It is starting : that was a polite warning to listen what they have been told. Not knowing who sold it my ...

It is starting : that was a polite warning to listen what they have been told. Not knowing who sold it my ...

Nagh

On one side there is Draghi mad at the Chinese for constantly buying Euro (to diversify reserves) and on the other side there is an "unknown" seller of $100 billion of US Treasury  :):)

:):)

Nagh On one side there is Draghi mad at the Chinese for constantly buying Euro (to diversify reserves) and on the other side there is an "unknown" seller of $100 billion of US Treasury

:):)

:):)Both China and Russia did say that they would dump US Bonds in lieu of any sanctions by Europe or US. With some people their word is their bond (no pun intended :-)

Xard777

Both China and Russia did say that they would dump US Bonds in lieu of any sanctions by Europe or US. With some people their word is their bond (no pun intended :-) Xard777

I agree. It is demonstrated that the gloves can be taken off by the other side too. The one way game that was going on ever since USSR stopped existing is coming to an end.

The Russians Have Already Quietly Pulled Their Money From The West

Earlier today we reported that according to weekly Fed data, a record amount - some $105 billion - in Treasurys had been sold or simply reallocated (which for political reasons is the same thing) from the Fed's custody accounts, bringing the total amount of US paper held at the Fed to a level not seen since December 2012. While China was one of the culprits suggested to have withdrawn the near USD-equivalent paper, a far likelier candidate was Russia, which as is well-known, has had a modest falling out with the West in general, and its financial system in particular. Turns out what Russian official institutions may have done with their Treasurys (and we won't know for sure until June), it was merely the beginning. In fact, as the FT reports, in silent and not so silent preparations for what will be near-certain financial sanctions (which would include account freezes and asset confiscations following this Sunday's Crimean referendum) the snealy Russians, read oligarchs, have already pulled billions from banks in the west thereby essentially making the biggest western gambit - that of going after the wealth of Russia's 0.0001% - moot.

From the FT:

Russian companies are pulling billions out of western banks, fearful that any US sanctions over the Crimean crisis could lead to an asset freeze, according to bankers in Moscow.Sberbank and VTB, Russia’s giant partly state-owned banks, as well as industrial companies, such as energy group Lukoil, are among those repatriating cash from western lenders with operations in the US. VTB has also cancelled a planned US investor summit next month, according to bankers.

The flight comes as last-ditch diplomatic talks between Russia’s foreign minister and the US secretary of state to resolve the tensions in Ukraine ended without an agreement.

Markets were nervous before Sunday’s Crimea referendum on secession from Ukraine. Traders and businesspeople fear this could spark western sanctions against Russia as early as Monday.

It probably will. What it will also do is force Russia to engage China far more actively in bilateral trade and ultimately to transact using either Rubles or Renminbi, and bypass the dollar. Perhaps even using gold, something which the price of the yellow metal sniffed out this week, pushing itself to 6 month highs. It will also make financial ties between the two commodity-rich nations even closer, while further alienating that "imperialist devil," the US.

Of course, the west thinking like the west, and assuming that all that matters to Russia is the closing level of the Micex, believes that a sufficient plunge in Russian stocks would have been enough to deter Putin. After all, the only thing everyone in the US cares about is if the S&P 500 closed at yet another all time high, right?

What the west didn't realize, as we predicted a month ago, for Putin it is orders of magnitude more important to have the price of commodities, primarily crude and gas, high than seeing the illusion of paper wealth, aka stocks, hitting all time highs. Especially since in Russia an even smaller portion of the population cares about the daily fluctuations of the stock market. As for the oligarchs, if there is someone who will be delighted to see their power, wealth and influence impacted adversely, if only for a short period of time, it is Vladimir Vladimirovich himself, whom the west misjudged massively once more. Not to mention that the general population will be even more delighted, and boost Putin's rating even higher, if these crony billionaires are made to suffer by the west, if only a little.

(Here we would be remiss not to comment on his easy it supposedly is for Obama to freeze the assets of a few corrupt Russian billionaires, and yet the very proud Americans who nearly brought the entire financial system to the brink in 2008, are now richer than ever.)

