Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.11 01:32

Week Ahead by Crédit Agricole (based on efxnews article)

"Next week could prove pivotal for the policy divergence trade with important releases out of the US and the UK likely to determine whether the recent aggressive repricing of Fed and BoE rate hikes has been justified. We think that the US activity and inflation data as well as the UK inflation and labour market data will highlight that investors may have overreacted selling USD and GBP of late. At the same time, we think that data out of Japan should strengthen the case for more QE at the end of the month (CACIB’s central case) and weaken JPY."

What we’re watching:

JPY - "CACIB economists have front-loaded their call for BoJ QE to 30 October from January 2016. We revised our year-end forecast for USD/JPY higher to 125 from 123 previously."

USD - "Better-than-expected data may bring expectations of the Fed considering higher rates this year back on the agenda."

GBP - "Still constructive labour market conditions as reflected in next week’s data should prevent rate expectations from falling further."

AUD - "Disappointing labour data should keep RBA rate expectations strongly capped. We remain in favour of selling AUD rallies."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.12 08:56

EUR/USD: calm before storm - Barclays (based on efxnews article)

Barclays made a fundamental forecast for EURUSD expecting big volatility for this pair and for USD/JPY as well:

-

"Last week saw a significant improvement in global risk sentiment,

benefitting risky assets, despite soft data prints and cautious central

bank rhetoric (Figures 1 and 2). However, the market is likely heading into an environment of lower growth, soft inflation and additional policy stimulus."

- "Central bank rhetoric is starting to reflect this new reality. The September FOMC minutes showed that the decision not to hike was not a close call, though some FOMC participants had described it as such.. At the same time, the ECB highlighted downside risks to euro area growth and inflation while the BoE also erred on the side of caution."

- "We look for the ECB to announce further easing before year-end and have frontloaded our call for additional BoJ easing at its 30 October meeting."

-

"Strategically, we like being long USD heading into those central bank meetings."

-

"In line with this view, we maintains a short EUR/USD position in its portfolio from 1.1278, with a stop at 1.1562, and a targets at 1.0460."

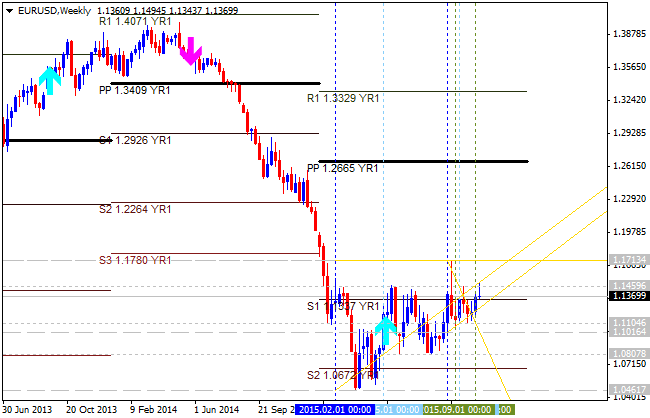

So, Barclays is still keeping sell position with 1.0460 take profit and stop loss as 1.1562. And as we see from the chart above - the price is on bearish market condition for the secondary ranging within 1.0461 key support level and 1.1713 key resistance level, so 1.0460 may be the real bearish target at year-end for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.13 08:57

EURUSD Intra-Day Fundamentals - ZEW Economic Sentiment (based on efxnews article)

Credit Agricole made a fundamental forecast concerning ZEW news event - German ZEW Economic Sentiment and ZEW Economic Sentiment. It's a leading indicator of economic health - investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity:

- "Investors will focus on the German the ZEW index for October. ZEW should point at some worsening in business sentiment on account of China, VW and, more recently, Deutsche Bank. We expect the former to be a longer-term drag on business sentiment in the Eurozone’s growth engine."

- "Indeed, recent trade and industrial orders data has already signalled that the German exporters are struggling in the face of the global demand shock emanating from China."

