- How much does it cost to write a "complex" EA?

- Is my EA worth something? 11+ years backtested, if profit reinvested, total profit 38 371%

- EA scams

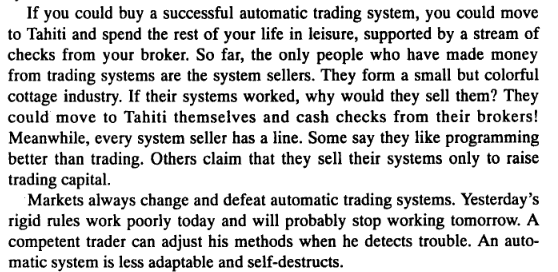

There is a difference between an EA that makes money, and Making money with an EA.

If you want to make money, i suggest you start by becoming a competent trader and,

read some of the finest literature available.

The problem is, that 99,9% of the people are either programmers OR traders. That it is like that, is proven already by the trading software systems themselves, not only EAs. I do not know ANY software that acts like a trader acts, not ANY software provides what´s really needed to trade manually efficiently, and I tested a lot on live-accounts. Assuming that I am not totally wrong, how can one expect, that an EA that costs nothing or just a few dollars can earn money? What costs nothing is worth nothing, this just by the way and solely this makes 99% obsolete, plus the 99,9% i claimed above and plus the fact, that I would not trust a programmer who cannot trade, so what remains in the list? Almost nothing, right, but not nothing.

I give you an example of an EA i am just finishing:

- Pair EUR/USD

- NO martingale

- NO grid

- NO scalping

- Defineable stop loss

- Uses fix take profit with limit orders

- Defineable progression

- Catches upcoming trends and trades pullbacks - after - news

- Trades on finished candles in M5, ticks are only used to figure out if it´s time to get rid of wrong trades, therefore the real ticks are not that important in backtesting here

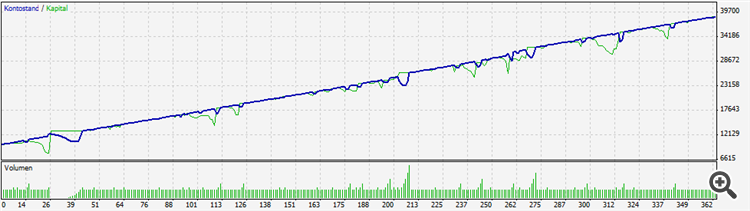

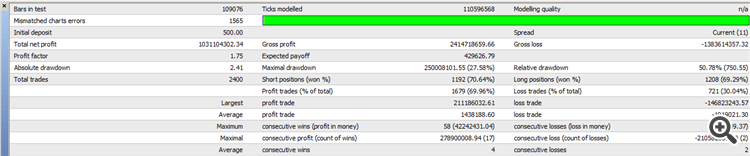

- One can choose between several risks. The graph below shows the maximum risk settings, which ends up in a profit of <>300% p.a. while the max DD is 25%. The lower the DD, the lower the result, of course.

- One can always intercept, add trades, remove trades and so on, also during visual strategy testing. The graph below results of a a full automated trading, no interception.

- The backtest includes the 15th of January 2015 and all other (bad) news days of the year. Easy to detect on the falling equity curve

- There is no curve fitting at all, no optimization at all, and a fixed spread of 20 (2 pips) was used here. With a spread of 50, which should cover worst case slippages too, the result is 50% lower, but still 250%.

.... and by the way: I can both: Trading & programming, but I don´t like Tahiti.

I can let you know when and if I am going to realease it to the public, but please don´t expect that I will cost only 20 USD.

Doerk

Maybe you´ve overlooked this part: "I am just finishing".

Of course I will start it on real accounts, but it will take a year to show the results. And that backtesting always means nothing, is not true. It means nothing in scalping in low timeframes, because the order execution in the tester is optimal, while on a real account it´s simply real. And it means nothing when you optimize all circumstances, because the market will give you events that you and your EA never expected. That´s why I do not do any curve fitting, because that makes no sense at all and is a kind of betraying yourself and the rest of the world. It´s totally easy to fit the curve by simply avoiding the bad trades after backtesting or optimize those trades, but these first results above are totally raw and of course it starts almost with a worst case scenario in january, and not at a time where everything was smooth. Anyway, I would not recommend to start the EA with the full risk settings, even when the DD is just 20%. I would use the half of the risk, cause nobody knows what´s gonna happen in the future.

Why don't you try that on a real account, and then show it's results... ?

It is easy to generate these results and images, they mean nothing at all.

Hey Marco I know there are unrealistic result, backtest can mean nothing.

But if the EA can't even work in backtest, do you expect it will profitable in real world?

Very good question.

I can tell you these two things,

#1. Things that do not work, or, can not be tested with the tester, can work excellent on live market feeds,

#2. Anything that performs real well in the tester, is most likely to fail on live market feeds.

So this leaves you with a few choices.

Maybe you´ve overlooked this part: "I am just finishing".

Of course I will start it on real accounts, but it will take a year to show the results. And that backtesting always means nothing, is not true. It means nothing in scalping in low timeframes, because the order execution in the tester is optimal, while on a real account it´s simply real. And it means nothing when you optimize all circumstances, because the market will give you events that you and your EA never expected. That´s why I do not do any curve fitting, because that makes no sense at all and is a kind of betraying yourself and the rest of the world. It´s totally easy to fit the curve by simply avoiding the bad trades after backtesting or optimize those trades, but these first results above are totally raw and of course it starts almost with a worst case scenario in january, and not at a time where everything was smooth. Anyway, I would not recommend to start the EA with the full risk settings, even when the DD is just 20%. I would use the half of the risk, cause nobody knows what´s gonna happen in the future.

I was quite clear when i said, it means NOTHING AT ALL.

And that's exactly what it is.

Maybe you didn't reach that point yet, but you will.

Have you ever taken into consideration that your very personal experience and meaning is just your very personal experience and very personal meaning and nothing more? This leads me directly to option #3.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use