Nobody Just Sold $100 Billion Of US Treasuries

In the week through Wednesday, March 12, the amount of U.S. Treasury securities held in custody for foreign official and international accounts (i.e., central banks) at the Federal Reserve dropped by a staggering $104.5 billion, marking what was far and away the biggest weekly drop on record.

These custody holdings have fallen almost every week since mid-December, as weakness in emerging-market (EM) currencies has caused EM central banks to raise dollars by liquidating their U.S. Treasury holdings, and then turn around and sell those dollars on the open market in order to prop up their own currencies.

This has prompted some speculation that central banks selling Treasuries were behind the record drop in Fed custody holdings. However, such activity doesn't come close to explaining what happened in the last week.

For example, the Central Bank of Russia — which has been in the spotlight due to escalating military tensions in Ukraine and has thus seriously underperformed against other EMs as of late — only bought 154.97 billion rubles in the week ended March 12.

At an average exchange rate of 36.35 rubles to the dollar over that time period, the CBR's intervention amounted to about $4.3 billion — leaving more than $100 billion of the drop in Fed custody holdings unaccounted for.

The second-largest weekly drop in Fed custody holdings of U.S. Treasuries for foreign official accounts on record took place in the week ended June 26, 2013. Recall that June 2013 was a period of significant, widespread stress in emerging markets on the back of assertions by then-Federal Reserve Chairman Ben Bernanke that the U.S. central bank would likely begin winding down its quantitative easing program later in the year.

During that week in June, JPMorgan's Emerging Markets Currency Index fell as much as 2.5%.

Over the week ended March 12, 2014, on the other hand, the index fell only 0.6%. Moreover, traders on U.S. Treasury desks were unaware of any unusual central bank flows this week — meaning "fire sales" of U.S. Treasuries by EM central banks appears to be an insufficient explanation for the large drop in holdings.

The most likely explanation for the drop in custody holdings is that Russia moved its U.S. Treasuries outside of the U.S., so that if and when the West levies financial sanctions against it as a result of escalating military tension in Ukraine, Russia will still be able to access its money.

BofA Merrill Lynch interest rate strategists Shyam Rajan and Priya Misra make two points to that effect in a note to clients (emphasis added):

1) Although large shifts out of the New York Fed custody are rare, we have seen custodian shifts elsewhere, recently. For example, the December 2013 TIC data showed a massive increase in Belgium's Treasury holdings (higher by $57 billion), matched by a drop in China’s holdings (-$48 billion). Given that Belgium’s reserves total less than $20 billion, the spike higher was likely a shift in custodians by a major reserve manager. The recent shift could be also be a similar large reallocation to a different custodian.2) The upcoming referendum in Crimea this weekend and the multiple threats of sanctions could have triggered a significant reallocation of Treasuries to a non-U.S. custodian. Note that custodian banks are not allowed to transact with entities listed in the OFAC list, once sanctions are imposed.

What impact does all of this have on the market?

"A mere shift in custodians should not have any impact on yields in the Treasury market," say the BofAML strategists.

"A consistent move out of the New York Fed merely diminishes the reliability of this indicator as a high frequency source for foreign official demand."

Now they are telling that nobody sold it?  :):)

:):)

Remember The $100 Billion In Treasuries That Went Missing? A Bunch Just Turned Back

In the week ended March 12, the Federal Reserve's custody holdings of U.S. Treasuries plummeted by $104.5 billion, marking what was far and away the single-largest weekly withdrawal on record.

The massive drop fueled speculation that Russia had moved a large portion of its holdings out of the U.S. in order to avoid asset freezes from impending financial sanctions.

Custody holdings have been falling in recent weeks and months as central banks in emerging markets have been forced to liquidate dollar assets in order to prop up their own currencies, which have come under pressure, but the size of the move seemed far too large to be explained by such activity.

The Fed just reported custody holdings data for the week ended March 19, and the numbers are sure to add to the confusion.

As the chart shows, custody holdings increased by $32.3 billion this week.

