You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

German Firms Stay at Joint 6-Mth Low: March PMI The backbone of the euro zone economy witnessed its businesses stall in March, a preliminary industry survey showed on Tuesday, with the reading still coming in better than expected.

Germany's flash Composite PMI booked 54.1 during the third month of the year, Markit said, the same as seen in February.

That's the lowest since September 2015.

Market consensus had penciled in a reading of 53.8 in March.

"Today’s flash PMI results signal ongoing growth of private sector output in the euro area’s largest member state, despite the pace of expansion failing to accelerate from February’s five-month low," Oliver Kolodseike, economist at Markit, commented in the reading.

"Moreover, it looks as if momentum in the German economy will remain sluggish in the months ahead, as slowing new order growth was accompanied by the weakest increase in backlogs of work since the summer of last year. Furthermore, there are signs that subdued demand is now also affecting the labour market, as the rate of job creation eased to a near one-year low," Kolodseike added.

read more

Preview: US New Home Sales (Feb)

We forecast new home sales to rise 5.0% m/m in February to 520k.We believe the steep drop in January sales was driven by anomalous rainfall in the West region. Robust housing starts in February confirmed that the housing market remains in recovery mode and we look for a healthy rebound in new home sales this month.

February 2016 US new home sales 512k vs 510k exp February 2016 US new home sales 23 March 2016

Housing continues to tick along nicely and with a 2.6% gain in prices from last year, it shows a solid market that's not close to overheating.

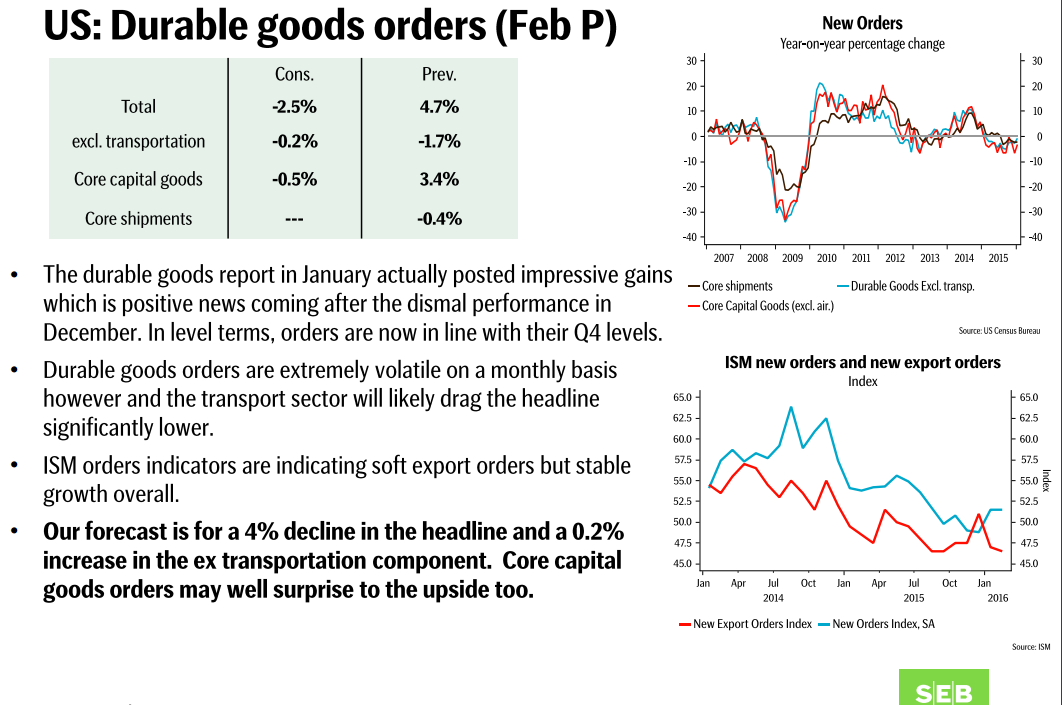

Preview: Durable Goods (Feb)

March 2016 US Markit services PMI flash 51.0 vs 51.4 exp Highlights from the March 2016 US Markit services PMI flash report

Missed expectations but the important news is it's back in expansion. New orders are down a touch but that's a small negative today. Prices charged are at the highest since Nov. Input prices were lower but there may be good news coming on the wage front;

"Meanwhile, input cost inflation slowed in March and remained close to the lows seen at the turn of the year. Survey respondents noted that lower fuel prices had helped to offset stronger salary pressures at their units."

