Sergey Pavlov / Profile

- Information

|

14+ years

experience

|

0

products

|

0

demo versions

|

|

60

jobs

|

0

signals

|

0

subscribers

|

1. I will do whatever your advisor profitable.

2. Multifactorial spend any of your research indicator and suggest a profitable trading strategy for him.

2. Multifactorial spend any of your research indicator and suggest a profitable trading strategy for him.

Friends

529

Requests

Outgoing

Sergey Pavlov

Sergey Pavlov

2023.10.02

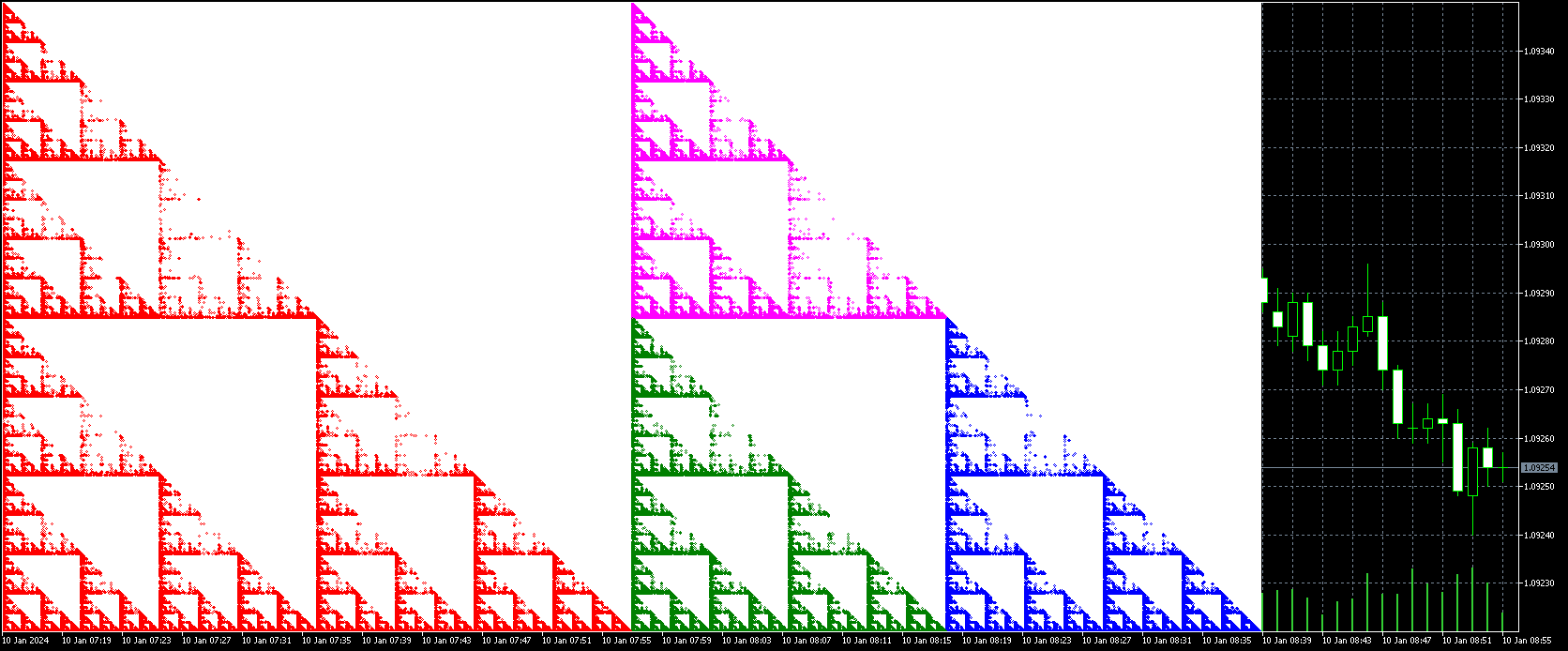

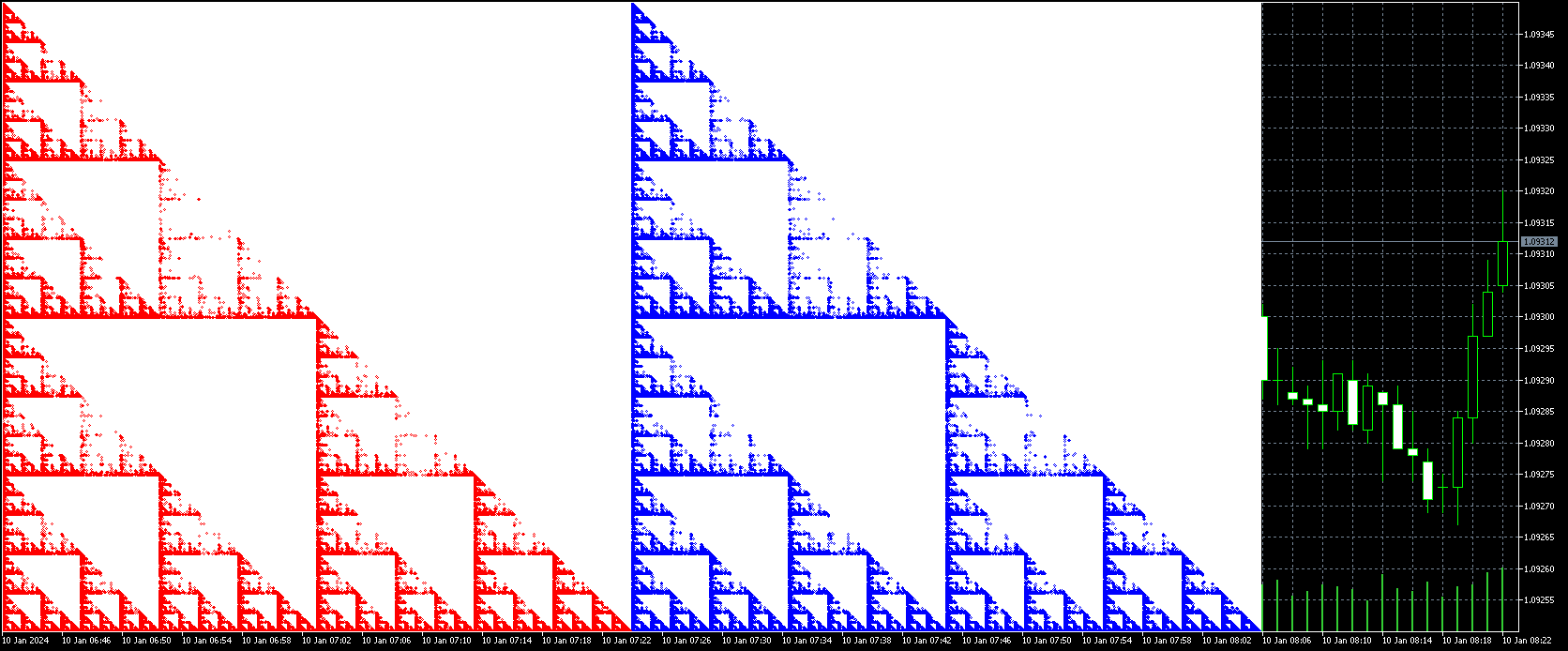

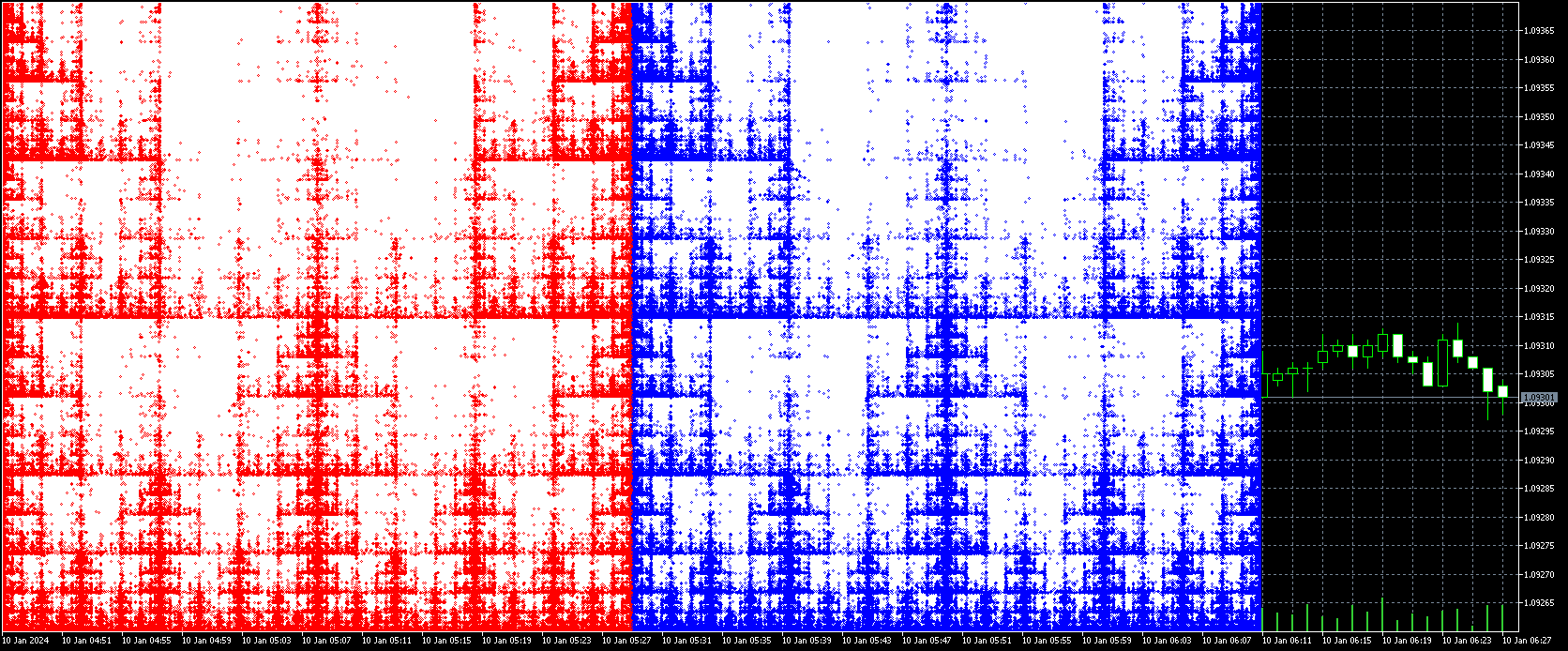

Прогноз начинается слева и можно посмотреть насколько он точен или наоборот нет...

Sergey Pavlov

Added topic How strong movements are born

I have always wondered how strong price movements come about. How it happens, what is the mechanism. Here is one of my observations. As you can see in the figure: you can see not only the beginning of a movement and its direction, but also future

Sergey Pavlov

Added topic Activity Spectrum and AFC of MTS using the Moving Average advisor as an example

