BREAKING: British Pound in 'Flash Crash' Against US Dollar and Euro on Exchange Rate Markets - Why?

A sudden crash in Sterling overnight has shocked global currency markets. The Pound suddenly plummeted to near-parity against the Euro and to 1.12 against the US Dollar when Asian markets opened. It appears the decline resembled a 'flash crash' - a big order that

goes through in thin market conditions, the result of which are

oversized moves. Often automated algorithims can be behind such a move. "Ostensibly triggered by harsh comments on UK exit terms from French PM Hollande,

GBP collapsed around the Asian open, with trades apparently going

through below 1.15. The move happened right at the point of thinnest

liquidity and on a day (payrolls Friday) when volumes would have been

unusually thin anyway," says Adam Cole at RBC Capital Markets. Cole warns the nature of the flows that pushed GBP to the lows may

not be clear for some time and for now and they are not changing

forecasts, which are already well below consensus (1.25 end-year, 1.15

early next year). Spillover into broader markets has been quite limited, but the tone is moderately risk-off (USD/JPY -40pts, AUD/USD -20pts). “Apparently it was a rogue algorithm that triggered the sell off

after it picked up comments made by the French President Francois

Hollande, who said if Theresa May and co. want hard Brexit, they will

get hard Brexit," says Kathleen Brooks at City Index in London. “These days some algos trade on the back of news sites, and even what

is trending on social media sites such as Twitter, so a deluge of

negative Brexit headlines could have led to an algo taking that as a

major sell signal for GBP," says BrooksSterling

plummeted overnight with some calling it a 'flash crash' triggered in

thin liquidity and some suggesting recent comments by France's Hollande

as being the trigger

Comments from various bank analysts from around the place

- "Low liquidity amplified the move. People suspect a 'fat finger' triggered stop-loss orders," said Kaneo Ogino, director at foreign exchange research firm Global-info Co in Tokyo.

- "The move coincided with an FT story about French President Hollande demanding tough Brexit negotiations. The move was exacerbated once stops were tripped below a key level of $1.2600 in very thin trading before the U.S. payrolls," said Su-Lin Ong, senior economist at RBC Capital Markets.

- "This is still the thinnest time of day for anything pretty much, the gap between New York and Tokyo. It's probably the time of day where you'll get the sharpest move for the smallest amount of selling but really we didn't see a news catalyst for it," said Sean Callow, senior currency strategist at Westpac . Sterling has been "on a precipice since Sunday, since Theresa May and the March Brexit negotiations," he said, adding, "I think we've underestimated how many people had money positions for a very wishy-washy Brexit, or even none."

- Derek Mumford, a director at Rochford Capital Pty in Sydney: "The speed of the move looks like a kind of a flash crash, some sort of failure," Mumford said, adding that sterling is set to drop to $1.15 in the coming weeks if it doesn't recover above $1.28. "I'm sort of struggling to justify it. I don't think there's any shock that the EU will be going for a hard Brexit."

- On Hollande's remarks .... "Such comments on

their own would not be enough to cause a plunge on this scale, but once

a move gets going in thin liquidity it can snowball quickly," said

Gareth Berry, a foreign-exchange and rates strategist in Singapore at

Macquarie Bank Ltd. While the pound "may recover to the $1.25 area

today, all technical support has now been obliterated, so sterling is

doomed from here over the months ahead."

- "It looks like it was a algorithm-driven flash crash triggered by a Financial Times article based on French President Hollande's speech on Brexit," said Angus Nicholson, a markets analyst in Melbourne at IG Ltd. "Given low volumes in the Asian session, it would have forced other algorithms to join in and magnify the fall."

BOE looking into cause of pound flash crash

BBG with a comment from the Old Lady

BOE spokesman declines to offer any more info.

Thanks for that. They're as clueless as the rest of us.

A Look Inside The Pound Flash Crash: What Really Happened In Those 30 Seconds

At just after 7 minutes after hour, whether 7pm on the east coast, midnight GMT or early Friday morning in Asian trading, pound sterling plunged by more than 6%, in the span of 2 minutes although the bulk of the plunge took place in just 30 seconds: from 7:16 to 7:46, when the market became "disorderly" in technical parlance, or in simple terms, broke. And since earlier today the Bank of England mandated none other than the BIS (specifically the bank's "Head of Foreign Exchange & Gold", Benoit Gilson) to explain what happened, here is a place to start trying to reverse engineer the latest flash crash.

For the best forensic analysis piecing together what happened last night, we go to Citi's Daniel Randall who tells the overnight story of the GBP, who also shows that the key pair involved in the selling was indeed cable...

not EURGBP as some have speculated.

As Randall points out, while GBP interbank volumes when Cable sold off to below 1.20 overnight were comparable to those of the BoE rate decision on the surprise “hold” on July 14, 2016, the big difference was that GBP sold off to a low of 1.1491 traded, moving almost 10%, when it “only” moved 2% on the July, 14. What were the key liquidity traits seen?

