EURUSD Technical Analysis 2015, 12.04 - 19.04: Bearish Breakdown with 1.0461 Next Key Support Level

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.10 19:22

Forex Weekly Outlook Apr. 13-17 (based on forexcrunch article)

The US dollar managed to stage a recovery after the previous blows,

especially against the majors. A busy week awaits traders with US

inflation and consumer data as well as rate decisions in Canada and the

euro-zone among other events. Here is an outlook on the highlights of

this week.

US data began recovering and the dollar followed. The ISM

Non-Manufacturing PMI was OK and JOLTs beat expectations. But it was the

meeting minutes that provided the greenback with the biggest push: they

revealed that in March, some members talked about hiking in June.

Despite the known fact about the existence of hawks and the timing of

the meeting before the weak NFP, the greenback soared. It probably

remains the cleanest shirt in the dirty pile. Elsewhere, Greek worries

weighed on the euro, elections worries hurt the pound and the yen also

slid. The Aussie stood out, enjoying yet another “no change” decision by

the RBA.

- UK CPI: Tuesday, 8:30. Inflation in the UK reached a flat 0% in February, a figure that alarmed many. Will Britain enter deflation? This could push back any potential rate hike for even longer and also cast its shadow on the euro-zone. Official expectations stand on another 0% read y/y.

- US Retail Sales: Tuesday, 12:30. For a third consecutive time, retail sales squeezed and disappointed. The fall of 0.6% in February will likely be followed by a bounce in March of 1.1%. Also core sales have followed the same pattern with a drop of 0.1% in February. Also here, a bounce is on the cards: +0.7%.

- US PPI: Tuesday, 12:30. Producer prices serve as a warm up to consumer prices. After a drop of 0.5% in both headline and core figures in February, rises are expected in both, 0.2% and 0.1% respectively, especially as oil prices have stabilized.

- Chinese GDP: Wednesday, 2:00. The world’s No. 2 economy has grown at a pace of 7.3% in Q4 2014 and is expected to experience slower growth in Q1. Some say it is inevitable and others say it is wisely engineered by the leadership. Growth in China closely impacts Australia but certainly has implications for the entire world. A slide to 7% y/y is on the cards and as authorities wish to see.

- Euro-zone rate decision: Wednesday, decision at 11:45, press conference at 12:30. In the last meeting by the ECB in early March, Draghi showed determination in implementing the QE program announced in January. Implementation has begun and it is going well. The Bank made it clear that success of the euro-zone in general and particularly regarding inflation depends on full implementation. Will he continue the same determination? If so, the euro would feel the weight. If optimism rises due to the recent signs of growth, we could see the common currency rise. The interest rate is expected to remain unchanged at 0.05% with a negative deposit rate of 0.20%. The latter serves as the lower bar for buying bonds in the QE program

- Canadian rate decision: Wednesday, 14:00. The Bank of Canada left the interest rate unchanged at 0.75% and is expected to do so once again. After the surprise cut in January, Poloz and his team seemed more optimistic about the economy and hinted that this was not the beginning of a new loosening cycle. How will they sound now? Worries about Q1 growth could be echoed in the statement. Note that the release is followed by a press conference at 15:15.

- Australian employment data: Thursday, 2:30. Australia enjoyed job growth in February: 15.6K jobs were added. Also the unemployment rate went in the right direction and dropped to 6.3%. In the bigger scheme of things, unemployment is still on the rise and is likely to rise later on in the year. Very similar number are expected now: a gain of 15.1K jobs and an unemployment rate of 6.3%.

- US housing data: Thursday, 12:30. These figures went in different directions: building permits rose to a promising 1.09 million (annualized) in February, while housing starts stood on 0.90 million. The latter can be blamed on the cold winter weather, while the former is more forward looking. Building permits are expected to stand at 1.08 million (annualized) and housing starts to bounce back to 1.04 million. Note that revisions are quite common here.

