newdigital, 2013.11.22 19:06

Breakout with Ichimoku (based on Take Advantage of False Breakouts at Great Prices with Ichimoku article)

Talking Points:

- What is a False Breakout?

- How Ichimoku Can Help You Recognize a False Breakout

- Trading Opportunity in EURUSD with Ichimoku on Recent Move

What is a False Breakout?

A false breakout takes place when price appears to be making a renewed move in the direction of the trend only to be retraced. A trend trader who is looking for prices to eventually move higher but wants confirmation of a price thrust in the direction of the trend is especially prey to false breakouts. This is because a break of resistance like a trendline that is pierced by price without follow through is ground zero to a false breakout.

How Ichimoku Helps You Recognize a False Breakout

Like many pains of trading such as stops getting hit at an unfortunate price, false breakouts cannot be avoided. However, they can be minimized as well as become a nice trading signal upon their failure. The reason I like looking to false breakouts as a trading opportunities is that they can often have a sharp reversal in the direction of the prior move with a good risk to reward ratio.

Ichimoku is a technical trading system that helps you catch moves in the direction of the trend on the time frame that you’re trading. Ichimoku is often seen as a difficult system to learn due to the 5 components that are displayed on the chart to explain a trading opportunity but each line serves a purpose and when you understand each purpose, you begin to get a feel for the value that Ichimoku can bring to your technical trading strategy.

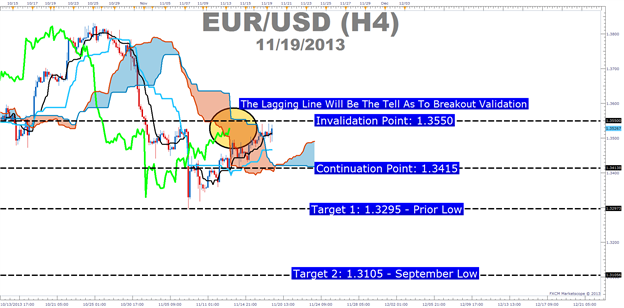

- Ichimoku Trade: Sell EURUSD If Price Breaks Below 1.3415 Showing a False Breakout Occurred

- Stop: 1.3550 (Technical Invalidation Point on the Chart)

- Limit: 1.3295 (Monthly Low)

If this is your first reading of the Ichimoku report, here is a recap of the traditional rules for a sell trade:

- Price is below the Kumo Cloud (That will be our entry trigger)

- The trigger line (black) is below the base line (light blue) or is crossing below

- Lagging line is below price action from 26 periods ago (bright green line)

- Kumo ahead of price is bearish and falling (red cloud = bearish Kumo)

If the breakout turns out to be legitimate and 1.3550 is taken out, then the next target would be in the neighborhood of 1.3630 /3650 range.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.07 07:56

Watch Price In Relation To Ichimoku Cloud (adapted from dailyfx article)

- Price & Cloud Relationships

- Price Bouncing Off Cloud Shows You A Well-Supported Trend

- An Example Ichimoku Trade with USDJPY

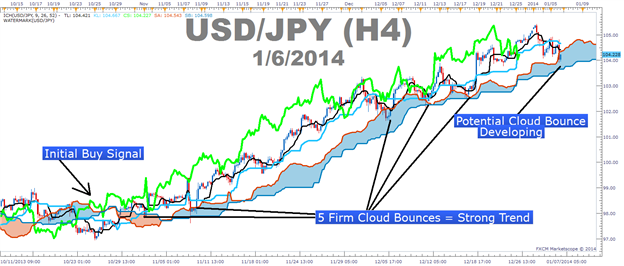

Ichimoku is a trend following indicator that almost anyone can learn to use with ease. When trading with Ichimoku, you’re often advised to start with the cloud to get a feel for whether or not price is trending up or down to past points on the chart. However, to get a better feel for the strength of the trend, it is better to see how price is reacting to the cloud rather than only looking where price is in relation to the cloud at any point in time.

Price & Cloud Interactions

USDJPY Has Demonstrated a Strong Trend Due To Multiple Cloud Bounces:

The cloud is a dynamic indicator that takes into consideration two aspects of a currency pair. In an uptrend, the top line of the cloud, traditionally known as Senkou Span A is composed of the mid-point between the 9 & 26 moving average based on mid-prices, or Tenkan-Sen & Kijun-Sen, and pushed forward 26-periods in order to give you a reference for the strength of a move. If current price is above the cloud, then current price is stronger than the mid-point of the 9 & 26 moving average from 26-periods ago, identifying the strength of the current trend.

The cloud’s bottom line in an uptrend, traditionally known as Senkou Span B, is composed of the mid-point over the last 52-periods on the chart and is also pushed forward 26-periods just like the top line. Therefore, if the current candle is above the cloud, which was created from 26-periods ago, then you can see that price is above both the mid-point of the 9 & 26 moving average as well as the mid-point over the last 52-sessions.

Price Bouncing Off Cloud Shows You a Well-Supported Trend

The key point of this article is that it’s not enough to simply know where price is in relation to the cloud to have a strong trend based trade. What you need to do is see if price is consistently on one side of the cloud or if price flips on either side of the cloud showing a very weak or non-existent trend. If there is no consistency with price and is consistently bouncing higher off the cloud proving the cloud as support and that the uptrend is strong, then it is best to take Ichimoku off your charts as Ichimoku doesn’t work well in ranges and will likely only clog up the charts if there is no clear trend.

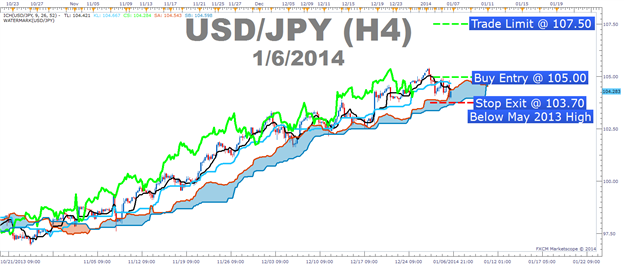

A Cloud & Price Example Trade with USDJPY

Entry to Buy: 105.00 (Breakout through resistance)

Stop: 103.70 (recent price action low and below May 2013 High – Pivotal Support)

Limit: 107.50 (Monthly R2 Pivot)

If this is your first reading of the Ichimoku report, here is a definitive guide on the versatile indicator:

- Full Candle Bodies above the Kumo Cloud

- The trigger line (black) is above the base line (light blue) or is crossing below

- Lagging line is above price action from 26 periods ago (Bright green line)

- Kumo ahead of price is bullish and rising (blue cloud = bullish Kumo)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

3XMA_Iсhimoku:

Author: Nikolay Kositsin