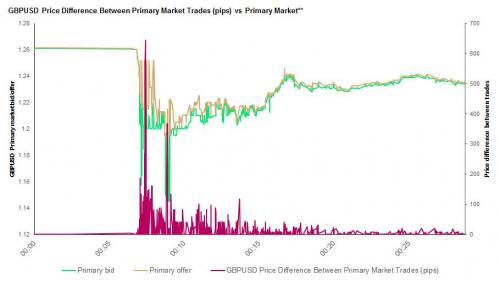

Price difference between GBPUSD trades in the primary market is usually 1 to 2 pips, however overnight, we saw this spike to over 50 pips up to over 600 pips.

This means that individual trades were over 50 pips apart, e.g. 1.2500 given, then 1.2450 given as the next trade, with there being vacuums of liquidity in between.

This was driven by the very large bid/offer spread in the interbank market at the time.

The below chart shows trade price differences as well as primary market bid/offer spread which blew out to 10 big figures maximum

The chart underneath gives high resolution around the move, which occurred over 50 seconds.

The first 10 seconds of the move we have smaller quick price moves lower but after this we see the primary market go two big figures wide.

As Citi points out, we have seen this on several occasions in the past, think August 24, 2015, and "could be associated with the high frequency market making interest leaving the primary market."

Not could, is.

Net flows we saw during this time period were also important and were similar as seen during the USDZAR move in January and also on the pre-referendum overnight two big figure spike in GBPUSD. While the market was still “intact” as per the chart above, we saw a large retail net selling flow, which is probably associated with stop losses. Unfortunately, it would appear that these continue stopping out, no matter what the rate, which can create large volatility when two-way prices are no longer intact as shown in the red circle above.

As a whole, whilst retail were net sellers, we net overall buying interest of GBP, mainly from the leveraged segment.

As Citi concludes:

"as we can see, execution technique is key, blunt aggression into the market can cause large impact, but if one spaces out orders and treats liquidity appropriately, then one can achieve a reasonable execution."

Translation: stay the hell out of the FX market, and just wait for more such flash crashes to occur, either buying at the trough when the algo selling is exhausted, or shorting/selling at the top, then quickly take profits, rinse and repeat. As an earlier chart from Citi showed, you will have numerous opportunities in the months ahead to do just that.

Reactions: British Pound hit by Raft of Forecast Downgrades Against Euro and US Dollar Following 'Flash Crash Friday'

The latest institutional analyst views and reactions to the collapse of Pound Sterling.

- British Pound to Euro exchange rate today (8010-16): 1.1107, flash crash low 1.06 as quoted by IG).

- Euro to Pound Sterling exchange rate today: 0.9012, flash crash high: 0.9435.

- Pound to Dollar exchange rate today: 1.2438, flash crash low: 1.16

GBP collapsed around the Asian open, with trades apparently going through below 1.15 in GBP/USD.

The move happened right at the point of thinnest liquidity and on a day (US payrolls Friday) when volumes would have been unusually thin anyway.

The official low reached has been hard to ascertain with various commercial rate providers offering different views.

The Bank of England is meanwhile investigating the cause of a sharp fall in the value of the pound in overnight trading in Asia, a spokesman for the central bank said on Friday.

"The Bank is looking into last night's fall in sterling," a Bank official told Reuters.

It will take time for the investigation to conclude but the damage to Sterling's reputation and outlook has been done, whatever the cause of the crash.

Here are the latest reactions and expectations from those in the know:

David Bloom at HSBC reckons par for the Euro and Pound is going to happen:

"GBP has gone from a cyclical to a political and structural currency. The structure and politics are conducive to a currency that needs to fall to a level that causes balance. That balancing act is and has been in our eyes is still a lot lower than where it is today.

"We continue to look for GBP-USD at 1.20 by year end and 1.10 by end 2017, taking EUR-GBP to parity."

Georgette Boele, ABN Amro believes Sterling is now oversold:

"Net-short speculative positions in sterling on the futures market are massive. At some point in time these investors will take profit on their sterling shorts, probably at a time when sterling fails to weaken further. If we take purchasing power parity into account, sterling is substantially undervalued."

Adam Cole at RBC Capital Markets says no need to panic and cut forecasts:

“Ostensibly triggered by harsh comments on UK exit terms from French PM Hollande, GBP collapsed around the Asian open, with trades apparently going through below 1.15.

“The nature of the flows that pushed GBP to the lows may not be clear

for some time and for now we are not changing our forecasts, which are

already well below consensus (1.25 end-year, 1.15 early next year).

