You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Quant Signals: Short NZD/USD, Short GBP/USD, Long AUD/USD - SocGen Short NZD/USD, short GBP/USD, and long AUD/USD are the latest strong FX signals from Societe Generale's Combined Momentum and IR-Driven models.

Tech Targets: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY - UOB EUR/USD: Bullish: Upside likely limited to 1.1245.

As mentioned last Friday, while we turned bullish EUR, the upside potential is likely limited to 1.1245. The current movement is a short-term consolidation and this should lead to an eventual move higher in the next few days.

GBP/USD: Neutral: Bearish only upon daily closing below 1.4200. The corrective rebound that started earlier this month has likely topped out at 1.4437 yesterday (exceeding our 1.4400 target).

While a short-term top is likely in place, only a daily closing below 1.5200 would indicate the start of a sustained down-move. In other words, the current outlook is still viewed as neutral as GBP could trade sideways for a while more (holding below 1.4437) before staging a deeper down-move.

AUD/USD: Bullish: To take partial profit at 0.7600.

The rapid drop from the high of 0.7595 yesterday (holding just below the revised 0.7600 target) is a warning sign that the current bullish AUD phase may be close to an end.

Those who are long should look to take partial profit on any attempt towards 0.7600. Stop-loss is adjusted higher to 0.7425 from 0.7400.

NZD/USD: Neutral: Pull-back likely limited to 0.6545.

There is no change to the current neutral view and we still think there is a chance that the sharp pull-back that started last week has a chance to extend lower to 0.6545 (even though 0.6615 is a strong support).

USD/JPY: Neutral: Still neutral, back in a broad 112.00/114.55 range.

We have held a neutral view since the middle of last month and at this stage, there is no change in our outlook.

Further choppy can be expected, likely in a broad 112.00/114.00 range.

source

Week Ahead: Don't Pass On The Buck; Fresh Longs Attractive Yellen dealt a heavy blow to the FX divergence trade and sent USD falling across the board. We doubt that this is the end of the multi-year USD bull-run, however, and see the current levels as an opportunity to establish fresh longs.

Indeed, the recovery in commodity prices and the easing of global financial conditions should allow the Fed to hike before long. We also note that the USD is starting to look quite cheap compared to the spread between the US and the average G9 2Y rates. Last but not least, the strong positive correlation between the USD and global risk appetite should limit any loses against EUR, JPY and CHF.

The mood in the markets has improved tangibly as well after the Fed reiterated its dovish bias and as fears about China abated further.

Looking ahead, there doesn’t seem to be much standing in the way of the risk rally. Investors could therefore continue to cut CAD-shorts, and add to longs in AUD and NZD. That said, market liquidity will likely deteriorate ahead of the Easter holidays and that could discourage investors from putting on sizeable risk-on bets.

Next week’s data calendar is rather light and, with liquidity thinning, position squaring could start dominating FX price action. The markets are still running sizeable GBP shorts and a potential short squeeze could support the currency, especially if UK inflation does not disappoint. Position squaring could favour CAD relative to other commodity currencies. Last but not least, with markets running JPYlongs but still generally neutral on EUR. EUR/JPY could bounce alongside USD/JPY if weak Japanese inflation boosts BoJ easing bets.

For latest trades & forecasts from major banks, sign-up to eFXplus

What we’re watching

EUR – The EUR should be driven by external factors still, irrespective of next week’s PMI and ifo business climate survey releases.

GBP – Inflation and retail sales data should confirm still constructive domestic conditions to the benefit of rate expectations and the currency.

source

USD, JPY, GBP, CHF, CAD, AUD, NZD: Weekly Outlook - Morgan Stanley USD: Catalysts to Become Bullish. Neutral.

We think the current USD fall will run out of steam. The catalysts for a turnaround back to a USD rally will be either strong US data confirming the need for tighter monetary policy in the US this year or other central banks globally fighting back against their own currency strength. In the short term FX rates can be influenced by central bank action but longer term it’s about the growth outlook relative to the rest of the world.

JPY: Staying Bullish. Bullish.

USDJPY made a new multi-year low on Thursday. We think that USDJPY had potential to fall further but on expectations that weakness in risk appetite will re-emerge. Recently Kuroda tried to use verbal intervention when JPY was strengthening, by keeping the option of further negative rates open. The impact was limited. Overall, the undervaluation of JPY and repatriation flows by pension funds for an ageing population should also support the currency.

GBP: Use Rebound to Sell. Bearish.

GBPUSD trading close to the 1.45 ‘pre-Boris’ level is a position adjustment rather than a fundamental shift in view on the UK. GBP is a highly risk-sensitive currency, so as risk appetite turns around in the coming days we expect GBPUSD to start to decline once again. The BoE was more neutral on rates this week and didn’t see a member opting for a cut. The Brexit risks should remain an undertone for the currency. Retail sales will be in focus this week.

CHF: EURCHF Range-Bound. Neutral.

