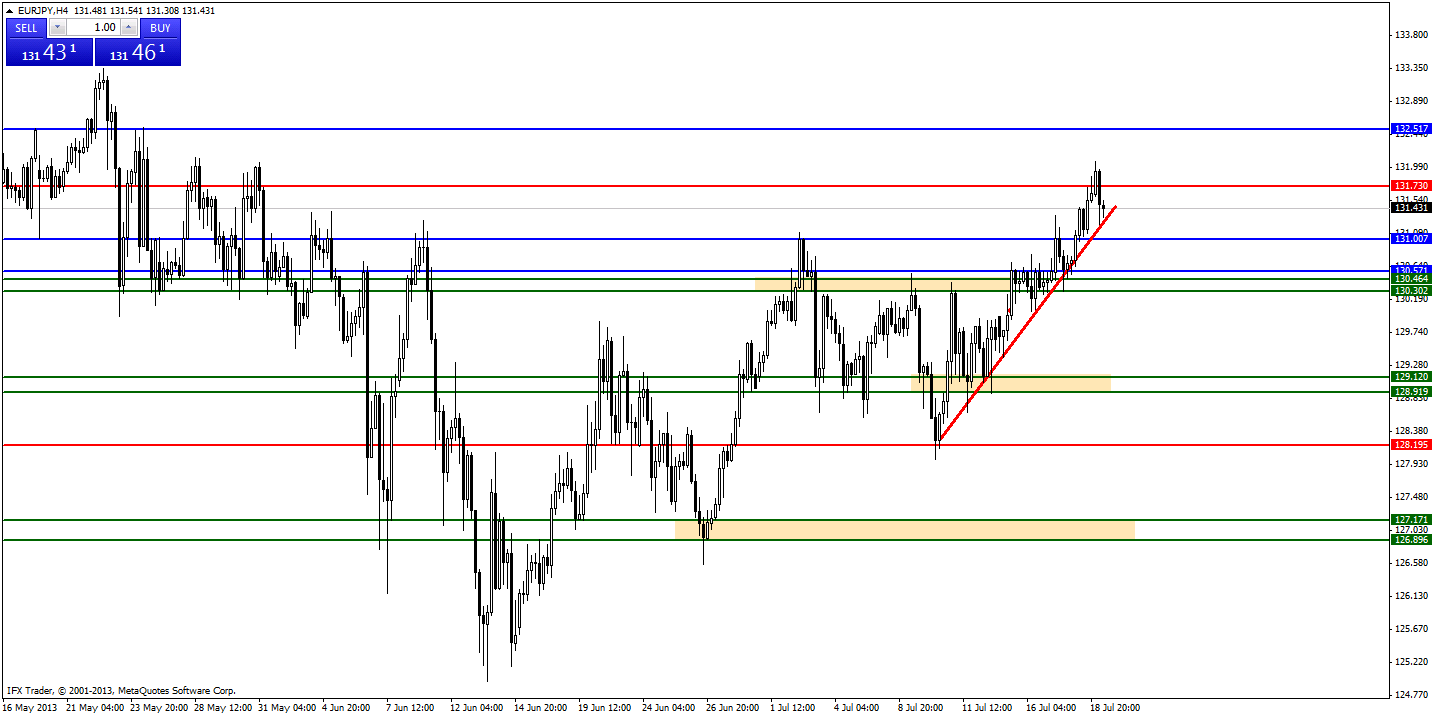

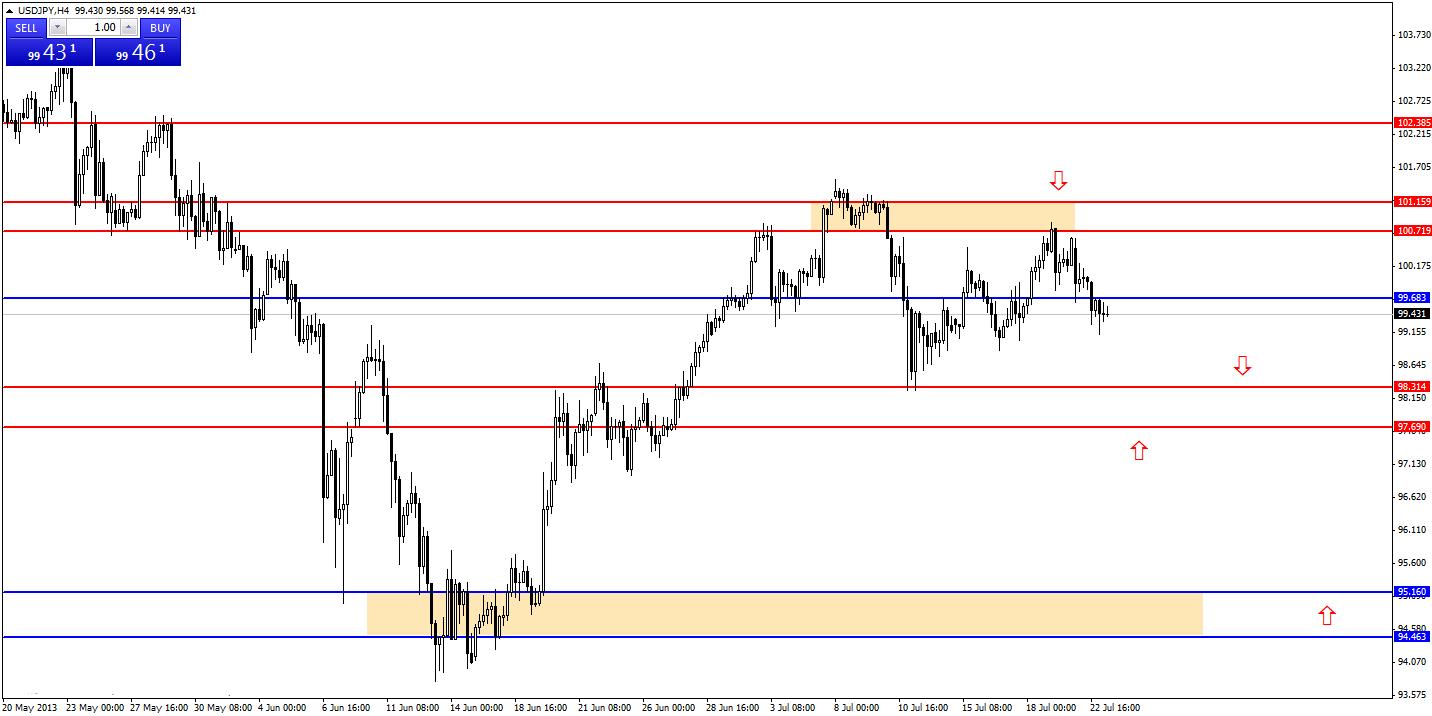

18 July 2013 Thursday Daily Yen Pairs analysis Today market will wait for the final day of Bernanke Testimony, in Yesterday testimony, Bernanke outlined The Fed’s asset purchases “are by no means on a preset course” and could even be expanded should economic conditions warrant, he said in his policy address. Dollar falls after this remark and gaining ground again in Asian session. Investor seems to take this speech as the positive signal Fed will continue their asset purchase program with no sets timeline. Later after the speech we have Beige books release, data released indicating modest to moderate rate in June and early July. USD/JPY Strengthening in Asian session, USD/JPY currently looks to try supply level, as long as price stays below 101.2 the bearish movement will continue, we can place SHORT position near that level with a tight stop. Demand located at 97.7 – 98.3, successfully closed below this level will open opportunity for bear to bring the price to 94.5 – 95.16 Today important level to watch: Resistance: 100.46, 100.7, 101.16 Support: 100, 99.7, 98.32, 97.85 EUR/JPY Not much change in EUR/JPY outlook, we can see price making higher low and higher high bouncing from a trend line. If all stays the same, we can expect 131.70 reached. Breached of trend line, and the trend will change to bearish for short term and 130.3 is interesting place to look for LONG position. Today important level to watch: Resistance: 131.70, 132, 132.5 Support: 131, 130.6, 130.3, 130

19 July 2013 Friday Daily Yen Pairs analysis

Today market will wait for the final day of Bernanke Testimony, in Yesterday testimony, Bernanke Federal reserve Ben Bernanke said it was too soon for the fed to begin tapering in September, back to first outlook where the fed had target 2% for inflation and 5.5% for unemployment level. Today session in Asian market started with bearish sentiment and dollar also weakening versus all major pairs after dovish speech from Bernanke.

Today analysis:

USD/JPY

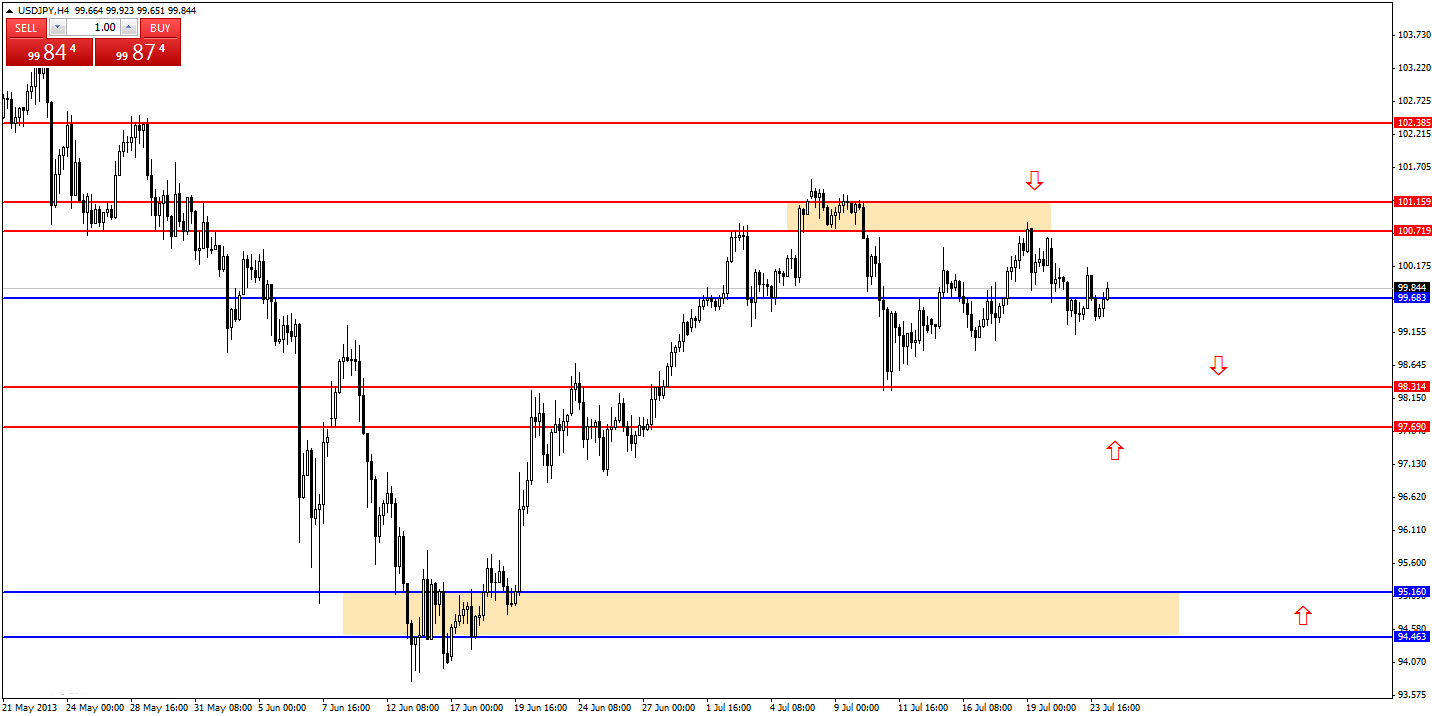

Strong rejection happen at supply level and give us lower high, but as long as lower low not created, the correction will continue. Price must go lower than 99 to confirm lower low and breaking 98.3 to continue downtrend.