- "A disappointing ZEW today could add to the worries in the market. All that said, however, with the ECB still not actively considering more easing measures, there need not be an immediate impact on EUR."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.14 09:47

EURUSD Intra-Day Fundamentals - USD Into Retail Sales (based on efxnews article)

BNP Paribas made fundamental forecast concerning Retail Sales news event for today:

- "They expect only a flat reading in total retail sales although the control group sales should come in at a more respectable pace of 0.3% m/m. They also expect softer producer prices ahead of what should be similarly soft headline CPI numbers on Thursday."

- "That said, the September payrolls report and dovish Fed communications have already lead to an even further pullback in US rates, with the amount of priced in Fed tightening now in line with the most dovish FOMC policymakers."

-

"This, as well as lighter positioning, should make the USD less vulnerable to bad news."

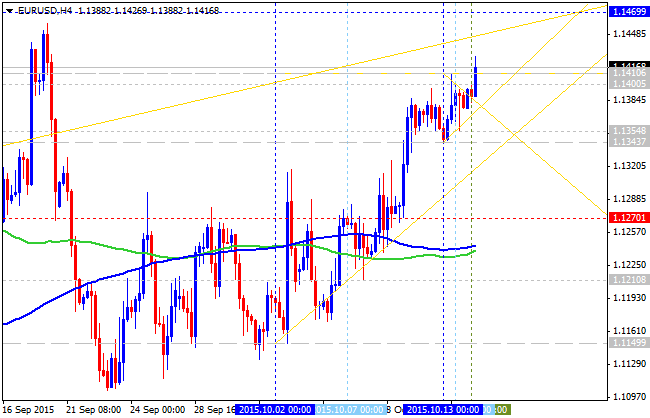

From the technical points of view - the price is located to be above 200 period SMA and above 100 period SMA for the bullish breakout: the price broke key resistance levels in intra-day basis and stopped near 1.1469 level. If the price will break this 1.1469 resistance level from below to above so the bullish breakout will be continuing, otherwise - ranging bullish.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.15 11:11

Outlooks For EUR/USD: Sell Signal - SEB (based on efxnews article)

Skandinaviska Enskilda Banken made a technical forecast for EUR/USD pair related to intra-day and day basis:

- "The buyers continued to be in control pushing prices up

close to the 1.15 handle. With 1.1476 achieved also the ideal target

point for a three wave upside correction (from the early Sept low

point), a-b-c, has been fulfilled. So if the past month and a half is a

corrective climb, well then it should end right here and now."

- "We are keeping a close eye on 1.1461 as its break kicks off an hourly sell signal and confirming an hourly RSI bear divergence."

Thus, SEB is estimating two key levels for this pair: 1.14 in intra-day base and 1.15 on long term situation. Anyway, the bearish AB=CD pattern was formed on W1 timeframe together with the bearish retracement pattern so we can expect more bearish situation with this pair in the few coming weeks for example.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2015.10.16 09:35

3 reasons to sell EUR/USD - BNP Paribas (based on efxnews article)

BNP Paribas suggested to make a short with EUR/USD with 1.0900 target and 1.1630 stop loss, and it is based on 3 fundamental reasons:

- "Further risk-on – Eurozone capital outflows resume and markets start to reprice Fed hikes = EURUSD lower."

-

"Stable risk – Without a strong impulse from risk

sentiment, the eurozone’s trade surplus is probably still putting some

natural upward pressure on EURUSD. But with valuations already

expensive, EUR funding should be more attractive = no clear signal for

EURUSD."

-

"Return of risk-off – EURUSD continues to rally,

which forces the ECB to step up dovish rhetoric and ultimately ease

policy = EURUSD first higher, then lower."

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is on bullish reversal condition for breaking 1.1326 resistance level from below to above with the following key support/resistance levels:

Intermediate s/r levels for this pair on the way to the key s/r are the following:

D1 price - ranging:

If D1 price will break 1.1086 support level on close D1 bar so the bearish market condition may be started.

If D1 price will break 1.0924 support level on close D1 bar so we may see the bearish breakdown.

If D1 price will break 1.1459 resistance level on close D1 bar so the bullish breakout be continuing up to 1.1713 as the next bullish target.

If not so the price will be on ranging within the levels.

SUMMARY : breakout

TREND : bullish reversal