You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

PBOC cuts RRR by 0.5% News just out

CNY and CNH both posting 3 week lows vs USD after the announcement.

The cut had been widely touted in the Chinese press. Eamonn had this last Thursday where the following observation was made:

"RRR cut will not bring pressure for yuan depreciation as long as authorities can manage market expectations well"

So with immediate posting of 3 week lows we wait to see whether it was kneed-jerk or more substantial.

AUDUSD on the rise to session highs of 0.7168 on the expectation that the cut will benefit local economies. We'll see about that one too.

Meanwhile EURUSD still digging in around 1.0900 but with euro generally softer all round.

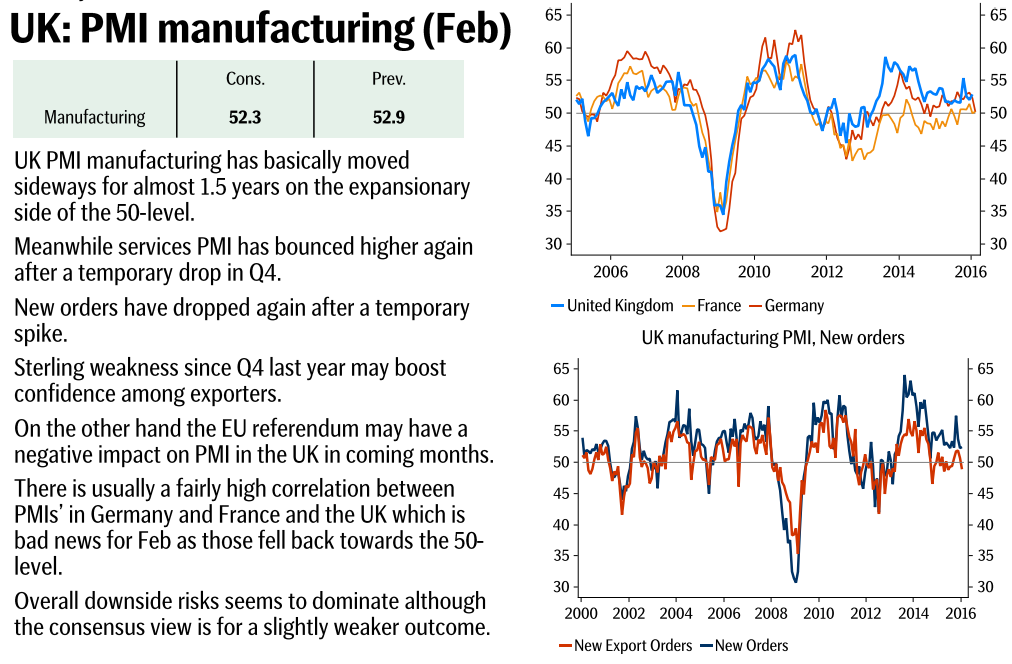

Preview: UK PMI Manufacturing (Feb) - SEB

ADP US Feb employment 214K vs 190K expected The US employment report from ADP for Feb 2016:

US dollar higher on the headlines.

The revision to the prior takes a bit of the shine of the report but right now the dollar bulls are eating up good news.

