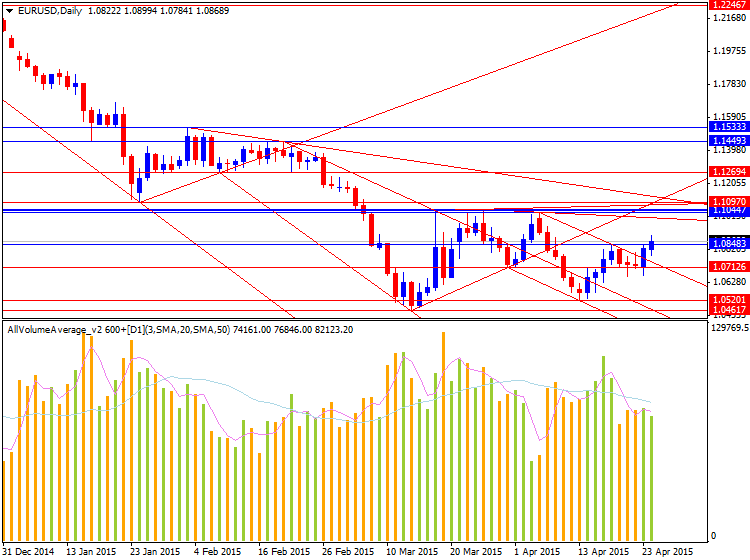

EURUSD Technical Analysis 2015, 19.04 - 26.04: Bear Market Rally with good reversal possibilities to primary bullish with 1.0461/1.0954 levels - page 2

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.23 10:33

2015-04-23 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Manufacturing PMI]if actual > forecast (or previous data) = good for currency (for EUR in our case)

[EUR - Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

==========

Commenting on the flash PMI data, Chris Williamson, Chief Economist at Markit said:“The weaker rate of expansion is a big disappointment, given widespread expectations that the ECB’s quantitative easing will have boosted the fledgling recovery seen at the start of the year. However, it’s too early to draw firm conclusions about whether growth is faltering again and the effectiveness of policy. Although the PMI has pulled back from March’s recent high, the index remains above the average seen in the first quarter and is indicative of the eurozone economy growing at a reasonably robust quarterly rate of 0.4% at the start of the second quarter. "

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.04.23

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 40 pips price movement by EUR - Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.23 17:50

EURUSD Mid-Day Outlook (based on actionforex article)

Daily Pivots:

No change in EUR/USD's outlook in spite of the mild recovery today. Consolidation pattern from 1.0461 is still in progress and stronger rise cannot be ruled out. But near term outlook stays bearish as long as 1.1096 support turned resistance holds and downside breakout is expected. Below 1.0461 will extend larger down trend to next fibonacci level at 1.0283.

In the bigger picture, overall price actions from 1.6039 long term top is viewed as a corrective pattern. Fall from 1.3993 is the third leg of such pattern and should target 100% projection of 1.6039 to 1.2329 from 1.3993 at 1.0283 next. On the upside, break of 1.2042 support turned resistance is needed to indicate medium term reversal. Otherwise, outlook will stay bearish.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.24 05:52

EUR/USD, USD/JPY - Goldman Sachs (based on fxnews article)

Goldman Sachs updates its outlook on EUR/USD and USD/JPY noticing that the latest messages form the ECB and BoJ seem to be 'lost in translation'. The following are the key points in GS' note along with its latest forecasts for EUR/USD and USD/JPY.

1- "When central banks are implementing QE – as the ECB and Bank of Japan clearly are – they deliver two basic messages. First, they comment on whether the current pace of asset purchases is still appropriate and, when it isn’t, they provide more accommodation, as the BoJ did in October. Second, because QE is controversial, they sing the praises of asset purchases, pointing to rising inflation expectations and an improving growth picture," GS argues.

2- "We think this is what happened towards the end of the ECB press conference on Apr. 15, when President Draghi made favorable comments on the inflation and growth picture. The market heard exit, but in our view this is a clear case of “lost in translation." GS adds.

3- "After all, President Draghi earlier in the press conference argued forcefully that focus on early exit is premature and that having this debate now is like “quitting a marathon after 1k.” Our European economists continue to expect “full implementation” of ECB QE, meaning an unchanged pace of asset purchases through at least Sep. 2016. This is key to our view that a cyclical recovery in the Euro zone is not a force for EUR/USD higher," GS clarifies.

4- "There was more “lost in translation” in Governor Kuroda’s speech on Apr. 19. The market picked up headlines that “the underlying trend of inflation has improved markedly,” but the more important message in the speech, in our opinion, is that low inflation momentum is threatening to pull inflation expectations lower (Exhibit 4), which will then set the stage for additional monetary easing," GS notes.

5 "Our Japan Chief Economist forecasts additional stimulus for July by way of duration extension of JGB purchases (akin to "Operation Twist" in the US). Given how small speculative long $/JPY positioning now is, we think there is room for the market to catch up with real story in Japan, which is that another round of monetary easing is coming," GS adds.

GS targets EUR/USD at 1.00 in 6-months and USD/JPY at 125 over the same end of period.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.24 12:32

Trading the News: U.S. Durable Goods Orders (based on dailyfx article)

A 0.6% rebound in orders for U.S. Durable Goods may heighten the appeal of the greenback and spur a bearish retraction in EUR/USD as it raises the fundamental outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Signs of a stronger recovery may encourage bets for a mid-2015 Fed rate hike, but the recent slew of weaker-than-expected data prints may encourage the central bank to further delay its normalization cycle in an effort to combat the ongoing slack in the real economy.

However, fading discounts along with the ongoing weakness in household spending may drag on orders for durable goods, and a dismal print may dampen the appeal of the greenback as it raises the Fed’s scope to retain its current policy beyond mid-2015.

How To Trade This Event Risk

Bullish USD Trade: Orders Rebound 0.6% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: Demand for Durable Goods Falter- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEURUSD Daily Chart

Orders for U.S. Durable Goods unexpectedly shrank 1.4% in February following a revised 1.9% expansion the month prior. The contraction was largely drive by a drop in transportation, with demand for non-defense aircrafts slipping 8.9% from the previous month. The slowdown in private-sector consumption may become a growing concern for the Fed as lower energy costs fail to boost household spending, and the central bank may look to further delay its normalization cycle in an effort to encourage a stronger recovery. Despite the weaker-than-expected prints, the initial market reaction was rather limited as EUR/USD struggled to hold above the 1.1000 handle during the North American trade to end the day at 1.0973.

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.04.24

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 64 pips range price movement by USD Durable Goods Orders news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2015.04.25 09:17

The Biggest EURUSD Resistance Test of the Year ( based on dailyfx article)

“EURUSD rolled over at slope resistance but several longer term technical observations are worthy of note; the rate found low at an important long term level (line off of 2008 and 2010 lows) and the ownership profile (as per COT) is at a record. The speculative crowd has never been more bearish…ever. Such conditions typically precede important reversals…although not necessarily right away. A break above the resistance lines (old support) would indicate that behavior has significantly changed and open up a run on 1.13.” It is decision time traders.