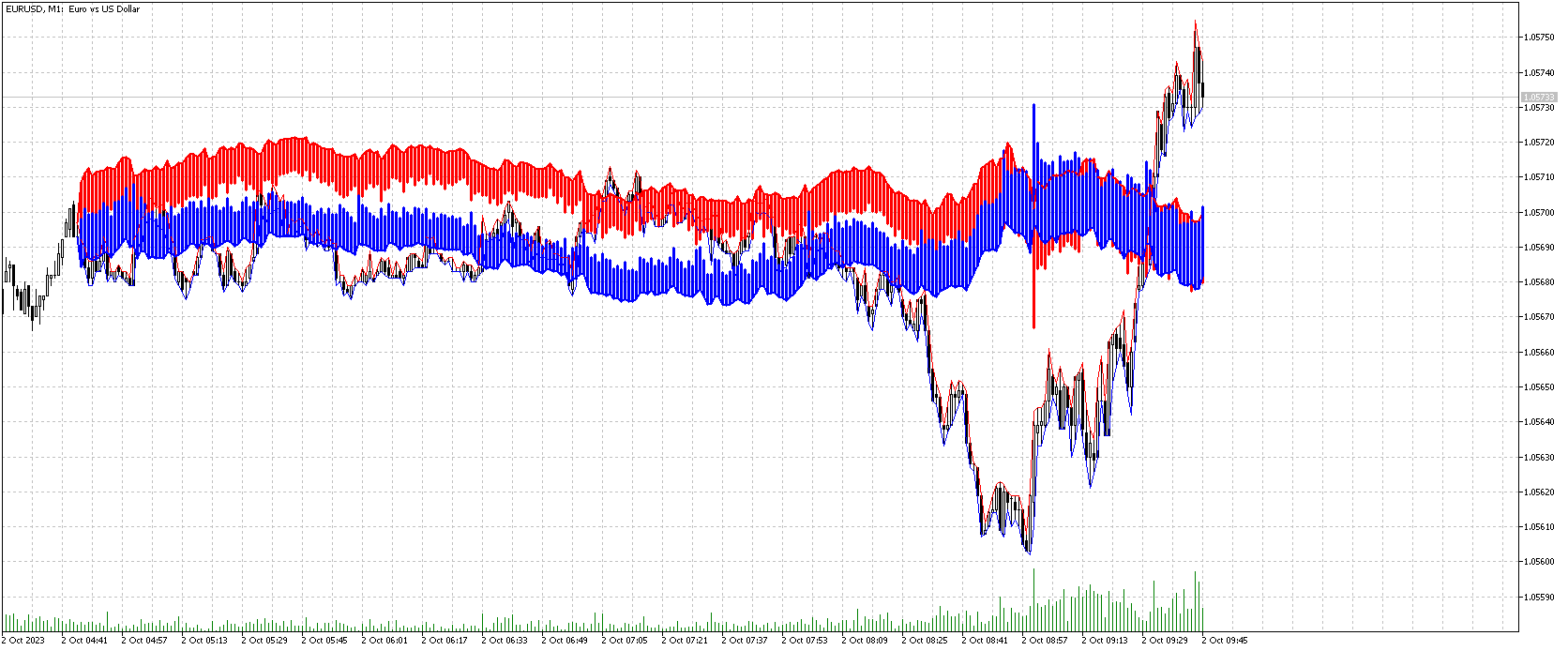

Blue - highs Red - minima Green - activity spectrum Dark blue - gains/losses Green - activity spectrum. === QUESTION: Given the amplitude-frequency characteristics of mts, is it possible to create profitable Expert Advisors only? A: Yes. Q: Can I

Sergey Pavlov

Added topic Classical thechanalysis doesn't work any more. What works, maybe quantum?

Our weakness is disunity and hostility towards one another. Our strength is the persistent pursuit of victory. For all those who agree that classical thechanalysis no longer works in today's market, I propose to discuss ways of developing time series

Sergey Pavlov

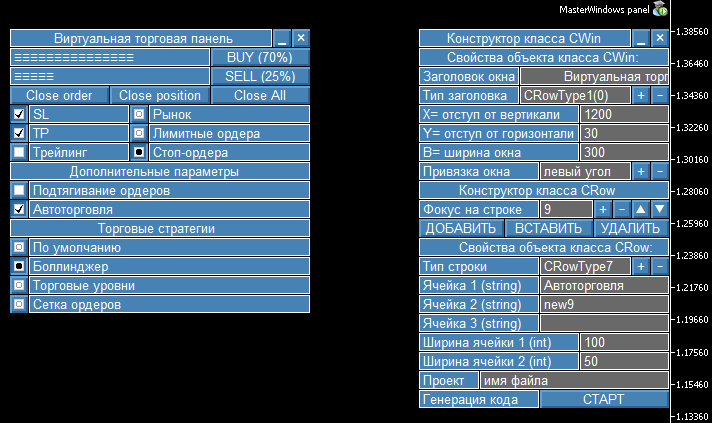

Published article Developing multi-module Expert Advisors

MQL programming language allows implementing the concept of modular development of trading strategies. The article shows an example of developing a multi-module Expert Advisor consisting of separately compiled file modules.

Share on social networks · 3

11298

adalto.sarraff

2021.06.29

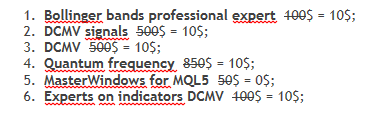

Hi, I rented EA Bollinger Bands for 1 month but I don't know where I can see my order. I've already made the payment via bank slip. can you help?

Sergey Pavlov

Northwest

2018.03.17

Чудесный вид!Извините что пишу здесь.Но так и не понял как с

вами связаться.А нужно!

вами связаться.А нужно!

Sergey Pavlov

Published code An abstract trading robot, an OOP pattern

An example of a template for developing automated trading systems.

Share on social networks · 1

8174

3693

Sergey Pavlov

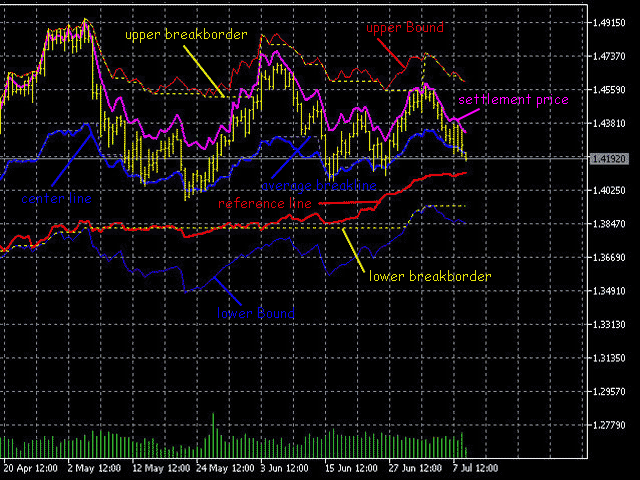

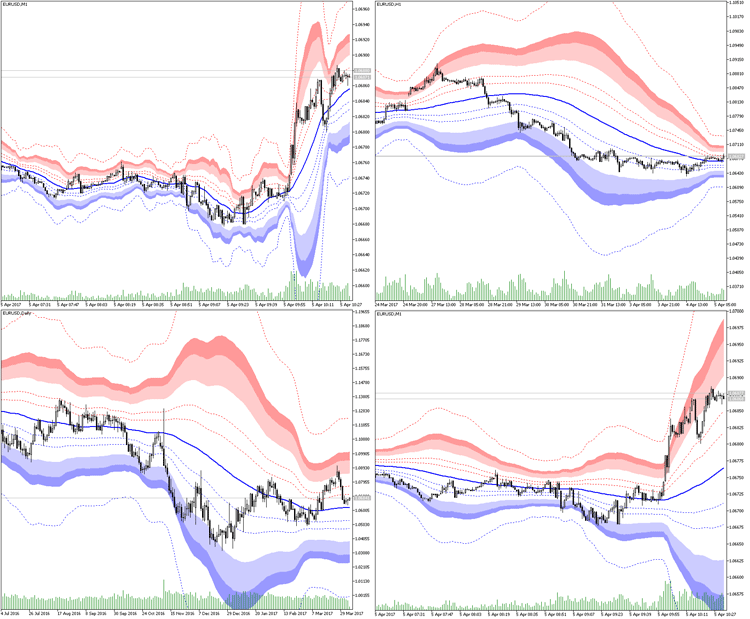

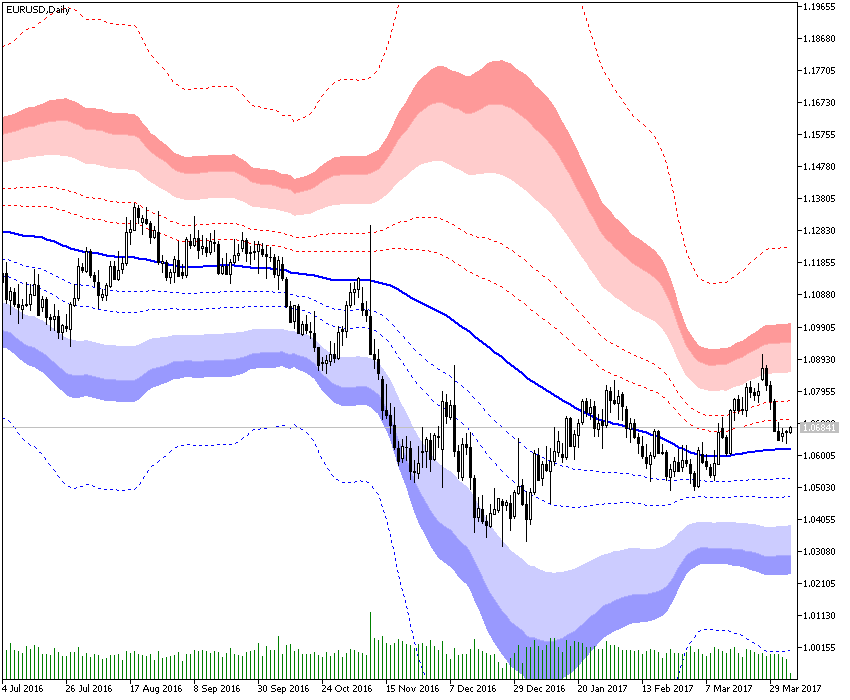

Published code Bollinger bands at Fibonacci levels

Bollinger bands at extended Fibonacci levels.

Share on social networks

20343

6197

: