That will be enough to destroy European middle class completely

That will be enough to destroy European middle class completely

For sure. it will be terrible.

The ECB Will Fail Given The "History Lessons Of US And Japan", Warns Deutsche Bank

Recall that the stated purpose behind the reason why Mario Draghi's ECB is about to launch a European government debt monetization program ranging between EUR500 and 1000 billion is to halt deflation, spark credit creation and rekindle inflation. Alas, if that is indeed the case, then as Deutsche Bank said has already determined apriori, it will be a failure. Here's why from the biggest German bank.

First, a broad strokes preview of what the world's most confused Central bank will do this week:

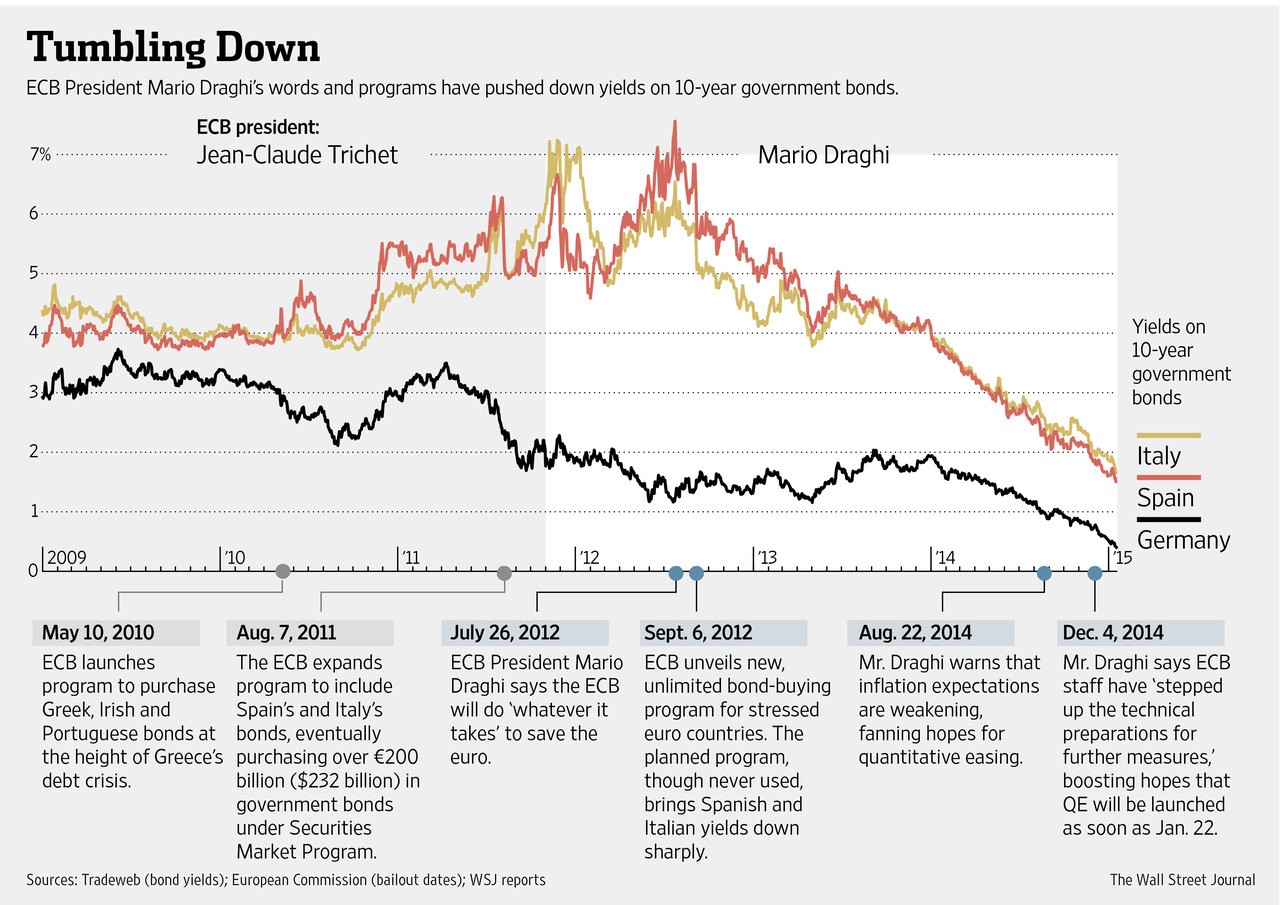

[The ECB] is trapped down a dark alley and they will bite. For all the pros and cons of public QE as well as the hows and whens, at the end of the day the market has pushed the ECB into that corner. Within the context of the practical limitations of QE, we have no doubt that Draghi once again will leave a warm fuzzy feeling that they are prepared to do all that it takes. Of course, like OMT, it probably doesn’t mean they are buying BTPs come February 1st, but that doesn’t matter for BTPs. It also doesn’t matter for the Euro zone outlook given the dubitancy of QE efficacy.

And here is why the ECB too will follow its peers, the Fed and BOJ, in failing to boost inflation expectations which at last check were below the Lehman collapse levels and sliding fast (see "The Chart That Terrifies The Fed")

We suspect whatever the ECB “under delivers on” in substance, it will “over deliver” in terms of perceived commitment and Draghi rhetoric. So net it is hard to be very bearish on peripherals nor core markets. Core markets ultimately benefit from the perception that there just aren’t enough assets out there even for a small program of Euro 500 billion. As the table below shows the free float as defined by other investors is expected to be a paltry 26 percent this year (after Euro 300 billion in purchases for CY 2015). This compares with almost 50 percent in the US.

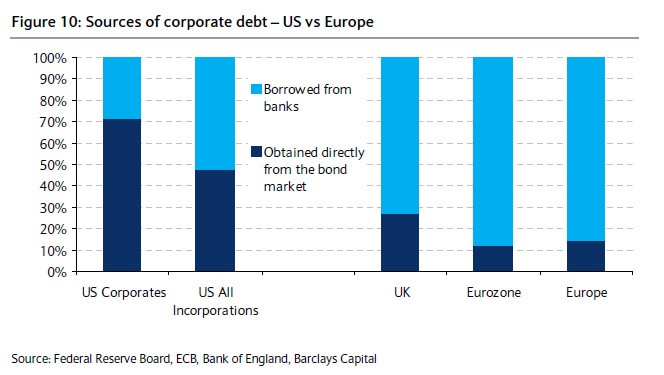

More importantly we doubt inflation expectations will spike sustainably higher on any announcement given the “failed” history lessons of US and Japan as well as doubts about QE making a difference quickly in the Euro zone. This really centers on the issues of the Euro zone’s different financial model (bank not security based) as well as the still ongoing deleveraging of the banks for regulatory purposes.

Ironic, because Zero Hedge pointed out precisely this distinction nearly three years ago in "A Few Quick Reminders Why NOTHING Has Been Fixed In Europe":

And we are also finally glad that with every passing day more and more banks, pundits and "straight to CNBC" experts wearing business suits realize what we said 6 years ago, namely that QE will never work as one can't fix a failed financial system due to record debt problem with more debt and even more props to support an even more failed financial system. And that QE has, is, and will continue failing... for everyone but the 1% of course, who with every passing day continue to tempt not only fate but the guillotines as well. Reference? See the French Revolution, because it is never different this time.

Looking at what SNB did, nobody knows what can happen now. But someone sold a whole lot of Euros on Thursday, that is for sure. Someone that is slowly buying them back. Why?

European Central Bank Nears Crucial Test of Its Powers

The European Central Bank is poised to head into uncharted territory as it nears a decision Thursday on whether to launch a controversial stimulus program aimed at boosting Europe’s fading economy.

The bank’s challenge: engineer a plan that impresses investors, passes muster with conservative ECB members and—most of all—helps bring Europe out of its slump.

The meeting comes as Europe is on the ropes. The region’s gross domestic product remains below 2008 levels and unemployment is stubbornly high at double-digit levels, inflicting pain on Spain, Italy, Greece and other struggling economies. Anti-euro parties are flourishing in parts of the region as politicians tap into voter discontent over Europe-imposed policies.