Spillover into broader markets has been quite limited, but the tone is

moderately risk-off (USD/JPY -40pts, AUD/USD -20pts).” Kathleen Brooks at City Index says Sterling is the victim of the new world of complex alogrithmic trading: “Apparently it was a rogue algorithm that triggered the sell off

after it picked up comments made by the French President Francois

Hollande, who said if Theresa May and co. want hard Brexit, they will

get hard Brexit. “These days some algos trade on the back of news sites, and even what

is trending on social media sites such as Twitter, so a deluge of

negative Brexit headlines could have led to an algo taking that as a

major sell signal for GBP. Once the pound started moving lower then more

technical algos could have followed suit, compounding the short, sharp,

selling pressure. “Thus, the pound has been the victim of the digital, headline-driven

world that we live in today. For sterling, algorithms have become the

modern-day version of a George Soros.” Aurelija Augulyte at Nordea Markets cuts her forecasts: "To adjust for the recent move in the GBP and uncertainty unleashed by this flash crash, we adjust the GBP forecasts lower.

"Technically, the GBP move tonight looks like a capitulation. The

0.88 - 0.91 for the EUR/GBP is a strong resistance area in the

post-Lehman trading. And while there is no anchor for the GBP/USD, the

USD index also met key resistance tonight."

read more

The Anatomy of the British Pound’s Flash Crash: An Algorithmic Panic-Attack

I know all of us old interbank market dinosaurs will be driving you crazy with our “I told you so’s”, but we did! Whether for regulatory, commercial or technical reasons, the very

core of the FX market no longer exists; namely the hundreds of interbank

traders who sat at their desks and provided pricing no matter what the

conditions. Yes the prices may have been wide and in small amounts at times, but there was always a price in the market. On Friday the 7th October we had another example of a Price-Less market! Most of the market’s liquidity is handled through a small-ish number

of interbank trading platforms with prices being derived via prime

brokerage agreements with hedge funds, asset managers, corporates, and

retail brokers etc. All of these big interbank trading platforms have algorithms which track liquidity and constantly analyse risk. I suspect that these algorithms are basically written with the same underlying rules. In other words, when one platform panics, they all panic. What we think happened this morning is that there was a large

knock-out option at 1.2600 and once this level broke, a number of

automated stop-loss sellers entered the market. As it was early Asian trade, there was very little immediate buying

interest to soak up this supply, so the ‘clever’ machines simply matched

the supply to wherever the demand was positioned on their platforms. Not many participants place their bids at levels >200-250 pips

away; most prefer just to wait until the market starts trading there and

then decide what to do. This means that there was a massive black hole with no prices for a rational market participant to make decisions off. To add insult to injury, another massive 1.2000 knock-out simply

compounded the problem and basically the sellers below 1.26 were joined

by the sub-1.20 sellers in a matter of seconds. More panic! Based on the price action since this morning’s events, I would safely

guess that if this had happened 15 years ago, we would have seen a

nasty sell-off from 1.26 to possibly 1.2400/1.2350 in increments of

25/40 pips before the demand took over and stabilised prices back around

1.2400-50.Ex-interbank

trader Sean Lee at ForexTell explains what happened during the Pound’s

algorithmic collapse and why such a fall would not have happened in

years gone by.

Instead of this we will have retail B-book brokers glorying in their

‘record’ profit days. So what exactly is the regulator’s main duty?

JPM Explains How HFTs Caused Friday's Sterling Flash Crash

On Friday, in the aftermath of the historic pound sterling flash crash, we presented Citi's forensic take of how in just 30 seconds, bid/ask spreads in cable exploded as wide 600 pips.

Today, we provide another take, that of JPM's Nikolaos Panigirtzoglou, who looks at the "gapping market" that emerged on Friday morning Asia time, and shares some color on the role of high frequency traders behind the sudden, dramatic plung in sterling.

Below is his full note:

Friday’s flash crash in sterling reinvigorates the debate about market liquidity and the role of High Frequency Traders (HFTs) as providers of liquidity. Similar to previous flash crashes such as the August 24th 2015 flash crash in US equities or the October 15th 2014 flash crash in USTs, market gapping, a step change in prices from one level to another without much trading in-between, raises questions about market structure and liquidity in FX markets. This is also because FX markets are perceived to be a lot more liquid than equity or bond markets, so the conventional view is that FX markets are unlikely to experience flash crashes or market gapping in the absence of high impact news.

The flash crash in a major currency like sterling questions the above perception and perhaps shows there are liquidity vulnerabilities in FX markets that are more similar to those seen in equity or bond markets. A step change following a significant event such the Brexit referendum or the SNB’s abandonment of its peg is not problematic as it represents a natural market resetting. But a step change triggered by an order flow is more problematic and in our opinion reflective of how vulnerable market liquidity is in FX markets also.

Liquidity vulnerabilities in equity or fixed income markets as a result of changing market structures are well documented. In equity markets the shift away from principal trading towards agency trading, where markets makers simply match buyers with sellers without holding inventory beyond a short period of time, took place well before the Lehman crisis. But the Lehman crisis caused a similar shift within fixed income markets. Regulatory and other forces have made it a lot more costly for traditional dealers to act as principal traders in fixed income markets, inducing them to change towards a more order-driven trading model of matching buyers and sellers with minimal inventory risk, or to retrench and be replaced by agent traders.

At the same time electronic trading and advances in technology has encouraged the emergence of HFTs as liquidity providers in the most liquid segments of equity, FX and to some extent income markets. These HFTs use sophisticated quantitative models coupled with speed and high trading frequency, to exploit small price moves. They do so by arbitraging price differences across venues or by detecting and taking advantage of order shifts or imbalances or by simply exploiting very short term momentum or mean reversion signals.

However, different to traditional market makers, HFTs tend to operate with a much shorter inventory cycle, meaning that they conduct offsetting trades within seconds or even shorter, in order to neutralize their original position. As a result they tend to quote for smaller sizes and for a very short period of time. This in turn reduces market depth, i.e. the ability to trade in size in markets, especially in those markets where HFTs are important liquidity providers like equity markets. So we note that while the emergence of HFTs has been beneficial for bid ask spreads and small investors, it has likely had a negative impact on the ability of big institutional investors to trade in size. This is one of the reasons big institutional investors have resorted to dark pools for implementing large equity trades.

More importantly, because HFTs’ models are typically adapted to exploit small price moves, HFTs have a higher incentive to withdraw from their market making role in periods when volatility rises abruptly as they are reluctant to subject themselves to the risk of large price moves. In addition, there is a similar incentive to withdraw from market making when they detect a big order imbalance, i.e. when they detect markets becoming one-sided, as they are reluctant to subject themselves to the risk of not being able to close their position in a very short period of time.

In addition, given HFTs employ similar models, this creates the risk of a simultaneous withdrawal by HFTs in periods of high volatility or stress or in periods when market become more one-sided. A simultaneous withdrawal by HFTs not only amplifies the initial market move, but also creates step changes or gapping markets as liquidity provision gets impaired and quotes are withdrawn.

How big is the role of HFT in FX markets relative to other markets? A previous report by the BIS “Highfrequency trading in the foreign exchange market”, September 2011 concluded that around a quarter to one third of spot FX trading volumes are due to HFTs. But given that this study was conducted five years ago, we suspect that this share has risen since then.

Indeed, the latest 2016 Euromoney FX rankings survey is consistent with a rising share by HFTs as liquidity providers. The biggest change in this year’s rankings has been the advent of non-bank liquidity providers led by XTX Markets who was ranked third for electronic spot FX trading with a market share of more than 10% and third for FX trading platforms. In contrast, the combined market share of the top five global banks dropped to just 44.7% for overall FX trading in this year’s survey. This market share had peaked in 2009 at 61.5% and was above 60% as recently as 2014.

Moreover, many of the banks ranked outside the top 10 for overall FX trading are understood to be sourcing liquidity from non-bank liquidity providers. According to Euromoney, these non-bank liquidity providers or HFTs are set to gain more market share in the future, helped by advances in technology, more defined business models and a lower-cost infrastructure base than traditional FX banks. HFTs are already very important in FX spot markets as mentioned above, but they look to build capability in forwards and other products in the near future.

In all, the FX market appears to be going through structural changes similar to those experienced by equity markets in the past. The advent of non-bank liquidity providers such as HFTs has reduced bid ask spread and increased market efficiency in FX markets, but at the cost of lower market depth and withdrawal of liquidity provision in periods of stress.

UK's May spokesman on GBP flash crash - Prices go up and prices go down

Brexit comments from Theresa May's spokesman

- There was no definite cause of the flash crash

- The nature of financial markets is that prices go up and down

- Parliament will scrutinise and debate Brexit process

- Holding a vote in parliament on Brexit to second guess the will of the British people is not an acceptable way forward

Another clear message why politicians should have nothing to do with the running of financial markets...ever ;-)

I find it very hard to believe there was no definite cause for the flash crash.They may not know what it was, but there has to be a reason.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up.

What caused the move? While nobody knows the catalyst behind the flash crash yet, Bloomberg has compiled several potential explanations.

Hopefully we will have a clear, official, and accurate answer from regulators for the crash soon: investors faith in broken markets is already non-existent as it is. However, if the May 2010 flash crash is any indication, the reason behind the collapse may not be forthcoming until 2021, and even then it will be blamed on some spoofer, living in his parents' basement.

Another question: whether any FX brokerages will need a bailout a la the infamous FXCM, in the aftermath of the Swiss National Bank revaluation of January 2015, as clients find themselves margined out and underwater even as cable is steadily recovering most, if not all losses.

source