Hi,

I was looking at this formulas:

and

I was wondering why those currencies where chosen and how could I calculate, for example, the USD_INDEX if I use other currency pairs? For example:

How could I determine/estimate CONST, A, B, C, D, E, F and G?

Also, I was kinda surprised that for USD_INDEX the EURUSD constant was -0.576 and the EUR_INDEX the EURUSD constant was 0.3155. I would have expected that the second one was 1 minus the first one, so the sum of both of them adds 1.

Hi Pedro,

reading on internet USDx is a like a definition. Read here please.

https://forextraininggroup.com/what-is-the-us-dollar-index-and-how-do-i-apply-it-in-fx/

You could create your own index related to portfolio.

For example: you will start tomorrow to trade pairs a b and c, giving more importance to a and b and much less to b.

You could set the weight as 45% for a and b and 10% for c

You do your calculations and then you will divide 100 by the number to have your CONST.

At the end your Pedro index will be defined.

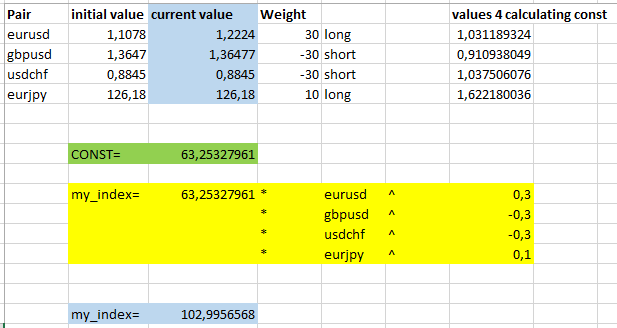

I spent some minutes to create an example:(hoping no bugs)

- forextraininggroup.com

Hi Pedro,

reading on internet USDx is a like a definition. Read here please.

https://forextraininggroup.com/what-is-the-us-dollar-index-and-how-do-i-apply-it-in-fx/

You could create your own index related to portfolio.

For example: you will start tomorrow to trade pairs a b and c, giving more importance to a and b and much less to b.

You could set the weight as 45% for a and b and 10% for c

You do your calculations and then you will divide 100 by the number to have your CONST.

At the end your Pedro index will be defined.

I spent some minutes to create an example:(hoping no bugs)

Hi,

Thank you for spending some time to create that excel sheet. However, I'm not sure your approach is completely correct. For example, if you see the USD_INDEX, every currency pair that is XXXUSD is multiplied like 1/XXXUSD and every USDYYY currency pair is multiplied as USDYYY. This is, I guess, to keep always the USD component up in the geometric mean of the index. Also, the sum of all weights of one particular index adds 1.

Also, if I understood well, you are assigning the weights based on how much importance does the currency pair have to you, right? I was hoping to get a more objective approach rather than a subjective one.

Hi,

Thank you for spending some time to create that excel sheet. However, I'm not sure your approach is completely correct. For example, if you see the USD_INDEX, every currency pair that is XXXUSD is multiplied like 1/XXXUSD and every USDYYY currency pair is multiplied as USDYYY. This is, I guess, to keep always the USD component up in the geometric mean of the index. Also, the sum of all weights of one particular index adds 1.

Also, if I understood well, you are assigning the weights based on how much importance does the currency pair have to you, right? I was hoping to get a more objective approach rather than a subjective one.

I think my approacxh is right but of course I am not sure.

we can consider USDX as the strength of usd against other currencies, that is why USD components are always in a part. In my case I give positive or negative contribute depending of my position (short/long)

If your portfolio is 80% eurusd and 20%eurchf, I think it is logical to give these weight in the index calculations.

Anyway let's see if someone else can give a good contribute to this interesting topic.

we can consider USDX as the strength of usd against other currencies

Absolutely agree with this, but can you consider the strength of USD using, for example, the EURCHF? EURCHF does not take into account USD. In fact, to get EURCHF using USD, you would have to get EURUSD and USDCHF.

In my case I give positive or negative contribute depending of my position (short/long)

If your portfolio is 80% eurusd and 20%eurchf, I think it is logical to give these weight in the index calculations.

You are taking into account if you have any trade on those currency pairs to assing an importance/weight to that index, but I think that is not correct. The idea of having a weight on each currency pair is to reflect the importance of that currency on the index and how big/small the movement of the index should be.