- US unemployment claims: Thursday, 12:30. The weekly gauge of jobs did bounce back from the lows but beat expectations by hitting 281K. Perhaps more importantly the moving average fell to levels last seen many years ago at 282K. It was above 300K not too long ago. A small rise to 284K is on the cards.

- US Philly Fed Manufacturing Index: Thursday, 14:00. The regional figure is for the month of April, providing a fresh insight on the manufacturing situation. 4 consecutive misses on expectations set the number on 5 points last time. A small rise is likely: 5.5 points.

- UK employment data: Friday, 8:30. This is the last jobs report before the May elections and carries more political weight. The claimant count change, aka jobless claims, continued dropping quickly in February: 31K. A similar number is probable now – a slide of 28.5K. The unemployment rate is also going in the right direction, and stood on 5.7% in January. A drop to 5.6% is expected. This is what the current conservative coalition government is championing. However, the average earnings index has risen by only 1.8% y/y in January, and this provides fuel for the opposition Labour. A tick down to 1.7% is expected now.

- US CPI: Friday, 12:30. When looking at the headline number, the US is experiencing deflation, but this is clearly oil-related. Year over year core inflation is actually on the rise, reaching 1.7% in February. Both monthly indicators rose 0.2% last time and could follow suit this time, with +0.3% in the headline number and +0.2% in the core figure.

- US Consumer Confidence: Friday, 14:00. The Reuters / University of Michigan consumer confidence survey edged up to 93 points in the final read for March. We now get the preliminary figure for April and a higher score is expected: 93.8 points.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.11 12:30

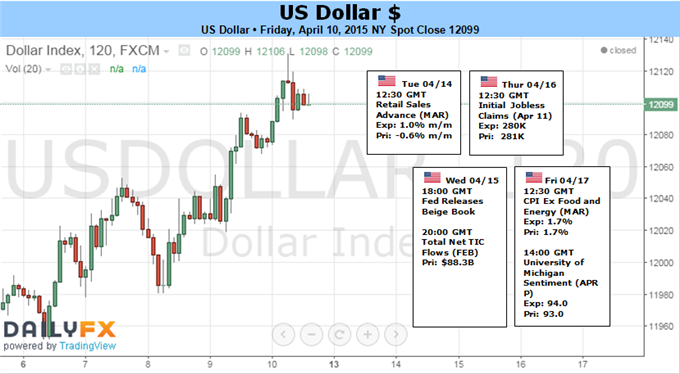

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for Dollar: Neutral

- A break above key price levels leaves the US Dollar in position to rally into May

- An intensified sensitivity to FOMC timing will gnaw at speculative long Dollar exposure

The US Dollar finished the week near decade-plus highs versus the Euro as it rallied against nearly all G10 counterparts. A noteworthy gain in US Treasury Yields helped explain much of the Dollar’s rally, but heavily stretched positioning and price momentum makes further gains relatively unlikely.

Global interest rate differentials remain the main driver of major currency moves, and expectations of US Federal Reserve interest rate hikes have pushed the US Dollar to impressive peaks. The US Federal Reserve is in fact the only G10 central bank expected to raise interest rates in the coming 12 months, and as long as this remains the case we expect the US currency to hold its gains against lower-yielding counterparts. Yet there remains clear uncertainty surrounding the Fed’s moves. Further Dollar strength is far from guaranteed.

Traders will look to the coming week’s US Retail Sales and Consumer Price Index inflation data for the next clues on the Federal Reserve’s interest rate policy, and major surprises could force important US Dollar volatility. Analysts predict the Advance Retail Sales report will show that consumer spending grew by 1.0 percent March—the first month-over-month gain in three months and the fastest pace of expansion in exactly a year. Lofty expectations leave ample room for disappointment and the odds seem stacked against the US Dollar ahead of the event.

