Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.21 10:51

Forex Weekly Outlook Nov. 23-27 (based on the article)

The dollar struggled after the meeting minutes but certainly recovered. US and UK GDP, US Consumer Confidence, Durable Goods Orders stand out . These are the main events on forex calendar. Here is an outlook on the highlights of this week.

Te Federal Reserve released the minutes of the Committee meeting held in October, leaving the door open for a rate hike announcement in December. Investors reacted by increasing the odds for a rate increase next month to 72%. Policy makers were confident that the US economy is strong enough to withstand a modest policy tightening and expect the central bank will succeed to balance between full employment and stable two percent inflation.

- German Ifo Business Climate: Tuesday, 9:00. The Volkswagen scandal hardly affected German business optimism in October. The index for German industry and trade inched down to 108.2 points from 108.5 points in September, posting the first drop since June this year. Nevertheless, business outlook continued to rise from 103.3 in September to 103.8 in October, the highest level since June last year. However, current conditions fell from 114.0 to 112.6. Business sentiment is expected to reach 108.3 this time.

- US GDP data: Tuesday, 13:30. According to the initial release, the US economy slowed down to an annualized growth rate of 1.5% in Q3 2015, after seeing 3.9% in Q2. In this release, which is the second one, the figure is expected to be upgrade to 2%, still mediocre, but looking better.

- US CB Consumer Confidence: Tuesday, 15:00. U.S. consumer confidence worsened in October, deteriorated to a three-month low of 97.6. The reading dimmed prospects for a U.S. interest rate hike this year. Analysts expected the index to rise to 103.0 in October. The current conditions Index fell from 120.3 last month to 112.1 in October, while the outlook Index declined to 88.0 from 90.8 in September. U.S. consumer confidence is expected to rise to 99.3 in November.

- US Durable Goods Orders: Wednesday, 13:30. Orders for long lasting products continued to weaken in September for the fourth time in five months with orders contracting more than expected, down 1.2% from minus 2.0% in August. Meanwhile core orders excluding transportation declined 0.4% after a downward revised 0.9% decline in August. Automobile orders edged up 1.8% reversing a similar sized decline in August. Analysts expect Durable goods orders to edge up 1.6% in October, while core orders are expected to rise by 0.5%.

- US Unemployment Claims: Wednesday, 13:30. The number of Americans filing initial claims for unemployment benefits declined last week by 5,000 to 271,000, indicating a strong labor market. Claims have remained below the 300,000 threshold for 37 consecutive weeks, the longest stretch in years. The four-week average of claims increased by 3000 to 270,750. Economists expect payrolls will increase by at least 200,000 in November, which will give the Federal Reserve confidence to raise its short-term interest rate at the Dec. 15-16 meeting. The number of jobless claims is expected to reach 273,000 this week.

- UK GDP data: Friday, 9:30. The first estimate of UK growth in Q2 showed a level of 0.5%. While somewhat lower than previous quarters, this growth rate still pleases policymakers. A confirmation of this level is expected in the second release.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.22 19:31

Weekly Outlook for EUR/USD by Morgan Stanley (adapted from the article)

Morgan Stanley made a fundamental forecast for EUR/USD related to the price movement - they estimated for this pair to be in ranging bearish in the near future up to the year-end for example: "EUR is likely to remain an underperformer in the current environment. Monetary divergence between the ECB and the Fed should keep the currency under pressure. The main risk to our EUR view would be a selloff in risk into the first Fed hike. This would likely drive some repatriation and funding unwinds, which would support EUR given its funding status. Overall, we maintain our bearish view."

Let's evaluate this forecast from the technical point of view.

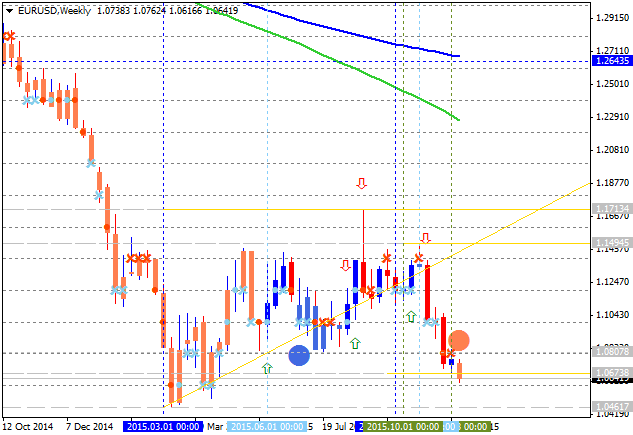

As we see from the chart above - weekly price is located below 100 period SMA (100 SMA) and 200 period SMA (200 SMA) for the bearish breakdown: the price is trying to break 1.0600 psy support level from above to below for the bearish breakdown to be continuing. And the next nearest target with this situation is 1.0461 support level.

