The golden age of forex is damaged. With all the rigging and things done by market makers it will take time till people start to have the same confidence as before. And with Makau taking over Las Vegas why should people risk giving money to crooked bankers when they can give the money to less crooked casinos

US retail forex brokers continue to bleed client assets

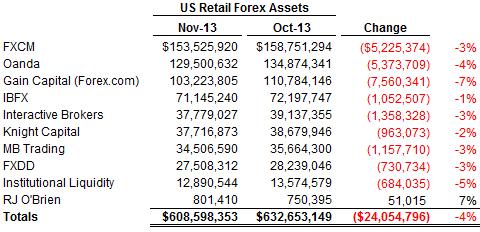

CFTC monthly November data show a further 4% decline in client assets held by US forex brokers.

(Over-) regulation continues to take its toll in the US retail FX business. CFTC's just-released November data showed continued erosion of assets held by US retail FX traders at their brokers. This wasn't a case of clients migrating from one broker to another. Virtually all US retail FX brokers lost client funds in November in the 3%-7% range, save for tiny RJ O'Brien, as shown in the chart below.

At about $608 million, US retail FX client assets are now down 7% from where they were at the beginning of the year, and 18% from start of 2012 levels. And this in a year where globally the forex industry had a very nice comeback in trading volumes -- our Retail FX Volume Index shows that global volumes in 2013 were more than 20% above 2012.

2013 has also seen a decline in choice facing US traders, with two known brokers -- FX Solutions and Alpari US -- withdrawing from the US market. FXCM acquired Alpari's US clients, while Gain Capital picked up FX Solutions' US business, the US arm of UK spreadbetting firm City Index.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily spot foreign exchange trading volumes on Thomson Reuters dealing platforms fell 11.5 percent in December to the lowest level since the company started tracking the data four years ago, figures showed on Wednesday.

Average daily spot volumes were $92 billion in December, traditionally the month of lowest volume, compared with $104 billion in November.

That is the lowest since Thomson Reuters started compiling the figures in January 2010, and together with September last year, only the second month when average daily volume has been below $100 billion.

Turnover across the world's largest financial market fell steadily over the course of last year, and comes against the background of the global investigation into alleged FX manipulation rates.

Average daily volume across Thomson Reuters dealing platforms in 2013 was $120 billion. That was down 6 percent from the previous year and a hefty 20 percent below the daily average of $150 billion in 2011.

On FXall, the electronic foreign exchange platform purchased by Thomson Reuters last year, average daily volumes fell 7 percent in December from a month earlier to $100 billion.

Volumes on FXall have steadily risen in the three years since data has been tracked. The daily average in 2013 was $108 billion, up 30 percent from $83 billion in 2011.

source