Dearest Mladen

Once again thanks for stoch extended ver,a real good toy

though currently MT5 indicators are being coded with basic functions and of course there is no space for any extension and or request even though i like request when it come turn especially regarding this version,for some smoothing factor addition plz

regards

thanks for this, I am really hoping for the QWMA stochastic from you please thanks!

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

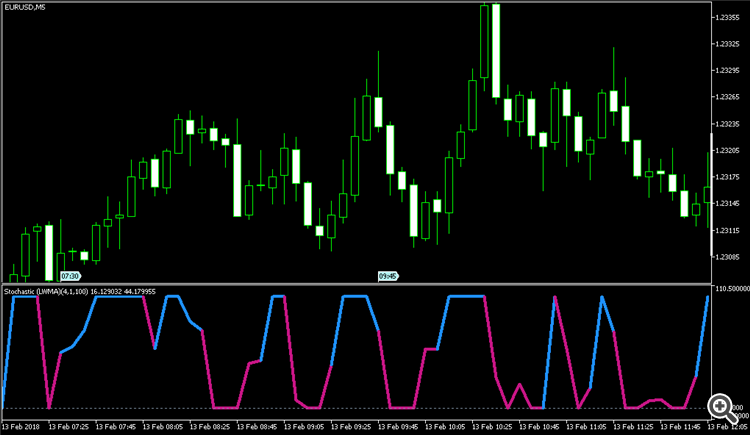

Stochastic Extended:

The Stochastic Oscillator is a Momentum indicator comparing the closing price of a security to the range of its prices over a certain period of time. The sensitivity of the oscillator to market movements is reducible by adjusting that time period or by taking a moving average of the result.

The Stochastic Oscillator is calculated using the following formula:

Where:

The general theory serving as the foundation for this indicator is that in a market trending upward, prices will close near the high, and in a market trending downward, prices close near the low. Transaction signals are created when the %K crosses through a three-period moving average, which is called the %D.

The usual average that is used for stochastic calculation is simple moving average (SMA). This version allows you to use any of the 4 basic types of averages (default is SMA, but you can use EMA, SMMA or LWMA too) - some are "faster" then the default version (like EMA and LWMA versions) and SMMA is a bit "slower" but this way you can fine tune the "speed" to signals ratio.

Author: Mladen Rakic