- Recommendation for long: N/A

- Recommendation

to go short: watch D1 price to break 1.0600 support level for 1.0461 as the next bearish target.

- Trading Summary: bearish

| Resistance | Support |

|---|---|

| 1.1494 | 1.0461 |

| N/A | 1.0400 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.24 07:10

EUIR/USD: Looking for a move lower near 1.0590 and then 1.0461 (based on the article)

Barclays Capital made a quick technical EUR/USD forecast for this week: "We are looking for a move lower towards targets near 1.0520 and then the 1.0460 year-to-date lows." Let's evaluate this forecast concerning the technical point of view using Metatrader.

EUR/USD: bearish ranging near key reversal levels. Intra-day price (H1) is on bearish market condition located below 100 period SMA (100 SMA) and 200 period SMA (200 SMA) in the bearish area of the chart. The price is located within the following key reversal s/r levels:

- 1.0680 resistance level located between 100 SMA/200 SMA on the border between the primary bearish and the primary bullish trend on intra-day chart, and

- 1.0591 support level located far below 100 SMA/200 SMA in the bearish area of the chart.

Descending triangle pattern was formed by the price to be crossed for the bearish breakdown.

- if the price

breaks 1.0680 resistance so the reversal of intra-day price from the primary bearish to the primary bullish trend will be started;

- if the price breaks 1.0591 support level so the primary bearish will be continuing without ranging up to the new 'bottom' to be forming;

- if not so the price will be moved within the channel.

| Resistance | Support |

|---|---|

| 1.0644 | 1.0591 |

| 1.0680 | N/A |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.25 09:24

Forecast and Levels for EUR/USD (adapted from the article)

UOB Group made a forecast for EUR/USD concerning bearish trend resuming on daily price: "Only a daily closing below 1.0580 would indicate the start of a fresh bearish phase." Let's evaluate this forecast in technical point of view.

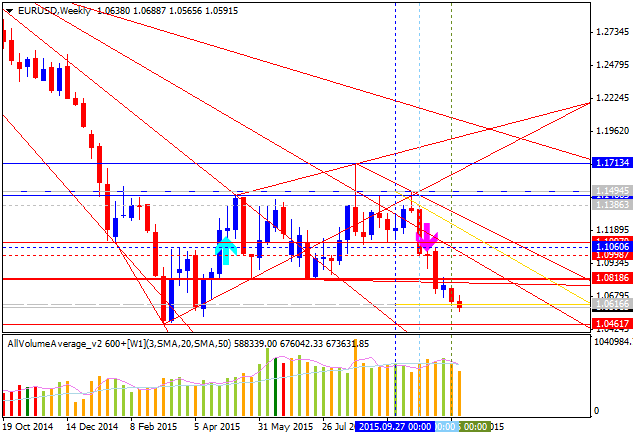

EUR/USD: bearish ranging. This pair is on primary bearish market condition located to be below 100 day SMA (100 SMA) and 200 day SMA (200 SMA) in the primary bearish area of the chart. Price is ranging within the following key support/resistance levels:

- 1.0807 resistance level; and

- 1.0591 support level.

RSI indicator's data is estimating the ranging bearish trend to be contining.

- if the price breaks 1.0807 resistance so the local uptrend as the bear market rally will be started with the good possibility to the bullish reversal of the price movement in the near future;

- if the price breaks 1.0591 support level so the primary bearish trend will be continuing up to 1.0461 level as the next bearish target;

- if not so the price will be moved within the channel.

| Resistance | Support |

|---|---|

| 1.0807 | 1.0591 |

| 1.1713 | 1.0461 |

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.26 16:30

Strategists See EUR/USD at 1.04-1.05 Ahead of December ECB Meet (based on the article)

Jeremy Stretch of CIBC World Markets Inc:

- "Since the October ECB statement the market has been increasingly

fixated by presumptions of a deposit rate cut of at least 10bp, this

being set against an extension in ECB balance sheet, beyond the current

September ’16 end date."

- "However, a report that the central bank may be considering a two-tier tiered system of charges for banks holding cash (similar to that utilised by the SNB), alongside presumptions of additional bond buying have encouraged a spike in the Euribor strip, a sharp widening in US-Bund spreads and an aggressive slide in the EUR."

- "Although the references to prospective ECB policy action are merely a reflection of non-attributable sources, the immediate market reaction underlines a broad negative bias."

- "Hence into the ECB meeting expect ’2015 lows at 1.0458 to remain in view."