In Greece, where the bloc’s debt crisis began five years ago, citizens go to the polls on Jan. 25 to pick a new parliament. Polls now show a slim lead for a far-left party that aims to reverse many of the austerity programs the country was forced to accept as a condition for vital international aid.

The stakes are high, and not just for the 19 countries that use the euro. The prospect of major ECB stimulus has already rippled through the central banking world. Last week, the Swiss National Bank was forced to abandon a ceiling it had set on the Swiss franc’s value against the euro amid persistent weakness in the single currency, roiling global financial markets.

On Monday, Denmark’s central bank made an unscheduled decision to cut its interest rates, also in apparent anticipation of the ECB’s move.

Expectations for large-scale government-bond purchases by the ECB are so entrenched that French President François Hollande on Monday made an unusually blunt comment that the ECB would on Thursday decide to buy government bonds. The central bank, which fiercely guards its independence from political interference, declined to comment. German Chancellor Angela Merkel later in the day emphasized that the ECB makes its decisions independently.

Investors say the prospect of massive ECB stimulus is broadly baked into financial markets already. Around a quarter of the eurozone’s €5 trillion ($5.8 trillion) government-bond market now pays a negative yield, according to Bank of America Merrill Lynch, compared with only a 10th back in October—a sign that investors are positioned for a large bond-buying scheme.

ECB officials themselves have fanned these hopes, signaling in recent weeks that they wanted to add as much as €1 trillion to the bank’s balance sheet, or the value of assets it holds. The government-bond market is the only asset class in Europe big enough to provide that scale.

But there are bigger issues than simply finding large quantities of bonds to buy. The ECB is grappling with a flock of chronically weak economies, including France’s as well as those of Italy and Greece.

It also is struggling with questions over its role and identity: namely whether a central bank that is largely modeled on Germany’s conservative Bundesbank, and whose philosophy is grounded in 20th-century concerns over too-high inflation, can adapt to using innovative tools to combat recurring financial crises and deflationary threats.

“The ECB should really graduate to a modern central bank that uses this instrument,” said Paul De Grauwe, professor at London School of Economics. “The only way to reach that point is by doing it.”

Large-scale government-bond purchases, known as quantitative easing, have become a standard part of the tool kit of central banks in the U.S., U.K. and Japan to reduce long-term interest rates.

Yet despite a wealth of experience at other central banks, the ECB—which was established in 1998—faces many unknowns. There is no federal asset to buy because the eurozone lacks a common debt security. Instead, the region has 19 different bond markets, ranging from triple-A Germany to junk-rated Greece. Bond yields are near record lows across much of the region, suggesting the ECB won’t be able to steer them much lower.

With eurozone consumer prices falling on an annual basis for the first time in over five years and the bloc’s $13.2 trillion economy barely growing, the ECB’s reputation as Europe’s most trusted institution may take a hit if it launches the policy Thursday but fails to get quick results.

7 Scenarios for the ECB decision

An announcement on QE in the euro-zone seems imminent in the euro-zone. The shocking move by the SNB with its accompanying hints and recent comments from ECB officials have paved the way for a very significant announcement. The reaction for EUR/USD depends on the size of the program. But, Draghi and co. will not necessarily give us an exact total number, but could go for other options such a program without a time frame, choosing a percentage of national debt as a measure, etc.

Here are 7 potential scenarios for the January 22nd event, with probabilities and possible reactions in EUR/USD:

- QE worth around €750 billion: This would fit nicely between €500 billion reportedly prepared and the big T word: €1 trillion euros. Counting the other tools such as the TLTRO and ABS, a QE program of this size would make the total balance sheet expansion reach around €1 trillion, as the Bank intended. In this scenario, the euro would slide, but not collapse. Probability: high.

- QE worth €500 billion: This is what the ECB staff was originally preparing, according to reports, but since then it seems that the move would be larger. Such a move is basically priced into EUR/USD and the reaction would be a “sell the fact”. Probability: medium.

