Discussing the article: "Neural networks made easy (Part 73): AutoBots for predicting price movements"

THIS is Second to THE BEST Article So far! <3

Hello. There are already five Expert Advisors in the folder. Could you tell me in what order you ran them?

0. ResearchRealORL.mq5 - we run it at the very beginning (not necessarily) for the initial collection of trajectories. But before launching it, you need preparatory work to collect real passages from signals or other sources. The process is described in article 67

1. research.mq5 - run for initial collection of trajectories by random policies and updating the database of examples after each iteration of policy training. Requires at least 1 pass in the example database.

2. StudyEncoder.mq5 - run "once for a long time" to train the trajectory prediction model.

3. Study.mq5 - run iteratively with Research.mq5 to train Agent policy. Requires a database of primary examples and a trained trajectory prediction model.

4. Test.mq5 - used to test the trained policy in the strategy tester.

- www.mql5.com

.... Also. Links to past articles have become like multiple Goto's to throw off the trail.

I can't give a complete list of the series. Some of the articles are listed under "Other articles by the author". And the full list can be found in a search.

There is no StudyEncoder.mq5 in the folder. But there is Alternate and Study Traj, which you don't mention.

I apologise, StudyEncoder was in the previous article. In this one it is renamed StudyTraj. The previous one taught the compressed representation of the trajectory in Autoencoder. And Autobot study returns the trajectory.

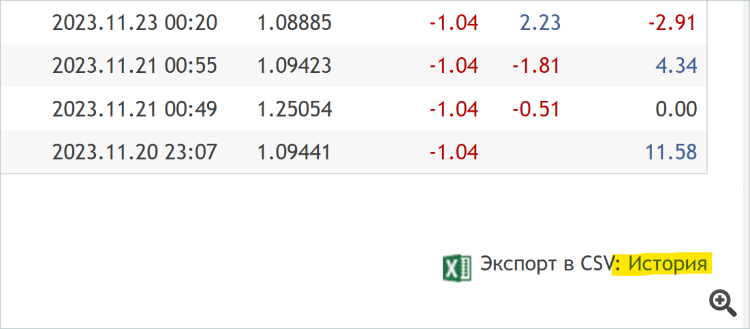

Alternate - used in the test to check the accuracy of trajectory prediction. In it, we simply take the trajectory predicted by Autobot, determine the nearest extremum on it and make a trade in its direction with a minimum lot.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Check out the new article: Neural networks made easy (Part 73): AutoBots for predicting price movements.

We continue to discuss algorithms for training trajectory prediction models. In this article, we will get acquainted with a method called "AutoBots".

Effectively predicting the movement of currency pairs is a key aspect of secure trading management. In this context, special attention is paid to developing efficient models that can accurately approximate the joint distribution of contextual and temporal information required for making trading decisions. As a possible solution to such tasks, let's discuss a new method called "Latent Variable Sequential Set Transformers" (AutoBots) presented in the paper "Latent Variable Sequential Set Transformers For Joint Multi-Agent Motion Prediction". The proposed method is based on the Encoder-Decoder architecture. It was developed to solve problems of safe control of robotic systems. It allows the generation of sequences of trajectories for multiple agents consistent with the scene. AutoBots can predict the trajectory of one ego-agent or the distribution of future trajectories for all agents in the scene. In our case, we will try to apply the proposed model to generate sequences of price movements of currency pairs consistent with market dynamics.

Author: Dmitriy Gizlyk