Late-week CPI inflation figures represent the biggest risk to the Greenback given their clear implications for the future of US Federal Reserve monetary policy. Headline CPI data is expected to show prices remained exactly unchanged in the 12 months through March, while CPI excluding food and energy will likely match February’s pace at 1.7 percent. Topside surprises could increase the Fed’s sense of urgency in raising interest rates and normalizing monetary policy.

Recent FOMC minutes showed a surprising level of support for raising interest rates at the highly-anticipated June meeting, and the jump in yields helped drive renewed Dollar strength. Yet rhetoric is one thing and actions an entirely different matter. Interest rate futures show a miniscule 7 percent chance that the Fed will hike in June—hardly encouraging for US Dollar bulls.

Patience may wear thin for those holding USD-long positions rather quickly; recent CFTC Commitment of Traders data showed large speculators were their most net-long US Dollar versus the Euro (short EUR/USD) on record. And though this in itself does not signal that the currency is likely to reverse, it does imply that there may be relatively few traders left to sell. The key question is simple: will interest rate expectations be enough to fuel further Dollar gains? It’s entirely possible, but we’ll keep a close eye on upcoming data given clear risks of an important USD reversal.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.13 11:32

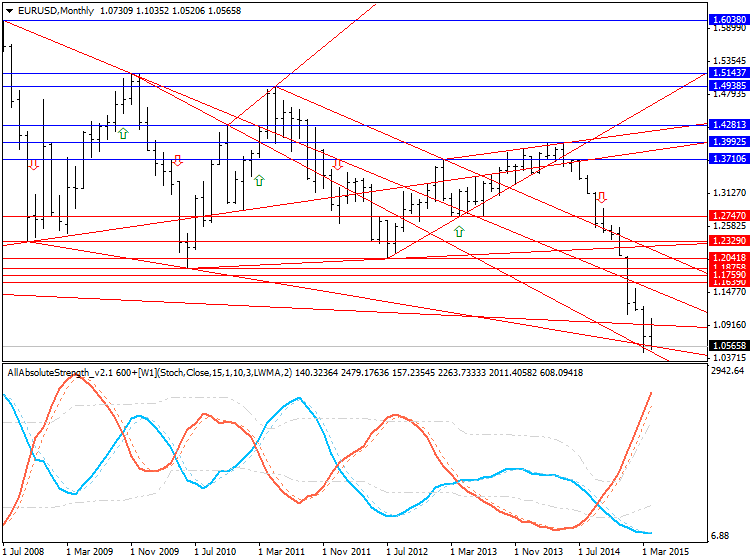

EUR/USD Technical Analysis: March Bottom Threatened (based on dailyfx article)

- EUR/USD Technical Strategy: Flat

- Support: 1.0456, 1.0386, 1.0229

- Resistance:1.0640, 1.0868, 1.1040

The Euro continues to push lower against the US Dollar,

with prices on pace to retest monthly lows below the 1.05 figure. A

daily close below the 1.0456-1.0513 area (March 16 low, 50% Fibonacci

expansion) exposes the 61.8% level at 1.0386. Alternatively, a move back

above the 38.2% expansion at 1.0640 opens the door for a challenge of

the 38.2% Fib retracement at 1.0868.

Breakdown!

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.13 16:43

AUDIO - Weekend Edition with John O'Donnell

Financial illiteracy is a major factor in America’s significant shortfall with retirement savings and much more. John and Merlin talk about how this illiteracy is spreading, and what we should do to help improve financial understanding. The duo also take a look at paper profits most investors hold, and how they should protect those gains in the face of a potential market correction.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video April 2015

newdigital, 2015.04.14 05:56

EUR/USD Forex Analysis- April 14, 2015

The EUR/USD pair fell during the bulk of the session on Monday, testing the 1.05 handle. This is an area that has been supportive in the past, so therefore it does not surprise me at all that we bounced. That bounce of course forming a hammer is a very bullish sign but I have no interest in buying this pair. I recognize that the Euro is a massive ball of trouble waiting to happen, and as a result I have no interest in being long of this pair. On top of that, the US dollar of course has strengthened exponentially for some time, so as a result I have no interest in shorting the Dollar.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.14 06:05

