http://i63.tinypic.com/2dkb7t5.png"]

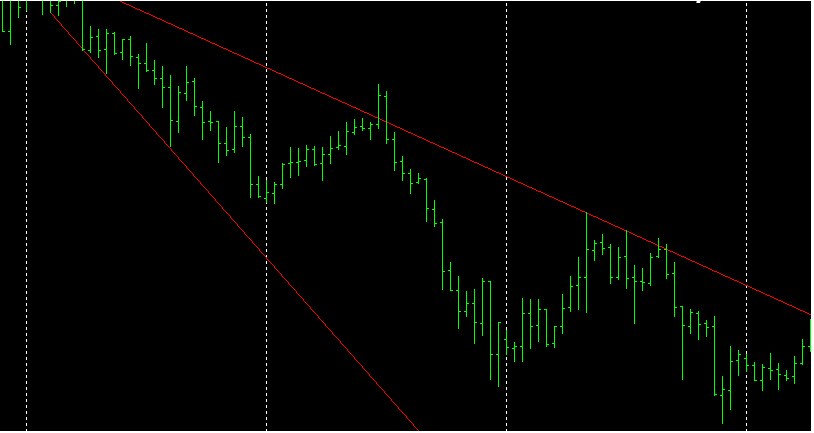

Here is a pictorial illustration of the whole idea of the Advers's Tactics strategy and when to enter the market.Firstly point out the local peak and assuming there will be a change in the trend direction place the number 1.Sometime later when the prices continue the movement in this case , search for a new local minimum or maximum or there was a correction and the price gave one more peak lower.This is the beginning of the weep, place the numbers 2 and 3 subsequently draw one line and wait for a rollback if it doesn't happen search again for the new maximum or minimum .If a rollback occurs place the number 4 and draw the second line . Now you have the price channel and can assume the price would move within that channel.

EURJPY signal based on Advers's Tactics active

Buy Order

Pair: EURJPY

Take Profit: 118.18

Stop Loss: 117.18

EURUSD signal based on the fifth measurement Strategy active

Buy Order

Pair: EURUSD

Take Profit: 1.1144

Stop Loss: 1.1864

EURUSD signal based on the fifth measurement Strategy active Sell Order Pair: EURUSD Take Profit: 1.1144 Stop Loss: 1.1864

GBPCHF signal based on the Advers Tactics Strategy active

Sell Order

Pair: GBPCHF

Take Profit: 1.2888

Stop Loss: 1.3018

USDCAD signal based on the Advers Tactics Strategy active

Sell Order

Pair: USDCAD

Take Profit:1.3082

Stop Loss: 1.2972

USDCAD signal based on the Advers Tactics Strategy active now.

Buy Order

Pair: USDCAD

Take Profit: 1.3098

Stop Loss: 1.3018

USDJPY signal based on the Advers Tactics Strategy active now.

Sell Order

Pair: USDJPY

Take Profit: 106.12

Stop Loss: 106.92

USDCAD signal based on the Advers Tactics Strategy active now.

Sell Order

Pair: USDCAD

Take Profit: 1.3202

Stop Loss: 1.3252

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

In today's article we would take a look at adverse tactics, this strategy isn't recommended for new traders. To apply this system, see the step by step video here

The idea of the system is to draw lines which would become the boarders of movement in the future. It happens as follows;

First we point out the local peak and assume there will be a change in the trend direction and we place the number 1.Sometime later the prices continue the movement in this case ,we search for a new local minimum or maximum or there was a correction and the price gave one more peak lower.

This is the beginning of the weep, we place the numbers 2 and 3 subsequently we draw one line and wait for a rollback if it doesn't happen we search again for the new maximum or minimum .If a rollback occurs we can place the number 4 and draw the second line .

Now we have the price channel and can assume the price would move within that channel. Accordingly we have support and resistance lines, if you become a professional in the use of the system you can achieve very good results in trading however the system isn't recommended for beginners because of the complexity of the construction and the high psychological stress.

Happy Trading!