For instance, if you have 0 trades on EURUSD and you're all in on EURCHF, then you don't take into account the EURUSD to calculate USD_INDEX, but you take into account EURCHF and give it a weight of 100%, despite the fact that there is no presence of USD in EURCHF. That makes no sense to me. Btw, the formulas I posted in the initial post weren't made up by me. Those formulas are from wikipedia and clearly they do not change if I have open trades or not.

Absolutely agree with this, but can you consider the strength of USD using, for example, the EURCHF? EURCHF does not take into account USD. In fact, to get EURCHF using USD, you would have to get EURUSD and USDCHF.

You are taking into account if you have any trade on those currency pairs to assing an importance/weight to that index, but I think that is not correct. The idea of having a weight on each currency pair is to reflect the importance of that currency on the index and how big/small the movement of the index should be.

For instance, if you have 0 trades on EURUSD and you're all in on EURCHF, then you don't take into account the EURUSD to calculate USD_INDEX, but you take into account EURCHF and give it a weight of 100%, despite the fact that there is no presence of USD in EURCHF. That makes no sense to me. Btw, the formulas I posted in the initial post weren't made up by me. Those formulas are from wikipedia and clearly they do not change if I have open trades or not.

NO wait, you are mixing things probably for my fault.

USDX is an index defined with those currencies against USD ( of course). The weight depends of the importance given by the number of exchnages as written in that link I gave you.

Then,

I gave you an example how you could create about your own index related for example to your portfolio. That is why I put eurchf.

If in your daily trading you trade only:

| eurusd |

| gbpusd |

| usdchf |

| eurjpy |

and when you started, you created your own index. I dunno if this idea is good, I think it is ok.

NO wait, you are mixing things probably for my fault.

USDX is an index defined with those currencies against USD ( of course). The weight depends of the importance given by the number of exchnages as written in that link I gave you.

Then,

I gave you an example how you could create about your own index related for example to your portfolio. That is why I put eurchf.

If in your daily trading you trade only:

| eurusd |

| gbpusd |

| usdchf |

| eurjpy |

and when you started, you created your own index. I dunno if this idea is good, I think it is ok.

Got it. Well, what I want is to actually map all currency indexes. You can find USDX and EURX, but how you can calculate JPYX, GBPX, and all those?

And also, I'm curious why the exponents are, for example, 0.576? How can I calculate the exponents of other currency indexes?

Got it. Well, what I want is to actually map all currency indexes. You can find USDX and EURX, but how you can calculate JPYX, GBPX, and all those?

And also, I'm curious why the exponents are, for example, 0.576? How can I calculate the exponents of other currency indexes?

I guess you did not read the link I gave you or other about usdx

I guess you did not read the link I gave you or other about usdx

I did. Actually, after reading I searched for this, but I don't know if this is the correct place because the numbers of 2016 do not match. Nevertheless, its very interesting and, if I understood it well, I think the TWI maybe it could be a better approach due the fact that it incorporates a globalization effect.

So, if I want to get the JPYX, based on what have we been talking, I should search for "Japan Fed's Component" or something like that and get the weights of each country/currency to get the GBPJPY, EURJPY, USDJPY, CADJPY, CHFJPY, AUDJPY and NZDJPY weight's, right?

- www.federalreserve.gov

I did. Actually, after reading I searched for this, but I don't know if this is the correct place because the numbers of 2016 do not match. Nevertheless, its very interesting and, if I understood it well, I think the TWI maybe it could be a better approach due the fact that it incorporates a globalization effect.

So, if I want to get the JPYX, based on what have we been talking, I should search for "Japan Fed's Component" or something like that and get the weights of each country/currency to get the GBPJPY, EURJPY, USDJPY, CADJPY, CHFJPY, AUDJPY and NZDJPY weight's, right?

it could be.

Consider that in usdx large part is taken by eurusd. Some traders consider usdx like if it was usdeur.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi,

I was looking at this formulas:

and

I was wondering why those currencies where chosen and how could I calculate, for example, the USD_INDEX if I use other currency pairs? For example:

How could I determine/estimate CONST, A, B, C, D, E, F and G?

Also, I was kinda surprised that for USD_INDEX the EURUSD constant was -0.576 and the EUR_INDEX the EURUSD constant was 0.3155. I would have expected that the second one was 1 minus the first one, so the sum of both of them adds 1.