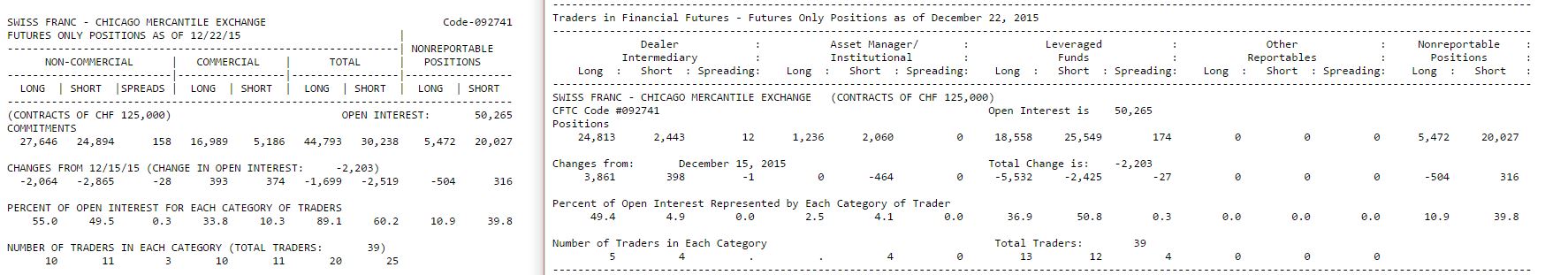

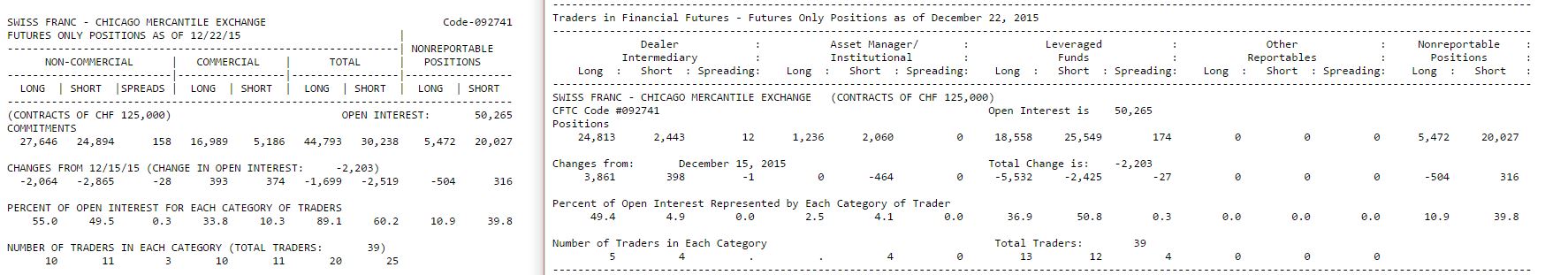

Hey all, Can someone explain the difference between these 2 reports. Thanks

Open interest is the same on both : 50.265

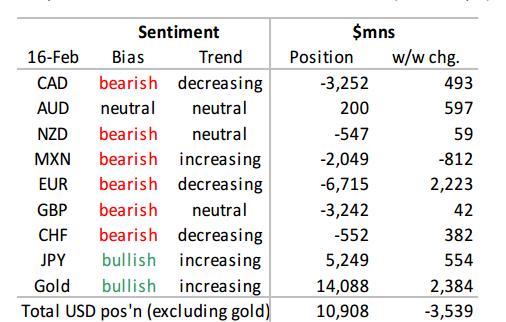

Takeaways From This Week's COT Report: USD Longs Falls To Lowest Since July 2014 Data in this report cover up to Tuesday Feb 16 & were released Friday Feb 19.

Bullish USD sentiment continues to moderate, the aggregate long falling to $10.9bn—its lowest level since July 2014. This week’s shift has been broad, with a deterioration in USD sentiment against all currencies (including gold) except MXN.

EUR sentiment has improved for a sixth consecutive week, with a cumulative $15bn narrowing in the net short since mid-January. The position is now at -$6.7bn, a level last seen in June 2014. An equal build in both long and short GBP positions underscores a considerable degree of uncertainty heading into this week’s EU negotiations, generating vulnerability for GBP.

JPY sentiment has improved in 7 of the past 8 weeks, however we note the considerable moderation in the pace of improvement. The slowing pace could hint to signs of exhaustion, leaving freshly built JPY positions vulnerable in the event of a turn.

CAD bears have liquidated their positions for a third consecutive week, driving the bulk of the most recent $0.5bn narrowing in the net short to $3.3bn. Confidence among bulls remains relatively muted however, suggesting a degree of comfort with current levels for CAD.

Details for AUD are unquestionably bullish, with a continued build in longs alongside a steady liquidation in shorts. The AUD position is now net long (albeit modestly) for the first time since mid-2015.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hey all, Can someone explain the difference between these 2 reports. Thanks