Negative risk sentiment could limit the downside for CHF and, with the SNB remaining on hold, there doesn’t seem to be an immediate currency-weakening catalyst. When the USD rally resumes in earnest then we would look to enter long USDCHF positions again, but not for another few days. The SNB lowered its inflation profile but saw no need to cut rates in the immediate future.

CAD: Better Data but Oil-Dependent. Neutral.

USDCAD is driven largely by the oil price, but the rapid weakness we saw in December-January is probably not going to be seen for a while as the BoC is less likely to cut rates in response to lower oil. Stronger-than-expected manufacturing sales figures have pointed to a resilient economy. Limited fiscal stimulus is expected to be announced on March 22.

AUD: Central Bank-Driven Weakness. Bearish.

Rebounding iron ore prices and stronger-than-expected labour market data have provided support for AUD. The issue for the RBA is whether AUD strength is now hurting the competitiveness of exporters. We believe that the RBA is a central bank that has room to cut if it wishes, unlike some other global banks we follow that have already adopted aggressive easing policies. We have added a limit order to short AUDUSD to our portfolio.

NZD: More Pain to Come. Bearish.

NZDUSD is approaching the top end of the range at 0.6880, last seen in December. In a risk-negative environment, the less liquid NZD should see the most downside in the G10. The downside should be supported by an accommodative central bank that may push back against currency strength. Note that the NZD TWI is trading over 4% higher than the RBNZ’s latest forecast. Milk prices and inflation expectations are expected to remain low.

source

Tech Targets: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY - UOB EUR/USD: Bullish: Above 1.1375 would open up the way for 1.1495.

The bullish EUR phase that started on 11 Mar is still intact even though we are faced with strong resistance at 1.1375 (high in early December 2015).

Only a clear break above this level would open up the way for a move to 1.1495.

GBP/USD: Bullish: Likely have seen bulk of up-move but another leg to 1.4570 will not be surprising.

While the strong rally from the low of 1.4053 last week is clearly overbought, there is no sign of weakness just yet and further GBP strength still appears likely in the days ahead. That said, 1.4570 is a very strong resistance and this level would not be easy to break. A move above this level would be very positive for GBP and would open up the way for a retest of the February high of 1.4672.

Overall, GBP is expected to remain underpinned as long as the key support at 1.4350 is intact (the 1.4053 low is unlikely to come under threat any time soon).

AUD/USD: Bullish: Target 0.7740.

We reestablished our bullish AUD view last Friday and there is no change to the outlook. As long as 0.7520 is intact, we believe the current AUD strength could extend higher to 0.7740.

That said, overbought short-term condition could lead to several days of sideway consolidation first (before the next leg higher can be expected).

NZD/USD: Bullish: Sharp drop does not bode well for bullish view.

NZD touched a high of 0.6875 last Friday and the subsequent sharp drop from the peak does not bode well for our bullish view. As mentioned in recent updates, 0.6880/00 is a massive resistance zone and would not be easy to break.

A move below 0.6750 would indicate that last week sharp rally is another false break.

USD/JPY: Bearish: Month-long consolidation over, bearish for 110.00.

While the month neutral consolidation is likely over, the decline in USD has been more rapid and aggressive than expected which mean we may have missed a bulk of the move. Overall, the risk is still on the downside and the target from here is at 110.00.

Resistance at 112.30 is likely strong enough to cap any short-term rebound but only a move above 113.00 would indicate that our view is wrong.

source

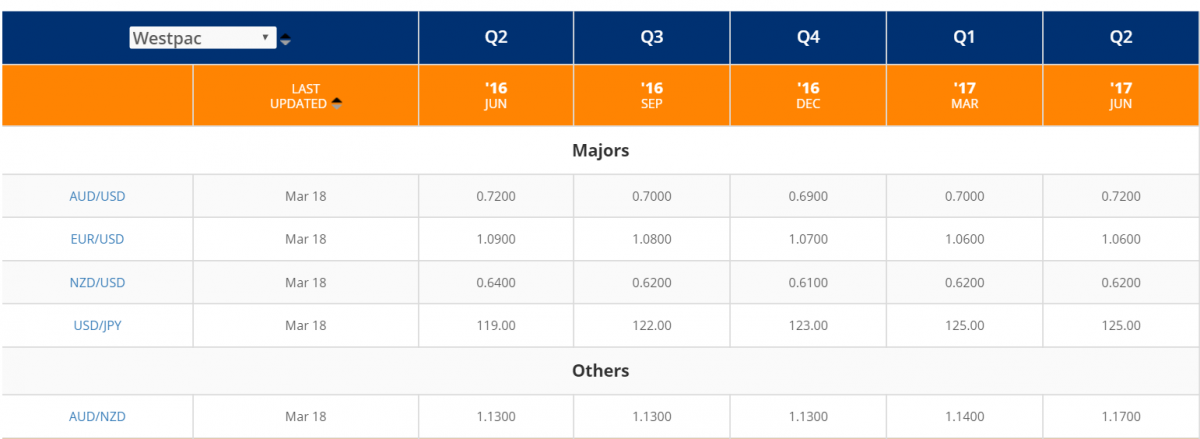

Forecasts For EUR/USD, USD/JPY, AUD/USD, NZD/USD, AUD/NZD

USD: Limited Downside Vs AUD, CAD; EUR: Rallies A Sell According to Fed’s Williams both April and June have the potential for rate hikes. He added that the US economy is looking great in isolation and that it proved remarkably resilient to global factors. He added that if it weren’t for global factors, they would have hiked sooner. Looking ahead, we share the view that there is only limited room of even further falling Fed monetary policy expectations. This is especially true as market expectations of marginally more than 30bp in terms of tightening for the reminder of the year stand in contrast to the Fed’s own projections. In line with our own expectations, the Fed anticipates two more hikes this year. From that angle we stay of the view that the USD will face only limited downside risks, in particular against risk sensitive currencies such as the AUD and CAD.

