I'm keen on learning how to use ALGLIB.

However, all the articles I have read so far were teaching too many things at once for me to confidently follow along. Like there's theory in there about SVM, Neural Networks, Grokking Market Memory (I don't even know what that means bro).

It's too much for me, honestly. Do you know any code bases accomplishing simpler tasks with ALGLIB in MQL5? Like even the humble linear regression or classical constrained portfolio variance optimization.

I'm the type of person who prefers a simpler example first, once I've grasped and mastered the simpler use cases, I'll move on to applying it to more complicated problems. For now, I just want to understand the ALGLIB API, how I call it and use it. But trying to learn that, and SVM theory at the same time, kills me. I know that normally we are supposed to share the code we have written so far, but guys I've been reading these articles and I feel even more confused now, than I did when I woke up this morning. Thank you.

You already have MT5, which provides built-in functions for tasks like linear regression and optimization. Why do you need ALGLIB specifically?

Are there certain features in ALGLIB that you're looking to use which aren't available in MT5?

You already have MT5, which provides built-in functions for tasks like linear regression and optimization. Why do you need ALGLIB specifically?

Are there certain features in ALGLIB that you're looking to use which aren't available in MT5?

Hey, I'd like to use the optimization algorithms in the ALGLIB Library, like L-BFGS-B.

We could, for example, create a cost function that returns the RMSE of a linear model on training data. The vector of coefficients could be estimated using L-BFGS-B or any other unconstrained global optimization procedure implemented in ALGLIB.

After solving this toy problem, we could use the algorithm to solve other, more interesting problems.

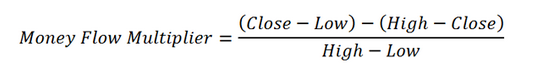

Like here is a problem I think could be more interesting: We could create customized models for forecasting indicator values. Most machine learning models, do not take into account the structural form of the indicators we use. Imagine if we were trying to forecast the Money Flow Multiplier. We could try to build a model that takes into account the formulaic shape of the calculation being performed.

I don't know if this will necessarily yield better accuracy, but I believe it's worth a check. Therefore, instead of using a model that's trying to generalize well to all possible data sets, we could build a new type of model that has 1 coefficient for each price variable being used by the indicator. But how would we find optimal values for these coefficients? ALGLIB.

I hope I'm expressing the idea in a meaningful way.

Fig 1: The Money Flow Multiplier Formula.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

I'm keen on learning how to use ALGLIB.

However, all the articles I have read so far were teaching too many things at once for me to confidently follow along. Like there's theory in there about SVM, Neural Networks, Grokking Market Memory (I don't even know what that means bro).

It's too much for me, honestly. Do you know any code bases accomplishing simpler tasks with ALGLIB in MQL5? Like even the humble linear regression or classical constrained portfolio variance optimization.

I'm the type of person who prefers a simpler example first, once I've grasped and mastered the simpler use cases, I'll move on to applying it to more complicated problems. For now, I just want to understand the ALGLIB API, how I call it and use it. But trying to learn that, and SVM theory at the same time, kills me. I know that normally we are supposed to share the code we have written so far, but guys I've been reading these articles and I feel even more confused now, than I did when I woke up this morning. Thank you.