You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

And how long will this demonstrative "sci-fi" go on?

Where is the final chord?

A life-affirming finale!

;)

It seems to me that even with cubic equation the approximation will still be rough at high t. And you'll get tired of messing around with Cardano's or Viet's formula, Sergey...

What I did: I decomposed (1+q-k)^t = (1+epsilon)^t to the third power. Suppose q = 0.01 and hence epsilon <~ 0.01.

Suppose that t=50. Then on the calculator, (1+0.01)^50 = 1.645. Binomial approximation to the 3rd degree: (1+0.01)^50 ~ 1 + 50*0.01 + 50*49/2*0.01^2 + 50*49*48/6*0.01^3 = 1 + 0.5 + 0.1225 + 0.0196 = 1.6421. Well, yes, that's pretty accurate.

But here, say, at t=100 (just over 8 years) the exact result is 2.7048... (almost an e number, by the way). Binomial approximation to the 3rd degree gives us 1 + 100*0.01 + 100*99/2*0.01^2 + 100*99*98/6*0.01^3 = 1 + 1 + 1 + 0.495 + 0.1617 = 2.6567. Already not very accurate, and with increasing t the error will increase.

In short, at large t any truncation of the binomial begins to produce a systematic error. It seems to me that it makes sense to make a move and refuse binomial expansions and simply work by Newton's method. Consecutive approximations under certain conditions converge to an exact value very quickly and can be calculated as follows (equation f(x)=0)

x(n+1) = x(n) - f(x(n))/f'(x(n))

Since our f is the first derivative of the withdrawal amount, we will have to find its second derivative. There shouldn't be any technical problems, although the formula will be cumbersome. I will post it a bit later.

2 avtomat: I don't care if you cut me, but I don't see any connection between your lattice function and the smallness of epsilon (this variable is continuous in principle). Can you finally show me the formula that solves your ACS? :) I am talking about the formula corresponding to the one given by Neutron on the previous page.

Let me have your energy in my battery. Mmm....

If you don't have anything special to do, and you want to apply your mental energy to something very much, you may benefit society by rewriting Hilbert-Huang transformations from C++ to MQL4/MQL5. The code is attached.

Okay, something came up and disappeared again. OK, I'm still solving with Newton's tangents. And I don't give a damn about all the ACS and annuities :)

I'm waiting for the ACCS and for you. Then I'll figure it out...

;)

false start - we need to assess the commercial component.

Otherwise, we'll just sit around again?

DDD

https://ru.wikipedia.org/wiki/%D0%90%D0%BD%D0%BD%D1%83%D0%B8%D1%82%D0%B5%D1%82 - not very clear, but I really liked the expression 'annuity postnumerando'.

About the same as a blowjob every night :)

Alexei has rightly remarked on the misconception of a constant "his-others" proportion.

But beyond that, as usual, it hit an optimistic dead end.

So.

If anyone really needs a solution - I lay out my vision. (sick of ASUTP with Archimedes in their tubs waiting ;)

First of all, the very possibility of applying the technique of not withdrawing all accrued interest must be decided.

It is easy to understand that in order to do it the period till the end of deposit term should be strictly greater than

Let's take the result as L

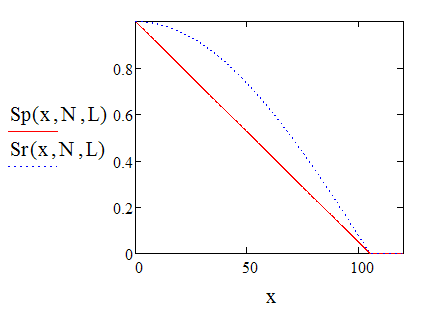

further also simply deduced ( keeping in mind the maximum "fruitful" area/deposit growth size -;)Sp is defined as a straight line -

In the end we have maximum withdrawal. Sr is a fraction of the accumulation...

graph of their behaviour.

It is easy to count and use.

examples for - Do=100, N=12*10 A STAFCA

And the annuity is my theme, and if you still try to derive its formula yourself.

Note that B is the size of the withdrawal of accrued interest from the deposit, including if N is less than L.

;)

I note that the last drawing is "conceptual"...

HOWEVER, to understand the idea of proof.

Anyone can build a correct one and be amazed.

;)

What is k, say, when q=0.01 (1% per month) and t=80?

Frankly speaking, your cosines are tense, Mikhail Andreevich. If I was not familiar with the Black-Scholes formula, I would have lost my mind...

What is k for, say, q=0.01 (1% per month) and t=80?

Frankly speaking, your cosines are tense, Mikhail Andreevich. If I was not familiar with Black-Scholes formula, I would have dropped out of my mind...

replace by sine...

D

:)