- QE worth €1 trillion or more: It could a a program of “up to one trillion” and not necessarily reach this sum, but the effect would be strong enough and would send the euro free-falling. Probability: low.

- QE of up to 25% of total debt, by NCBs, with opt-outs: This is certainly a valid option according to what Knot had to say and it implies even €2 trillion. However, if bond buying is done at the national levels, with the National Central Banks (NCBs) rather than the ECB and countries could opt out, Germany would certainly a candidate that could avoid participation, taking a lot of weight out of the program. This could trigger a mixed reaction and lots of confusion in markets but hurt the euro. Probability: medium-high.

- QE of up to 25% total debt, managed by the ECB: In this scenario, the ECB manages all the bond buying, and does it relatively quickly, printing lots of euros and steering fast towards the 2012 balance sheet. This would send the euro plunging fast. Probability: medium-low, due to German opposition.

- No QE now: Some are still expecting the ECB to only talk about acting in March but not do anything now. Given recent hints, the probability seems very low. If this is the case, the euro would jump, as avoiding action now could mean avoiding action later.

- Unlimited time frame: If Draghi takes a page from the last Fed book, he would announce monthly bond buying and no time frame for ending it or tapering it down. An unlimited program is the strongest one, and parity for EUR/USD is an option for the next days, depending on the monthly quantity. However, the probability is low: the ECB does adopt other banks’ policies, but usually not the latest ones and not the most extreme ones.

We are assuming that the ECB will not go for buys of corporate bonds, an option that was raised in the past but could be kept as a possible “Phase II” – keeping ammunition in the tool shed.

Perceptions of ECB independence hang in the balance

This Thursday’s ECB press conference will be a show stopper for the forex markets and could deliver another market moving shocker following closely on the Swiss National Bank’s surprise decision to unpeg CHF from the EUR last week.

The ECB is widely expected to announce the launch of a long waited and much anticipated quantitative easing programme on Thursday. Markets are already speculating about its size – EUR 0.5-1.0 trillion – and it’s composition, buying only high credit quality sovereign bonds or buying sovereign bonds of all Eurozone countries with national central banks responsible for any losses due to defaults.

However, there is a chance there may be no QE announcement. Germany is strongly opposed to it and may get its way. If that happens the EUR is likely to spike as traders rush to cover short positions and reassess the ECB’s ability to manage monetary policy.

Such an outcome would be a severe blow to the ECB’s independence. It’s one thing for politicians to air their views publicly, but it’s quite another for them to actually get their way.

Deutsche Bank's Most Cynical Take On Draghi's QE Yet: Buy European Stocks Even Though QE Will "Prevent Improvements"

For the most succinct, and most cynical, take on yesterday's ECB QE announcement we go to Deutsche Bank which 7 years after the grand money printing experiment started, has thrown in the towel on spinning the now annual CTRL-P ritual, and - in a nutshell - says: QE will fail to do anything but boost stocks, so may as well buy stocks.

To wit from DB's Jim Reid:With the ECB now committed to a large and sustained QE program we continue to believe that this will be a good environment for European equities and European credit whether you like the fundamentals or notor whether you think it makes any difference to the economy longer-term. Indeed if you believe a lack of structural reform, increasing inequality and low fiscal injections are holding back growth then yesterday's announcement hardly changes the long-term picture. Indeed it could even prevent improvements here.

So yes, the printers are still playing music and one must dance, at least until the ECB pulls a "Swissy" and rips the rug out from under everyone. So enjoy it until then. As for those 99% whose lives are about to get even worse: better luck in the next life.

That is cynical - since they are going to get the biggest part of QE

The scamm does not have shame : they are laughing in our faces

ECB to Kick Off QE on March 9: Sources

The European Central Bank (ECB) will launch its long-awaited government debt purchasing program next Monday, sourced told Italian paper Il Sole 24 Ore on Monday.

According to the story, Eurosystem central banks will start buying sovereign bonds from the bloc on March 9, with ECB president Mario Draghi announcing the step during his press conference this Thursday in Cyprus.