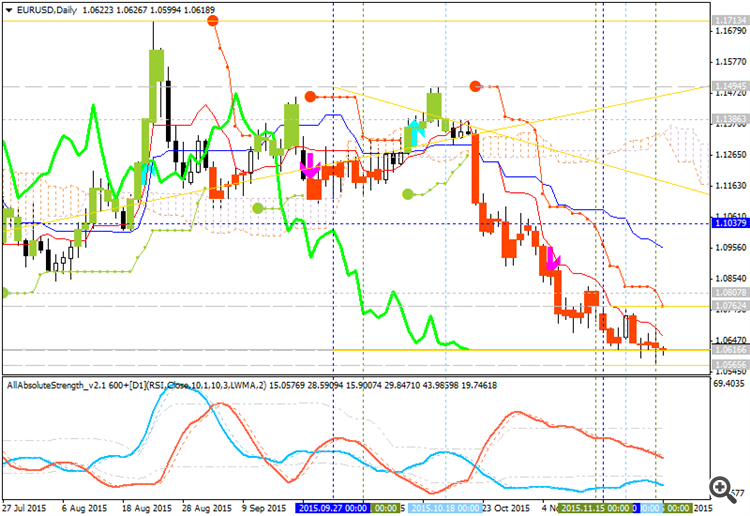

From the technical point of view - daily price is breaking 1.0616 support for the 1.0565 level as the next bearish target. According to forecasts made by strategists - the price will be ranging within 1.05/1.04 levels which means the following - the price will be located within the following key support/resistance levels:

- 1.0565 level, and

- 1.0461 level.

The strategy: watch close D1 price to break 1.0616 support level for possible sell trade with 1.0565 level as the next bearish target.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.11.27 11:52

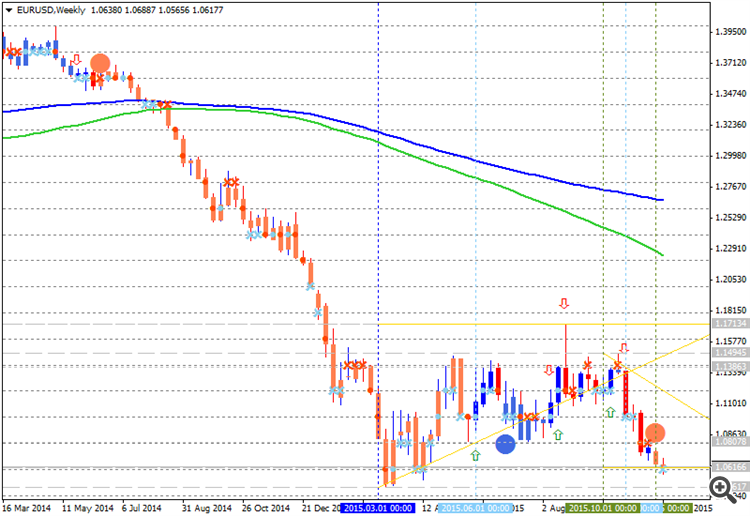

Outlooks For EUR/USD (adapted from the article)Skandinaviska Enskilda Banken (SEB) made a forecast related to EUR/USD with the stated that the pairs will be in more ups and downs: the price will break 1.05 and 1.04 support level before go up to 1.0830. It means the following: the price will be in ranging market condition with the following steps:

- price will continuing in the primary bearish condition for breaking 1.05/1.04 levels' area, and after that

- the price will start local uptrend as the bear market rally within the primary bearish condition with 1.0830 as the target.

As we see from the chart above - the price is on bearish market condition for the breaking 1.0616 support level from above to below for the bearish trend to be contining with 1.0461 level as the next bearish target. Thus, SEB nmade a forecast that the price may touch this 1.0461 level from above and bounce from it to 1.0818 resistance area on the 'downs and ups' way.

The Strategy: watch the price to go to be near 1.0461 level to open buy trade.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on the primary bearish market condition located below Ichimoku cloud and'reversal' Sinkou Span lines within the following key support/resistance levels:

- 1.0829 key resistance level, and

- 1.0461 key support level.

The price is trying to break 1.0616 support level from above to below for the bearish trend to be continuing.D1 price - bearish breakdown:

If D1 price will break 1.0461 support level on close D1 bar so the bearish trend will be continuing without secondary ranging.

If D1 price will break 1.0829 resistance level on close D1 bar so we may see the local uptrend as the bear market rally with the good possibility to the reversal of the price movement to the bullish market condition in the future.

If D1 price will break 1.1494 resistance level on close D1 bar so the price will be fully reversed to the bullish condition located to be above Ichimoku cloud in the bullish area of the chart.

If not so the price will be on ranging within the levels.

SUMMARY : bearish

TREND : bearish breakout