Today important level to watch:

Resistance: 100.46, 100.7, 101.16

Support: 100, 99.7, 99, 98.32, 97.85

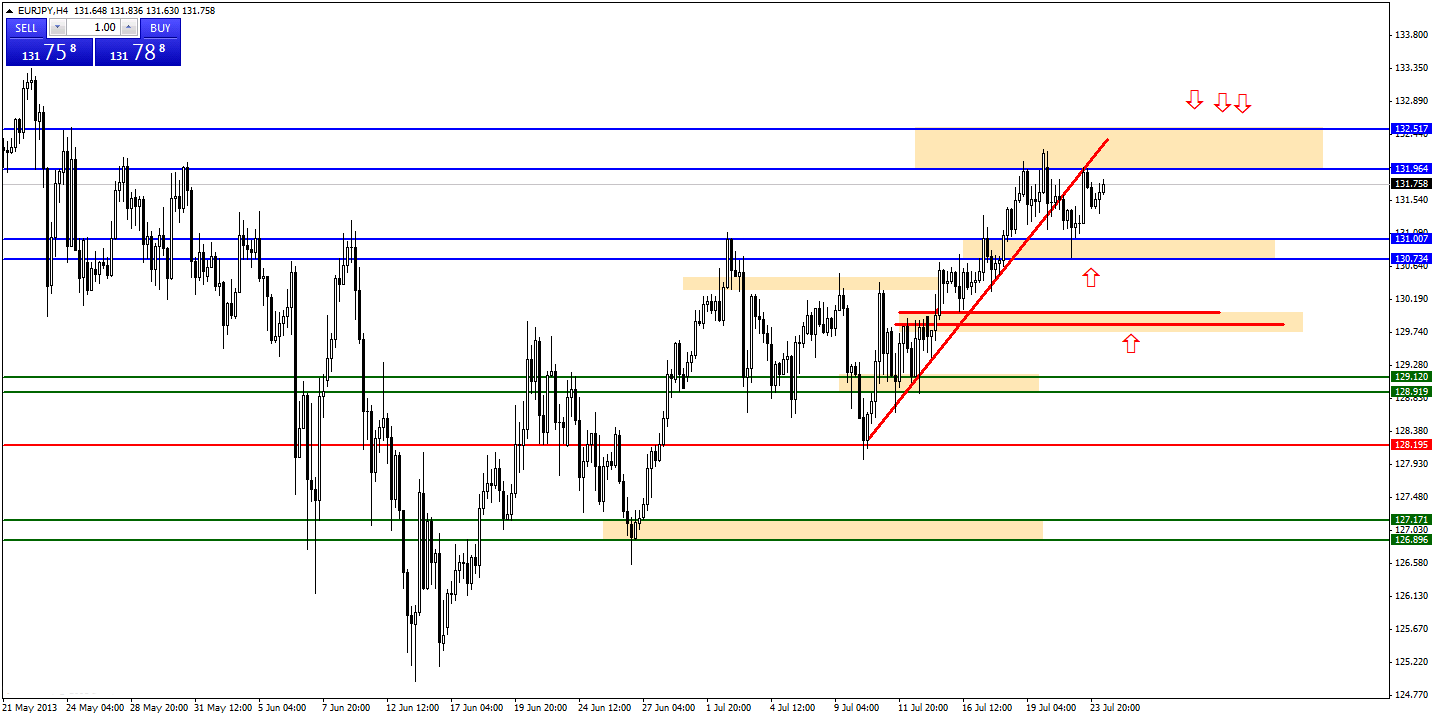

EUR/JPY

Maintaining the trend and staying above trend line, no outlook change for EUR/JPY, as long as price stay above the trend line we think the trend will continue. Close below trend line might open chance to 130.5, target for LONG position already achieved at 132, next resistance 132.5.

Today important level to watch:

Resistance: 131.70, 132, 132.5

Support: 131.3, 131, 130.6, 130.3, 130

22 July 2013 Monday Daily Yen Pairs analysis by tradingforex.com Last week market had focused on news releases from the fed and mostly the fed sounded dovish also said no preset timeline for fed bond purchase. This remark sent the dollar to fall against its counterpart. Today important news, existing home sales from the USA will give an outlook on housing condition in the USA. Today analysis: USD/JPY Short term rejection happens in our drawn supply level, USD/JPY looks to find demand at 99.70, for bull a close above 101.6 is needed to continue bullish trend, for bear, a close below 98.3 will open room for 95.2. We maintain buy at support and sell at resistance until higher high or lower low created. Today important level to watch: Resistance: 100, 100.46, 100.7, 101.16 Support: 99.7, 99, 98.32, 97.85 EUR/JPY Not much change in EUR/JPY, price moving above the trend line making higher high and higher low. Currently we are near supply level 132 which tell us to be careful and see if the price can break above the supply level. Today important level to watch: Resistance: 131.70, 132, 132.5 Support: 131.3, 131, 130.6, 130.3, 130

