You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

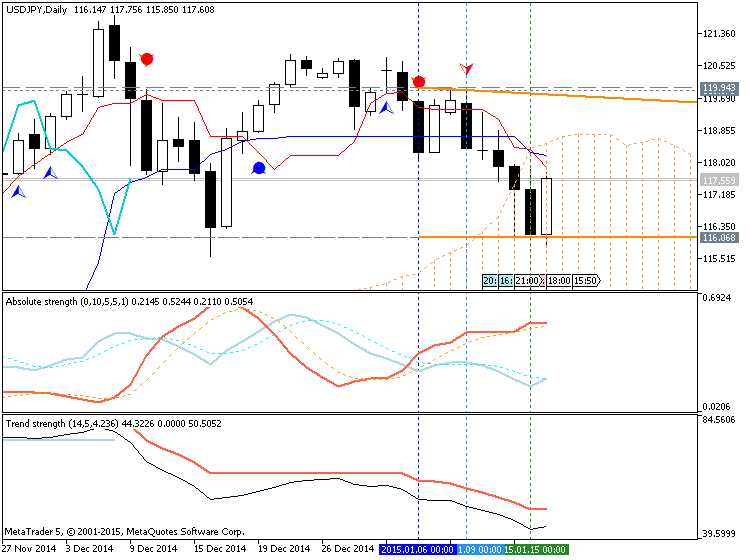

D1 price is on primary bullish with the secondary correction started on open bar:

W1 price is on primary bullish with the correction started in the middle of December last year.

MN price is on bullish market condition which was stopped by 121.83 resistance.

If D1 price will break 118.05 support level so the bearish breakdown will be continuing

If D1 price will break 120.74 resistance level so it will be the market rally

If not so we can see the flat within the bearish market condition.

This is end-of-week update:

So, it means the following: D1 price was reversed from primary bullish to the primary bearish market condition. If the price is inside kumo so we can expect the secondary ranging.