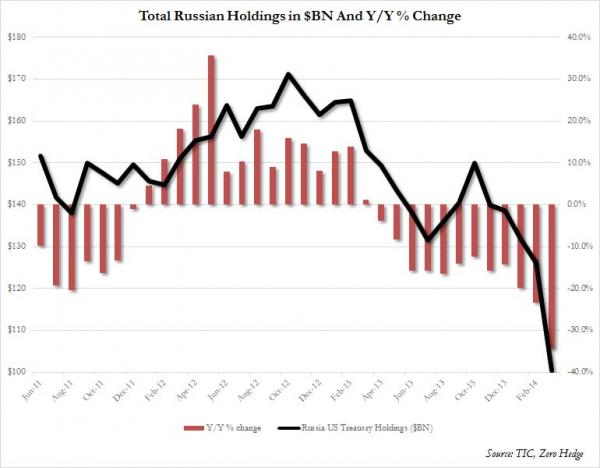

Russia Dumps 20% Of Its Treasury Holdings As Mystery "Belgium" Buyer Adds $40 Billion

Back in mid-March, there was a brief scare after the start of the Ukraine conflict, when Fed custody holdings plunged by a record $104.5 billion (if promptly bouncing back the following week), leading many to believe that Russia may have dumped its Treasurys, or at least change its bond custodian. We noted that we wouldn't have a definitive answer until the May TIC number came out to know for sure how much Russia had sold, or if indeed, anything. Moments ago the May TIC numbers did come out, and as expected, Russia indeed dumped a record $26 billion, or some 20% of all of its holdings, bringing its post-March total to just over $100 billion - the lowest since the Lehman crisis.

But as shocking as this largely pre-telegraphed dump was, is the country that has quietly and quite rapidly become the third largest holder of US paper: Belgium. Or rather, "Belgium" because it is quite clear that it is not the country of Begium who is engaging in this unprecedented buying spree of US paper, but some account acting through Belgian custody.

This is how we explained it last month :

Make that an unprecedented $381 billion because as we just learned "Belgium" bought another $40 billion in March!... to clarify for our trigger-happy Belgian (non) readers: it is quite clear that Belgium itself is not the buyer. What is not clear is who the mysterious buyer using Belgium as a front is. Because that same "buyer", who to further explain is not China, just bought another whopping $31 billion in Treasurys in February, bringing the "Belgian" total to a record $341.2 billion, cementing "it", or rather whoever the mysterious name behind the Euroclear buying rampage is, as the third largest holder of US Treasurys, well above the hedge fund buying community, also known as Caribbean Banking Centers, which held $300 billion in March.

In summary: someone, unclear who, operating through Belgium and most likely the Euroclear service (possible but unconfirmed), has added a record $141 billion in Treasurys since December, or the month in which Bernanke announced the start of the Taper, bringing the host's total to an unprecedented $341 billion!

In the end sanctions may backfire to US. As if they forgot how much they owe and that they can not use that (the debt) as a weapon of controlling the other any more

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

A month ago we reported that according to much delayed TIC data, China had just dumped the second-largest amount of US Treasurys in history. The problem, of course, with this data is that it is stale and very backward looking. For a much better, and up to date, indicator of what foreigners are doing with US Treasurys in near real time, the bond watchers keep track of a less known data series, called "Treasury Securities Held in Custody for Foreign Official and International Accounts" which as the name implies shows what foreigners are doing with their Treasury securities held in custody by the Fed on a weekly basis. So here it goes: in the just reported latest data, for the week ended March 12, Treasurys held in custody by the Fed dropped to $2.855 trillion: a drop of $104.5 billion. This was the biggest drop of Treasurys held by the Fed on record, i.e., foreigners were really busy selling.

This brings the total Treasury holdings in custody at the Fed to levels not seen since December 2012, a period during which the Fed alone has monetized well over $1 trillion in US paper.

So is this the proverbial beginning of foreign dumping of US paper? Could Russia simply have designated a different custodian of its holdings? No, because as of most recently it owned $139 billion in US paper, or well above the number "sold" and a custodial reallocation would mean all holdings are moved, not just a portion. For another view, here is what the bond experts at Stone McCarthy had to say:

As for the timing: