary

In conclusion, there are many factors that can impact a trader’s perspective. Some of these factors, such as recency bias and emotional state, are outside of the trader’s control. But a few other factors, such as risk profile and experience level, are within the trader’s control.

It is important to be aware of all of these factors and how they might influence your trading decisions. By doing so, you can make sure that you are making the best possible decisions for your trading strategy.

Author Bio

Charlie Svensson is a fast and engaging freelance writer who works for the college paper help agency. He is a master of finance-related content writing and blogging. Besides that, Charlie likes writing about education, social media, marketing, SEO, motivation, and self-growth.

: