Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.10.29 11:23

Weekly Fundamental Forecast for USD/CAD (based on the article)

USD/CAD Index - "Next week brings two major economic prints that could certainly add volatility into the Canadian Dollar. On Tuesday, GDP numbers will be unveiled and on Friday, at the same 8:30 release as U.S. Non-Farm Payrolls, Canadian employment data for the month of October will be released to markets. On Tuesday Canadian GDP for the month of August will be released, and of recent this has become a disconcerting data point for Canada after July’s contraction of -.4%; and this followed a 2nd quarter print that also saw GDP shrink by -.4%. The expectation for GDP is to come in at a gain of .2%, annualized at 1.3%. Should this come in below expectations, we’ll likely see some additional CAD weakness enter the picture as markets factor in a slightly-higher probability of an eventual increase in QE."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.01 13:39

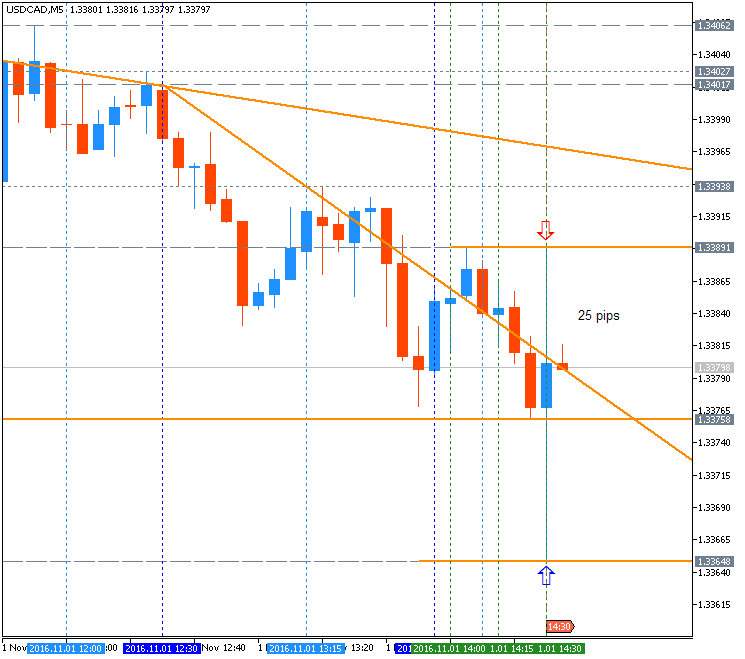

USD/CAD Intra-Day Fundamentals: Canada's Gross Domestic Product and 25 pips range price movement

2016-11-01 12:30 GMT | [CAD - GDP]

- past data is 0.5%

- forecast data is 0.2%

- actual data is 0.2% according to the latest press release

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report:

- "Real gross domestic product rose 0.2% in August, following a 0.4% increase in July. The output of goods-producing industries rose while service-producing industries were essentially unchanged."

- "The output of goods-producing industries grew 0.7% in August, with the

main contribution coming from mining, quarrying and oil and gas

extraction and utilities. Manufacturing and construction were also up,

while the agriculture and forestry sector was down."

==========

USD/CAD M5: 25 pips range price movement by Canada's Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.01 16:17

Intra-Day Fundamentals - EUR/USD, USD/CAD and USD/JPY : Manufacturing ISM Report On Business

2016-11-01 14:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 51.5

- forecast data is 51.8

- actual data is 51.9 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

image]

==========

EUR/USD M5: 23 pips range price movement by ISM Manufacturing PMI news events

==========

USD/CAD M5: 19 pips range price movement by ISM Manufacturing PMI news events

==========

USD/JPY M5: 33 pips range price movement by ISM Manufacturing PMI news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.02 19:35

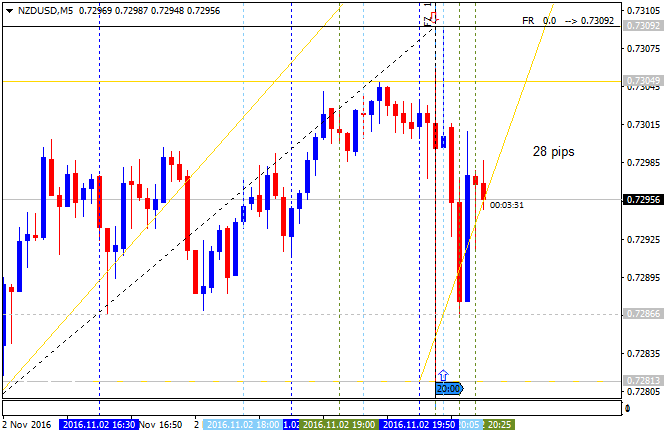

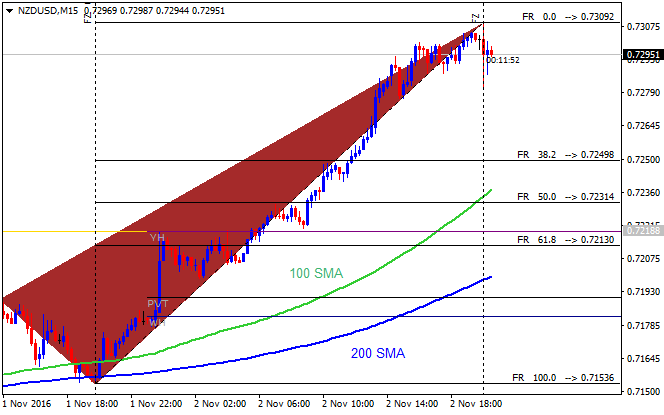

Intra-Day Fundamentals - EUR/USD, USD/CAD and NZD/USD : Federal Funds Rate and Federal Open Market Committee Statement

2016-11-02 18:00 GMT | [USD - Federal Funds Rate]

- past data is 0.50%

- forecast data is 0.50%

- actual data is 0.50% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From official report:

- "Inflation has increased somewhat since earlier this year but is still

below the Committee's 2 percent longer-run objective, partly reflecting

earlier declines in energy prices and in prices of non-energy imports.

Market-based measures of inflation compensation have moved up but remain

low; most survey-based measures of longer-term inflation expectations

are little changed, on balance, in recent months."

- "Against this backdrop, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The Committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation."

==========

EUR/USD M5: 29 pips range price movement by Federal Funds Rate news events

==========

USD/CAD M5: 19 pips range price movement by Federal Funds Rate news events

==========

NZD/USD M5: 28 pips range price movement by Federal Funds Rate news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.03 16:42

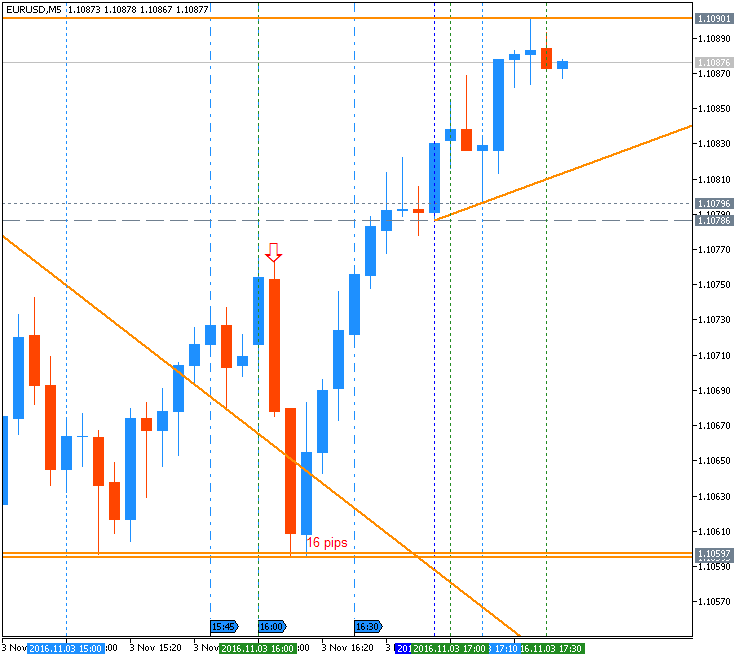

Intra-Day Fundamentals - EUR/USD and USD/CAD : The Institute for Supply Management Non-Manufacturing PMI

2016-11-03 14:00 GMT | [USD - ISM Non-Manufacturing PMI]

- past data is 57.1

- forecast data is 56.2

- actual data is 54.8 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Non-Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers, excluding the manufacturing industry.

==========

From official report:

"The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI®

registered 54.8 percent in October, 2.3 percentage points lower than

the September reading of 57.1 percent. This represents continued growth

in the non-manufacturing sector at a slower rate. The Non-Manufacturing

Business Activity Index decreased to 57.7 percent, 2.6 percentage points

lower than the September reading of 60.3 percent, reflecting growth for

the 87th consecutive month, at a slower rate in October."