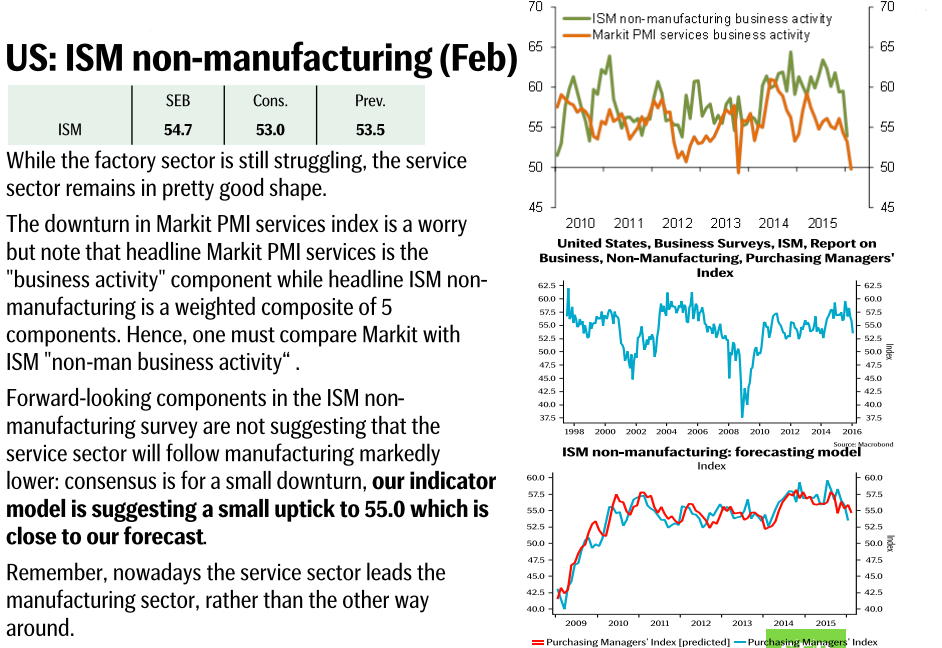

Preview: ISM Non-Manufacturing Survey (Feb) - SEB

China's 5-year Plan: Premier Li says they "must be prepared for a tough battle"

Reuters has more here

UK stats office says CPI data including housing costs should be the favoured method The UK's chief statistician writes a letter to the UK stats authority

Mark Carney has been very critical of our stats and wants to shake things up. He's got a point and RPI can be very volatile and prices these days don't conform to how they did years ago with the rise of online shopping. In the good old days, sales were seasonal. Now there's always sales and offers flying around and online, prices can be different one minute to the next. swapping retail prices for housing costs is I probably a smart move.

ECB Preview: Deposit Rate Cut Seen Shunting Euro Higher The European Central Bank (ECB) is seen expanding its monetary stimulus this Thursday, giving the existing asset purchasing program a further boost after it prolonged the program till March 2017 back in December last year.

The decision of the ECB to expand the current asset purchasing program would be in line with its extra dovish rhetoric of late, as the Bank struggles to meet its inflation target of close to, but not exceeding 2%.

"It will therefore be necessary to review and possibly reconsider our monetary policy stance at our next meeting in early March, when the new staff macroeconomic projections become available which will also cover the year 2018," ECB President Mario Draghi said in the introductory statement after January ECB Governing Council meeting in Frankfurt.

The general consensus is that the ECB will cut the deposit rate further into negative. What else the ECB will deliver is an open question, with the Bank unlikely to build up any kind of market expectations after the blow back in December which hammered the credibility of both the ECB and Draghi and sent the euro jumping more than 400 pips higher against the US dollar.

A repeat this time round would more than likely send the euro higher, stifling any hopes for inflation or a boost to export competitiveness.

After ramping up expectations, delivering only a partial package would only be surpassed by actually doing nothing. That, however, is unlikely to be the case this Thursday, even though currency traders buying euros might desire that scenario, as the last action which fell well short of expectations back in December resulted in the eighth strongest intra-day gain for the euro in its 16-year history.

Moreover, oil is currently trading some 44% higher from it 2016 lows, possibly allowing the ECB to play it cautious in its anti-deflation fight.

read more

March 2016 ECB main refi rate 0.00% vs +0.05% exp Deposit rate -0.40% vs -0.40% exp Increases QE to 80bn March 2016 ECB governing council meeting interest rate decision 10 March 2016

US Feb CPI +1.0% y/y vs +0.9% y/y expected Details of the February 2016 US consumer price index report:

Month-over-month data:

Real average weekly earnings +0.6% vs +1.1% prior.

The inflation numbers were a touch hot but with wages up just 0.6%, will the Fed feel a need to send a hawkish signal? So far the market is saying 'yes' as the US dollar catches a quick bid.

The +2.3% core inflation figure will stand out to the Fed hawks in a big way. Higher wages haven't materialized but they surely believe that it's only a matter of time.

USD/JPY: To Move Along With Real Money Flows Next Week USD/JPY may settle down and move along with real money flows ahead of the Easter holiday next week, says BTMU.

"Japanese exporters JPY buying has been picking up gradually. Real flows may generate sizeable yen buying pressure, weighing further on USD/JPY ahead of the fiscal year-end," BTMU adds.

BTMU is bearish 0n USD/JPY in the near-term seeing the pair trading at 110.50-113.50 range.