if your system is based on less trades but taking the long trends, why do you need an EA? And scalping is very risky, you can program the best EA but it will never take the long trends, that is

what really makes money, because you can predict the long trends direction, but the small waves on scalping it would take a lot of trades an risk, so who can make money by EA's if the long trends are better on manual mode?

has anyone ever seen a really profitable EA, that makes huge money on a live account? Scalping do really works that way, or works at all?

In long trends you work with less risk to hold trades for long

Via EA you can scalp and can use high risk if ea have short stops and short time trade

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.02.14 14:41

So, we understand that scalping is very risly trading style. Besides, it is very difficult to make it manually in consistent way for example. What the developers/traders/coders are doing to minimize the risk?

- they are using timefilter. It is not a secret that scalping is making mostly on flat market condition. So, they are estimating 1 hour or few hours in a day to trade. For example, they are trading since 10 pm to 11 pm every day excluding Friday.

- they are using martingale as additional feature. For example: if the price went againt me by 20 pips so the other trade is open on same direction but with bigger lot size ... and so on. It is double risk: scalping (very risky) + martingale (very risky as well) = twice risk for trader.

- using fibo and pivot lines

- forecasting market condition in programming way

===========

There are 2 kinds of scalping:

- scalping in classical way (on the way of signal systems - trading on close bar only)

- scalping traded on open bar. It is most popular scalping for now - such as tick scalping (on close tick of course :) ). Traders are using special indicators such as Tick_MACD and so on for M1 timeframe in Metatrader just to get 10 seconds timeframe in reality. It is most modentr and cool scalping right now.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2013.02.15 15:39

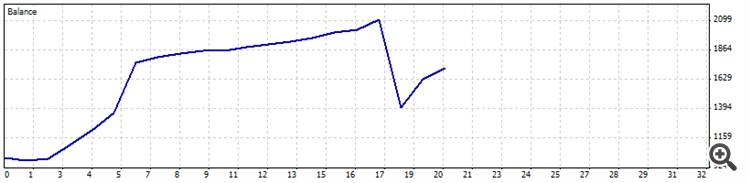

Just some practical example about risk - it is my updated statement for this scalping system:

I lost 70 dollars for EURUSD but I won 228 dollars for USDJPY and 83 dollars for CADJPY after that. But anyway - 70 dollars were lost ...

In long trends you work with less risk to hold trades for long

Via EA you can scalp and can use high risk if ea have short stops and short time trade

i can work with high risk on long trends too, that exactly how you can make a lot of money, do you know a scalping EA real profitable on a live account?

ok but that's only 5 days, do you have a graph with 2 months on this scalping strategy?

Yes, I was testing (on demo)/trading (on real) using scalping systems and EAs during the long time (graphs for few years) - I do not want to advertise some external resources sorry.

Besides, as far as I see - there are many scalping signals which are the profitable. But the problem with scalping in case of the signals is the following:

- you should use same broker with signal provider;

- use MQL5 VPS;

- and you must be sure that the signal provider is using MQL5 VPS too (and in this case the trades will be copied directly from the broker's server to you without much delay for example).

The other situation with the scalping is the following: you should subscribe to the signal in right time and unsubscribe in right time. Because scalping system/EA will lose soon or later (will lose some part of deposit, or will have big drawdown, etc). "Soon or later" - it may be tomorrow, or it may be in the next year for example. So, subscribe in right time (signal provider is trading it during the 1-3 months) and unsubscribe in right time (more than 6 months using) may be some unofficial rule which the trader (signal subscriber) will define for himself.

---------------

Of course, trading in classical way (1 trade per Metatrader; from 1 to few trades in a week/month) is less risky. But the people want to get more profit in very short time, and it is the scalping, martingale, martingale scalping, pyramiding and so on. And it is very risky styles of trading.