The EUR, in contrast, may stay supported should rising rate expectations lower investors’ demand for risk assets. However, in line with our forecasts we expect rallies to remain a sell.

In Australia, RBA Governor Stevens was on the wires. He more or less kept all options regarding lower rates open. Even if domestic conditions have been improving, uncertainty with respect to Asia is keeping the central bank cautious. At the same time it must be noted that a further appreciating currency’s dampening impact on monetary conditions is unlikely welcomed. Indeed, Stevens stressed that the AUD may be getting a bit ahead of itself. It must still be noted that he indicated that the economy is coping well with current conditions.

Even if the AUD has been in demand of late, we see only limited upside risks from the current levels. This is especially true as balanced speculative positioning indicates only limited position squaring related upside risks.

source

Setups: EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD, USD/CAD The following are the latest technical setups for EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD, and USD/CAD as provided by the technical strategy team at Barclays Capital.

EUR/USD: We are cautiously bearish. Yesterday’s low close was on below average volume, but price action points lower in range in the short term. We are looking for a move towards targets near 1.1145 and then the 1.1055 area.

USD/JPY: Our preference is to fade upticks against 113.10. A move below the 110.65 lows would signal lower towards our targets near 110.35/05.

GBP/USD: Monday’s low close endorses Friday’s “doji” topping candle and signals lower in range towards support near the 1.4050 range lows. A move below 1.4050 would point lower towards our targets near 1.3835 and then the 1.3500 area.

AUD/USD: A move above our initial upside targets near 0.7690 would signal higher towards greater targets in the 0.7875 area. We are also bullish AUDNZD and look for a move above 1.1320 to open targets near the 1.1430 range highs.

NZD/USD: We are bearish against the 0.6890 range highs and look for a move lower towards our initial targets near 0.6545. Our next targets are at the 0.6350 range lows.

USD/CAD: We prefer to fade upticks while resistance in the 1.3360 area caps. A move below 1.2920 would encourage our bearish view towards initial targets near 1.2830.

source

Setups For EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD - Barclays The following are the latest technical setups for EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD, and USD/CAD as provided by the technical strategy team at Barclays Capital.

EUR/USD: We are bearish against the 1.1380 range highs and look for a move lower in range. Our initial targets are towards 1.1145 and then the 1.1055 area.

USD/JPY: Our preference is to fade upticks against 113.10. A move below the 110.65 lows would signal lower towards our targets near 110.35/05.

GBP/USD: Our bearish view was encouraged by Tuesday’s sell-off. Our initial downside targets are near the 1.4050 range lows. A move below 1.4050 would point lower towards our targets near 1.3835 and then the 1.3500 area.

AUD/USD: We are bullish and look for a move above our initial upside targets near 0.7690 to signal higher towards greater targets in the 0.7875 area.

NZD/USD: We are bearish against the 0.6890 range highs and look for a move lower towards our initial targets near 0.6545. Our next targets are at the 0.6350 range lows.

USD/CAD: We prefer to fade upticks while resistance in the 1.3360 area caps. A move below 1.2920 would encourage our bearish view towards initial targets near 1.2830.

source

Setups: EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD, USD/CAD - Barclays The following are the latest technical setups for EUR/USD, USD/JPY, GBP/USD, AUD/USD, NZD/USD, and USD/CAD as provided by the technical strategy team at Barclays Capital.

EUR/USD: A move below our initial downside targets near 1.1145 would encourage our bearish view. Our next targets are in the 1.1055 area.

USD/JPY: We are bearish and prefer to fade upticks towards resistance near 113.10. The greater range highs near 114.90 help to keep our overall view bearish. Targets are towards the 110.65 lows and then the 110.35/05 area.

GBP/USD: We look for a break below our initial downside targets near 1.4050 to confirm downside traction towards support near 1.3980 and then our next targets in the 1.3835 area, the year-to-date lows.

AUD/USD: We prefer to fade dips towards support in the 0.7410 area and look for a move through our initial targets near 0.7690 towards the 0.7875 area.

NZD/USD: We are bearish against the 0.6890 range highs and look for a move lower towards our initial targets near 0.6545. Our next targets are at the 0.6350 range lows.

USD/CAD: We view upticks as counter trend and would look to sell while resistance near 1.3340 caps. A move below 1.2920 would encourage our bearish view towards initial targets near 1.2830.

source