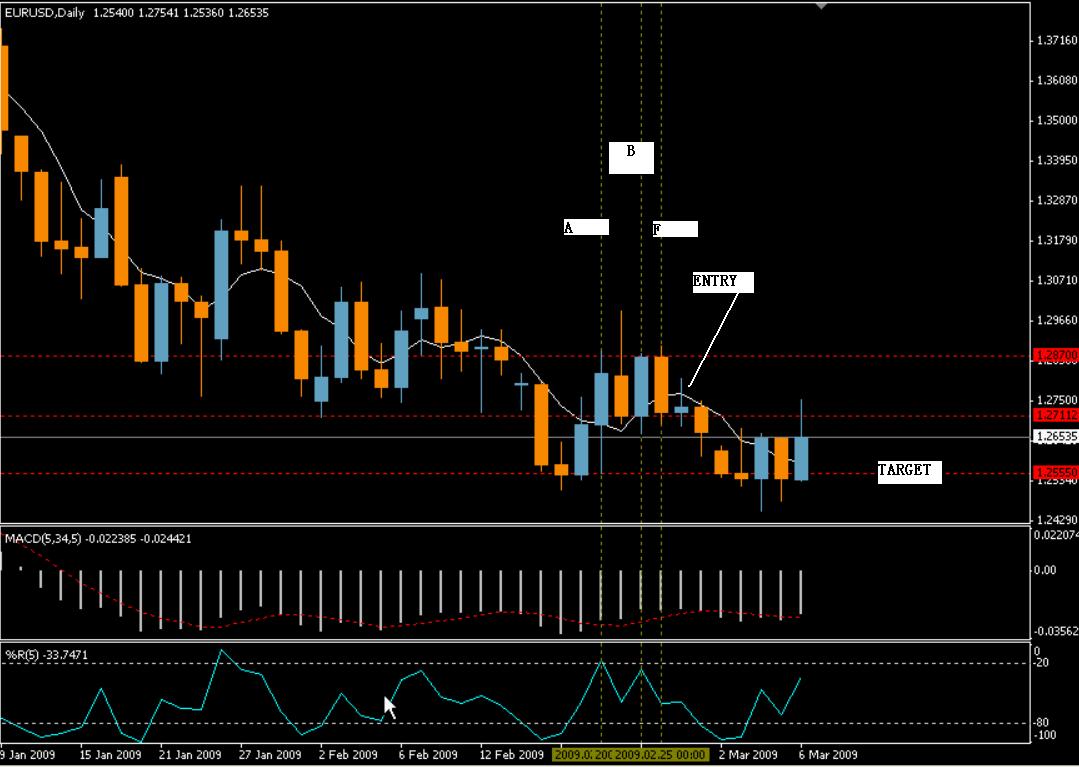

General Divergence

RULES:

1. the close price of B is higher than the close price of A ,but the indicator of William’s Percent Range is lower

2. F break 5 day’s SMA and the correspondent indicator of F is lower than any indicator digit between A and B

ENTRY:

When break the low price of F

STOP LOSS:

The high price of F

Target:

Target 1: the price of the neckline - the SAME space between neckline and the close price of A or B. the neckline is the 1.2708 here, and for top divergence, between the close price of A or B, we choose higher , so we choose the close price of B here. So , our target is the neckline 1.2708 - (the close price of B 1.2868 – the neckline price 1.2708 ) = 1.2548

Target 2: the open or close price of A.

Neckline: it is the lowest open price of close price of candles between A and B, here there are 2 candles between A and B, a bear candle and a bull candle . the close price of the Bear candle is 1.2810, the open price of the bull candle is 1.2808, so we choose 1.2808 here.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use