23 July 2013 Tuesday Daily Yen Pairs analysis by tradingforex.com Monday quiet session with less major news in the market except existing home sales from US market that missed the forecast, coming out in 5.08M vs. expected 5.27 drove the dollar down further. Today there is no major news from the Euro zone and US market, the market will watch the trade balance news from Japan and CPI news from Australia. Today analysis: USD/JPY

With the dollar weakening, USD/JPY also follows the same trend, we expect a further correction taking place and bring USD/JPY down to 97.7 – 98.3 area, consolidate and continue further down. Today important level to watch: Resistance: 99.7, 100, 100.46, 100.7, 101.16 Support: 98.32, 97.7 EUR/JPY

Closing below trend line changes the short term trend for EUR/JPY, we are near strong supply level and this is a good place to take a short position, the only consideration is there was no lower low created yet, medium term trend still bullish. Closes below 128.2 will change medium-long term trend. Today important level to watch: Resistance: 131.90, 132, 132.5 Support: 131, 130.6, 130.3, 130

24 July 2013 Wednesday Daily Yen Pairs analysis by tradingforex.com

Euro zone flash PMI is the major headline for today Euro session, forecasted numbers expected to show improvement in manufacturing and will boost ECB policy. Later in US session New Home Sales figures will tell us the housing situation in the USA, May and June number came out better than expected, strong number will boost the dollar.

Today analysis:

USD/JPY

Consolidating at 99.8 – 100, USD/JPY looks undecided right now to go lower or higher, we expect prices to go lower, but waiting for more confirmation might be the best action to take for now.

Today important level to watch:

Resistance: 99.7, 100, 100.46, 100.7, 101.16

Support: 98.32, 97.7

EUR/JPY

Bounced from demand level at 130.7 – 131, EUR/JPY continues to challenge high and rejected at the trend line. Price seems reluctant to go lower, we expect another try to supply level, strong reaction needed to turn the price away from resistance. Breaking below 130.70 will open the way to 130 - 130.2

Today important level to watch:

Resistance: 131.90, 132, 132.5

Support: 131, 130.6, 130.3, 130

25 July 2013 Thursday Daily Yen Pairs analysis by tradingforex.com Good data from US housing market last night boosted the dollar, most dollar pairs weaken during London and US session and continue weakness near the close of US markets. With all of the news, a market currently consolidating and waiting for clearer view. Traders will watch three major news today, the news are: 1. German IFO business climate 2. GDP data from England 3. Unemployment claims from the US Today analysis: USD/JPY USD/JPY moves inside triangle, we will wait for a break at either side, price currently making lower high and higher low which confirms the consolidation. Today important level to watch: Resistance: 100, 100.46, 100.7, 101.16 Support: 99.7, 98.32, 97.7 EUR/JPY Trusted strongly at supply level, EUR/JPY is currently trying to find support, we expect prices will turn up again near the pink area. A close below the pink area will bring prices down and turn the trend. We will wait and place a tight stop for long positions because we are near supply area. Today important level to watch: Resistance:132, 132.5 Support: 131.90, 131.80, 131.60

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

17 July 2013 Wednesday Daily Yen Pairs analysis by tradingforex.com Wednesday will be first day for Fed Chairman Bernanke to testify against congress, market participant will pay attention to hint or clues on Fed’s exit strategy. Most of today’s move will be driven by the anticipation of the news, so we recommend traders to wait and see first the result and the sentiment of the market. USD/JPY Not able to stay above support yesterday, USD/JPY is trying to go above the broken trendline, but rejected in the process. We think there is more room for bear in USD/JPY, close below yesterday low will open room for 98.30. Today important level to watch: Resistance: 99.5, 100, 100.46, 100.7 Support: 98.26, 97.85, 97.00 EUR/JPY Moving in a different direction than USD/JPY, EUR/JPY successfully maintains position above the support trend line, resistance currently at 130.6. If price can close above the resistance, we will see further bullish movement for 131.1. We favor Long position when price returns to trend line. Today important level to watch: Resistance: 130.5, 131.1, 131.70 Support: 130.3, 130, 129.1, 128.9