Markit's Chris Williamson isn't letting the better data get ahead of itself, he says that the PMI's so far suggest Q1 GDP of around 0.7%

source

German Inflation Accelerates in March The CPI in euro zone's largest economy accelerated in March, preliminary data from Destatis showed on Wednesday.

On a yearly basis the gauge saw a 0.3% increase, beating the estimated 0.1% growth and above last month's zero growth.

Calculated on a monthly basis, CPI grew 0.8%, faster than February's figure of 0.4% above the estimated 0.6% increase.

This puts inflation closer but still far from the numbers predicted by the European Commission in its Winter Forecast, which predict German inflation at 0.5% on a yearly basis in 2016.

The gauge measures price changes seen in consumer goods and services, including transportation, food and medical care. CPI data are one of the main economic indicators on which central banks base their decisions.

read more

Germany retail sales Feb mm -0.4% vs +0.4% expected German February retail sales report 31 March

YY looks healthy enough but an unwelcome wobble on mm basis. Germany, like many economies, needs domestic demand.

EURUSD a tad lower at 113.15 with EURGBP failing into 0.7900 so far

German Plants in Spring Fatigue: March PMI Barely Rises From 15-Mth Low The backbone of the euro zone economy witnessed its factories surprisingly accelerate in March, a final industry survey showed on Friday, with the reading lifting itself from the recent 15-moth low, but remaining well too weak from a broader perspective.

Germany's final manufacturing PMI booked 50.7 during the third month of the year, slightly up from 50.5 seen in February and snatching the second-weakest print in sixteen months.

A preliminary print showed the reading at 50.4, missing original estimates that had called an acceleration to 50.8.

"German manufacturers ended their worst quarter in over a year in March, with overall growth in the sector slowing to a crawl. Although production growth was maintained, the pace of expansion was little-changed from February’s 14-month low. With new business growth slowing further and workforce numbers falling for a second month running, it is likely that output growth will remain sluggish in coming months. There are also signs that Germany’s export-oriented manufacturing sector is struggling in a challenging global economic environment, with new business from abroad barely rising in March," Oliver Kolodseike, economist at Markit, stated.

Moreover, he added that the "low energy and raw material prices continued to push overall input costs down further, adding to signs that deflationary pressures may persist for some time. Price discounting also intensified, with manufacturers reducing their charges to the greatest extent since the end of 2009."

read more

US Trade Gap Widens Beyond F'cast in Feb With businesses importing more consumer and non-auto capital goods, the US trade gap increased more than analysts had projected in February.

The total nominal trade deficit widened 2.6% to $47.1 billion in February, compared to the $46.2 billion shortfall the markets had been expecting. The January deficit was revised slightly to $45.9 billion from an original $45.7 billion, fresh figures from the Department of Commerce showed on Tuesday.

Imports climbed 1.3% to $225.1 billion, posting the biggest month-to-month increase in a year.

Companies bought more consumer and non-auto capital goods, and demand for imported foods, feeds and beverages reached the highest level ever recorded. On the other hand, shipments of industrial supplies and materials from abroad were the lowest since May 2009.

Imports of services climbed to a record high of $41.8 billion in February.

Exports increased 1% to $178.1 billion, after hitting $176.3 billion in January, the lowest level since June 2011. Shipments of industrial supplies and materials from the US were the lowest in almost six years and exports of capital goods fell to the lowest level since November 2011.

The petroleum deficit shrank to $3.6 billion in February. While petroleum exports hit $6.3 billion, the lowest level since September 2010, imports fell to a 14.5-year low of $9.9 billion.

On average, US companies imported 7.4 million barrels of crude oil per day. At the same time, one barrel cost an average $27.48 to import, the lowest price in more than 15 years. That is about $4.6 less than in January.

source