EUR/USD: Towards 1.15 Or Below 1.00 - JP Morgan (based on efxnews article)

JP Morgan's EUR/USD forecast profile is unchanged this month and continues to show a slower decline for the rest of the year, after an unprecedented -11% drop in Q1. JPM's Quarter-end targets are 1.07 in Q2, 1.06 in Q3 and 1.05 in Q4.

"Downside targets would be more aggressive were it not for the US dollar’s valuation problem and the Fed’s gradual pushback on a strong currency," JPM argues.

"Based on JPM’s expectations that the ECB balance sheet expands to €3.5trn by end 2016 and that 5-yr spreads might move about 50bp in the US’s favour, EUR/USD’s fair value is about 1.12 (blue cell in table 1). The euro's current level near 1.06 would be justified if the ECB balance sheet were heading to €5trn (unlikely given how Euro area growth is improving) or the USEuro 5-yr spread would widen to over 300bp over the cycle (unlikely as the Fed dots fall towards the money market curve due to mediocre US growth)," JPM adds.

"So while we know that currencies can undershoot for some time until a macroeconomic or policy catalyst emerges, we are reluctant to forecast trend extensions that have little empirical basis," JPM argues.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.14 11:51

The Next Big Levels In EUR/USD, GBP/USD, USD/CAD - Goldman Sachs (based on efxnews article)

Starting with EUR/USD, GS notes that it peaked least week right underneath an important resistance area at 1.1052-1.1099, a region included the interim high (bearish key day reversal) from Mar. 26th , the interim low from Jan. 26th and the 55-dma.

"It’s since broken lower from a triangle type pattern (ABCDE). Triangles tend to be characteristic of wave 4s which in this case suits the underlying wave count and implies that there is further downside potential. The next near-term support stands down at 1.0487- 1.0458 (1.618 extension from Mar. 26th and the low from Mar. 15th)," GS projects.

Bigger picture, GS targets f EURUSD at 1.0286-1.0103 pivot which includes 76.4% retrace of the entire ‘00/’08 rise as well as an equality target taken from the Jul. ’08 peak.

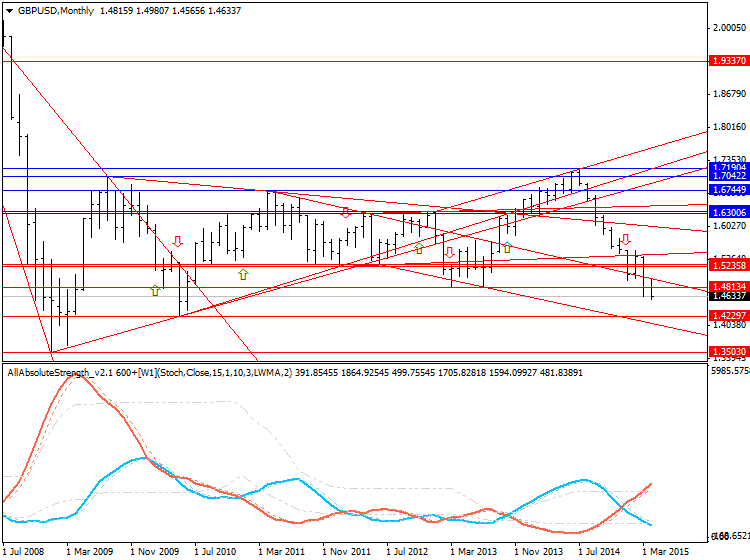

Moving to GBP/USD, GS notes that it has broken trendline support and this should in theory be a strong signal opening up potential to accelerate lower.