During the meeting, the bank is also set to raise its quarterly GDP growth estimates and at the same time, lower its inflation projections, sources told the daily, however, without providing any exact figures.

QE to come

The QE framework was announced during the latest rate-setting committee get-together, on January 22.

This week’s ECB meeting in Cyprus will set the stage for QE implementation this month. So far Draghi has been more than secretive about details, even about exactly when asset purchases will start. That's because how the ECB manages its bond buying will largely determine where yields head next.

The ECB plans €60 billion in monthly purchases, although €10 billion will be in private bonds. This has already raised many questions, as numerous economists pointed that the purchases under the ECB's QE programme will comfortably exceed net debt issuance - especially in Germany.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

In the past week, we have received quite a few fat hints from Draghi and his colleagues. Also the SNB’s shock move included 3 ECB QE hints. And if fat hints weren’t enough, Dutch ECB member Klaas Knot spills the beans on QE, or if you wish, ties the knot.

Here are the recent details emerging from the ECB, calculations for the potential size of the QE and implications for the euro:

The news

Knot gave an interview to Spiegel Magazine and provided some details reported here by Bloomberg. The most important detail is the guidance about the size: it could reach 20% to 25% of each countries outstanding government debt. The ECB is set to set a 20-25% purchase limit for each country’s debt.

Before we calculate what that means, here are additional important details: sovereign bonds will be bought by the national central banks: each NCB will buy its own bonds. This lowers the risk of fiscal transfer (forbidden by the EU treaty).

Another important detail is that the plan will not include Greek bonds due to their low rating. Greece may not be the only country not buying bonds. As Adam Button notes. this may allow the German Bundesbank to opt out of this big program, thus reducing the size of the program.

Another important news bit from Knot is that he said that Draghi presented the plan to German Chancellor Angela Merkel and to her finance minister Wolfgang Schäuble. This means that political preparation has been made at the highest levels.

Both the ECB and the German government declined to comment on this specific topic.

It is important to note that a decision hasn’t been announced yet and it could turn out differently than currently reported.

Yet according to what we know now, here are some numbers:

QE Calculations

According to Eurostat (you can see debt to GDP and also debt in millions of euros), the total government debt of the 18 country euro-zone for 2013 (before the addition of Lithuania in 2015) stood on just over 9 trillion euros: 9,007,691,600,000 euros if one wants to be precise. Greece had a debt of over 319 billion: 319,133,000,000 according to the data. That leaves: 8,688,558,600,000 or 8.68 trillion.

Assuming debt hasn’t squeezed since then and using simple math, 25% of 8.68 trillion is 2.17 trillion euros in the extreme scenario That is much larger than the 500-750 billion estimates.

Now let’s go for a more conservative calculations: let’s exclude Germany with 2,159,467,900,000 euros of debt, or 2.16 trillion. That leaves us with 6,529,090,700,000 or 6.529 trillion. And, let’s take 20% instead of 20%

So: 20% of 6.529 trillion is 1,305,818,140,000 or just over 1.3 trillion euros in a conservative calculation. Also here, the sum is huge: it includes the “trillion” word and is much higher than current estimations.

Bazooka Impact

It is important to note that for QE to have a material impact on the value of the euro (which it already has) and for QE to help the euro-area economies, there isn’t a need to deploy 1.3 or 2.17 trillion euros. The mere option of using such huge sums is strong enough.

With these kind of numbers, the ECB much more than compensates for the squeeze in its balance sheet due to the LTRO repayments. And contrary to the LTROs which have a limited time scope and need to be paid back, the QE-related expansion can be rolled over. The US and the UK maintain the wide balance sheets via reinvesting QE proceeds.

As aforementioned, the ECB hasn’t made an official announcement just yet: this awaits for Thursday, January 22nd. They could still make changes. And, prospects of ECB QE are on the cards for a long time and they have already hit the euro hard.

However, if a 20-25% debt purchase limit is set, the potential size could be huge and another big leg down from the euro cannot be ruled out.

source