You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.12.19 03:52

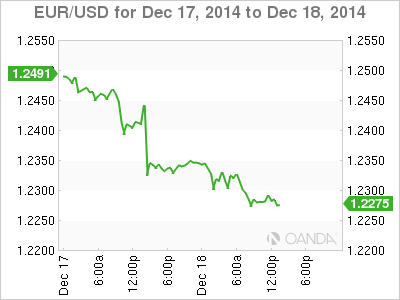

EUR/USD - Euro Sinks As Yellen Hints At Rate Hike In Mid-2015 (adapted from seekingalpha article)

EUR/USD is steady on Thursday, following the euro’s sharp losses following the Federal Reserve statement on Wednesday. In the European session, the pair is trading slightly above the 1.23 line. On the release front, German Ifo Business Climate rose to 105.5 points. Later in the day, the US will release Unemployment Claims and the Philly Fed Manufacturing Index.

The shaky euro took another tumble on Wednesday, courtesy of the Federal Reserve. Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed terminology, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, but not before April. The news sent the euro sprawling, as the currency lost about 170 points on Wednesday.

There was good news out of Germany, the locomotive of the Eurozone. Ifo Business Climate, a key indicator, improved to 105.5 points, up from 104.4 a month earlier. The strong reading was very close to the forecast of 105.4 points. We’ll get a look at consumer confidence on Friday, with the release of GfK German Consumer Climate. The markets are expecting a strong reading of 8.9 points.

Meanwhile, Eurozone inflation remains at low levels, and there were no surprises as Eurozone CPI dipped to 0.3% in November, down from 0.4% a month earlier. Persistent efforts from the ECB have not improved matters, and the danger of deflation has risen with the crash in oil prices. Germany has not been immune to weak inflation, with German Final CPI coming in at a flat 0.0% in November.