"The next big level lower is 1.4372-1.420. This

includes two long-term Fibonacci retracements and the low from May

’10...Put simply, it appears that GBPUSD is gradually making its way

down to the bottom of its multi-decade range," GS projects.

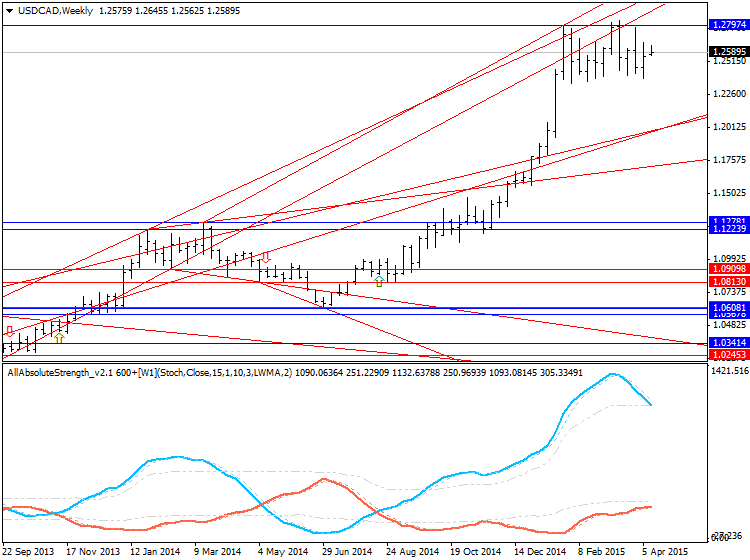

Finally in USD/CAD, GS thinks that the focus should be back on the range highs; 1.2799-1.2835.

"Would however need a clean break above 1.2799-1.2835 to cancel out the

risk of a double top and to diminish the bearish implications of the

bearish key day reversal which formed on Mar. 18th . Ideally want to play the range until a break in either direction is finally attain," GS advises.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2015.04.14 15:25

2015-04-14 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Retail Sales]- past data is -0.5%

- forecast data is 1.1%

- actual data is 0.9% according to the latest press release

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level. It's the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

==========

U.S. Retail Sales Rebound Less Than Expected In March

After reporting lower U.S. retail sales for three straight months, the Commerce Department released a report on Tuesday showing that sales rebounded in the month of March.

The Commerce Department said retail sales climbed by 0.9 percent in March following a revised 0.5 percent decrease in February.

However, economists had been expecting sales to surge up by 1.1 percent compared to the 0.6 percent drop originally reported for the previous month.

Excluding a jump in sales by motor vehicle and parts dealers, retail sales rose by 0.4 percent in March after coming in unchanged in February. Ex-auto sales had been expected to rise by 0.6 percent.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 119 pips price movement by USD - Retail Sales nes event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

W1 price is on bearish breakdown which is just started on open W1 bar after ranging market condition for few weeks ago, nearest support level for this timeframe is 1.0461

MN price is on bearish breakdown with 1.0461 support level

If D1 price will break 1.0637 support level on close D1 bar so the primary bearish breakdown will be continuing

If D1 price will break 1.1034 resistance level so we may see the market rally within the primary bearish with good possibility to reversal to the primary bullish condition

If not so the price will be ranging between 1.0637 and 1.1034 levels

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2015-04-14 13:30 GMT (or 15:30 MQ MT5 time) | [USD - PPI]

2015-04-14 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Retail Sales]

2015-04-15 03:00 GMT (or 05:00 MQ MT5 time) | [CNY - GDP]

2015-04-15 12:45 GMT (or 14:45 MQ MT5 time) | [EUR - Minimum Bid Rate]

2015-04-16 13:30 GMT (or 15:30 MQ MT5 time) | [USD - Building Permits]

2015-04-16 15:00 GMT (or 17:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

2015-04-17 13:30 GMT (or 15:30 MQ MT5 time) | [USD - CPI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movement

SUMMARY : bearish

TREND : breakdown