But for most of the people - this kind of risk may be illustrated as the following:

- "kill me/[my deposit] slowly" = classical way of trading;

- "kill me/[my deposit] quicky" = scalping, martingale, martingale scalping, pyramiding and so on.

- "kill me/[my deposit] at the time" = pre-evaluated time when the system/EA will lose a lot.

:)

Of course, #3 way is most preferable because we know when and why the system may lose big money. And it is related to the system itself.

So,

- big profit = big risk = big headache = big problems;

- small profit = low risk = no headache = small problems;

- no profit = no risk = no headache = no money with no problems at all.

- www.mql5.com

yes but they eventually lose all the money, as you said. But the ones who trade long trends, that believe in the trend are very sucessfull, if you are sucessful on scalping, can you show me someone doing great with living account verification? just need a link

Lets say a scalper is a trader looking for only 100 points, just by comission if you leverage 1:1000 1 in 5 trades all your capital is going to your broker in comission, on the long term searching for long trends you look for >500 points at least.

My question is:

1 Trading on consolidation (scalper) is profitable on the long term> 6 months? - if yes- can someone give an example on a living account.

2- why create an EA for something other than a scalping system? And if question 1 is no, then all EA's are doomed to fail?

i can work with high risk on long trends too, that exactly how you can make a lot of money, do you know a scalping EA real profitable on a live account?

You can not make a lot money with risk on long trends just you will loose always

Profit and loss are part of trade but facts telling only 10% peoples in success. What 10% peoples doing and they have success?

- Winner Trader means staying in profit more then 16 Months and facing draw down less then 25%.

- These winner traders actually earns average profit around 5% or less a month.

- They using lowest leverage 1:1 or 1:25

- They holds long trades from 1 day to 60 days average (How they can hold long trades because they don't puts load on balance using less risk volume trade against balance)

- They sets SL/TP on weekly and daily chart base.

- Winner traders actually collects small profits and they don't waits for big turn.

- Winner traders actually copying simple banks strategy Supply and Demand.

- Winner Traders sometimes waits for long to open a trade.

- For winner traders most difficult things is to set profit targets.

- Winner traders don't depends on news base trading, they only checks big events coming in a year like Brexit and they avoids to trade in big events.

- Successful traders don't depends on 1 broker they split capital with 3 to 4 brokers.

- In generally good starting balance for successful trading 10K USD.

- Their average Money management .01 or micro lot against 2000 USD balance.

- Average successful traders gains experience after 3 years and their first 6 months always in loss.

yes but they eventually lose all the money, as you said. But the ones who trade long trends, that believe in the trend are very sucessfull, if you are sucessful on scalping, can you show me someone doing great with living account verification? just need a link

...

To say seriously: someone lose, someone - not.

About the links to the profitable statements/EAs/signals ... I think - you are able to find them by yourself on the Signals for example, or on the Market (it may be some coders/traders who are selling EAs which are used on the signals). Because it is your money, your risk and your decision.

- www.mql5.com

if your system is based on less trades but taking the long trends, why do you need an EA? And scalping is very risky, you can program the best EA but it will never take the long trends, that is

what really makes money, because you can predict the long trends direction, but the small waves on scalping it would take a lot of trades an risk, so who can make money by EA's if the long trends are better on manual mode?

has anyone ever seen a really profitable EA, that makes huge money on a live account? Scalping do really works that way, or works at all?

EA's are to assist you.

In any way of form that you can think of.

Why does it always have to be so black and white?

Do you have any form of imagination? at all??

Please stop using the word "just"

Just for this and just that you are looking black and white when there are a million colors available.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

if your system is based on less trades but taking the long trends, why do you need an EA? And scalping is very risky, you can program the best EA but it will never take the long trends, that is

what really makes money, because you can predict the long trends direction, but the small waves on scalping it would take a lot of trades an risk, so who can make money by EA's if the long trends are better on manual mode?

has anyone ever seen a really profitable EA, that makes huge money on a live account? Scalping do really works that way, or works at all?