==========

EUR/USD M5: 16 pips range price movement by ISM Non-Manufacturing PMI news events

==========

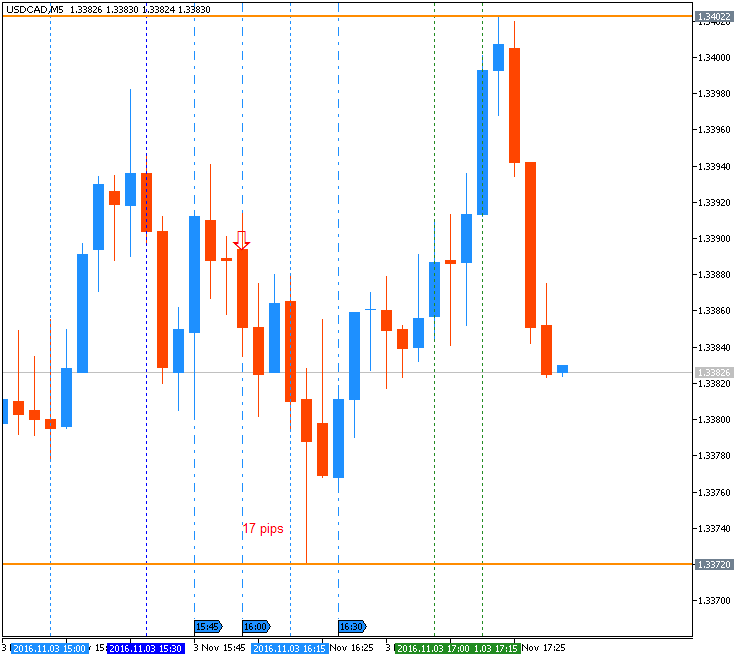

USD/CAD M5: 17 pips range price movement by ISM Non-Manufacturing PMI news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.04 13:52

Intra-Day Fundamentals - EUR/USD, USD/CAD and GBP/USD : Non-Farm Payrolls

2016-11-04 12:30 GMT | [USD - Non-Farm Employment Change]

- past data is 191K

- forecast data is 174K

- actual data is 161K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report:

"Total nonfarm payroll employment rose by 161,000 in October, and the unemployment rate was little changed at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in health care, professional and business services, and financial activities."

==========

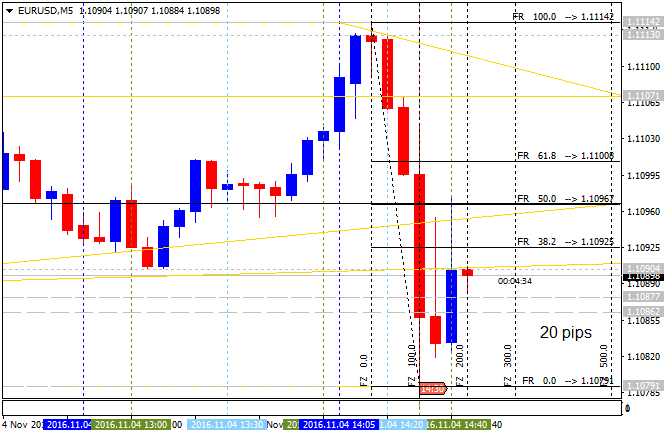

EUR/USD M5: 20 pips range price movement by Non-Farm Payrolls news events

==========

USD/CAD M5: 65 pips range price movement by Non-Farm Payrolls news events

==========

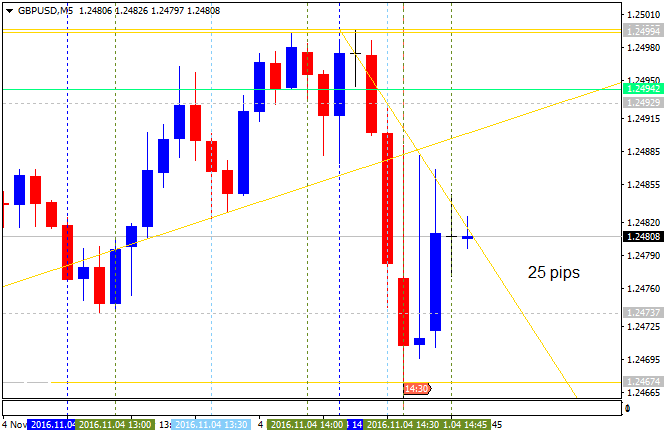

GBP/USD M5: 25 pips range price movement by Non-Farm Payrolls news events

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on located above Ichimoku cloud in the bullish area of the chart. The price is testing 1.3406 resistance level to above for the bullish trend to be continuing.

Ascending triangle pattern was formed by the price to be crossed to above for the bullish trend to be continuing, Trend Strength indicator is estimating the trend as a primary bullish in the future, and Absolute Strength indicator together with Chinkou Span line of Ichimoku are evaluating the future trend as ranging bullish.

If D1 price breaks 1.3229 support level on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If D1 price breaks 1.2999 support level on close bar so we may see the reversal of the price movement from the ranging bullish to the primary bearish market condition.

If D1 price breaks 1.3406 resistance level on close bar from below to above so the primary bullish trend will be continuing.

If not so the price will be on bullish ranging within the levels.

SUMMARY: bullish

TREND: daily bullish trend